How Healthy Will the Bitcoin Network Be Post-halving?

Johnson Xu is the Chief Analyst at TokenInsight, a token data and rating agency.

_____

Bitcoin (BTC)’s third halving is now less than two weeks away, per most estimates. As such, the industry is curious to discover what will happen to the Bitcoin network in the wake of this long-awaited event.

Breaking down the data around hashrate, miner revenue, block interval and BTC marginal cost of creation can help anyone hoping to take a sneak-peek into the future of the network’s health.

We have made the following observations based on our analysis:

- Network hashrate should experience a reasonable decline post-halving as older ASICs mining rigs (such as S9s) are phased out of the Bitcoin network.

- The percentage of mining revenue from fees will at least temporarily double post-halving.

- Short term average fees are likely to spike post-halving, provided that hashrate experiences a reasonable decline while network activity maintains its pre-halving status.

- Long-term average fees per transaction will depend on the dynamic of network activity and network hashrate.

- The average size of block intervals will increase in the short-term, post-halving, due to a reasonable decline in network hashrate.

Network hashrate should experience a reasonable level of decline

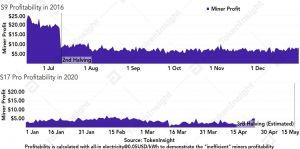

Due to the fact that miners were making healthy margin gains pre- and post-halving, the second halving, which occurred in 2016, did not see any meaningful hashrate reduction take place. In other words, there were still significant incentives for miners to continue mining at a profit.

We believe the third halving will be different, however.

Based on our analysis, current miners’ profit margins are significantly lower than they were in 2016 using the most efficient mining rigs then on the market (such as S17 Pro). This means that they were earning less than USD 5 per day, pre-halving compared to the most efficient miner on the market in 2016 (such as the S9), which was earning its operators around USD 20 per day pre-halving, or USD 8/day post-halving.

Unless bitcoin quickly rebounds to USD 10,000 post-halving, we believe that the majority of miners using S9s (the least efficient mining rigs currently on the network) will shut down their rigs, at least temporarily, and in the long term, shut them off permanently.

The marginal cost of BTC creation also demonstrates the fact that the cost to mine BTC 1 for ASICs such as the S9s currently stands in the USD 6,000 range and currently only earns miners a profit margin of around 15%.

After the next halving event, the marginal cost of creation for S9s will immediately double to at least USD 10,000.

As such, there will be no economic benefit for miners to continue operating such machines on the network.

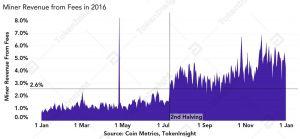

The percentage of miner revenue from fees will see a short term increase

Miner revenue from fees will see an increase of around x2 in the short term as the Bitcoin network undergoes its next halving, cutting block rewards from 12.5 to 6.25, reducing the portion of the block reward in total miner revenue (block reward + transaction fees).

The long-term percentage of miner revenue from fees will depend on network activity.

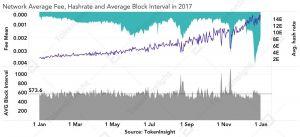

The network experienced an immediate jump in miner revenue from fees after the second halving in 2016.

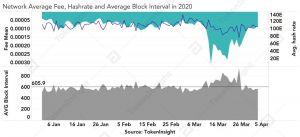

Average transaction fees could spike in the short term

The network could see a spike in average transaction fees in the short term post-halving while some inefficient miners eventually capitulate and shut off their rigs.

This, in turn, will reduce the network hashrate while Bitcoin rebalances, finding an equilibrium during the first difficulty adjustment period post-halving.

According to our analysis, we believe there are two main reasons for a temporary spike in average network fees, namely:

- Increased network activity in the current difficulty epoch while hashrate remains relatively stable, as indicated by the relatively constant average block interval, offset by higher average transaction fees.

- Hashrate significantly decreased in the short term while network activity did not decrease enough to compensate for the decrease in hashrate, represented by an increase in block interval size.

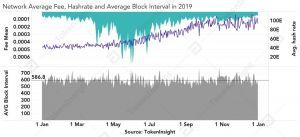

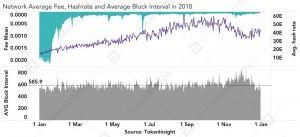

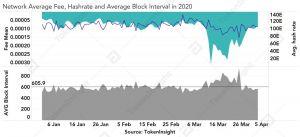

We have analyzed the data of the four-year period after the second bitcoin halving. During this period, the Bitcoin network experienced multiple spikes in the average level of transaction fees:

- March 2020: Due to a significant decrease in short-term hashrate (Reason 2)

- May- June 2019: Due to increased network activity (Reason 1)

- November 2018: Due to a significant decrease in short-term hashrate (Reason 2)

- December 2017: Due to increased network activity (Reason 1)

- November 2017: Due to a significant decrease in short-term hashrate (Reason 2)

- August 2017: Due to a significant decrease in short-term hashrate (Reason 2)

- June 2017: Due to increased network activity (Reason 1)

Based on this data, we believe the third Bitcoin halving, which is expected to take place on May 12, 2020, could result in a short-term spike in average transaction fees due to a sudden drop in short term hashrate (Reason 2).

__

__

__

Average block interval will increase in the short term post-halving

As some inefficient miners shut off their rigs, network hashrate decreases, resulting in an increased level of difficulty in solving blocks in the current difficulty epoch, directly impacting block generation and thus increasing average block interval size.

However, once the Bitcoin network hits its next difficulty adjustment window, the network will re-adjust its difficulty target and bring the network to a stable average rate of 10 minutes per block.

Final thoughts

The Bitcoin network is a self-balancing platform that will re-adjust its network based on hashrate and difficulty level to maintain an average of 10 mins per block.

Network participants will have enough incentives to pay higher fees in the short-term, when network activity is significantly high, or when it experiences a short-term but significant reduction in network hashrate.