9 Best Ethereum Staking Platforms in 2024

Ethereum became a proof-of-stake coin in 2022, meaning investors can now earn staking rewards on their ETH holdings. But which staking platforms should you consider in 2024?

This guide reveals the 9 best Ethereum staking platforms in the market today. We focus on key metrics like APYs, staking terms, minimum investment requirements, security, withdrawal times, and more.

Top 9 Ethereum Staking Platforms Ranked

The best Ethereum staking platforms are summarized below:

- MEXC – Overall best Ethereum staking platform for 2024.

- OKX – Stake ETH and secure liquidity in BETH at a 1:1 Ratio.

- Gate.io – Generate bonuses on top of your standard ETH yield.

- Binance – Lower staking APYs with Binance’s ‘Principal Guaranteed.’

- KuCoin – On-chain staking with 3.7% APYs and a 5-Day redemption.

- Ledger – Secure hardware wallet that doubles up as a staking tool.

- Bybit – Earn flexible and fixed ETH staking yields, up to 3% annually.

- Coinbase – User-friendly staking platform with tier-one security.

- Kraken – Competitive staking rewards of up to 6%.

Ethereum Staking Platforms Reviewed

Now we’ll review the staking platforms listed above. This will help you choose the best place to stake Ethereum in 2024.

1. MEXC: Overall Best Ethereum Staking Platform for 2024

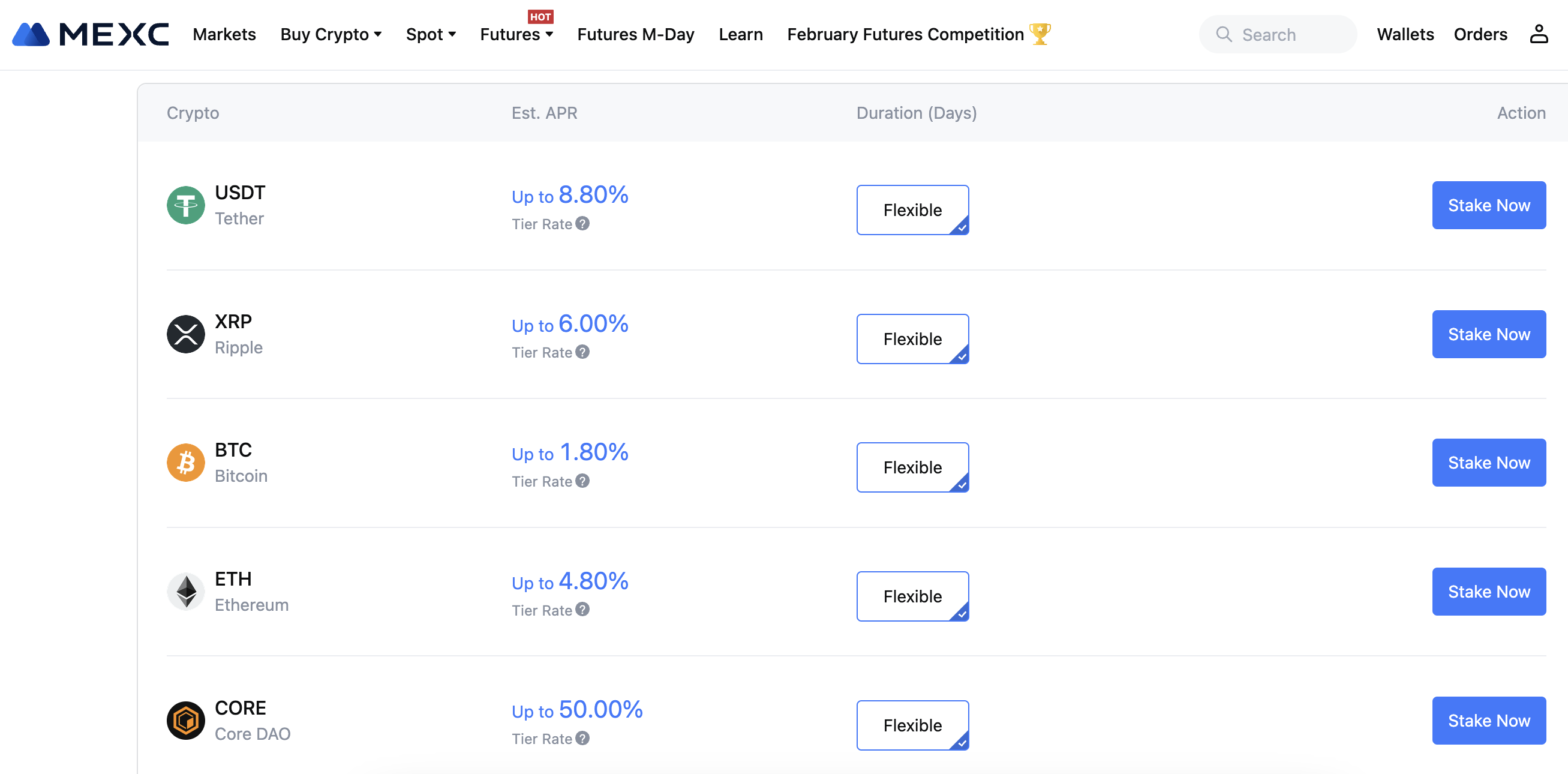

Our top pick for Ethereum staking is MEXC, a popular cryptocurrency exchange with robust security. MEXC is best known for its 0% commission trading, which is offered on hundreds of cryptocurrencies. That said, MEXC also offers competitive staking rewards on multiple PoS coins, including Ethereum.

Unlike the original Ethereum blockchain, MEXC doesn’t have any staking minimums. What’s more, staking terms are flexible. This means you can withdraw your ETH coins at any time – without penalties. In terms of rates, MEXC offers Ethereum APYs of up to 4.8%. While this is competitive, only the first 0.1 ETH earns 4.8% rewards.

