What is Proof-of-Stake (PoS) in Crypto?

Proof-of-stake or PoS is the consensus mechanism whereby transactions on the blockchain are validated by stakers, who have crypto locked into the network. To maintain decentralization and overall integrity, transactions on the blockchain are usually stored within blocks, with members of the network tasked with verifying these records.

This way of validating transactions was created as an alternative to the proof-of-work (PoW) model, which Bitcoin currently operates with and has a higher energy dependence. In this article, we shall explore its origins and its current use cases, and hopefully answer the question, what is proof of stake?

Proof-of-Stake Explained in Simple Terms

Let’s break down the concept in simpler terms. The proof-of-stake mechanism was created to provide an alternative way of validating transactions on the blockchain. To understand PoS, you first need to understand its predecessor, proof-of-work. As a decentralized system, no single controlling force is keeping a record of transactions, these are held within the blockchain, which is a distributed ledger.

In this ledger, you have blocks of data, which hold the records of transactions, and to verify these transactions, they must go through a consensus mechanism, which ultimately reconciles and fact-checks all data stored on the network.

Previously, the consensus mechanism used to do this was proof-of-work, where any party who had their computer connected to the blockchain became a node, and was able to complete a puzzle, which when completed, would verify the block of transactions.

Instead, proof-of-stake doesn’t need the computational power of PoW, all a user needs to do is stake their crypto into the network, which will highlight their intention to be a validator (someone who verifies transactions on the blockchain).

How Does Proof of Stake Work?

Okay, so how does proof of stake work? Let’s go into a little more detail and briefly explain each of the key pillars of this mechanism.

Staking Cryptocurrency

As described above, a user must have some crypto locked into the blockchain to become a validator, this is known as staking. Stakers will then be allowed to validate blocks of data on the network, and once completed, they will be added to the wider blockchain.

Depending on the amount staked, the chances of a staker or validator being selected to complete the process of a block will drastically increase. So ultimately, the more crypto you have staked, the better chance you have of being selected by the blockchain algorithm.

Once you have staked, you are unable to simply withdraw from the process at any time, there is typically a lock-up period, which can range from 1 – 2 years. Also staking on some networks comes with a minimum amount, for example on Ethereum, a minimum of 32 ETH is required to be a node.

Validating Transactions

Now you have staked your crypto, you are viewed as a node, which is a computer that can participate in the blockchain network. As such, you can now start validating transactions, provided you have been selected by the algorithm to do so. The selection is randomized to upkeep the integrity of the network, and the overall decentralized aspect of the blockchain.

Once a block of transactions has been created, a committee or group of nodes is selected to verify that the proposed transaction within this block is correct. Previously this was done using proof-of-work, where miners would compete by seeing who could complete a mathematical problem, in turn verifying the transactions on a block.

The drawback of this was that it required a large amount of electricity, and high-powered computers to partake.

Rewards & Penalties

When validators are selected, and complete the verification process of a dataset on a block of transactions, they will be issued a reward. This reward will come in the form of newly minted crypto. To successfully receive this reward, the block will need to be verified in an allotted time.

Should a validator not be present during a verification process, they will typically receive a penalty for being offline. In cases where a validator attempts to make a fraudulent verification, they will have their entire stake seized and sent to an unusable wallet.

What Are The Advantages of PoS?

There are several standout advantages of PoS, especially when comparing it to other consensus mechanisms.

Superior Energy Efficiency and Lower Environmental Impact

Firstly, due to its emphasis on staking as opposed to mining, there are fewer dependencies on running high-powered computers around the clock to mine crypto and validate transactions on the blockchain. According to an article by the Guardian, “Bitcoin mining may be responsible for 65.4 megatons of CO2 per year which is comparable to country-level emissions in Greece (56.6 megatons in 2019).”

This carbon footprint of PoW led Elon Musk to stop using Bitcoin as a payment method for Tesla vehicles back in 2021. PoS was birthed shortly after that, with the likes of Ethereum using this mechanism in its network. Energy consumption has been down by nearly 100% using this as a consensus algorithm.

Unique Approach to Network Security

Previously with mining, it was found by the National Bureau of Economic Research that, “the top 10% of miners control 90% of the Bitcoin mining capacity.” However, with PoS, the validation process is more distributed, which in turn boosts security. Validators on the platform must stake their own crypto, in the instance of Ethereum, the amount needed to be a node is 32 ETH or $75,712 based on today’s value.

