5 Best Crypto Tax Software in May 2024

The best crypto tax software can help you become tax-compliant in minutes. The software will connect to crypto exchanges and wallets, assess your cost and sale prices, and evaluate how much tax to pay.

But which crypto tax software should you consider in 2024? Read on to discover the best providers for fees, speed, supported platforms, reputation, and user-friendliness.

List of The Best Crypto Tax Software in 2024

Let’s start with a list of the best crypto tax software in the market today:

- Koinly – Overall Best Crypto Tax Software in 2024

- ZenLedger – Great Option for Crypto Traders Using DeFi Exchanges

- CoinLedger – Cheapest Tax Software for IRS Form 8949 Generation

- TokenTax – Popular Crypto Tax Platform for Beginners

- CoinTracker – Trending Crypto Tax Software Offering Tax Loss Harvesting Tools

The Top Crypto Tax Software Reviewed

Selecting the right crypto tax software is an important task. The software should produce accurate results in a timely and cost-effective way. Crypto tax software reviews can be found in the following sections.

1. Koinly – Free Crypto Tax Software With up to 10,000 Transactions

Next is Koinly, which is the best free crypto tax software. Although Koinly also offers paid subscriptions, its free plan covers up to 10,000 transactions. This will be more than enough for most crypto investors, even those that trade actively. Unlike other providers, Koinly’s free plan supports all compatible exchanges and wallets.

It also supports DeFi platforms, margin trades, and leveraged futures. Multiple cost basis methods are included, including LIFO and FIFO. The free plan supports six years of historical spot prices and over 20,000 cryptocurrencies. What’s more, Koinly also evaluates income from staking, lending, airdrops, and mining.

The main drawback is that the free plan doesn’t include Form 8949. This means you’ll need to complete the form yourself, based on the figures Koinly provides. The free plan also lacks a comprehensive tax report and the ability to export to TurboTax. These features cost $49/year, but you’ll be limited to just 100 transactions. Additional transactions require a more expensive plan.

| Software Provider | Integrations | Supported Countries | Pricing |

| Koinly | 750+ exchanges and wallets | US, UK, Canada, Australia, Switzerland, France, Denmark, Norway, Finland, Sweden | From $0 to $279 |