Anything above 0.1 ETH will earn just 0.5%. Therefore, MEXC is the best option for casual investors. In addition, MEXC is one of the best crypto staking platforms for stablecoins; you’ll earn 8.8% on Tether. MEXC – as a tier-one exchange, allows you to buy Ethereum instantly with a debit/credit card. This means you can still stake ETH even if you don’t currently have any coins.

| Staking Platform | Ethereum Staking APYs | Key Staking Terms |

| MEXC | Up to 4.8% | Flexible withdrawals without penalties. Only the first 0.1 ETH earns 4.8%. The APY then drops to 0.5%. |

Pros

- In our view, the best place to stake Ethereum

- Earn APYs of up to 4.8%

- Staking accounts are flexible – withdraw at any time

- No minimum investment requirements

- Backed by a tier-one exchange with proven reserves

Cons

- The APY drops to 0.5% after the first 0.1 ETH

- Doesn’t accept US clients

2. OKX – Stake ETH and Secure Liquidity in BETH at a 1:1 Ratio

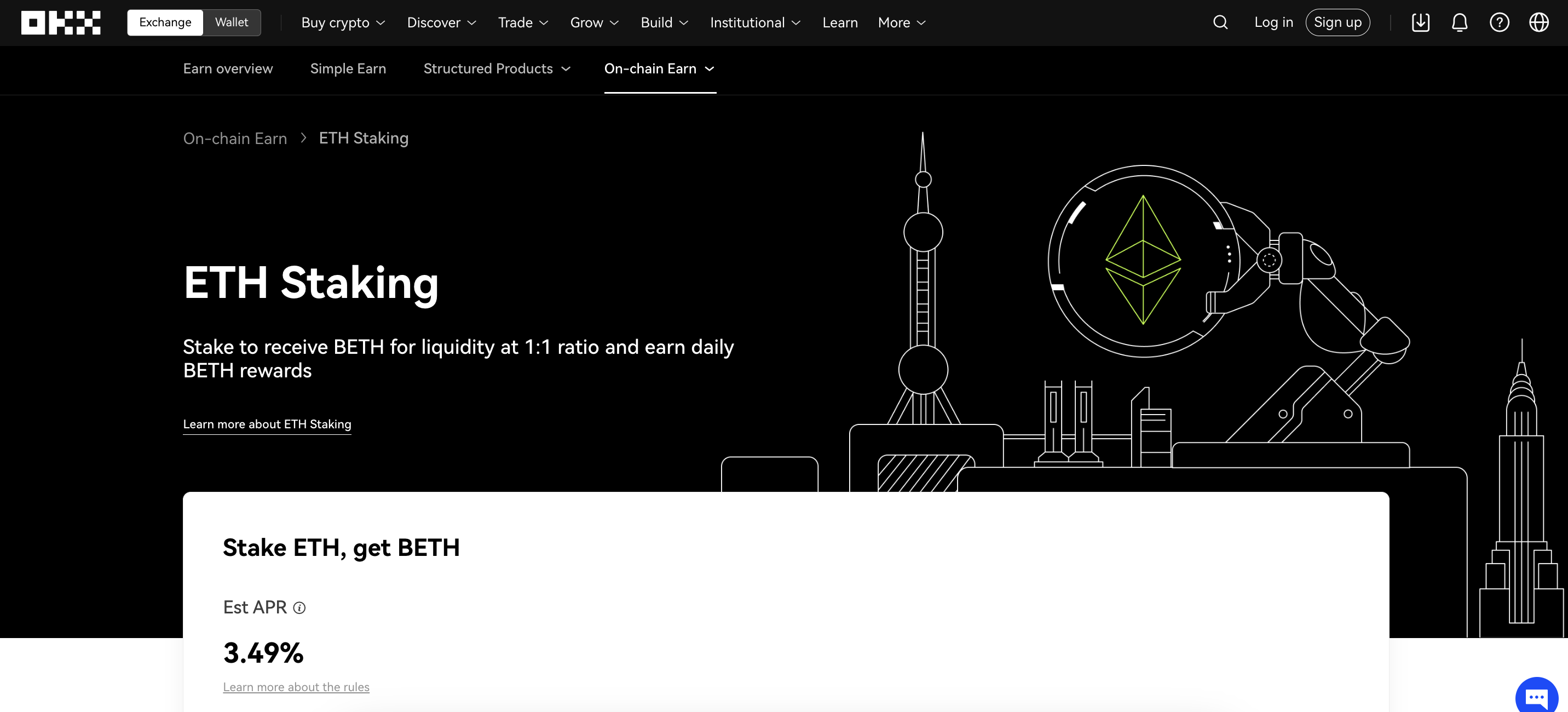

We found that OKX is also worth considering when exploring where to stake Ethereum. OKX is a popular cryptocurrency exchange with low fees, hundreds of trading pairs, and audited proof of reserves. OKX allows you to stake Ethereum at the click of a button. You’ll currently earn APYs of 3.49%, which includes a 5% staking fee.

That said, staking APYs will fluctuate based on network conditions. For example, the APY skyrocketed to over 15% this week. OKX is a great option if you’re seeking instant liquidity. After you stake Ethereum, you’ll receive Beacon Ethereum (BETH) at a 1:1 ratio. So, you’ll receive 1 BETH for every 1 ETH staked.

