Bitcoin Sees First 12-Month Period with Losses Since 2019 Rally

After a series of lower highs for bitcoin (BTC) price since its last major rally in 2019, some investors in the number one cryptocurrency may be forced to adjust their expectations, the latest return figures suggest.

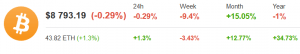

Following a decline in the bitcoin price of nearly 9% over the past 7 days, the digital asset is now once again back at the same price level as in the spring of 2019. As a result, investors who bought bitcoin one year ago are – for the first time since the 2019 rally – are starting seeing negative returns on their investment. As of Tuesday evening, European time, the 12-month return for bitcoin stood at -1%, data from Coinpaprika showed.

BTC was also close to entering this negative zone during a market crash in March this year.

BTC price chart

At pixel time (08:36 UTC), BTC trades at USD 8,943 and is almost unchanged in day. The price is up by 14% in a month and 1.6% in a year.

However, should BTC fail to repeat the 2019 June rally this year, those who bought it a year ago would be at loss.

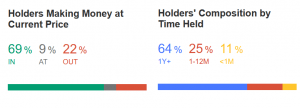

According to data from on-chain analytics firm IntoTheBlock, 69% of BTC holders are still sitting on profits.

In either case, other major cryptoassets from the top 10 are down by 25%-68% in a year, except bitcoin SV (BSV) (+54%) and tezos (XTZ) (+65%).

The weak performance for bitcoin over the past day follows an even stronger sell-off in gold on the same day, and comes as the US stock market has seen three consecutive days of higher prices. The shift in sentiment away from safe havens and over to stocks is likely related to investors positioning themselves for a gradual re-opening of several countries, as well as positive news about potential vaccine candidates developed in the US.

Despite bitcoin showing that it can trade down on typical “risk-on” days, however, any connection here is difficult to point to, given that technicals in the bitcoin chart have also signaled a possible correction for some time, with a series of lower highs being formed since June 2019.

___

Reactions:

___

Learn more: 5 Historic Post-Halving Bitcoin Price Predictions