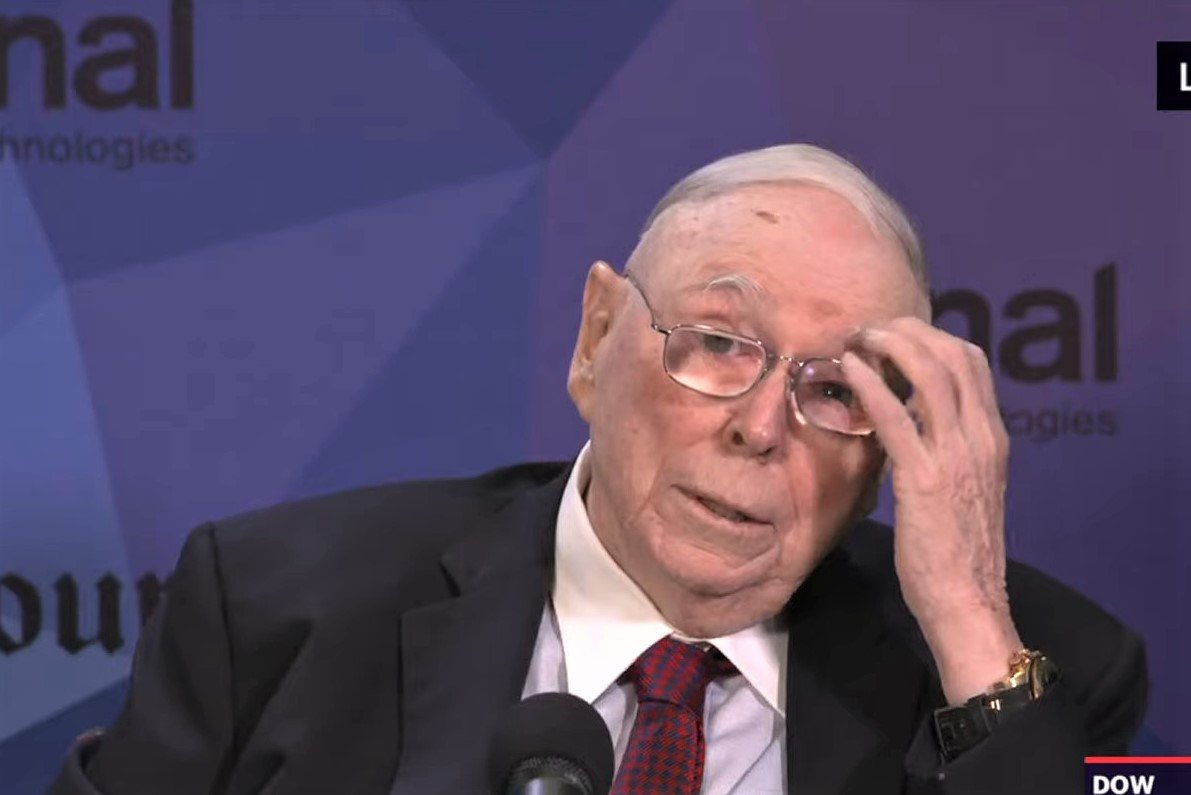

Billionaire Charlie Munger Condemns Cryptocurrencies Following FTX Collapse, Says ‘I Think It’s Totally Crazy’

Berkshire Hathaway’s Vice Chairman Charlie Munger has long voiced his criticism of crypto, with a particular focus on Bitcoin (BTC). Unsurprisingly, the ongoing market downturn and the abrupt collapse of the major exchange FTX have further reinforced the billionaire’s disdain for digital assets.

“This is a very, very bad thing. The country did not need a currency that was good for kidnappers and so on,” said Munger, Buffett’s longtime business partner, in an interview with US broadcaster CNBC.

“There are people who think they’ve got to be on every deal that’s hot. And they don’t care whether it’s child prostitution or Bitcoin,” he stated. “I think that’s totally crazy. Reputation is very helpful in financial life.”

Munger also compared investing in crypto to a “delusion” despite the fact that numerous legacy finance players from across the world have invested major funds in crypto.

“Good ideas carried to wretched excess become bad ideas,” according to the businessman. “Nobody’s gonna say I got some shit that I want to sell you. They say—it’s blockchain! Blockchain is the new good thing to come up. Like fairy dust.”

It is noteworthy that, during an interview in February 2022, Munger said that crypto is “an ideal currency if you want to commit extortion or kidnapping, or have a protection racket” and reiterated that BTC and other cryptos are “beneath contempt”.

“Why should a civilized government want an ideal, untraceable technology to come into the payment system, run by a bunch of people who want to get rich quick for doing very little for civilization?” the investor asked. “Of course I hate it.”

Munger concluded his tirade by praising China’s government for being “wiser than we were” and banning crypto.

Meanwhile, Sam Bankman-Fried, the founder and former CEO of FTX, has announced he is striving to raise fresh capital to make the bankrupt exchange’s customers whole despite its Chapter 11 proceedings.

“A few weeks ago, FTX was handling ~$10b/day of volume and billions of transfers. But there was too much leverage–more than I realized. A run on the bank and market crash exhausted liquidity. So what can I try to do? Raise liquidity, make customers whole, and restart,” SBF said in a tweet.

SBF added he is “meeting in-person” with potential investors and regulators to do what can be done for FTX’s customers. “And after that, investors. But first, customers,” he said.