Tesla’s Bitcoin Buy Comes As Earlier Large Investors Retreat

Philip Gradwell is Chief Economist at Chainalysis. He provides data and insight on the uses of cryptocurrencies and the direction of the market at markets.chainalysis.com.

______

On 8 February, Tesla disclosed in an SEC filing that it had “invested an aggregate USD 1.50 billion in bitcoin” following the meeting of its Audit Committee in January 2021. Elon Musk changed his Twitter bio to #Bitcoin between 29 January and 4 February 2021, which resulted in a price pump.

Unless Musk wanted to make it more expensive for Tesla to acquire its bitcoin and/or antagonize regulators – neither of which is impossible! – this means Tesla likely acquired its bitcoin between 4 January, the first working day of the year, and 29 January 2021. At the January average price, Tesla’s USD 1.5bn buys 43,000 bitcoin.

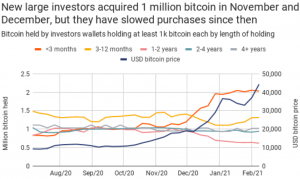

Tesla is not the only large purchaser of bitcoin in recent months. In fact, new large investors have acquired 1 million bitcoin from November to January. This is shown by the orange line in the chart below, which shows the bitcoin held by large investors: wallets that hold at least 1,000 bitcoin, that retain at least 75% of the bitcoin they receive, and that are not controlled by exchanges or other services. These holdings are split by the length of time that large investors have held their bitcoin.

New large investors, those holding bitcoin for less than 3 months, significantly increased their holdings, by 1 million bitcoin, through November and December, which appears to have driven the price up.

As the holdings of large investors who have held for 3 to 12 months and 1 to 2 years declined during this period, it appears that some medium-term investors cashed out. However, the holdings of longer-term investors, those who have held for more than 2 years, have been stable for a while.

But in 2021 so far, new large investors appear to have slowed their purchases, which coincided with a weakening of prices. This is indicated by the flattening of the orange line, holdings of large investors holding for less than 3 months, in the chart above. While that line is flat, the yellow line, holdings of large investors holding for 3 to 12 months, increased by 210,000 bitcoin in January. This increase comes from large investors who purchased in October and continued to hold, thereby holding for more than 3 months by January. So their bitcoin moved category from the orange to the yellow line. For the orange line to remain flat in January, new large investors must have purchased at least 210,000 bitcoin, as this much bitcoin aged into the 3 to 12 months category. This is a large amount, but less than the 1 million bitcoin acquired over 2 months in November and December.

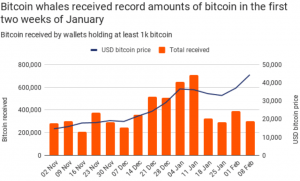

So Tesla has actually been following the trend of institutions acquiring bitcoin, rather than leading. But, if Tesla bought in the first two weeks of January, it appears to have made an impact. The chart below shows the bitcoin received each week by whales, and in the first two weeks of January they received record amounts of bitcoin, as the price reached a peak – at least until this week. This suggests that in early January there were some big buyers in the market, likely including Tesla, and they pushed the price to a peak.

Even if Tesla bought in the last two weeks of January, it still appears to have supported the market. The price weakened in late January, at the same time that whales received fewer bitcoin.

So either Tesla bought in early January and helped drive price to a peak, or it bought in late January and provided demand as other whales stopped buying.

Whales are wallets that hold at least 1,000 bitcoin and that are not controlled by exchanges or other services. The large investors analyzed earlier are a subset of these whales, specifically, large investors are whales that retain at least 75% of the bitcoin they receive. So this broader set of whales in the bar chart above includes traders, who circulate rather than retain the assets they receive. This is why there is such a high volume of bitcoin received by whales. Much of what is received by whales is sent on, often to other whales. This is because many whales are over-the-counter (OTC) brokers, who buy and sell from investor whales. As I’ll show below, these intermediaries play an important role in sourcing bitcoin for large investors.

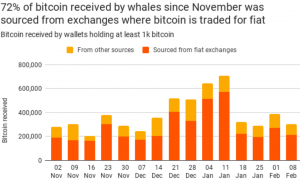

So where do whales source their bitcoin? Since November, 72% of the bitcoin received by whales was ultimately sourced from exchanges where bitcoin is traded for fiat, predominantly exchanges with large USD markets. The other sources are primarily exchanges where bitcoin is traded for other cryptocurrencies, including tether (USDT). But these other sources are a minority, suggesting that currently whales typically buy with USD.

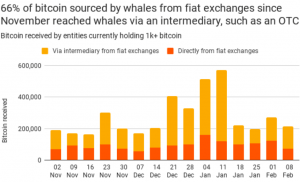

But while fiat exchanges are the primary ultimate source of whale bitcoin, they are only the direct source for one third of it since November. Instead, 66% of bitcoin sourced by whales from fiat exchanges since November reached whales via an intermediary, such as an OTC, as the chart below shows. This suggests an ecosystem where fiat exchanges are an ultimate source of liquidity but there is a complex network of OTC brokers and custodians catering to large investors.

So what does this all mean?

Tesla’s investment in bitcoin is going to drive further interest and demonstrate that corporates can acquire and hold bitcoin with ease.

But it appears that Tesla is not the only institution buying large amounts of bitcoin. Indeed, Tesla appears to have lagged huge acquisitions by new large investors in November and December. Either Tesla bought at peak prices in early January, with that peak potentially reached due to Tesla’s own purchases. Or Tesla bought later in January when demand and prices fell. If Tesla was buying then, it may have been Tesla’s demand that kept the bitcoin price above USD 30,000.

Tesla’s news, plus other positive news, means that currently there is no shortage of demand. However, this demand is based on the expectation of future mass adoption, rather than actual adoption today. I’ve never had a stronger conviction about bitcoin achieving greater adoption.

But I cannot help feeling that the price rally this week comes after the new large investors that entered in November and December actually withdrew from the market.

So a new cohort of large investors is going to be needed to maintain these record prices, and ultimately that expected future mass adoption will need to occur.

___

Learn more:

– Spain Crypto Warning Was ‘to Spook Companies Planning Tesla-type BTC Buys’

– Tesla Bitcoin Buy Highlights Need to Fix US Accounting Rules

– Elon Musk Rages at Wallet, May Land in Hot Water from Regulators

– Here’s What the Mainstream Media Makes of Tesla’s Bitcoin Move

– So You’re Not a Bitcoin Whale – But What Kind of BTC Sea Creature Are You?