Bitcoin Realized Cap Soars, Analysts Divided on Near-Term Outlook

With bitcoin (BTC) still trading lower both on a weekly and daily basis, a new high in a key price metric shows that investors in recent years have continued to accumulate coins at ever-higher prices. However, opinions still seem to be divided on what the near-term outlook for the bitcoin price is.

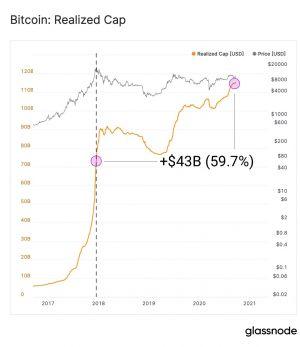

According to crypto research firm Glassnode, the popular metric known as the bitcoin realized capitalization just reached another all-time high, currently sitting at USD 115bn. The current level is USD 43bn – or 60% – above where the metric stood when bitcoin’s spot price reached its all-time high of close to USD 20,000 in late 2017, which shows that investors have continued to accumulate coins as prices have risen since the bottom in late 2018.

The BTC realized capitalization values each coin “at the time they last moved,” thus offering an estimate for what bitcoin holders’ aggregate cost basis is. The metric can also be divided on the number of circulating coins to get the Realized Price on a per coin basis.

Meanwhile, Bloomberg Intelligence analyst Mike McGlone recently shared his own bullish take on bitcoin, saying that the digital asset “should be a primary beneficiary” if the recent gains in stock and bond prices are now largely over:

And although McGlone remained bullish, some technical analysts in the crypto community appeared to have a more bearish bias on the number one cryptocurrency. Among them was the popular trader Teddy Claps, who warned of a “bear flag” in the bitcoin chart that he said could push the price down to the high USD 9,000s.

Also skeptical about the market at the moment was Blockroots Co-founder Josh Rager, who said that he would like to see BTC above the USD 10,600 level before he would “start to feel good about it.”

“Traditional markets will likely continue to have a strong influence on BTC and the direction it takes,” he said.

Others, however, remained focused on the long-term outlook for the cryptocurrency, with for instance Ronnie Moas of Standpoint Research telling his followers on Twitter that they should “stop trading.”

“During the next 20 years, the USD under your mattress will probably lose 50% of their value. Bitcoin will probably jump by at least 1,000% during that time,” Moas wrote.

As of press time on Thursday (12:18 PM UTC), BTC was down by 1% over the past 24 hours, trading at a price of USD 10,408 per coin. The cryptocurrency also remained down just over 4% over the past 7 days, after having fallen from the USD 11,000 level at the beginning of the week.

BTC price chart

__