Should a validator falsely verify a block of transactions, they will risk losing the crypto they have staked. Additionally, this distribution of validators means it is highly improbable for actions such as a 51% attack to be successful. This is due to the increased hashrate, which is the computational power on the network. Attackers would need to acquire a significant amount of nodes, to be able to fully win control.

What Are The Disadvantages of PoS?

Despite several notable advantages of the proof-of-stake consensus mechanism, there are also some shortcomings.

Risk of Centralization

Firstly, although staking is less energy-intensive, there is a risk of favoritism to those with a higher amount of capital. The blockchain algorithm will most likely select a node with a higher level of staked crypto. So essentially, the more you have committed, the better the chance you have of being chosen to validate a block.

This can result in centralization due to a concentration of power towards those with more investment in the network. As a result, there could be far more exposure to governance, and potential censorship of some transactions.

Despite this, the system of selecting validators is randomized, which is the blockchain’s way of countering the very credible threat of centralization.

Wealth Inequality

As briefly mentioned above, there is slight favoritism to those with greater levels of staked crypto on the blockchain. This could lead to growing inequality as these validators will be the ones receiving the lion’s share of rewards on the network. This could potentially increase the wealth gap between participants in the ecosystem.

What Are Some Real-World Applications of PoS Systems?

Ethereum

Ethereum has been one of the early adopters of the proof-of-stake mechanism, after it completed its merge back in 2022, switching to PoS from PoW. To be a staker on the Ethereum network, 32 ETH is required to be considered a node. Stakers or validators on the network who successfully verify a block of transactions will then receive crypto as a reward. There is also an Annual Percentage Yield (APY) of around 2.84% for staking Ethereum on ETH staking platforms.

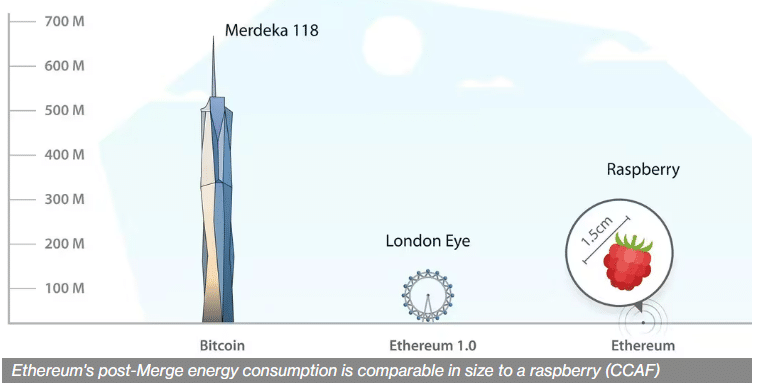

In terms of its carbon footprint, Ethereum 2.0 has been significantly more environmentally friendly than its original system. According to Yahoo Finance, Since moving to proof-of-stake, power demand on the network plunged to 235 kilowatts from 2.44 gigawatts. The below graph from Cambridge’s Centre for Alternative Finance (CCAF) illustrates how Ethereum 2.0 compares to both Bitcoin and its legacy PoW system in terms of energy consumption.

Additionally, the number of transactions per second has also dramatically risen, going from 15 – 20 per second, to now over 100,000. Despite this, the main concern has been the risk of centralization, with liquid pools such as Lido controlling a substantial portion of funds staked on the network.

Tezos

Ahead of the Ethereum proof-of-stake, Tezos was one of the original blockchains to use the PoS mechanism. Launched in 2018, the network has gone on to process millions of transactions within that period. This has been done with the help of those who “bake” (stake) XTZ, which is the native token of Tezos.

Tezos operates a liquid proof-of-stake (LPoS) model, where these bakers, similar to Ethereum’s validators, are responsible for verifying transactions on the block. There are a few differences however, with Tezos there is no lockup period, which is often found with other PoS operators.

This flexibility enables bakers to unstake or withdraw their tokens anytime. Additionally, bakers can also propose changes to protocols by submitting proposals.

Staking Pools and Community Governance

Above we briefly mentioned staking pools like Lido, but what exactly are these? A staking pool is a group of community of stakers combining to collectively stake. Operators of the pool are responsible for conducting the actual staking and distributing the rewards to participants based on their contribution to the pool.

