A Year Since Big Market Crash: Bitcoin Up 1,370%, Ethereum – 1,740%

It has been a year since the infamous Black Thursday (USA time) / Black Friday (UTC time) – one of the “droppiest” events in Bitcoin (BTC)‘s, Ethereum (ETH)‘s, and altcoins‘ history. And the world’s first crypto has come a long way since.

On the night (UTC time) from Thursday, March 12, to Friday, March 13, 2020, the crypto markets turned very bloody. The focus was on the number one crypto by market capitalization which had abruptly taken a steep dive – some 40%. It went from the USD 9,000 level to below USD 5,000, and at one point even below USD 4,000.

Numerous industry insiders, analysts, researchers, and many outside the industry – all gave their insights into what had happened, why it might have happened, and took to social networking sites, research papers, and blog posts to share what they expect to see next.

Nic Carter, Partner at venture capital firm Castle Island Ventures said this loss marked the second-biggest one-day loss in bitcoin’s history, while crypto analysis firm Glassnode revealed that more than half of all circulating bitcoin was held at a loss, for the first time in over a year.

Hot on the heels of this massive event, there was major selling in altcoins, including ethereum (ETH), XRP, and litecoin (LTC). And soon after, BTC safe-haven status was questioned.

Vijay Ayyar, head of business development at crypto exchange Luno, said at the time that “investors are moving out of any risky assets.” While BTC is compared to gold as a safe-haven asset, “it’s very under-penetrated and is considered more as a risky asset to hold at this point,” he added. Jonathan Leong, CEO of fintech BTSE, also argued that “it is difficult to consider bitcoin as a safe haven at this time,” while crypto trader Alex Krüger said that bitcoin was trading like “the exact opposite” of a safe-haven.

Yet Ross Middleton, Chief Financial Officer at decentralized exchange DeversiFi, noted that BTC will show “its safe-haven credentials” longer-term, while Mike Novogratz argued that the crash set “the narrative of bitcoin as a store of value […] back 12 to 18 months,” adding that “we’re going to have to get through this, and then we’re going to have to rebuild confidence.”

Placing blame

Crypto exchange BitMEX was one of the places the crypto world looked into first following the crash, as the exchange halted trading in the midst of the storm due to an alleged “hardware issue” at a cloud service provider. BitMEX denied the theories that surrounded this.

Outages were noticed on Coinbase, Gemini, and Huobi as well.

Crypto market analysis firm Coin Metrics, however, found that the price movements were likely mostly driven by shorter-term and relatively new holders.

But what next?

But the outlook wasn’t as pessimistic for the most part as one would think. Just days post-crash, there was generally positive sentiment surrounding bitcoin.

Yakov Barinsky, CEO of investment company HASH CIB, considered the sell-off to be expected given the overall global markets situation caused by the onset of the COVID-19 pandemic – but that it’s temporary for BTC. Also, Johnson Xu, then-Chief Analyst at token data and rating agency TokenInsight, considered the plunge to have been “driven by strong irrational behavior,” and that healthier levels are ahead. George McDonaugh, Co-Founder of blockchain investment firm KR1 plc, said that they expect crypto markets to maintain their overall upwards trajectory.

Also, many, like blockchain business consultant Lee Jong Cheol, saw the drop as a potential opportunity for people to buy (more) BTC. Days after the crash, Glassnode’s report showed that hodlers on average are accumulating bitcoin again.

That said, there were those who thought that the market had bottomed, and others who weren’t as convinced. Some said that until the pandemic is under control, more falls are to be expected. But nobody could say for certain how far BTC could drop if it continued falling.

And this led to the discussion of the broken narrative. Some, like cryptoasset analyst Glen Goodman commented that BTC breaking down through an upward trendline so dramatically damaged the bitcoin bulls’ morale and the USD 100,000 narrative. The bull narrative would be dead if BTC broke the USD 1,150 level, he said.

But bitcoiners seemed relatively optimistic about the future, with many stating that those who wanted to sell had done so already, and that the drop was just a period the market had to go through.

Back and beyond

After reaching USD 3,858 on Coinbase, bitcoin started recouping its losses already the next day. Following a few smaller ups and downs, BTC started pulling upwards already the following week.

In early May, it reached USD 9,900, with the Cryptoverse waiting for the USD 10,000 break. Soon enough, August brought jumps to USD 12,000, and since October, BTC has seen major rallies.

This led it to USD 40,000 in January this year, and its current all-time high of USD 58,642 (per Coingecko.com) in February. At 9:31 Friday morning, it’s trading at USD 56,646, having gone up 3.4% in a day, and 20.5% in a week.

This makes it around a 1,370% rise from that lowest point on this day last year.

To put it even further in perspective, BTC has now several times dropped and risen more than the USD 4,000 – USD 5,000 it had fallen to that faithful day – but its price is so high, that there is barely any reaction to the difference.

Additionally, per Coinpaprika, BTC’s market capitalization was USD 145.2bn on March 12 last year, dropping to USD 88bn the next day, while it stands at USD 1.044trn today.

While the thousands of dollars in drops are now less noticeable, the Cryptoverse is celebrating bitcoin’s progress in a single year and seems optimistic about it both near- and long-term. “USD 3,858 one year ago today. If you are reading this, more than likely you made it through the crash, Up $53,000 in one year, and nowhere but Up!! HODL ON!!!” posted a redditor.

Some remember Black Thursday/Friday as “a good day to buy,” claiming that they got in at the lower levels and saw large returns on their investment.

For many others the day was a lot more stressful. Popular BTC investor WhalePanda described it as “my most painful and stressful trading day in my life,” suffering “a big loss” but not blowing up the entire account – adding that “risk management is everything.”

And apparently, some much-discussed questions have been answered. “Many questioned if BTC was a safe-heaven asset a year ago today. The answer should be clear by now,” said Binance CEO Changpeng Zhao.

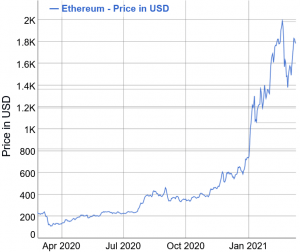

Meanwhile, ETH and major altcoins have also turned green. ETH, for example, surged from USD 97 to which it had dropped on March 13, to its all-time high of USD 2,035 on February 20, and the current USD 1,784. Since March 13, it’s up by more than 1,739%.

____

More reactions from Black Thursday veterans:

__

__

__

__

____

Learn more:

– BlackRock Says Gold Bites the Dust as It Eyes Bitcoin

– Why Bitcoin Likes a Hard-On Environment

– This Is Why ‘Hedge Against Inflation’, Bitcoin, Dropped On Inflation Fears

– This Is Why Old Models Don’t Work With Bitcoin According to Raoul Pal

– Bitcoin Snowball Is Expected To Hit More Institutions in 2021

– Norwegian Giant Aker Goes Bitcoin, Defends BTC Mining, Eyes Micropayments