Bitcoin Rally Supported by More Busy Miners and Lower Fees

As bitcoin (BTC) rallied, with the trading volume rising as well, the transaction fees moved in the opposite direction as miners turned more of their machines on.

Bitcoin has made quite a move upwards since the beginning of November, with analysts predicting further volatility, but also appreciation in this month. The world’s number one coin surpassed the USD 16,000 level for the first time since January 2018 just yesterday, and today jumped above USD 16,400 before correcting lower.

BTC price chart:

At the same time, the trading volume has been rising. At the time of writing, on November 13, Coinpaprika.com shows BTC 1,552,121 changing hands so far, worth around USD 25n. This is already up from yesterday’s BTC 1.52m, as well as 31% more from the BTC 1.18 seen three days ago – which was the lowest amount recorded this week so far. In comparison, the highest number seen last week was BTC 1.87m, and the lowest was BTC 1.2m.

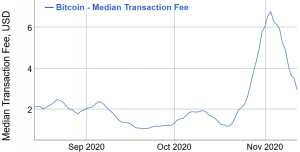

Meanwhile, the fees have been dropping in the last ten days. After jumping to USD 11.99 on November 3, the 7-day moving average fees dropped 41% to USD 7 recorded yesterday. This is still a lot higher than USD 2.18 recorded before the latest jump in fees.

The median transaction fees show a similar picture, dropping 56.6% between November 3 and November 12. Their USD 2.9 is still higher than USD 1.17 seen in mid-October.

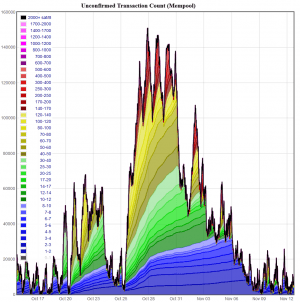

BTC mempool, where all the valid transactions wait to be confirmed, is also less busy compared to October.

That said, hashrate, or the computational power of the Bitcoin network, shows something of an inverted fee picture: after dropping substantially in late October, it started climbing again on November 2. It’s gone up 17.7% between then and November 12 to 127.36 EH/s. It’s still a lower than the all-time high of 147.21 recorded in mid-October.

Bitcoin mining difficulty, or the measure of how hard it is to compete for mining rewards, is expected to drop again during the next adjustment in three days, following the second-largest drop in the network’s history.

___

Learn more: Crypto Adoption in 2021: Bitcoin Rules, Ethereum Grows & Faces Rivals