You’ll need to return the BETH when you want to redeem your ETH staking rewards. BETH is pegged to ETH, meaning it has the same value. To maximize your rewards, consider staking BETH too. In terms of getting started, it takes seconds to register with OKX. The platform is available via browsers, desktop software, and an app for iOS and Android.

| Staking Platform | Ethereum Staking APYs | Key Staking Terms |

| OKX | 3.49% | Minimum staking deposit of 0.01 ETH. You’ll receive BETH on a 1:1 ratio. Staking funds are returned when released by the Ethereum network. |

Pros

- Competitive APYs of 3.49%

- Get BETH as liquidity on a 1:1 basis

- Staking fees are built into the APY

- Fast registration process

- Also one of the best crypto exchanges for spot trading

Cons

- No guarantee that BETH will remain pegged to ETH

- Doesn’t offer flexible withdrawals

3. Gate.io – Stake ETH2.0 and Earn High Yields with this Crypto Exchange

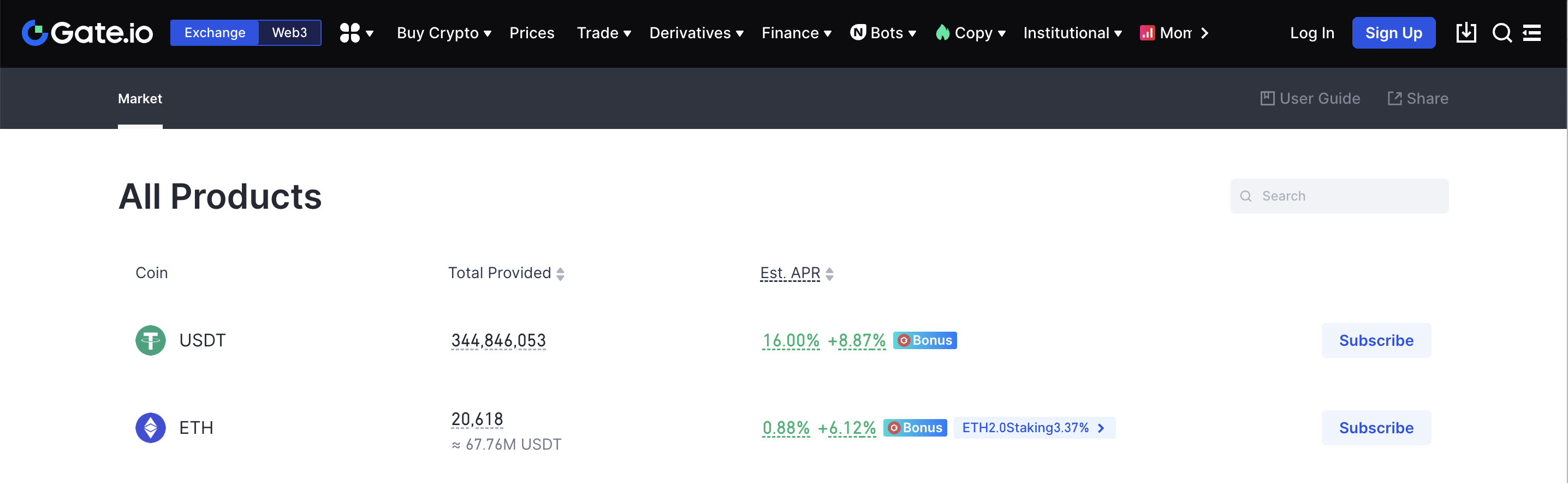

Gate.io is one of the top cryptocurrency exchanges that lets you stake Ethereum. One of the most popular trading platforms, Gate.io boasts an average daily trading volume of over $10 billion.

Over 14 million registered customers can stake ETH through Gate.io’s ‘Earn’ section. You can stake and earn 0.88% APYs on ETH through the simple earn mechanism.

On top of the 0.88%, Gate.io offers up to a 6.12% bonus on staking ETH. However, the bonus amount is offered as $GT, the native token of Gate.io.

This top platform also offers staking returns on ETH2.0. The ETH2 token can be purchased through the exchange and staked on-chain to generate higher rewards while paying zero fees. An estimated APR of 3.37% is offered to ETH2.0 staked token holders.

Over 78.11K ETH has been staked on Gate.io. This beginner-friendly platform also provides innovative tools such as copy trading and cryptocurrency loans to customers. Apart from Ethereum, over 1,700 cryptos can be traded on Gate.io.

Staking Platform

Ethereum Staking APYs

Key Staking Terms

Gate.io

0.88% (Additional 6.12% as GT bonus)

