Bitcoin Mining Difficulty Set to Drop for the First Time in Two Months

The short string of very high highs in Bitcoin (BTC) mining difficulty is to be broken today according to the current estimates, with miners about to see a difficulty drop instead.

Per the current estimations by mining pool BTC.com, the difficulty will decrease by more than 3% to 16.8 T.

This would be the first drop since early June, and the smallest one since late February.

As reported, the months of June and July – or the last three difficulty adjustments in BTC mining difficulty, the measure of how hard it is to compete for mining rewards – have seen two major levels surpassed.

To be precise, one – the 16 T level – was surpassed yet again, but in such a way that it was completely skipped over, with the difficulty jumping from 15.78 T and hitting a new all-time high of 17.35 T two weeks ago.

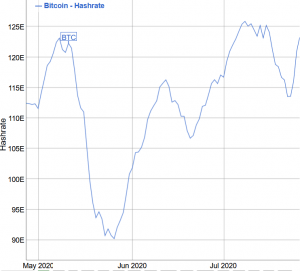

The mining difficulty of Bitcoin is adjusted every two weeks (every 2016 blocks, to be precise) to maintain the normal 10-minute block time. Rising to more than 12 minutes on July 17, it is currently around 9 minutes, according to BitInfoCharts.com.

Following a drop in mid-July hashrate, or the computational power of the network, was on a rise until yesterday – going up 8.6% in five days. It’s less than 2% lower than it was during the previous adjustment.

Meanwhile, over the weekend, BTC finally broke through the crucial resistance level of USD 10,000, currently (12:53 UTC) standing at USD 10,219.

During the previous adjustment, the situation was somewhat different. Earlier this month, Tim Rainey, Chief Financial Officer of Greenidge Generation, New York-based fully compliant cryptocurrency mine-power plant hybrid, said that the reason behind the then rising hashrate while the market dropped is mainly newer-generation machines coming online from pre-orders, which were placed a few months ago.

At the same time, CEO of BTC.TOP, a Bitcoin mining pool and mining services provider, Jiang Zhuoer, estimated hat no significant percentage of mining machines would be forced to shut down inside China, which accounts for approximately 70% of the total hashrate.

Since then, there have been reports of devastating flooding coming out of the country, as well as the world’s largest hydropower station, the Three Gorges Dam, being under major stress. However, industry observers said that this seems not to have had an impact on the miners in the country, though they noted that very little information of their exact state is available.

As long as hashrate remains above c. 110 EH/s with the BTC price of c. USD 9,300, “the best we can do is keep an eye on block times and speculate that Bitcoin mining isn’t being impacted significantly,” Daniel Frumkin, researcher at Braiins, the company behind Slush Pool and the Stratum V2 protocol for pooled mining, told Cryptonews.com last week.