Another Bank Down: Crypto-Friendly Signature Bank Closed Over Systemic Risk Concerns – What Does This Mean for Crypto?

Yet another crypto-friendly bank has gone down with the collapse of New York-based Signature Bank. But according to the industry, crypto now cannot be stopped.

The collapse, which occurred over the weekend, is the latest in a series of bank failures that are sending shockwaves through global financial markets, with many fearing that a major banking crisis is unfolding. The crisis has hit the crypto industry particularly hard, with Signature seen as a key bank for companies operating in the sector.

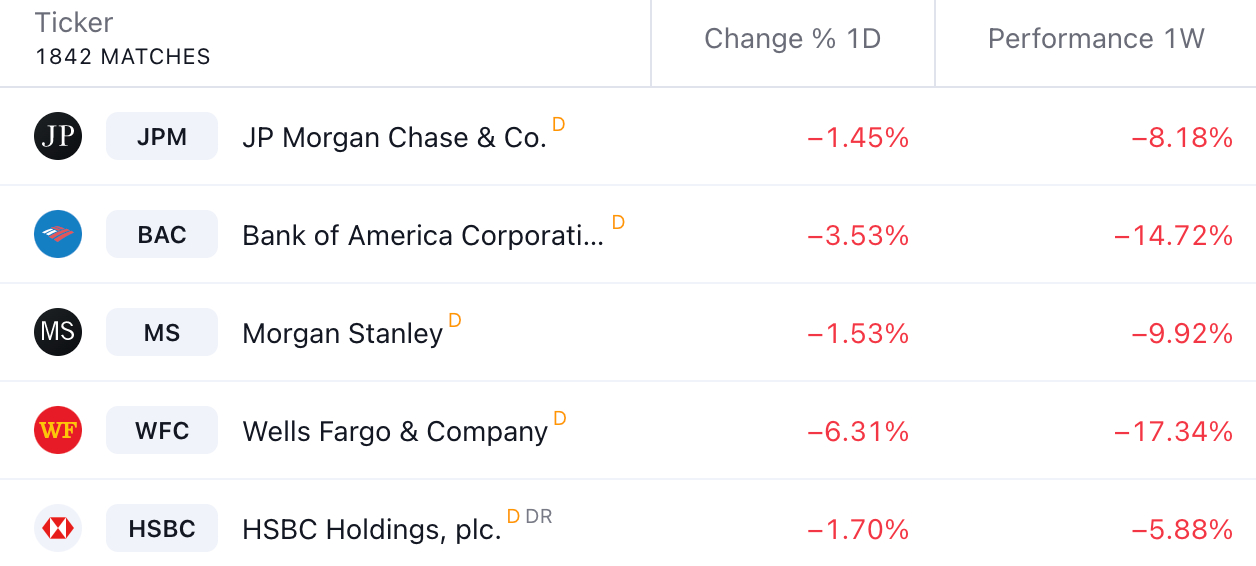

Despite reassurances from Treasury Secretary Janet Yellen that “decisive actions” are being taken to strengthen confidence in the banking system, shares of major US banks fell sharply in Wall Street trading on Monday morning.

The collapse in share prices across the sector intensified after President Joe Biden commented on the situation in a Monday morning speech that some crypto community members said did nothing to calm the markets.

Banks loving one of the worst presidential speeches in the history of democracy pic.twitter.com/L6OladsCzH

— Alex Krüger (@krugermacro) March 13, 2023

Series of bank failures

The troubles for Signature Bank came to light shortly after two other crypto- and tech-focused banks, Silvergate Capital and Silicon Valley Bank, both collapsed before the weekend.

Silvergate Capital is known as one of the most crypto-friendly banks in the US, and the bank has worked with many of the most prominent crypto companies, including Michael Saylor’s MicroStrategy. The bank was hit hard by the fall of FTX in November last year, and suffered a run that forced it to sell $5.2 billion of debt securities at a loss.

Silicon Valley Bank, on the other hand, is known as an important banking partner for California-based start-ups and venture capitalists, and has been used by USDC issuer Circle. The bank’s collapse now stands as the second largest bank failure in US history.

Government promises depositors will be made whole

Signature Bank’s closure is technically the result of government action, with regulators on Sunday forcibly shutting down the bank.

As part of the action by regulators, all depositors in the bank will be made whole, similar to what the government said about Silicon Valley Bank depositors. Additionally, US regulators claimed in a joint statement that no losses will be borne by taxpayers.

“Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law,” the statement said.

US crypto companies

The collapse of both Signature and Silvergate is a major hit for the crypto industry in the US in particular, where many companies have relied on the two banks for important functions.

Among those who shared their opinion on the situation, the Bitcoin-focused venture capitalist Nic Carter hinted in tweets over the weekend that the government intentionally targets the crypto sector with the bank closures.

It’s a “decapitation” of the industry from banks, he said, adding that “every pro-crypto bank has been shuttered.”

this is a bigtime "we're back" and "it's over" moment. on the one hand, the run has been apparently staunched. on the other, every remotely pro-crypto bank is defunct.

— nic 🌠 carter (@nic__carter) March 12, 2023

Carter doubled down on the same in later tweets, saying he has heard from multiple sources that the closure of Signature Bank came about because regulators “wanted to kill off the last major pro-crypto bank.”

Heard this independently from other sources as well. I suspected as much last night but confirmed today. Signature was executed last night not due to any runs but as a political scalp, intended to be veiled by the fog of war.

— nic 🌠 carter (@nic__carter) March 13, 2023

Others, such as Messari Crypto CEO Ryan Selkis, remained optimistic, saying it will be “difficult if not impossible” to kill crypto, which he called “an idea whose time has come.”

https://www.twitter.com/twobitidiot/status/1635112405016678401Bitcoin sees strong gains

Despite the bearishness on companies in the crypto industry, however, spot bitcoin prices have continued to rise sharply on Monday, possibly as a result of depositors seeking safety from failing banks.

“[I] find this BTC [price action] today extraordinary,” the popular economist and crypto trader Alex Krüger said on Twitter on Monday, while pointing out that the rally appears “largely spot driven.”

largely spot driven

— Alex Krüger (@krugermacro) March 13, 2023

perps basis strongly negative, futures basis almost flat, plenty of room for the market to lever up pic.twitter.com/ayDcMDOCtn

As of press time at 17:45 UTC, bitcoin was up a massive 16% for the past 24 hours to a price of $24,190. Ethereum’s native token ETH followed with a gain of 10% over the same time period to $1,679.