7 Best Crypto Index Funds for 2024

Disclaimer: The Industry Talk section features insights from crypto industry players and is not a part of the editorial content of Cryptonews.com.

Crypto index funds are tasked with tracking a basket of digital currencies. This enables investors to gain exposure to a diversified portfolio of cryptocurrencies through a single investment.

In this guide, we explore the 7 best crypto index funds in the market.

7 Best Cryptocurrency Index Funds to Buy 2024

The 7 best crypto index funds are listed below:

- Bitcoin ETF token – Latest Token Presale Based Around the Spot Bitcoin ETF Approval is the Best Alternative to Crypto Index Funds

- Bitcoin Minetrix – Stake-to-Mine Bitcoin Solution as an Alternative to Crypto Index Funds

- Bitwise 10 Crypto Index Fund – Weight Index Fund of the Top 10 Cryptos by Market Cap

- Galaxy Crypto Index Fund – Invest in 12 Different Cryptocurrencies With Monthly Rebalancing

- Nasdaq Crypto Index Fund – Diversified Basket of Market Cap Weighted Cryptocurrencies

- Fidelity Crypto Industry and Digital Payments Index – Diversified Portfolio of Crypto-Centric Stocks

- Bitwise DeFi Crypto Index Fund – Invest in the Future of Decentralized Finance

Each crypto index fund will differ in terms of the digital currencies it elects to track, in addition to the weighting and rebalancing strategy utilized.

Therefore, investors can read on to pick the best crypto index fund for their financial goals and tolerance for risk.

Reviewing the Best Crypto Index Funds 2024

As noted above, no two crypto index funds are the same. Each crypto index fund will contain a selected basket of digital currencies at various weights.

Moreover, the chosen cryptocurrencies will often be determined by market capitalization. This means that the crypto index fund will regularly rebalance its tracking benchmark.

Once again, this will vary from one crypto index fund to the next.

1. Crypto Presales – A Better Alternative to Crypto Index Funds

We should start by noting that overall, there are much better alternatives to crypto index funds. From an investment perspective, the vast majority of crypto index funds focus on large-cap digital currencies. Considering that the broader market has been bearish for nearly 12 months, this offers little in the way of upside potential.

Instead, investors might consider crypto presales – which offer early access to newly launched digital currencies. Not only that, but early investors get a discounted price when compared to that of the subsequent exchange listing. In this regard, investors may wish to explore to Bitcoin ETF Token – a new presale token which has raised nearly $500,000 within the first week of the presale.

1. Bitcoin ETF Token – Latest Crypto Presale is the Best Alternative to Crypto Index Funds

Bitcoin ETF Token is a token presale designed around the spot Bitcoin ETF approval by the Securities and Exchange Commission (SEC). This is our pick for the best alternative to crypto index funds because it could potentially take off if the spot Bitcoin ETFs are approved. Investors are showing interest in this project given how quickly in less than a week it raised close to $500,000.

Buy $BTCETF tokens on the Bitcoin ETF Token presale page. You need an Ethereum-based wallet like MetaMask to connect to the presale site and use ETH, USDT or card to complete the purchase. You can also buy $BTCETF with MATIC and BNB coins but you won’t be eligible for the staking APY.

The token presale runs in 10 stages. Each stage comes with a slightly higher token price than the previous starting from $0.0050 for the first stage and ending with $0.0068 in the last stage. Because of that, buying the token as early as possible may offer the best reward outcome.

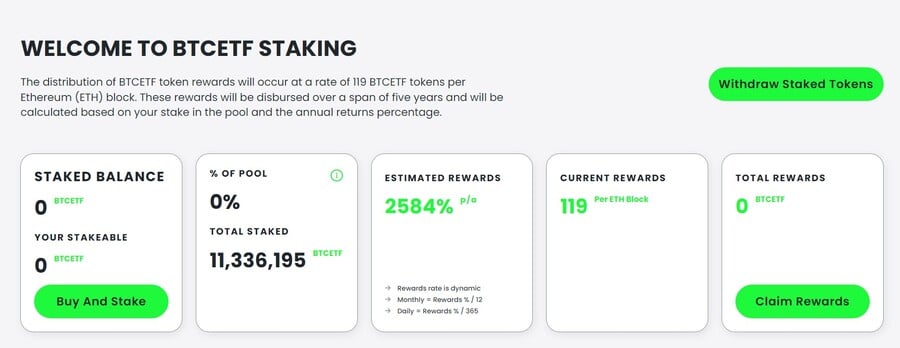

Regardless in which stage you buy, you can maximize your potential rewards by using the staking mechanism. In the early presale stages, the staking APY stood at over 2,000%. This number will drop, however, which makes it prudent to stake as early as possible, especially if you’re planning to buy the $BTCETF tokens anyway.