Pros

- Best free crypto tax software in the market

- Supports up to 10,000 transactions

- Compatible with 750+ exchanges and wallets

- Full tax reporting in just 20 minutes

- Integrates with the best crypto margin trading exchanges

Cons

- Localized tax reports are only available in 10 countries

- The free plan doesn’t include Form 8949

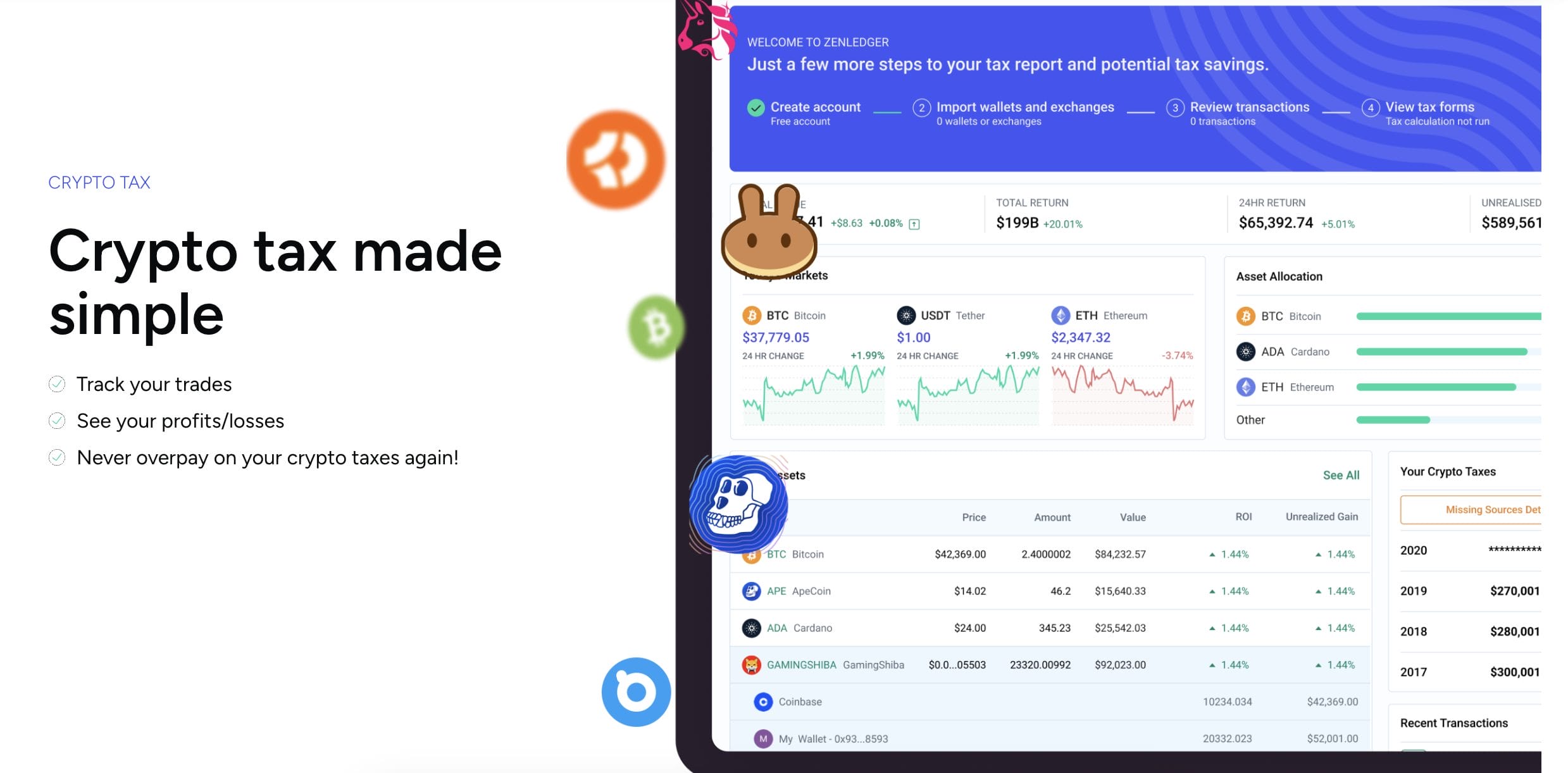

2. ZenLedger – Great Option for Crypto Traders Using DeFi Platforms

We found that ZenLedger is the best crypto tax software for DeFi platforms. It’s compatible with the best decentralized exchanges, including Uniswap, 1inch, Aave, PancakeSwap, and SushiSwap. It also connects with centralized exchanges and crypto wallets. Not only can ZenLedger help with DeFi capital gains but also income.

It automatically calculates the cost basis on staking, yield farming, interest accounts, airdrops, and everything in between. ZenLedger also supports CSV uploads. This ensures that transactions from non-supported platforms are included in your tax report. We also like that ZenLedger automatically generates Schedule D, which is ideal for US investors.

ZenLedger also supports tax loss harvesting tools. Regarding pricing, you’ll pay $127/year for DeFi integration. This plan supports up to 5,000 transactions. There’s also a free plan but this only supports 25 transactions. Unlimited transactions cost $999/year, which includes two hours of premium support.

| Software Provider | Integrations | Supported Countries | Pricing |

| ZenLedger | 400+ exchanges and wallets | Supports the US but doesn’t reference any other countries | From $0 to $999 |

Pros

- Best option for active DeFi traders

- Compatible with the best decentralized crypto wallets and exchanges

- Calculates capital gains and crypto income

- Automatically populates Schedule D

- Tax loss harvesting tools can reduce your taxes

Cons

- The free plan is capped at 25 transactions

- DeFi integration costs $127/year

3. CoinLedger – Cheapest Tax Software for IRS Form 8949 Generation

If you’re a US investor looking for complete automation at an affordable price, CoinLedger could be the best crypto tax software for you. For just $49, you can generate IRS Form 8949. This plan also includes micro-transactions. This is useful for calculating daily income rewards like staking and yield farming.

However, the $49 plan is capped at just 100 transactions. For $99 or $199, you’ll get 1,000 and 3,000 transactions, respectively. If you’re happy to fill out IRS Form 8949 yourself, the free plan supports unlimited transactions. CoinLedger also supports localized tax reporting for other countries, including the UK, South Africa, Australia, Canada, India, and Japan.

