El Salvador Will Be a Serious Test for Bitcoin’s Layer-2 Networks

The adoption of legislation in El Salvador that could help foster the further development of bitcoin (BTC) as a store of value and medium of exchange in the country is one of the most important developments in the entire history of cryptocurrencies. This is the closest a country has ever come to adopting a bitcoin standard. That said, the US dollar is likely to remain the major unit of account in El Salvador for some time.

Some critics have said the promotion of a bitcoin standard by El Salvador does not make sense because there is not enough on-chain transaction capacity on the Bitcoin network. However, these critics ignore the development of various layer-two Bitcoin networks such as the Lightning Network, RSK, and Liquid. It’s important to understand that it is these upper-layer Bitcoin protocols that will be tested as El Salvador embraces Bitcoin and not necessarily the base blockchain.

Why is El Salvador Interested in Bitcoin?

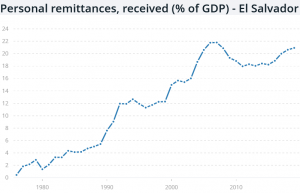

There are three main reasons for El Salvador to embrace Bitcoin. For one, 20% of the country’s gross domestic product (GDP) comes from remittances, according to the most recent data from the World Bank.

This means a large chunk of the population depends on money transfers from outside the country to make ends meet. According to Strike CEO Jack Mallers, the cost of a remittance from the United States to El Salvador can be up to 50% of the value of the transfer, in addition to the security and time-related costs of picking up the money at a physical location.

Secondly, El Salvador has an incentive to break their reliance upon the US dollar and embrace a neutral store of value for savings due to the fact that newly issued dollars tend to have diluted value by the time they reach the Central American country. This phenomenon is known as the Cantillon Effect.

For example, the people of El Salvador did not receive any of the new money that was created to send out stimulus payments in the United States.

By the time that money has reached El Salvador, inflation will have occurred. This setup is advantageous to Americans, but not so much for El Salvador.

Thirdly, roughly 70% of the population in El Salvador does not have a bank account, according to President Nayib Bukele. This limits access to the global financial system that has emerged on the internet and increases transactional friction in the economy.

Strike and the Lightning Network

Strike can be summarized as a Venmo and Cash App alternative that is heavily integrated with Bitcoin’s Lightning Network. A Strike user can instantly transfer value from the United States to El Salvador at little cost via the Lightning Network. While critics have pointed out that Strike users in El Salvador hold value in US dollars via stablecoins like tether (USDT) rather than bitcoin, the reality is users can also send US dollars in their Strike account instantly to any Lightning Network invoice. In terms of the remittance use case, the key point is that bitcoin’s ability to act as digital cash is what enables the instant and free transfer of money from the United States to El Salvador. With Strike, those receiving remittances in El Salvador can choose to receive US dollars in the form of a stablecoin (although the use of Tether is now being phased out) or receive bitcoin directly into their own Lightning Network-enabled wallet such as the one developed by the Bitcoin Beach community.

In a situation where non-KYC (know your customer) stablecoins, which are coming under increased scrutiny, are regulated out of existence, the improvements to remittances to El Salvador made possible by bitcoin could be greatly enhanced through the development of a circular economy around the cryptocurrency. However, even in that scenario, those who wish to hedge against bitcoin’s volatility could do so via technology like Discreet Log Contracts (DLCs), which would effectively allow users to short bitcoin and long the US dollar in their Bitcoin wallet at the click of a button. However, these hedging contracts can also turn out to be somewhat costly, as there needs to be someone willing to take the other side of the trade.

A key criticism of the Lightning Network from those who are either bearish on bitcoin or advocate for a specific altcoin focused on low-value payments is that some of the most popular Lightning Network-enabled wallets are custodial. This is due to the fact that a custodial setup creates a much more user-friendly experience. Indeed, the Bitcoin Beach Wallet works on a system of “shared custody” where every user’s bitcoins are really in the hands of trusted members of the Bitcoin Beach community rather than each user having full sovereignty over their own funds.

Of course, anyone can still use whatever Bitcoin wallet they want, and there are plenty of non-custodial Lightning Network-enabled options available too.

Additionally, potential future improvements to the Bitcoin protocol, such as SIGHASH_ANYPREVOUT, could help make these non-custodial wallets more attractive to end-users. El Salvador’s embrace of bitcoin should create plenty of opportunities to experiment with different trust models for Lightning-enabled Bitcoin wallets. However, those who want a higher degree of financial sovereignty will need to be willing to pay for it, at least for now.

Liquid and RSK

While the Lightning Network gets most of the attention, it is not the only layer-two Bitcoin network that exists today.

The Liquid federated sidechain is another alternative to using the base blockchain that makes different tradeoffs, and there may be a role for Liquid to play in El Salvador. Specifically, Blockstream has mentioned how Liquid could help modernize El Salvador’s financial market. According to Blockstream Chief Strategy Officer Samson Mow, it’s also possible stablecoins closely tied to the traditional banking system, such as tether and USD coin (USDC), could see a new competitor emerge in the form of a bitcoin-backed stablecoin issued on Liquid. While still centralized and trusted, this alternative stablecoin model would potentially have the added benefits of improved transparency and security of reserves.

Another Bitcoin sidechain that has seen tremendous growth in 2021 is RSK, which is compatible with smart contracts created for use on the Ethereum (ETH) network but uses a BTC-pegged token for gas payments rather than ETH. Two of the most popular applications on RSK today are Sovryn and Money on Chain. Money on Chain’s Dollar on Chain (DOC) token may be of particular interest in El Salvador, as it’s a somewhat decentralized, bitcoin-backed stablecoin pegged to the value of the US dollar.

“The people of El Salvador will be the world’s beta testers of Bitcoin’s usability for commerce and finance- decentralized or otherwise,” pseudonymous Sovryn contributor Ingalandia told Cryptonews.com.

“Because it is a country with a majority of its people unbanked, Bitcoin applications such as Sovryn could be their first experience of secure savings accounts. Once they experience interest-earning by lending an appreciating asset, the gears will really start to turn.”

It should also be noted that, much like the Lightning Network, simple bitcoin payments made via Liquid and RSK are also cheaper than on-chain transactions.

There is still plenty of work to do when it comes to improving the privacy, scalability, censorship resistance, and interoperability of the Lightning Network, Liquid, and RSK; however, El Salvador has created a useful environment to see just how valuable these layer-two systems can be as the world continues its march towards a bitcoin standard. The entire country of El Salvador is not going to switch from dollars to bitcoin overnight, so it’s useful to remember that just because these projects are not perfect today does not mean they can’t provide tremendous value over the long term.

____

Learn more:

– Bitcoin Starts Legal Tender Test on Sept 7 With a BTC Airdrop

– Bukele Teases Volcano-powered Bitcoin Mining Center as Exchange Arrives

– MP Lodges Constitutional Challenge to Bukele’s Bitcoin Bill

– MPs’ Bid to Amend El Salvador’s BTC Bill Raises Questions About State & Freedom

– Understanding What Turned El Salvador’s President Bukele on to Bitcoin

– El Salvador Brings New Global Puzzle – What Is Bitcoin & How To Tax It?

– The Bitcoin Lightning Network Grows Even If You’ve Forgotten About It

– Solving These 7 Challenges Would Accelerate Bitcoin Adoption