US Senators Warren and Cassidy Push for Action Against Cryptocurrency Use in Child Abuse Trade

A concerted effort to crack down on the use of cryptocurrencies in the buying and selling of child sexual abuse material (CSAM) is underway in the United States, spearheaded by Senators Elizabeth Warren and Bill Cassidy.

The senators are asking federal agencies about their technical capacity to combat crypto payments in the sale of child abuse-related materials.

Senators Urge DOJ and DHS to Combat Use of Cryptocurrency in Child Sexual Abuse Material Transactions

US Senators Elizabeth Warren and Bill Cassidy are urging the Department of Justice and the Department of Homeland Security to intensify efforts in combating the use of cryptocurrency for payments in the distribution of child sexual abuse material (CSAM) online, citing a perceived escalation in the problem.

In a letter addressed to Attorney General Merrick Garland and Secretary of Homeland Security Alejandro Mayorkas, the senators expressed concerns over the anonymity provided by cryptocurrency transactions. They argue that such anonymity facilitates the evasion of law enforcement by those involved in CSAM trading.

Drawing on data from the US Treasury’s Financial Crime Enforcement Network, Chainalysis, and the Internet Watch Foundation, the letter highlights an apparent rise in the use of cryptocurrency in illicit CSAM transactions.

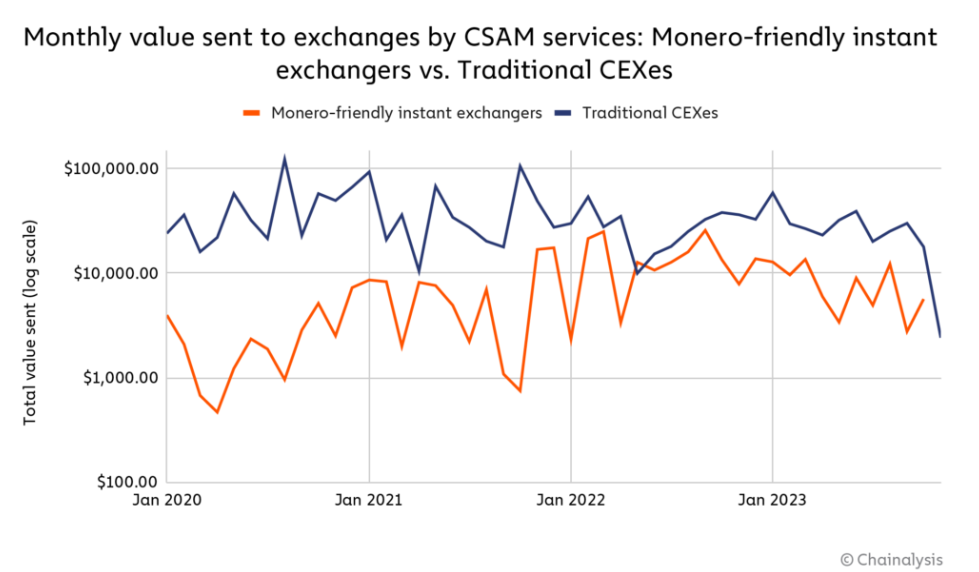

It notes that financial institutions identified 1,800 Bitcoin wallets suspected of engaging in such transactions between 2020 and 2022. However, Chainalysis observed a decrease in the scale of the crypto-based CSAM market in 2023.

The senators highlighted the methods used by individuals involved in CSAM trading to conceal their activities, including the utilization of crypto mixing services and ATMs to obscure the origin of funds.

A Chainalysis study revealed that sellers of such materials are utilizing “mixers” and “privacy coins” like Monero to launder profits and evade law enforcement scrutiny. Additionally, instant exchangers facilitating Monero conversions have seen a significant rise in activity in recent years.

Warren and Cassidy called attention to the seriousness of the issue. They emphasized cryptocurrency’s prevalence as the preferred payment method for perpetrators of child sexual abuse and exploitation.

To prompt action, the senators requested the DOJ and DHS to disclose their research findings on the extent of cryptocurrency’s role in the CSAM problem. They set a deadline of May 10 for the agencies to respond.

Warren’s Stance on Cryptocurrency Regulation and Recent DOJ Indictment of KuCoin

Warren’s vocal criticisms of cryptocurrency, particularly regarding its potential involvement in illicit activities, have drawn negative responses from some within the crypto community.

Her proposed anti-money-laundering legislation in July 2023, however, faced opposition from crypto advocacy groups, who argued it could harm US startups and investors. Despite pushback, Warren has reiterated her belief that stringent regulations are necessary to prevent criminal misuse of cryptocurrencies, including in cases related to CSAM.

The DOJ’s current technical capabilities in examining crypto transactions have already yielded results, as evidenced by the indictment of cryptocurrency exchange KuCoin and two of its founders.

On March 26, the DOJ charged KuCoin and its founders with operating an unlicensed money-transmitting business and violating the Bank Secrecy Act. The indictment alleges that KuCoin facilitated the laundering of more than $5 billion in suspicious and criminal funds.

The DOJ emphasized that KuCoin’s failure to implement basic anti-money laundering policies allowed it to operate in the shadows of financial markets and serve as a haven for illicit money laundering activities.