Flexible term, principal amount protected, bonuses offered in the native token

Pros

- Offers staking bonuses on top of the regular yield

- ETH2.0 staking offered

- More than 78K ETH staked

- Flexible staking terms

Cons

- Bonus yield offered in GT

- Base staking yield for ETH is low

4. Binance – Lower Staking APYs With Binance’s ‘Principal Guaranteed’

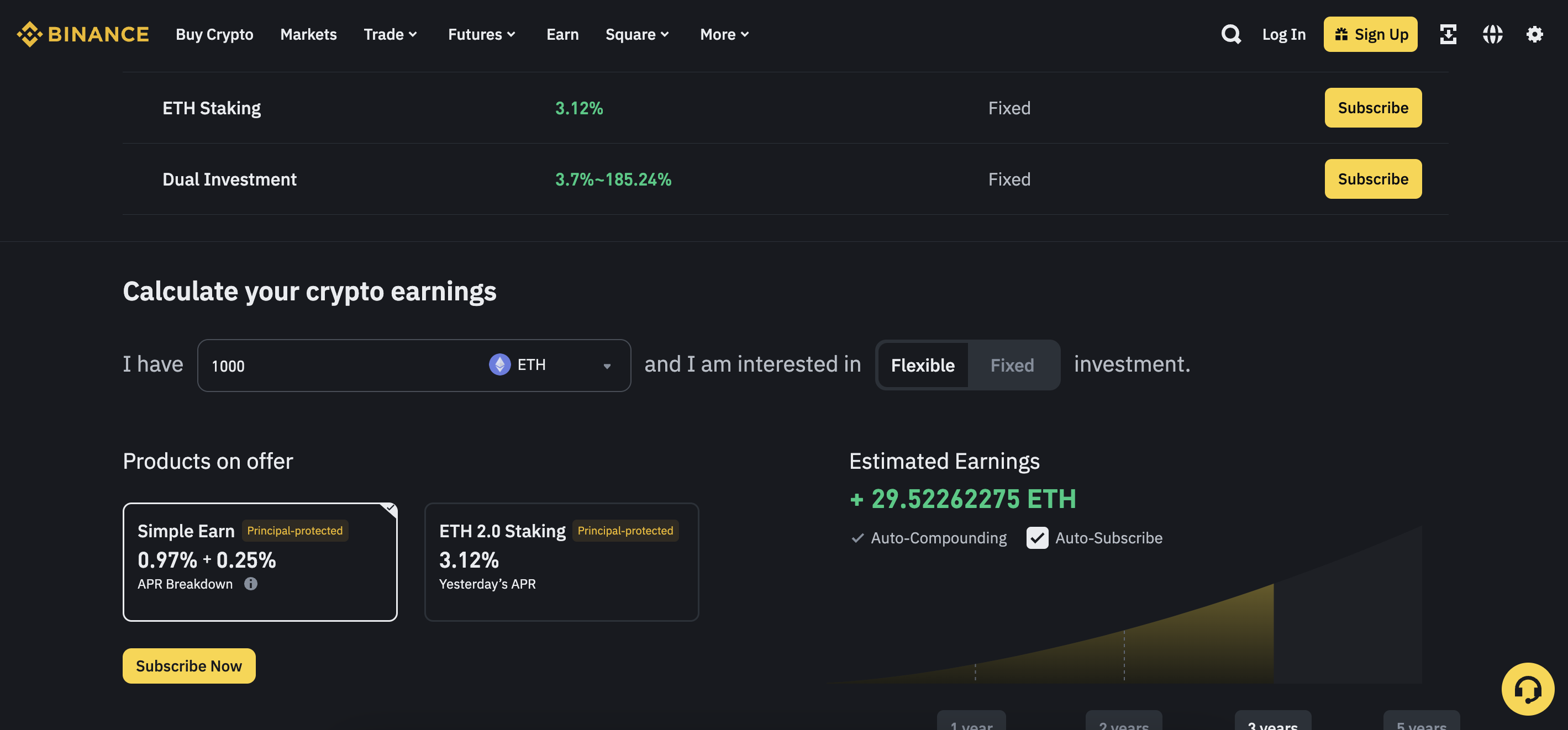

We found that Binance – the world’s largest cryptocurrency exchange, is also a great option when staking Ethereum. It takes seconds to register an account, deposit ETH, and begin staking. Binance currently pays staking APYs of 3.12%, which fluctuates daily. This rate is lower than other Ethereum staking platforms.

However, Binance offers something called ‘Principal Guaranteed’. It claims that even if the market crashes, you’ll receive your original principal back. This is the amount you deposit into the staking pool, so doesn’t include any earned interest. In terms of redemption, this is determined by the Ethereum blockchain.

So, once the staking period concludes, you’ll be able to withdraw your ETH coins. If you’re looking for more flexibility, Binance also offers Ethereum savings accounts. While these allow you to make withdrawals at any time, you’ll earn a reduced APY of 1.22%. Binance also supports other earning products, including dual investments and liquidity farming.

| Staking Platform | Ethereum Staking APYs | Key Staking Terms |

| Binance | 3.12% | No minimum staking requirements. APYs fluctuate daily. Staking deposits can be withdrawn once released by the Ethereum network. |

Pros

- Start staking ETH with any amount

- Staking deposits are protected by Binance’s ‘Principal Guaranteed’