Regarding integration, CoinLedger claims to support all crypto exchanges. This covers DeFi platforms like Uniswap and PancakeSwap. CoinLedger also supports the best non-custodial wallets, including MetaMask, Exodus, Trust Wallet, and MyEtherWallet. We like that CoinLedger also offers free crypto tax guides.

| Software Provider | Integrations | Supported Countries | Pricing |

| CoinLedger | All exchanges and wallets | US, UK, Canada, Australia, Switzerland, France, Japan, Sweden, New Zealand, India, Ireland, Spain, South Africa, Austria, Denmark, Germany | From $0 to $199 |

Pros

- IRS Form 8949 generation for just $49

- Also supports other countries

- Compatible with any exchange and wallet

- Supports DeFi products like staking

- The free plan comes with unlimited transactions

Cons

- Just $25 worth of micro-transactions are included

- The $199 plan is capped at 3,000 transactions

4. TokenTax – Popular Crypto Tax Platform For Beginners

If TokenTax is one of the best options for beginners. It offers a simple and hassle-free tax reporting process. First, you’ll need to copy and paste your exchange and wallet APIs. After selecting your preferred currency TokenTax will begin calculating your taxes. Users report that this is usually completed in under 30 minutes.

TokenTax covers the most popular exchanges, including centralized and DeFi platforms. It also supports hundreds of wallets and is compatible with both cryptocurrencies and NFTs. We also like that TokenTax integrates with derivative trading platforms. This means the software can evaluate margin interest payments.

There are four cost-based reporting methods to choose from; FIFO, LIFO, minimization, and average cost. The main drawback of TokenTax is pricing. There’s no free plan and the cheapest option costs $65/year. This includes just 100 transactions. You’ll pay $199/year or $1,599 /year for up to 5,000 and 20,000 transactions, respectively.