On top of staking, the team will employ token burning mechanics that will remove from circulation up to 25% of the total supply. This will start with a 5% token burn tax on every transaction, which will drop to 0% as certain milestones around the spot Bitcoin ETF are reached. The milestones themselves will remove 5% of the total supply each, including when the first spot Bitcoin ETF is approved, the first Bitcoin spot ETF is launched as well as when all spot Bitcoin ETFs have at least $1 billion in assets under management.

Follow Bitcoin ETF Token on X and join the Bitcoin ETF Token Telegram channel for the latest information regarding the project and the Bitcoin spot ETF approval. Read the Whitepaper for more details.

| Presale Started | 6 Noe 2023 |

| Purchase Methods | ETH, USDT, BNB, MATIC and Card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

2. Bitcoin Minetrix – New Stake-to-Mine Crypto an Alternative to Crypto Index Funds

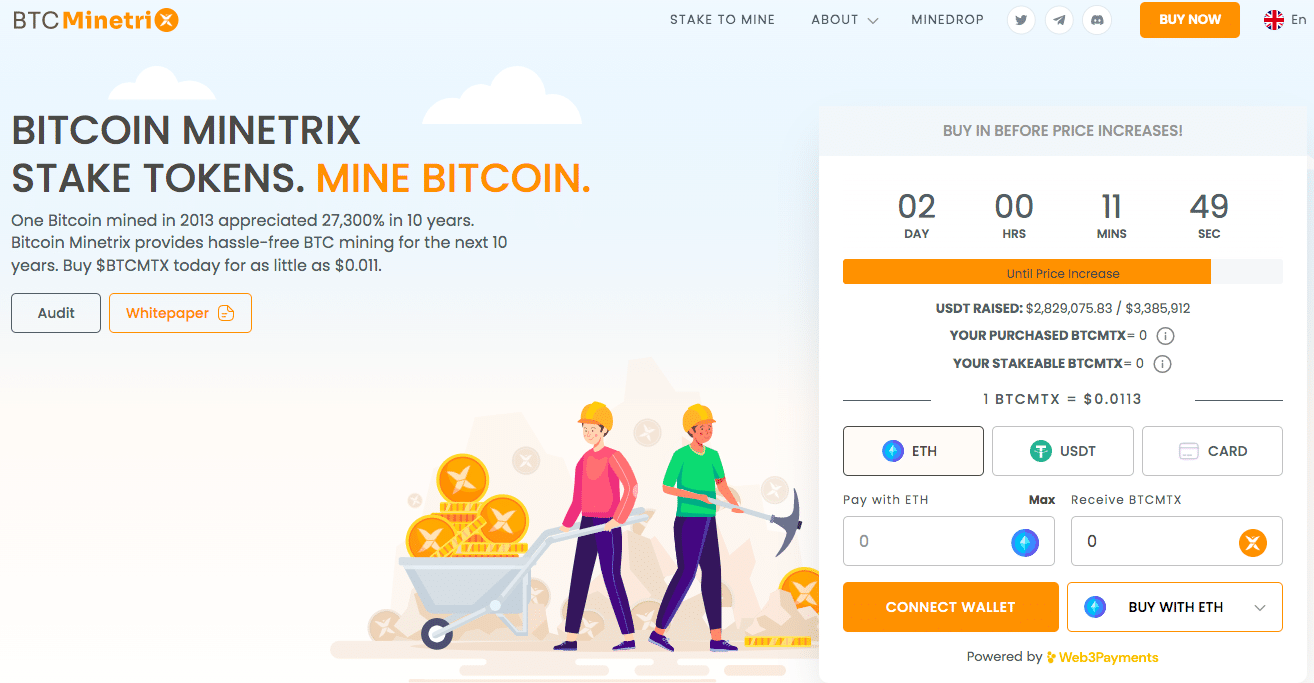

Bitcoin Minetrix is a new stake-to-mine cryptocurrency platform and one of the top alternatives to cryptocurrency index funds. This proof-of-stake cryptocurrency offers a unique use case as it allows everyday people to earn mining rewards.