- Rewards can be compounded for faster growth

- Also offers Ethereum savings accounts with instant withdrawals

- Backed by the world’s largest and most liquid exchange

Cons

- You can’t withdraw your ETH until it’s released by the network

- Higher staking APYs are available elsewhere

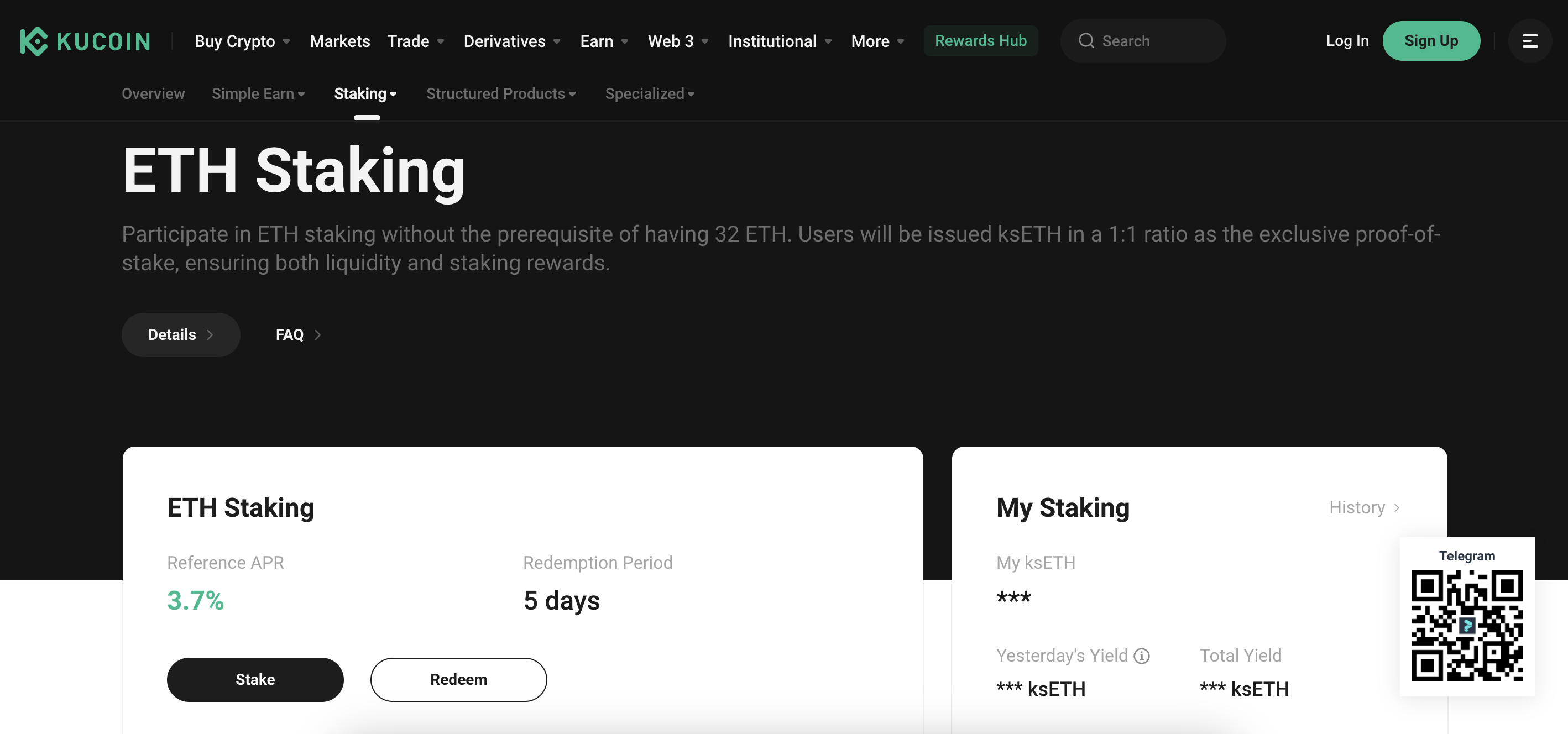

5. KuCoin – On-Chain Staking With 3.7% APYs and a 5-Day Redemption

Next is KuCoin, which is one of the best Ethereum staking platforms for short-term investors. It currently offers APYs of 3.7% when staking Ethereum, which is very competitive. There are no staking limits, so the entire deposit will get this rate. What’s more, there are no minimum requirements, so KuCoin is ideal for all budgets.

We also like that KuCoin releases the staked Ethereum after just five days. This means you won’t need to lock your ETH coins away for long periods. Another benefit is that KuCoin offers liquidity when staking Ethereum. On a 1:1 ratio, you’ll receive ksETH while the coins are locked.

This is native to KuCoin and it’s backed 1:1 by ETH. This is confirmed via audited proof of reserves. In addition, KuCoin supports many other staking coins. This includes Cosmos, Polkadot, and ApeCoin. KuCoin is also considered one of the best crypto leverage trading platforms – especially when speculating on perpetual futures.

| Staking Platform | Ethereum Staking APYs | Key Staking Terms |

| KuCoin | 3.7% | No minimum staking requirements. ETH is unlocked after five days. Receive ksETH on a 1:1 basis. |

Pros

- Earn Ethereum staking APYs of 3.7%

- Staking deposits released after five days

- No limits on how much you can stake

- No minimum investment requirements

- Receive ksETH on a 1:1 basis

Cons

- ksETH has limited utility other than redeeming ETH rewards

- Staking fees are not published

6. Ledger – Secure Hardware Wallet That Doubles up as a Staking Tool

The next Ethereum staking option is Ledger, which is considered one of the best crypto hardware wallets. Ledger offers institutional-grade security, with private keys kept in cold storage at all times. This makes Ledger a great option for long-term investors with large ETH holdings.

However, do note that Ledger doesn’t directly connect you with the Ethereum blockchain. On the contrary, you’ll need to connect Ledger with a third-party staking protocol. It offers two options in this regard. First, you can connect with Kiln, which offers APYs of 7%. Alternatively, consider Lido, which offers a more sustainable APY of 4%.

Ledger has no input in the rates offered. To get started, you’ll need to download the Ledger Live app for iOS or Android. After connecting with the Ledger device, click on the ‘Earn’ button. Choose between Kiln and Lido, enter the staking amount, and confirm. If you don’t have any Ethereum, you can buy some on the Ledger Live app.

| Staking Platform | Ethereum Staking APYs | Key Staking Terms |

| Ledger | Averages 4-7%, depending on the staking pool | Depends on the chosen third-party staking pool |