| Software Provider | Integrations | Supported Countries | Pricing |

| TokenTax | 120+ exchanges and wallets | US | From $65 to $2,999 |

Pros

- Great option for beginners seeking a user-friendly platform

- Supports cryptocurrencies and NFTs

- Reports are generated in under 30 minutes

- Easily integrates with exchanges and wallets via APIs

- Offers a demo account

Cons

- Doesn’t offer a free plan

- The $65 plan is capped at 100 transactions

5. CoinTracker – Trending Crypto Tax Software Offering Tax Loss Harvesting Tools

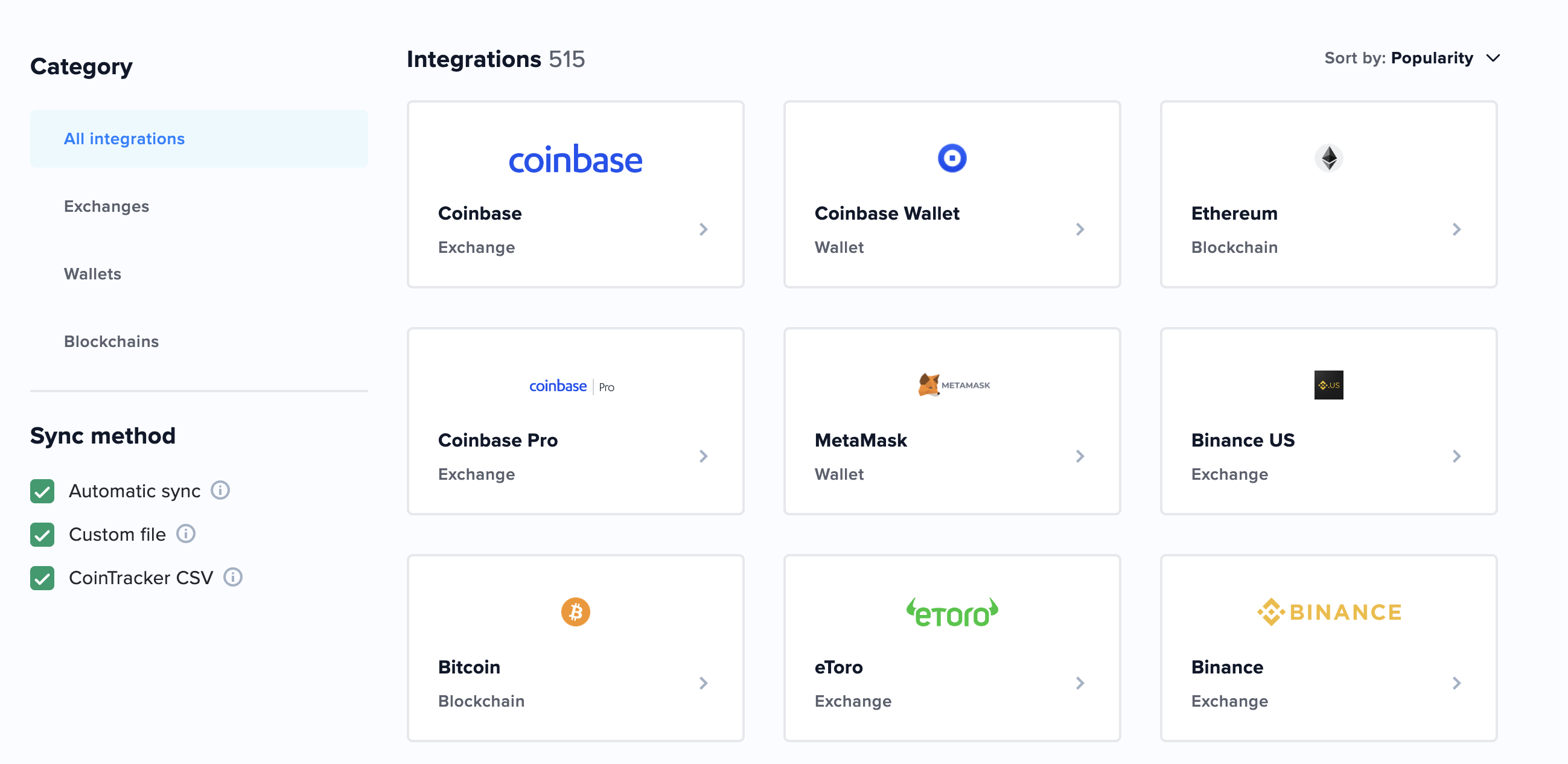

CoinTracker offers an all-in-one solution for automating your crypto taxes. Trusted by over 2 million users, CoinTracker is compatible with every platform imaginable. This includes more than 500 of the best crypto exchanges and wallets. Not to mention over 10,000 cryptocurrencies and 20,000 DeFi smart contracts.

This is crucial, as some crypto tax software providers don’t support DeFi platforms and exchanges. Not only is CoinTracker ideal for automating capital gains but also crypto income taxes. This includes staking, mining, airdrops, mints, margin interest, and forks. What’s more, the computational process takes minutes, no matter how many transactions are being assessed.

There are four pricing plans to choose from at CoinTracker. There’s a free plan but this is limited to an overall tax summary. The base plan costs $59/year and includes unlimited tax reports. For $199/year, you’ll also get tax loss harvesting tools, which can help you avoid crypto taxes legally. The $599/year plan includes multiple cost-basis methods and 24-hour support.

| Software Provider | Integrations | Supported Countries | Pricing |

| CoinTracker | 500+ exchanges and wallets | US, UK, Canada, Australia | From $0 to $599 |

Pros

- Supports 500+ exchanges and wallets

- Compatible with DeFi exchanges

- Evaluates airdrops, staking, mints, mining, and other income niches

- Tax reports take minutes to generate

Cons

- Full tax reporting is only available in US, UK, Canada, and Australia

- Tax loss harvesting tools cost $199/year

What if my Country Isn’t Supported?

- You might have noticed that even the best crypto tax software supported selected countries.

- The good news is that you can still use your preferred software provider if your country isn’t supported.

- The software will still generate your capital gains/losses and income for the respective year.

- It just won’t be able to populate your required tax form. This means you’ll need to fill it in manually.

How We Chose The Best Crypto Tax Software

It’s important to choose the right crypto tax software for your needs. Here are some considerations to make when selecting a provider:

Ease of Use

We prioritized software providers offering a user-friendly experience. After all, you’ll be using crypto tax software to save time. In most cases, the only task required is providing the software with your API keys. This needs to be copied from all of the crypto exchanges and wallets you’ve previously used.

