As SushiSwap Drains Liquidity From Uniswap, Aave Leads In DeFi

Following SushiSwap (SUSHI)’s completed migration from the major decentralized exchange Uniswap to its own decentralized exchange, taking hundreds of millions of dollars in liquidity with it, Uniswap fell from the throne of dominance, with crypto lending protocol Aave (LEND) sitting in its place – at least for now.

DeFi Pulse shows total value locked (TVL) to be USD 7.17bn, with Aave flipping Uniswap, given the latter’s drop from the 1st to the 9th spot. Aave itself currently has USD 1.53bn in TVL.

Per Uniswap, its liquidity is down 70.6% in 24 hours, to USD 467.5m. DeFi Pulse shows total value locked in Uniswap dropping nearly 74% from USD 1.44bn on September 9 to the current USD 348m. However, the numbers are nonetheless higher than they were before the Sushi’s creation and the following craze in late August.

DeFi Pulse didn’t include SushiSwap yet though, so the overall number and ranking could potentially change if/when it does, and if Sushi continues growing.

Per the SushiSwap analytics dashboard, there is currently USD 1.32bn in liquidity. Volume on September 10 is recorded at USD 81m.

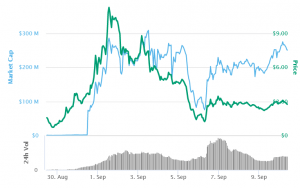

At pixel time (08:23 UTC), SUSHI, ranked 60th by market capitalization on CoinMarketCap, trades at USD 2.7. It is up by 10.5% in a day.

SUSHI price chart:

On September 9, SushiSwap completed its migration from Uniswap to its own community-owned, decentralized exchange platform, as announced by Sam Bankman-Fried, CEO of crypto derivatives exchange FTX, who took over the protocol just a couple of days prior.

The new Sushi head chef tweeted out the migration process, which involved tests as they go, marking an end to it just hours ago. “Once the migration has been completed, SUSHI rewards will flow to the new SushiSwap pool stakers,” said the CEO, and if one kept on staking they’d automatically migrate and participate in SushiSwap. “If you stop staking prior to migration you will stay behind in Uniswap and cease to receive rewards,” he added.

With it, he also announced the official transition to multisignature governance model, whereby changes are made through an approval of majority of elected leaders.

As a reminder, Sushi is one of the new projects in the decentralized finance (DeFi) space that have prompted quite a buzz in the Cryprosphere during their short lives, having been created less than two weeks ago by one ‘Chef Nomi’ as a fork of Uniswap – subsequently seeing a major rise in value, as well as the Chef’s controversial decision to withdraw USD 13m from SUSHI’s liquidity pool on Uniswap before handing the control over to Bankman-Fried.

____

Reactions:

__

__