Pros

- One of the safest ways to store and stake ETH

- Ideal for long-term investors with large holdings

- Never exposure your private keys to live serves

- Supports Kiln and Lido integration

Cons

- APYs and terms are determined by third parties

- Doesn’t offer the same convenience as a hot wallet

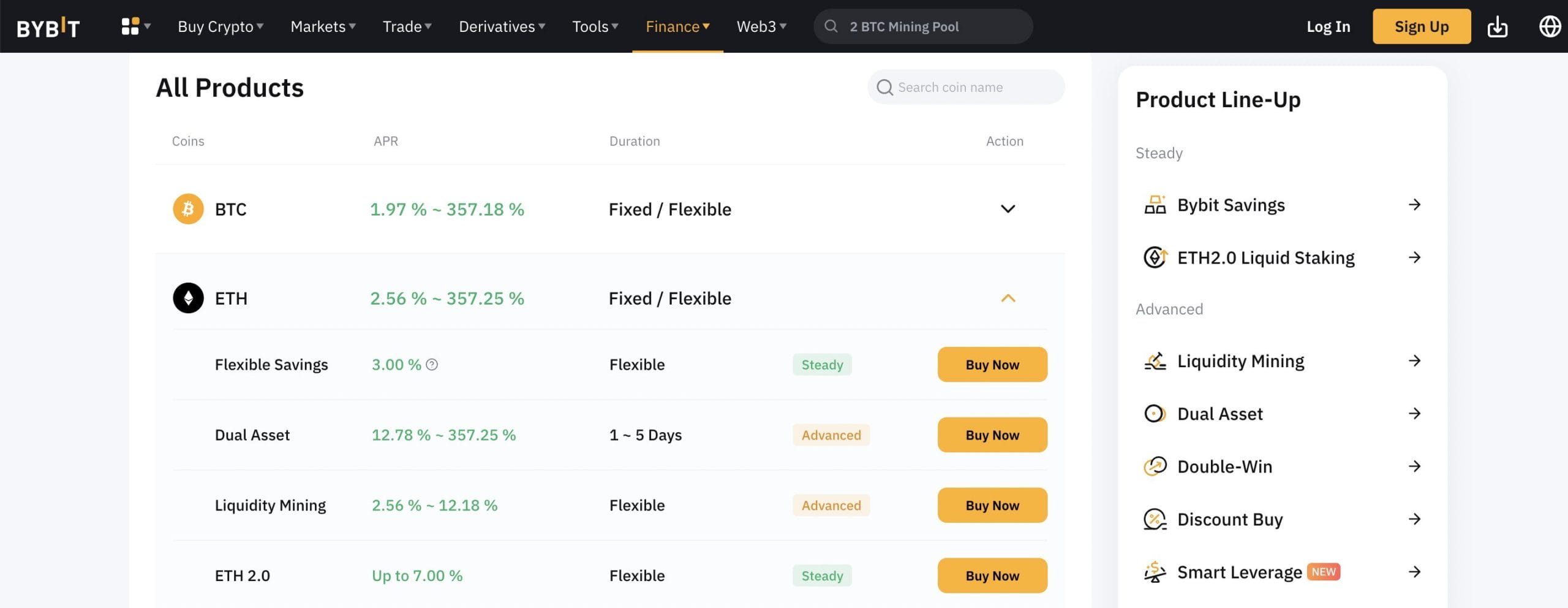

7. Bybit – Flexible Staking Options for ETH, Get 3% – 7% Returns

Bybit is another top crypto exchange that offers competitive staking yields for locking Ethereum. This exchange has a user base of more than 15 million, scattered across 200 countries.

Investors can generate Ethereum staking yields through Bybit ‘Earn’ and ‘Savings.’ Through the Earn option, you earn up to 3% in flexible staking options. However, if you deposit more than 0.2 ETH, the APY reduces to 0.5%.

ETH2.0 can also be staked on Bybit to generate up to 7% annual yields. Bybit issues a ‘dual asset’ staking tool, where ETH and other tokens can be staked to earn between 12% – 357% APYs.

Through ‘Bybit Savings,’ one can earn 1.50% APYs, through a fixed 30-day plan. 1.80% APYs are offered for a 60-day plan. Thus, Bybit is a top option for those seeking multiple earning options.

Bybit is also known for offering innovative tools such as automated crypto trading, crypto loans, and AI platforms.

1.5% – 1.8% with Bybit Savings

Staking Platform

Ethereum Staking APYs

Key Staking Terms

Bybit

0.5% – 3% with Bybit Earn

Provides flexible and fixed staking options, 3% return up to 0.2 ETH, reduces to 0.5% if you stake more than 0.2 ETH

Pros

- Flexible and fixed staking plans

- Stake ETH2.0 and get 7% APYs

- Supports dual asset staking

- Offers crypto loans

Cons

- APY reduces once you stake over 0.2 ETH

- Restricted in the US

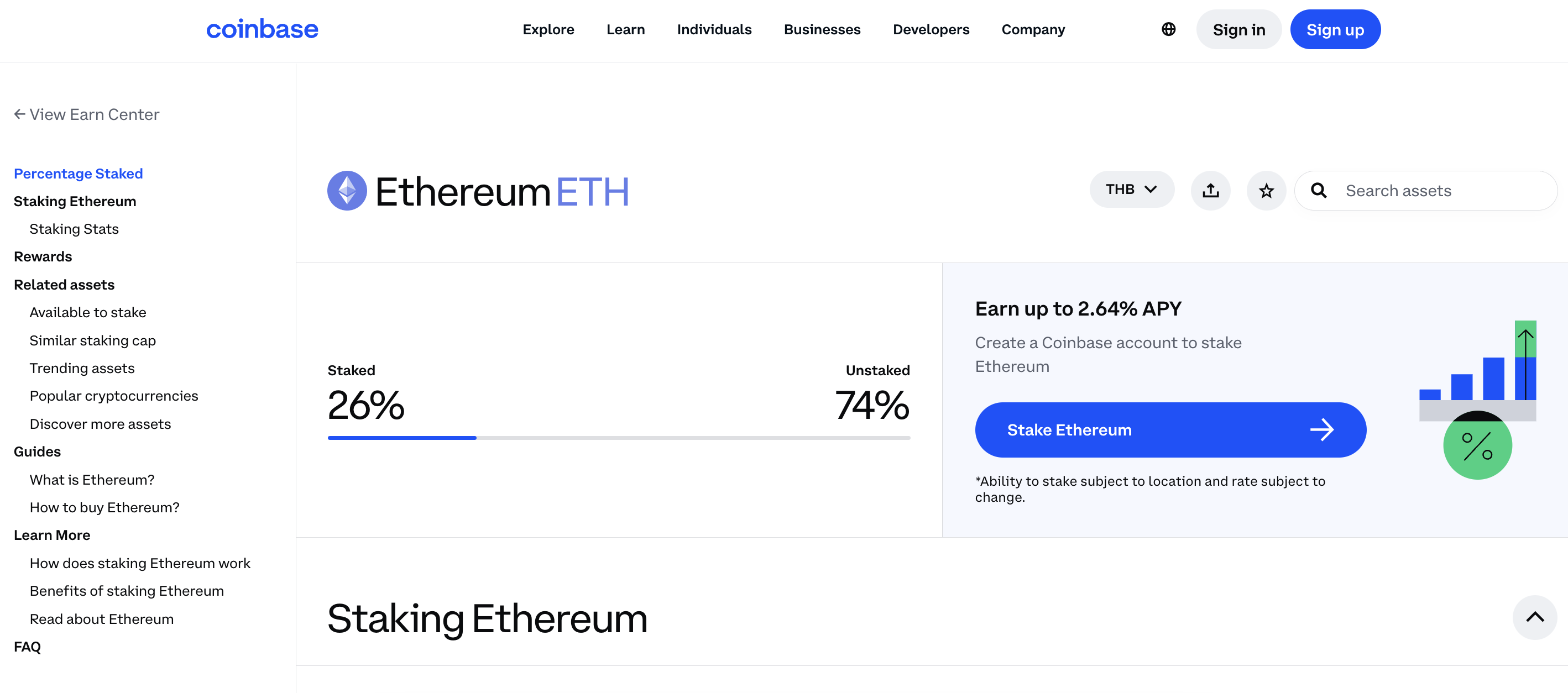

8. Coinbase – User-Friendly Staking Platform With Tier-One Security

While Coinbase doesn’t offer the best staking APYs, it’s a great option for first-time investors. Coinbase offers a user-friendly experience from start to finish. It takes minutes to register an account, verify your identity, and begin earning staking rewards. What’s more, Coinbase is a trusted exchange with tier-one security controls.