You only need to do this once. After that, the software goes to work. You should have your full crypto tax report in within 15-30 minutes. This is the case even if you’ve executed thousands of transactions.

Compatibility with Most Wallets and Exchanges

It’s crucial to check what exchanges and wallets are supported before proceeding. If one of your platforms isn’t supported, you’ll need to manually upload a CSV file. This can make the reporting process cumbersome. Fortunately, top crypto tax software providers support hundreds of platforms. All you need to do is copy and paste your APIs.

If you’ve previously earned crypto income, this also needs to be accounted for. As such, make sure your chosen provider supports DeFi integration. This should include popular earning methods like staking, yield farming, interest accounts, airdrops, and mints. What’s more, make sure NFTs are supported if you’ve previously traded them.

Best Value for Money

Although some providers offer a free plan, you’ll need to pay for full functionality. Plan prices are determined by two key factors. First, most pricing plans come with a transaction limit. For example, Koinly offers a free plan as well as paid plans ranging from $39, $79, and $139 for up to 100, 1,000, and 10,000 transactions, respectively.

A transaction can include the following:

- Buying or selling a crypto asset

- Transferring crypto between wallets or exchanges

- Receiving crypto income, such as staking or yield farming

- Earning free crypto from an airdrop

- Trading NFTs

Transactions can quickly add up, so make sure you choose a suitable plan. Second, pricing plans are also determined by features. For example, some crypto tax software providers charge more for tax loss harvesting tools. This can be worth paying if you’ve traded large amounts, as even one strategic sale can save you thousands of dollars.

Ultimately, we focused on providers that offer good value for money. This means a suitable number of transactions and features for the price point.

Integration Options

Some crypto investors prefer using traditional tax software. This is often because crypto forms just one part of an investor’s financial lifestyle. Therefore, we made sure to include providers that integrate with traditional software like TurboTax and H&R Block.

Other Important Factors

- Full Report Generation: We also prioritized software providers offering full report generation. US investors, for example, should choose a platform that generates IRS Form 8949. Otherwise, you’ll need to manually populate every short and long-term trade.

- Cost Basis Method: Make sure the crypto tax software supports your preferred cost basis method. This can have a direct impact on how much tax you pay. Some of the most common reporting methods are FIFO, LIFO, and minimization.

- Tax Loss Harvesting: You should also opt for a provider that supports tax loss harvesting tools. This can make suggestions about ‘strategically’ selling at a loss. In doing so, you can reduce your overall tax burden.

What Can You Use Crypto Tax Software For?

Crypto tax software solves many pain points, especially when it comes to cost and sale prices. Without software, you need to check prices for each transaction. This will be time-consuming if you’re an active trader or you’re investing in crypto income products. Let’s take a closer look at how crypto tax software can make your life easier.

Comprehensive Transaction Tracking

The only way to file crypto taxes accurately is to know the cost and sale prices for all transactions. This determines how much tax needs to be paid. Crypto prices are not only volatile but they change every second. Tracking prices will be time-consuming if you don’t keep accurate records.

In contrast, crypto tax software automates the tracking process. You simply need to provide the software with an API key. This will be unique to your exchange accounts and wallets. This can also be done retrospectively. For example, Koinly supports six years of historical spot prices. Once connected, you’ll also get real-time portfolio valuations.

Capital Gains and Losses Calculation

Investors in most countries must pay taxes on crypto capital gains. This is usually based on ‘realized’ gains, meaning you’ve already disposed of the crypto. Many tax authorities, including the IRS, require detailed transactions for every trade. This includes:

- The name of the crypto coin

- The date it was purchased

- The price it was purchased

- The date it was sold

- The price it was sold

- And overall profit or loss

But is there a way to claim crypto losses on taxes? Now, these data points are easy to populate when you’re an inactive investor. However, the process quickly becomes cumbersome if you’re an active crypto trader. This is also the case if you take a dollar-cost averaging strategy. After all, crypto prices change every second.