The goal of Bitcoin Minetrix is to decentralize the cloud mining space – since it has been plagued by dubious activities, resulting in investors losing their funds. By leveraging $BTCMTX, the native token – Bitcoin Minetrix offers cloud mining credits as ERC-20 tokens. These tokens are stored on the blockchain, and cannot be duplicated.

To start earning the tokenized cloud mining credits, Bitcoin Minetrix investors can lock up their $BTCMTX holdings on an Ethereum-powered smart contract. Over time, the smart contract generates credits for token holders. By keeping your assets locked on the staking contract, Bitcoin Minetrix will also offer APYs (Annual Percentage Yields) as high as 200%.

The ERC-20 tokens generated can be burned to acquire Bitcoin cloud mining power. Thus, users can earn allocated mining times and earn a percentage of crypto and Bitcoin mining revenues. Therefore, Bitcoin Minetrix offers more transparency through the blockchain, while reducing the entry barrier for earning through mining operations.

This new cryptocurrency has a supply of only 4 billion – 70% of which has been allocated for the ongoing presale. The presale consists of 39 rounds – each allocating 70 million tokens. Currently, $BTCMTX is priced at $0.0113, but will increase to $0.0148 by the final round. This equates to a price increase of more than 30%.

Since the presale started, Bitcoin Minetrix has raised over $2.8 million. The goal is to raise more than $24 million by the end of the presale. Go through the Bitcoin Minetrix whitepaper and join the Telegram channel to keep yourselves updated with this cryptocurrency project.

| Presale Started | 26 Sept 2023 |

| Purchase Methods | ETH, USDT, BNB |

| Chain | Ethereum |

| Min Investment | $10 |

| Max Investment | None |

3. Bitwise 10 Crypto Index Fund – Weight Index Fund of the Top 10 Cryptos by Market Cap

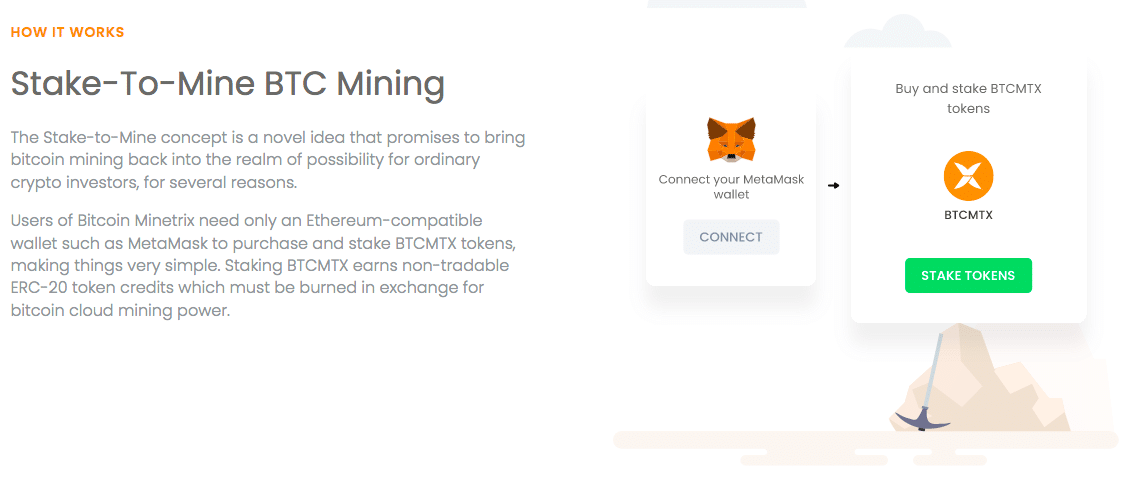

In terms of specific crypto index funds, Bitwise is one of the most notable benchmarks in this space. As the name suggests, the Bitwise 10 Crypto Index Fund tracks the 10 largest cryptocurrencies by market capitalization. This means that the more valuable a cryptocurrency is in terms of its market capitalization, the more it contributes to the index.

As of writing, Bitcoin and Ethereum contribute 61.5% and 29.3% to the index fund. As a result, these two cryptocurrencies alone contribute over 91% of the overall allocation. This is once again why crypto index funds are somewhat unattractive, not least because the vast majority of the investment will often be allocated to just two digital currencies.

