Bitcoin Rallies as Fiat Currencies Drop Against the U.S. Dollar

After a major market crash last week, bitcoin (BTC), the most popular cryptocurrency, at least today is somewhat showing its power as a hedge against risks inherent in fiat currencies and the broader financial system.

After touching the USD 4,000 level less than a week ago, BTC rallied around 50% and is now (19:13 UTC) trading above USD 6,000 again. Other major coins are also in the green today.

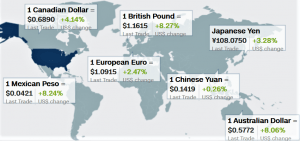

Over the past few days, we have witnessed what can be described as a meltdown in several fiat currencies, as measured against the U.S. dollar. Among these is the euro, the Australian dollar, the Canadian dollar, and many smaller currencies such as the Norwegian krone, which have all seen historic sell-offs against the U.S. dollar.

In the past five days, the U.S. dollar is up more than 8% against some of the largest fiat currencies:

Despite the massive sell-offs that have already been seen, however, investors such as CEO of Real Vision Group, Raoul Pal, believes the U.S. dollar is still the place to be for most people, writing on Twitter:

“Literally no one is long enough dollars. NO ONE. Pick any currency to short, it matters not. If you are in a different country, switch some cash into dollars. Buy what everyone is about to be desperate for….and do it NOW.”

“We are seeing an unprecedented situation where the more central banks ease, the more dollars are being stacked,” Min Gyeong-won, an economist at Shinhan Bank in Seoul, told Bloomberg. “The Fed’s bid for victory has failed, with markets not listening, worsening the dollar chaos and extending losses in Asian currencies.”

___

Learn more:

Fiat Money Printer ‘Goes BRRR,’ Is It a Time To Sell All Cash For Bitcoin?

10 Crypto Minds Weigh in On Post-Crash Bitcoin and Its Future

___

Meanwhile, according to Bruce Ng, a lead crypto-tech analyst for Weiss Cryptocurrency Ratings, when markets go down quickly enough, it’s not just the prices that can collapse: “It’s also the market mechanism.”

“First, the difference between bids and asks goes haywire. Liquidity disappears and trading dies. Investors who want out get locked in. Then, the MIDDLEMEN themselves drop out or face bankruptcy … or both. <…> And it’s especially true in broker/dealer markets (such a government securities) where the middleman has to buy the securities wholesale for his own account … and then sells them retail,” he said, stressing that other than massive, emergency, government bailouts, there’s no immediate fix.

“And we’re not even sure government bailouts would do the trick,” Ng said, adding that, in the long term, this can be fixed by cutting the middleman out with the help of blockchain technology.

The downwards trend for most fiat currencies has accelerated in recent days as a result of liquidations and margin calls in the stock market, which in turn has led investors to sell virtually all assets in a global rush to raise cash. Although this selling has even weighed heavily on the traditional safe-haven gold, bitcoin has remained more or less in consolidation mode after the crash on March 12.

The most recent positive trading activity in bitcoin has improved the sentiment among crypto market participants, with many analysts, industry players sharing their ideas online.

Among them is popular bitcoin analyst Willy Woo, who shared several charts that, in theory, might build a bullish case for bitcoin going forward:

And once again Raoul Pal, also made it clear just how bullish he believes the current situation is for bitcoin, arguing that “all trust is lost” in the traditional financial system:

In addition, a large number of other industry players also revealed just how bullish they believe the outlook for bitcoin is right now, given the downtrend in many fiat currencies and a meltdown in the stock market:

Meanwhile, blockchain and analytics specialist Chainalysis said that although BTC inflow volumes to exchanges are still high, it looks as though prices have attained some degree of temporary stability. However, they stressed that “given the uncertainty around the COVID-19 pandemic, it’s hard to predict where the bitcoin market will go next.”

{no_ads}