Staking pools were formed to support would-be validators who did not have the capital requirements needed to individually stake. However, this coming together of such validators into a pool, has been one of the main drivers of centralization. As with the case of Lido, and even Coinbase, who initially were responsible for 40% of all staked crypto on the Ethereum network.

This community governance, although distributed, has still been viewed as increasing overall centralization on the blockchain, due to small groups controlling a significant portion of the network, and what gets written into the ledger. The same article above also mentioned that the U.S. government could pressure such pools to block transactions from certain addresses that have been sanctioned.

The Future of Proof-of-Stake

There are both clear benefits as well as drawbacks for proof-of-stake blockchains, but what will the future of this mechanism look like?

Scalability and Performance

One of the main challenges for blockchains in general has been scalability, with proof-of-stake offering a better alternative to proof-of-work. Despite this, there are still some challenges to be addressed in the future. Particularly as the number of transactions grows, how will this mechanism manage to handle these pain points?

Before the merge, the total number of transactions per second on PoW was 20, with this number now at a max capacity of 100,000. However, as the network grows, this could become a challenge as more capacity could be needed.

Currently, sharding is used to help solve this problem, by splitting the blockchain into multiple parts, as opposed to one singular ecosystem. Each shard was responsible for processing transactions simultaneously on the network, boosting the overall flow, and this may need to be magnified in the future.

Additionally, sidechains like Polygon can be used to boost the scalability of the transactions on the Ethereum network. Polygon uses two techniques for greater scalability, the main being the Polygon PoS sidechain. This is a layer-2 blockchain that works in conjunction with Ethereum to boost speed and lower fees for users.

Regulation and Compliance

Regulation has long been a concern in crypto, with many governments looking at ways to implement structure and safeguards within the ecosystem. Proof-of-stake blockchains, and in particular the staking pools that form community governance could face increased pressure from regulators in the future.

Should this happen, the current fears of centralization will gradually begin to be realized, with more stringent rules for those who want to become stakers. Regulators may require staking pools to form tougher onboarding rules and implement governance like anti-money laundering (AML) and know-your-client (KYC).

If this ever occurs, some crypto loyalists may begin to move back to proof-of-work, which wouldn’t have this same level of compliance.

Conclusion

Ultimately, it appears that proof-of-stake is not only a significantly more environmentally friendly alternative to other consensus mechanisms, but it is also more scalable The system has already been adopted by Tezos and Ethereum, with many now calling for Bitcoin to make the switch. Although this may not happen, the potential of such a move could be seismic for the entire world of crypto, and its bid for mainstream adoption.

However, this potential adoption, and scale is also the biggest challenge facing the overall ecosystem, with many fearful that such shifts could impact decentralized finance as a whole. For now, PoS will likely continue to grow in use, with more and more crypto holders looking to become stakers, and potentially earn rewards by doing so.

Proof-of-Stake FAQs

What does Proof-of-Stake mean?

Proof-of-stake is the consensus mechanism used to decide which users can verify transactions on the blockchain.

What is the difference between PoS and PoW?

PoS requires a person to stake crypto tokens to be eligible to verify blocks of transactions, with PoW you need to use high-powered machines to solve puzzles or mine, to confirm blockchain transactions.

Which crypto uses Proof-of-Stake?

Ethereum, and Tezos are the main cryptos that use the proof-of-stake mechanism.

How does staking work in PoS?

A person stakes their crypto and becomes a validator. Validators are randomly selected by the algorithm to verify new blocks of transactions. Once validated, the staker will be rewarded for participating.

References

- What is a consensus mechanism (CoinDesk)

- Bitcoin terrible for the environment (The Guardian)

- Elon Musk to stop using Bitcoin (BBC)

- 0.1% miners control half of Bitcoin’s mining capacity ( National Bureau of Economic Research)

- What is a 51% attack? (CoinDesk)

- Impact of Ethereum merge on climate pollution (The Verge)

- Ethereum post merge energy usage (Yahoo Finance)

- Staking pools control 40% of all staked crypto on the Ethereum network (CoinDesk)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Viraj Randev

Viraj Randev

Nick Pappas

Nick Pappas

Eric Huffman

Eric Huffman