Nonetheless, while there is no performance fee, the Bitwise 10 Crypto Index Fund charges an expense ratio of 2.5%. This is very costly and in reality, it would be cheaper to buy the respective cryptocurrencies directly from an exchange. This index fund for cryptocurrency has nearly $400 million in assets under management and it carries the ticker symbol BITW.

In terms of performance, the Bitwise 10 Crypto Index Fund has generated returns of 93.35 since its inception in December 2020. On a 12-mont basis, however, the fund is down 70%. Finally, this crypto index fund is rebalanced on a monthly basis. This ensures that the fund is aligned with the broader market.

4. Galaxy Crypto Index Fund – Invest in 12 Different Cryptocurrencies With Monthly Rebalancing

Next up on our list is the Galaxy Crypto Index Fund. The purpose of this fund is to track the Bloomberg Galaxy Crypto Index like-for-like. This crypto index fund contains 12 digital currencies and weighting is focused on market capitalization. As a result, the portfolio is heavily weighted to Bitcoin and Ethereum.

With that said, unlike the previously discussed Bitwise crypto index fund, Galaxy caps the weighting to a maximum of 35% per coin. This means that both Bitcoin and Ethereum are collectively weighted at 70%.

The remainder of the portfolio consists of Cardano, Solana, Avalanche, Polkadot, Polygon, Cosmos, Litecoin, Chainlink, Uniswap, and Algorand. The Galaxy Crypto Index Fund was incepted in August 2017 under the ticker symbol BGCI – which makes it one of the most established options in this market.

6. Nasdaq Crypto Index Fund – Diversified Basket of Market Cap Weighted Cryptocurrencies

Incepted in 2020, the Nasdaq Crypto Index Fund is a popular option for those seeking diversification through a single, managed investment. Nasdaq focuses on leading cryptocurrencies across 11 projects. Each digital currency being tracked must trade on at least two vetted exchanges.

Rebalanced every three months, this crypto index fund is once again weighted by market capitalization. As of writing, Bitcoin and Ethereum are weighted at over 69% and 27% respectively, which represents nearly 97% of the overall portfolio.

As a result, just 3% is left over for the remaining 9 cryptocurrencies. This is inclusive of Litecoin, Chainlink, Polkadot, Bitcoin Cash, Stellar Lumens, Uniswap, Axie Infinity, the Sandbox, and Filecoin.