This ensures your Ethereum is safe at all times. For instance, all Coinbase accounts are protected by two-factor authentication. Not to mention IP and device whitelisting. In terms of Ethereum staking, there are no minimum investment requirements, which will appeal to beginners.

The bad news is that Coinbase currently offers staking APYs of just 2.64%. This is considerably lower than the industry average. Upon closer inspection, the low APY correlates to Coinbase’s fee structure; it takes a commission of up to 35% on staking rewards. In addition to Ethereum, Coinbase also supports other staking coins, including Cosmos, Tezos, and Cardano.

| Staking Platform | Ethereum Staking APYs | Key Staking Terms |

| Coinbase | 2.64% | No minimum staking requirements or lock-up periods. |

Pros

- User-friendly staking platform with solid security controls

- Unstake your Ethereum at any time

- No minimum staking requirements

- Supports other staking coins – including Cosmos and Cardano

Cons

- Currently pays staking rewards of just 2.64%

- Takes a staking commission of up to 35%

9. Kraken – Competitive Staking Rewards of up to 6%

Last on this list of Ethereum staking platforms is Kraken. This popular cryptocurrency exchange offers a safe and user-friendly way to stake ETH. Simply open an account, deposit ETH, and click the ‘Allocate’ button. In doing so, you’ll earn competitive staking APYs of 3-6%.

This APY range is dependent on network conditions. That said, you’ll also need to consider the ‘bonding’ period. According to Kraken, it can take several weeks for newly staked ETH to start generating rewards. Although in most cases this is just a few hours. Like many staking platforms, Kraken takes a commission from any rewards earned.

This ranges from 8% to 20%, depending on the amount of Ethereum being staked. Nonetheless, the good news is that you can unstake your Ethereum at any time. Kraken also offers competitive staking APYs on other coins. For example, you’ll get up to 18% when staking Cosmos on a 21-day bonding period.

| Staking Platform | Ethereum Staking APYs | Key Staking Terms |

| Kraken | 3-6% depending on network conditions | Unstake at any time. A bonding period must pass before you start earning rewards (a few hours to a few weeks). No staking minimums. |

Pros

- Earn Ethereum staking rewards of up to 6%

- No staking minimums are required

- Unstake your Ethereum at any time

- Offers high APYs on other staking coins

- Also one of the best crypto futures trading platforms

Cons

- A bonding period must pass before you start earning rewards

- Charges staking commissions of up to 20%

What is Ethereum Staking?

In simple terms, ‘Ethereum staking’ allows you to earn passive income on your ETH holdings. Similar to keeping cash in a savings account, staking generates interest. The key difference is that your interest payments are paid in ETH. This enables you to grow your ETH holdings organically. After all, you’ll earn staking rewards regardless of how Ethereum is performing in the market.

Here’s a quick example:

- You deposit 1 ETH into a staking platform

- The staking platform offers APYs of 4%

- After a year of staking, you’ve earned rewards of 0.04 ETH

- After withdrawing your original 1 ETH, you’ve now got 1.04 ETH

In terms of the specifics, Ethereum staking is based on the proof-of-stake mechanism. This helps keep the Ethereum network safe, decentralized, and inclusive. Staking rewards are funded by newly minted ETH. This means that Ethereum is an inflationary cryptocurrency, as there is no cap on the number of new ETH coins that can be issued.

3 Different Types of Ethereum Staking

There are three different ways to earn Ethereum staking rewards in 2024. The method you opt for will depend on your budget and liquidity requirements.

Let’s take a closer look at the three staking methods.

Validator Staking – Requires Minimum 32 ETH

The first option is validator staking. In a nutshell, this allows you to become a ‘validator’ on the Ethereum network, meaning you’re engaging directly with the blockchain. The key benefit here is that you don’t need to go through a third party. As such, any staking rewards you earn are yours to keep.

In addition, validator staking is the safest option, as you don’t need to trust a custodian. As soon as the staking period is over, you’ll receive your original ETH deposit. However, validator staking also comes with several drawbacks. For a start, you’ll need to meet a minimum staking deposit of 32 ETH. Based on ETH/USD prices today, that’s over $96,000.

This means that validator staking isn’t suitable for casual investors. Another drawback is that validators can be penalized. This can happen if your validator experiences downtime. In this instance, you could lose the ETH that you deposited, meaning you bear all of the risk.

Pooled Staking – The Easiest Way to Stake ETH

If you don’t have over $96,000 worth of ETH to stake, ‘pooled’ staking is likely the best option. This is because you won’t personally need to cover the 32 ETH minimum. Instead, your Ethereum will be pooled together with other investors, meaning that the 32 ETH minimum is met collectively.

Pooled staking typically requires a centralized third party to put everything together. For instance, the custodian will deposit the 32 ETH into the Ethereum blockchain, and then offer staking rewards on their own platform. This is the case with most of the Ethereum staking platforms discussed today.

The key benefit of pooled staking is that it’s inclusive. Even if you only have a few dollars worth of ETH, you can still earn rewards. However, it’s important to understand the terms set by the staking pool, as this can vary considerably. In particular, look for the minimum staking amount, redemption period in days, and fees.

Do I Need Mining Equipment to Stake Ethereum?

- No, unlike proof-of-work – which is used by the Bitcoin network, Ethereum staking doesn’t require any mining equipment.

- What’s more, Ethereum staking is energy-efficient, so you won’t need to waste thousands of dollars on electricity consumption.

- All you need to get started is some ETH. If you have at least 32 ETH, you can stake directly on the Ethereum network. If not, you can use a staking pool like MEXC.

Liquid Staking – Most Flexible Option

Another option to consider is ‘liquid’ staking. In some ways, this method is similar to pooled staking. This is because you won’t need to meet a 32 ETH minimum. What’s more, you’ll be using a third-party platform, rather than staking directly with the Ethereum blockchain.