Instead of spending hours recording prices, crypto tax software does it on your behalf. This shouldn’t take more than 30 minutes, although it’s usually much faster. The software simply cross-references the coin with spot trading prices when the orders are placed. This ensures your tax report is accurate.

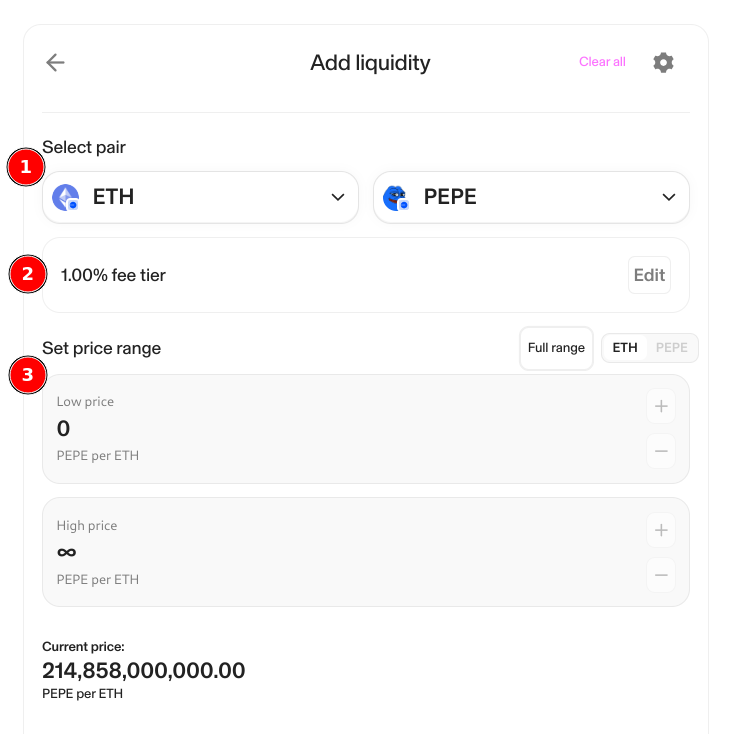

Calculating DeFi Taxes

If you’ve previously invested in DeFi products, you’ll quickly find that tax reporting is a headache. This is because DeFi products like staking, yield farming, and interest accounts often make daily distributions. Now, unlike capital gains income, the rewards don’t need to be sold to trigger a taxable event.

The event happens as soon as the DeFi income is received. This is usually added to your income total for the year. But the specifics will vary depending on where you live. Nonetheless, you’ll need to report the value of each payment on the day it’s received.

For example, suppose you receive 0.0025 ETH in daily staking rewards. On Monday, 0.0025 ETH could be worth $10. On Tuesday, it could be worth $11. Fortunately, the best crypto tax software can automatically assign a cost basis to all DeFi rewards. This means that you’ll receive a total in minutes.

Tax Form Automation

You’ll need to complete a form when filing taxes. For example, US investors must file IRS Form 8949. As mentioned this details each transaction, including the coin, dates, prices, and profit/loss. Transactions also need to be split into short-term and long-term investments.

This is a manual task that can be time-consuming when a lot of transactions are involved. We found that some crypto tax software providers automatically fill out IRS Form 8949. Other localized standards are sometimes supported too. This means you can then file the form directly to your local tax authority.

Tax Loss Harvesting

Paying for tax loss harvesting tools can be a smart move. In doing so, you could reduce your tax burden by thousands of dollars. Put simply, tax loss harvesting is a legal tax avoidance strategy. It involves strategically selling some crypto to reduce or eliminate your capital gains for the respective year.

- For example, suppose you’ve made annual capital gains of $10,000 across all assets. You’re currently invested in Bitcoin. You originally invested $20,000, but the Bitcoin is now worth $15,000. If you sold that Bitcoin, you’d make a $5,000 loss. This $5,000 can then be deducted from your $10,000 capital gains, meaning you’ve reduced your tax liability.

This strategy wouldn’t be possible when investing in traditional assets like stocks because of the wash sale rule. This requires stock investors to wait 30 days before repurchasing the same asset that was sold at a loss. The wash sale rule doesn’t apply to crypto, which is a major benefit.

However, assessing potential tax loss harvesting plays can be difficult if you’re an active investor. This is especially the case if you’re investing in a coin at multiple buy prices. This is another issue that crypto tax software solves. Once your transaction history has been analyzed, the software can suggest the most suitable sales based on your circumstances.