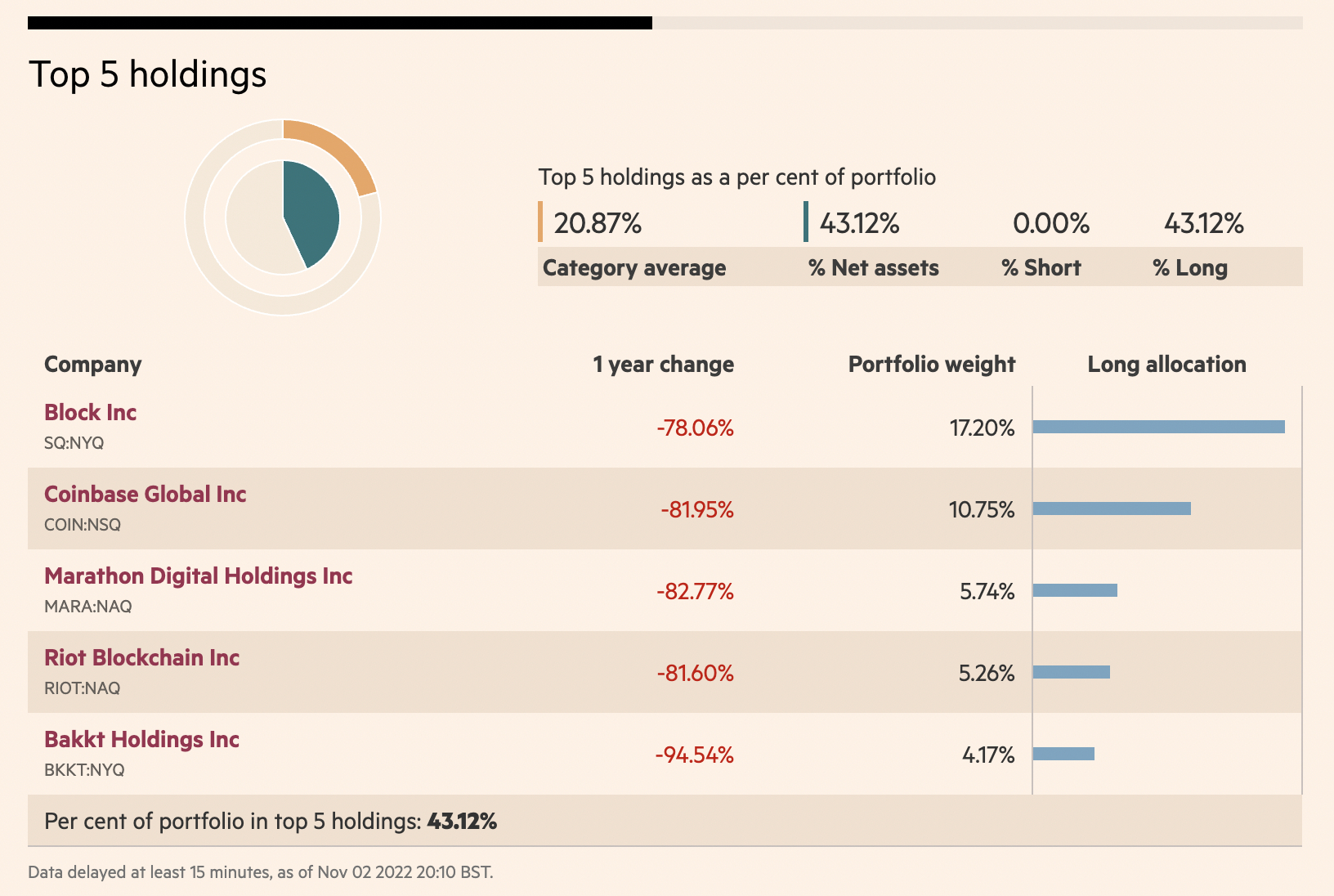

6. Fidelity Crypto Industry and Digital Payments Index – Diversified Portfolio of Crypto-Centric Stocks

This Fidelity cryptocurrency index fund will appeal to investors that feel more comfortable with stocks as opposed to directly investing in digital currencies. In a nutshell, the fund specializes exclusively in stocks that operate in the blockchain technology and cryptocurrency industry.

The largest holdings in this portfolio, at 17.2% and 10.7% respectively, are Block and Coinbase. Other constituents include Riot Blockchain, Cleanspark, Bakkt Holdings, Hut 8 Mining, Bit Digital and Bitfarms.

Some of the stocks within this crypto index fund have taken an unprecedented beating over the prior year. For example, Bakkt and Bit Digital are down nearly 95% and 92% respectively. The Fidelity Crypto Industry and Digital Payments Index comes with a cost-effective expense ratio of just 0.39%.