However, the key difference is that liquid staking is ideal for securing liquidity on your deposit. In more simple terms, after depositing ETH into the pool, you’ll receive another cryptocurrency on a 1:1 basis. This cryptocurrency is usually pegged to ETH.

- For instance, suppose you deposit 0.5 ETH on OKX.

- In return, you’ll receive 0.5 BETH.

- BETH has the same value as ETH.

- So, while ETH is locked in the staking pool, you can use BETH for liquidity.

- Crucially, when you’re ready to unstake your ETH on OKX, you’d need to return the BETH.

Although liquid staking is ideal for raising liquidity, it often comes with higher fees. Moreover, there’s no guarantee the cryptocurrency issued will remain pegged to ETH.

The Advantages of Staking Ethereum

Ethereum staking comes with many advantages, which we’ll discuss in the sections below.

Passive Growth

Ethereum staking is a great way to earn passive income – especially if you’re a long-term investor. After all, you simply need to deposit your ETH into a staking pool and you’re good to go. You’ll earn a competitive yield on your deposit, regardless of how Ethereum’s price is performing in the market.

This is particularly beneficial during bearish cycles. Sure, the price of Ethereum might decline, but you’ll earn staking rewards. Alongside a dollar-cost averaging strategy, staking allows you to build your Ethereum holdings organically. And, similar to dividend stocks, you can reinvest your Ethereum staking rewards.

This means your rewards will also earn interest. As a result, you can compound your staking rewards over time. For example, suppose you earn 1 ETH in staking rewards after a year. In year two, that 1 ETH will generate staking rewards. This process can be repeated indefinitely.

Low Risk Compared to Other Cryptocurrencies

Staking is never 100% risk-free, even if you’re depositing the coins directly into the blockchain network. However, in the case of Ethereum, it’s considered lower risk than other staking coins.

This is because Ethereum has solidified itself as the world’s leading smart contract platform. It’s the second-largest cryptocurrency by market capitalization and after Bitcoin, has the most holders.

In contrast, many staking coins have a limited track record. They also witness a lot more volatility than Ethereum, often due to lower liquidity levels.

The Drawbacks of Staking Ethereum

Ethereum staking also comes with some drawbacks, which are discussed below.

Risks Associated With Staking Platforms

Unless you have 32 ETH to stake, you’ll need to use a third-party staking platform. This in itself is a counterparty risk. You need to trust that the platform will keep your ETH safe and that it will honor redemption requests.

If the platform runs into issues – such as a hack or a liquidity crunch, your ETH could be at risk. The solution? Diversify your ETH deposits across multiple staking platforms. If one goes under, this will only impact a small percentage of your overall holdings.

Illiquidity During Lock-up Periods

Ethereum staking can also create liquidity issues. This is because the ETH is locked while it’s being staked. Even if you need the ETH for an emergency, you’ll need to wait for the staking period to pass.

Fortunately, there are some solutions available. First, consider using a staking platform that doesn’t have lock-up periods. MEXC is a great option here, as it enables users to withdraw their ETH at any time.

Alternatively, you might also consider a liquid staking pool. As we mentioned, you’ll receive a liquid cryptocurrency that’s pegged to Ethereum. So, while the ETH is locked, you still have access to a liquid asset.

How Much Can You Earn Staking Ethereum?

First and foremost, there is no fixed APY when staking Ethereum. APYs vary depending on the market conditions. In particular, APYs increase when there are fewer validators. And visa versa when there are more validators. Moreover, APYs will vary from one staking platform to the next.

For example, while MEXC is currently offering APYs of up to 4.8%, you’ll get just 2.64% at Coinbase. The minimum lock-up period can also impact what APYs you get. For instance, staking plans with instant withdrawals usually come with lower APYs. To increase your APY, you’d need to agree to a minimum lock-up term.

Ultimately, we found that the average Ethereum staking APY is 3-4%. This is considerably lower than other staking coins, such as Cardano and Cosmos. However, other staking coins carry a lot more risk, especially regarding liquidity and volatility. Moreover, even if you’re only making 3-4%, this is in addition to Ethereum’s price appreciation over time.

Conclusion: Is Staking Ethereum Worth it?

If you believe in the long-term future of Ethereum, staking is absolutely worth it. In addition to price appreciation, you’ll earn passive income – simply by depositing your ETH into a staking pool.

Overall, we rate MEXC as the best place to stake Ethereum in 2024. You’ll earn staking yields of up to 4.8% and withdrawals are flexible. This means you can cash out your staked ETH at any time.

FAQs

What is ETH 2.0 staking?

ETH 2.0 staking allows you to ‘stake’ Ethereum, meaning you’ll earn passive rewards. This is due to Ethereum’s proof-of-stake mechanism, which rewards users for keeping the network secure.

What is the best Ethereum staking platform?

We found that MEXC is the best Ethereum staking platform. Staking terms are flexible and you’ll earn APYs of up to 4.8%.

How do you stake Ethereum?

If you have at least 32 ETH, you can stake directly on the Ethereum network. If not, you can use a staking pool like MEXC, which enables you to stake small amounts.

Should I stake my Ethereum?

Staking Ethereum makes sense, as you won’t earn any interest by leaving them idle in a wallet. Put otherwise, staking Ethereum allows you to earn passive rewards in addition to price appreciation.

Is it safe to stake Ethereum?

In general, staking Ethereum is safe. However, if you’re using a third-party staking platform (like a crypto exchange), you’ll need to consider counterparty risks.

How does Ethereum staking work?

Ethereum staking aligns with the proof-of-stake concept. Users deposit ETH into the network, meaning they become a ‘validator’. This helps keep the network secure, so validators are rewarded with staking rewards.

References

- Explainer: What is ‘staking,’ the cryptocurrency practice in regulators’ crosshairs? (Reuters)

- The Ethereum merge ups the stakes—and reshapes the crypto universe (Bloomberg)

- Explainer: Ethereum’s energy-saving Merge upgrade (Reuters)

Michael Graw

Michael Graw

Eliman Dambell

Eliman Dambell

Eric Huffman

Eric Huffman