Zero Interest Rates Not The Only Driver For Stablecoin Demand

Demand for USD-pegged stablecoins depends on many factors. Stablecoins are not immune to the fluctuations of their underlying assets. A more likely scenario is a broader turn towards cryptoassets.

The coronavirus has brought zero USD interest rates. And with zero or potentially even negative interest rates, it might also bring greater demand for stablecoins and for cryptocurrencies more generally.

Why? Because now there’s no opportunity cost when it comes to holding USD-backed stablecoins, as opposed to holding USD in a bank, something which will no longer provide interest.

At the same time, likely volatility in the crypto market will generate additional demand for stablecoins, since they will provide a buffer against fluctuating prices. And as zero or negative interest rates and possible USD inflation create greater demand for non-stablecoin cryptocurrencies, stablecoins may also witness further inflows.

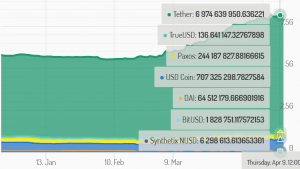

Global inflows into stablecoins

On March 18, ICO Analytics pointed out in a tweet that the market capitalization for most USD-based stablecoins had increased considerably over the previous month.

Clearly, for whatever reason, demand for USD-pegged stablecoins has increased in recent weeks. And for the CEO of Three Arrows Capital, Su Zhu, this is largely because zero USD interest rates are making such stablecoins more attractive to investors.

___

Stablecoin market capitalization, in USD

For other analysts and industry figures, there is a chance that global inflows into stablecoins will increase as a zero-percent interest rate climate persists. Although the picture is mixed and highly conditional.

“There are good arguments for and against both sentiments,” Dr Omri Ross, eToro‘s chief blockchain scientist, tells Cryptonews.com. “Investors may choose to go into stablecoins as most do not charge negative interest at the moment. Of course, this may change in the future.”

Likewise, Smith + Crown research analyst Brant Downes thinks demand for USD-pegged stablecoins could rise, but that this would depend on a number of factors besides zero interest rates.

“What unfolds is likely to depend on the context of any extended period of low or negative interest rates,” he tells Cryptonews.com.

“In our view and in the broadest sense, stablecoins are not immune to the fluctuations of their underlying pegged assets (whether that be gold, a particular fiat currency, a piece of real estate, some other commodity, or an asset of some other sort.) This suggests that holding a USD-backed stablecoin is unlikely to be a scaleable, long-term manner of escaping the impacts of a potential negative interest rate scenario for the US dollar.”

Indirect demand for stablecoins

While the current environment is too uncertain to determine whether there will be a direct interest in holding stablecoins, commentators suspect that low or negative interest rates (and the ongoing coronavirus recession) will indirectly drive demand for stablecoins.

“A scenario that is potentially more likely is a broader turn towards cryptocurrencies as a result of both this crisis and the associated relief measures being taken by governments around the world,” says Brant Downes.

He predicts that, if an inflationary environment emerges, there will be a broader turn towards alternative assets including cryptocurrencies as a hedge against inflation. (Learn more: QE Won’t Trigger Hyperinflation, says World’s Hyperinflation Expert)

“Stablecoins, as an important element of the larger cryptocurrency ecosystem that enable easy onboarding and facilitate trading, would likely benefit,” he says, “even if indirectly as opposed to as a result of traders specifically looking to gain exposure to stablecoins.”

That said, Downes makes it clear that Smith + Crown suspects the evolution or expansion of the stablecoin universe will most likely to track the broader growth and evolution of the crypto ecosystem, “rather than as an isolated response to interest rate environments.”

Omri Ross largely agrees with this assessment.

He says, “As stablecoins provide a mechanism for investors to remain within the crypto ecosystem, they may now look to move into other cryptoassets such as bitcoin as an inflation hedge against a depreciating US dollar.”

Still, even though Ross thinks this will be the most likely driver of stablecoin inflows, he suspects that there may be a more direct interest in stablecoins that can be used for DeFi (decentralized finance).

“One last thing to note is that decentralized peer to peer-based stablecoin lending may attract inflows, depending on the return for potential investors,” he adds.

Higher volatility

But if zero USD interest rates won’t result in greater stablecoin inflows, then how can we explain the fact that stablecoin market capitalizations have risen over the past month?

“Year to date, for instance, Tether’s reported market cap is 54% higher, while USDC has a reported market cap that is 31% higher, while the Paxos Stablecoin has an 8% higher market cap,” Brant Downes acknowledges.

That said, Downes thinks this increase is more to do with increased volatility in crypto markets.

“However, the challenge comes in isolating this growth from the general decline in the price of major cryptocurrencies over roughly this same period,” he says, “which we would also expect to incite a move towards stablecoins as people attempt to sidestep ongoing or feared declines.”

Omri Ross also suspects that the increased fortunes of stablecoins is mostly a function of increased volatility.

He explains, “While not tightly correlated, stablecoin volumes are typically affected by bitcoin volatility and dollar-denominated price, as the primary purpose of these assets remains the on-off boarding into cryptoassets.”

This might be deflating news for anyone hoping for some kind of stablecoin rally. However, Brant Downes suspects that a climate of zero interest rates will boost crypto in general, provided that the coronavirus downturn isn’t too protracted.

“Broadly speaking, yes, low or negative interest rates should drive an interest in alternative assets,” he concludes.

____

Learn more: Stablecoins Will Have to Adapt to Survive Coronavirus Recession