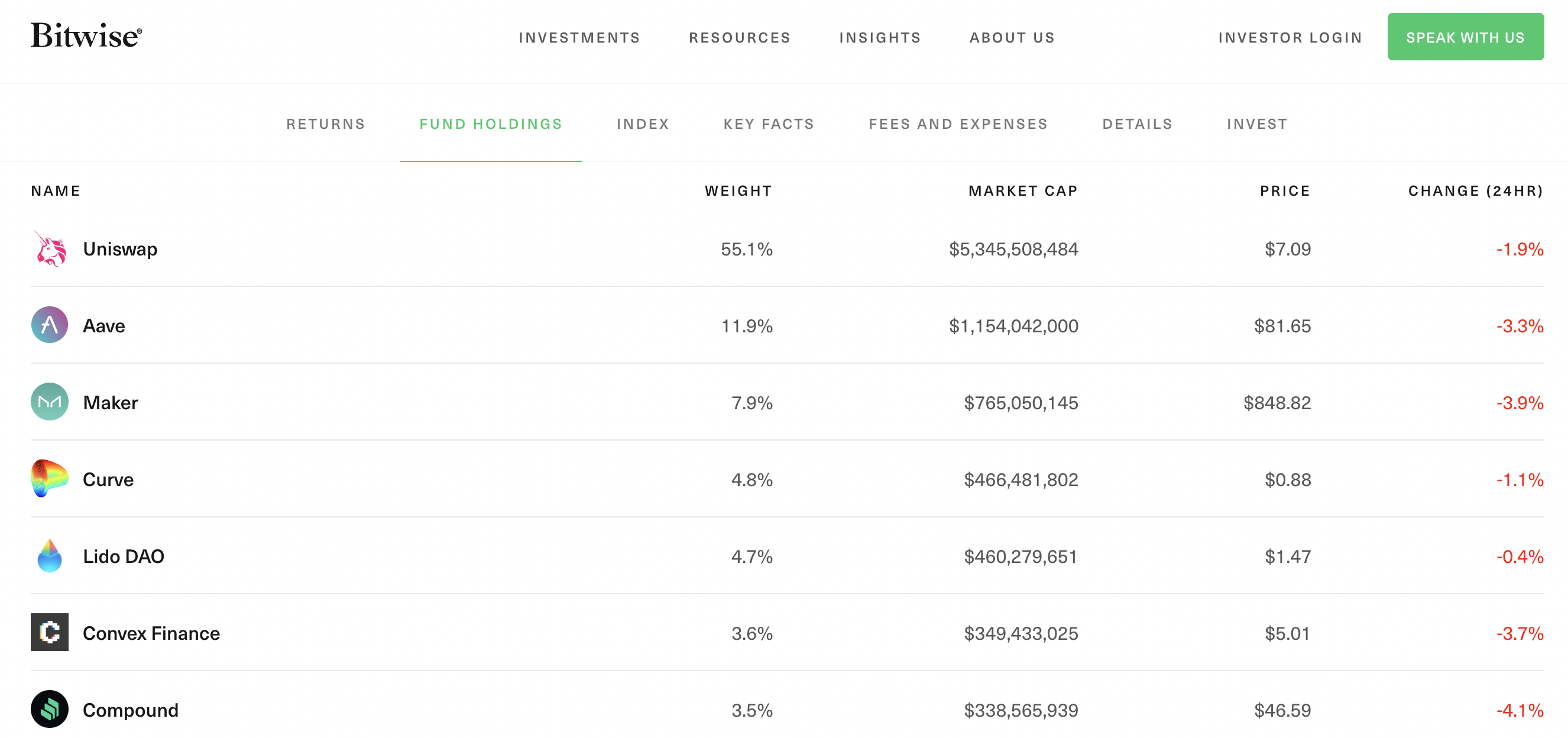

7. Bitwise DeFi Crypto Index Fund – Invest in the Future of Decentralized Finance

Bitwise once again makes this list of the best crypto index funds. This time, we will discuss the Bitwise DeFi Crypto Index Fund – which offers exposure to the growth of decentralized finance. The fund contains 10 notable DeFi projects at various weights.

However, the fund is heavily weighted to Uniswap at just over 55%. Uniswap and Maker contribute 11.9% and 7.9% respectively. The remainder of this crypto index fund is represented by Curve, Lido DAO, Convex Finance, Compound, Loopring, Yearn.finance, and 0x.

As per the other Bitwise crypto index fund that we discussed earlier, the expense ratio stands at an expense of 2.50%. Furthermore, the minimum investment requirement to access this crypto index fund is $25,000. Since its inception in February 2021, Bitwise DeFi Crypto Index Fund has declined in value by 81%.

What are Crypto Index Funds?

Crypto index funds are created to offer exposure to the digital asset marketplace but in a diversified manner. The main concept is that instead of investing in multiple cryptocurrencies directly through an exchange, index funds offer access to a basket of digital assets through a single trade.

The overarching benefit of this is that the best crypto index funds enable investors to gain exposure to the broader digital asset market. There are more than a dozen crypto index funds in this space – eight of which we have discussed on this page. Each crypto index fund will have its own strategy and goals.

For example, some index funds target the top 10 cryptocurrencies by market capitalization. While others might focus on a specific niche area of the crypto space – such as DeFi. The key metric to look for when choosing the best cryptocurrency index fund is the weighting system utilized. This refers to the percentage that each individual cryptocurrency contributed to the index.

The key issue in this regard is that most crypto index funds give preference based on market capitalization. This means that oftentimes, the vast majority of the portfolio will be weighted towards Bitcoin and Ethereum. In fact, several of the funds discussed today weight more than 90% of the entire portfolio just to these two cryptocurrencies.

As a result, this doesn’t really offer investors much in the way of diversification. On the contrary, the investor is essentially allocating the vast majority of their funds to Bitcoin and Ethereum, with the balance split loosely across other cryptocurrencies. Moreover, expense rations are often expensive, with the likes of Bitwise charging 2.5% annually.

Why Invest in Crypto Index Funds?

Still unsure whether crypto index funds are suitable for your trading style? Or are you perhaps considering the best crypto ETFs to buy in 2024?

In this section, we’ll discuss some of the main considerations to make before proceeding.