When Should You Start Using Crypto Tax Software?

Crypto tax software won’t be suitable for all investors. For example, if you’ve only made a few crypto investments, you can easily calculate your taxes on a DIY basis. Here are some of the reasons why you might need to start using crypto tax software:

High Trading Activity

The main use case is for investors who have a high trading activity. This is because you need to account for all realized disposals. For instance, consider a crypto day trader that averages six daily positions. That’s 12 buy and sell orders every day. Over 12 months that’s thousands of transactions, each with a different price.

In this instance, crypto tax software is a must. Once you’ve copied and pasted your exchange/wallet APIs, the transaction prices will be logged and summarized in minutes. Otherwise, you’ll need to do this manually – which will be a laborious process.

Diverse Transaction Types

We’d also suggest considering crypto tax software if you’re invested in diverse DeFi products, such as staking and yield farming platforms. This is because any income received must be reported at the respective price.

This is then added to your income for the year. Some DeFi products make distributions daily or weekly, so many calculations need to be made. Especially if you’ve invested multiple coins at different intervals.

In addition, don’t forget that capital gains tax might also apply once you dispose of the DeFi rewards. This will be the case if you sell the DeFi rewards at a higher price. The cost basis is based on the price when the rewards are received.

- For example, suppose you receive 1 ETH in staking rewards. That 1 ETH was worth $4,000 when it was received.

- A few months later you sell that 1 ETH when it’s worth $5,000. That’s a capital gain of $1,000.

- Conversely, suppose you sold that 1 ETH when it was worth $3,000 – you would have made a capital loss. This can then be subtracted from your total capital gains for the year.

Crucially, crypto tax software is suitable for complex DeFi transactions. All transactions will be assigned a cost basis and sale price within minutes. Just make sure your chosen software provider supports DeFi transactions.

Preparing for Tax Planning Season

Not only does crypto tax software ensure you file your taxes accurately and on time, but it can optimize your overall financial outlook. This is because software providers offer optimization tools, such as tax loss harvesting. Top providers also support various cost-basis methods, such as FIFO and LIFO.

Importantly, the software can suggest the best method for minimizing your tax burden. However, don’t forget about other asset classes you’re invested in, such as stocks or index funds. These will also have a say in how much tax you pay.

Conclusion

In summary, crypto tax software will help you meet your tax obligations in minutes. Simply copy and paste your exchange and wallet APIs. Not only will the software save you time but it can also reduce your overall tax burden.

This is because crypto tax software often comes with optimization tools like tax loss harvesting. Just make sure your chosen provider supports all of the platforms you’ve previously traded on. Follow the link below to automate your crypto tax returns via Koinly.

FAQs

Do you have to pay tax on crypto?

Yes, taxes are required on crypto capital gains and income, such as staking and mining. Crypto tax rules vary from one country to the next.

How much does crypto tax software cost?

Some crypto tax software can be used for free, although this often comes with limited transactions and features. Premium plans average $50 – $150 for increased functionality.

What is the cheapest crypto tax software?

Koinly offers a free plan that supports up to 10,000 transactions. That said, the free plan doesn’t automate IRS Form 8949.

What is the best tax software for crypto?

Our crypto tax software comparison shows that Koinly is the overall best option. It supports over 750 exchanges and wallets, is compatible with DeFi products, and prices are competitive.

Do I need crypto tax software?

Crypto tax software is a must if you actively trade, which includes dollar-cost averaging strategies. Crypto tax software is also advised if you frequently invest in DeFi products like staking and yield farming.

Are crypto gas fees tax deductible?

Yes, the IRS views crypto as property, meaning there are many tax-deductible events. This includes network fees, or ‘gas’.

References

- Form 8949, Sales and Other Dispositions of Capital Assets (IRS)

- Everything you need to know about filing crypto taxes — especially if your exchange went bankrupt (CNBC)

- Tax-Loss Harvesting Strategies: How They Work (Goldman Sachs)

- House Dem Duo Seeks Crypto Reporting Regs (Thomson Reuters)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Eric Huffman

Eric Huffman

Michael Graw

Michael Graw