Diversification

Perhaps the main reason why some investors turn to crypto index funds is that it offers instant diversification.

As we have noted throughout this guide, index funds will track a basket of different digital assets, This means that via a single investment, exposure to each and every cryptocurrency can be achieved.

The key issue is that many crypto index funds are heavily weighted to Bitcoin and Ethereum. This means that the portfolio won’t be anywhere near as diversified as it could be.

Passive

Another benefit of investing in a crypto index fund is that the process is entirely passive. After the initial investment is made, the provider will automatically rebalance and reweight the crypto index fund based on its own systems and objectives.

For example, some crypto index funds will rebalance the portfolio every month. This will usually readjust the percentage contributions that each individual cryptocurrency is given.

- If a cryptocurrency has a large market capitalization when compared to the previous month, then it will be given a higher percentage.

- And equally, if the cryptocurrency has declined in value, it will likely be given a smaller percentage.

There is also every chance that the rebalancing process will result in a new crypto asset being added to the index fund.

For instance, let’s suppose that Solana is the 10th holding in the fund, which is based on market capitalization. If in the following month Solana has been replaced by Polygon at the 10th spot, then the crypto index fund will likely make the swap.

Traditional Investment Process

Investors that are used to traditional financial instruments such as stocks and ETFs will often prefer a crypto index fund over investing directly.

This is because many investors are hesitant about using crypto exchanges – owing to the many scandals concerning hacks.

Then there is the issue of safeguarding the purchased cryptocurrencies in a private wallet which, again, can be intimidating for investors without experience in this space.

Instead, by opting for a crypto index fund, investors can allocate funds via traditional channels. This means investing in the fund through a reputable ETF provider, via an SEC-regulated brokerage.

Crypto Presales vs Crypto Index Funds – Which is Best?

Crypto index funds can represent a viable investment product when the broader markets are bullish. After all, the crypto industry typically moves in tandem – especially in the case of large-cap coins. In other words, when Bitcoin does well, so do other top-10 cryptocurrencies.

However, the fact of the matter is that for nearly 12 months, the cryptocurrency arena has been embroiled in a bear market. And as such, most cryptocurrencies have lost at least 70% from previous highs – sometimes more.

As a result, crypto index funds are losing significant sums of money for their investors. In comparison, throughout the current bear market, many crypto presales have gone on to generate unprecedented returns. Just two examples from 2022 include Lucky Block and Tamadoge – which after their respective presales generated growth of 60x, and 20x respectively.

The best ICOs as of writing is Bitcoin ETF Token. This crypto offers high staking yields and tokenized cloud mining credits.

Conclusion

On the one hand, crypto index funds offer a seamless way to gain exposure to a diversified basket of digital assets via a single trader. Moreover, the best crypto index funds rebalance and reweight the portfolio on behalf of investors.

However, crypto index funds are generating sizable losses at present – as per the broader bear market. As such, crypto presales like Bitcoin ETF Token offer a great alternative, as its high staking APY offers high yield early on. Currently on presale, $BTCETF, the native token, is priced at $0.0052 per token.

FAQs

Are there crypto index funds?

Yes, there are now more than a dozen crypto index funds in the market. Some of the most popular include the Bitwise 10 Crypto Index Fund, Galaxy Crypto Index Fund, and the Bitwise DeFi Crypto Index Fund. Each of the aforementioned index funds exclusively tracks cryptocurrency prices. The Fidelity Crypto Industry and Digital Payments Index, on the other hand, tracks a basket of crypto-centric stocks.

What is the best crypto index fund?

One of the best crypto index funds in terms of popularity is the Bitwise DeFi Crypto Index Fund. This fund invests in a basket of projects that are involved in the growth of decentralized finance – such as Uniswap, Maker, and SushiSwap.

Does Fidelity have a crypto index fund?

Yes, Fidelity currently offers two crypto index funds that may appeal to investors that seek exposure to this emerging industry. First, there is the Fidelity Crypto Industry and Digital Payments Index – which tracks crypto-centric stocks like Coinbase and Block. Then there is the Fidelity Metaverse ETF. This fund tracks stocks that are loosely involved in the metaverse – such as Tencent, Electronic Arts, Netease, and Nintendo.

Is there a Vanguard crypto index fund?

Unlike major competitor Fidelity, Vanguard does not currently offer an index fund for crypto. Whether or not there will be a Vanguard Cryptocurrency index fund in time for the next bull run remains to be seen.