How to Claim Crypto Losses on Taxes

Many investors are unaware that crypto losses can be offset against other capital gains. The IRS also allows up to $3,000 of capital losses to be deducted from your taxable income each year. Anything over this can be offset in future years.

This guide on Crypto Losses Tax explains everything you need to know. We explain what crypto losses are eligible, how much can be claimed, and what strategies can be implemented to maximize tax benefits.

How do Crypto Losses Impact Your Taxes?

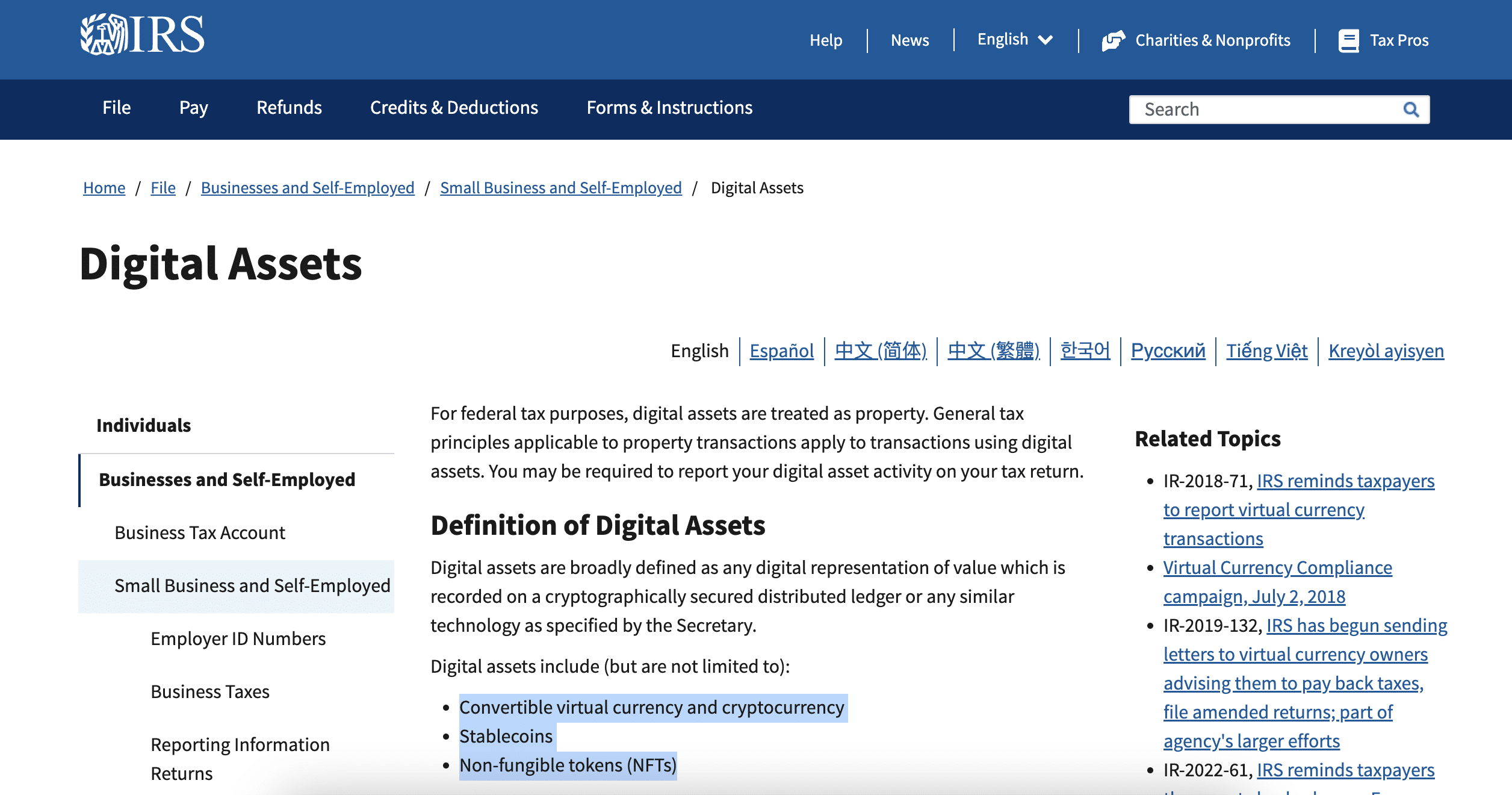

The IRS defines crypto assets as ‘property’. In simple terms, this means that capital losses can be offset against future taxes. This is the same as stocks, bonds, mutual funds, and other investment classes. For example, suppose you originally invested $10,000 in Bitcoin. Your investment is now worth just $4,000. You cut your losses and sell the Bitcoin at a $6,000 loss.

This $6,000 loss can be offset against other capital gains. For instance, in the same year, you made $10,000 from a stock investment. This means that your capital gains have been reduced to $4,000. However, do note that the IRS only allows up to $3,000 worth of capital losses to be offset each year.

The good news is that anything above the $3,000 limit can be offset in future years. Moreover, crypto losses can be offset against your tax liabilities even if you don’t have any other investments. The amount will be deducted from your income total for the year. That said, there are some considerations to make.

First, crypto losses can only be claimed if they’re ‘realized’. This means you must have already disposed of the crypto assets. Second, you also need to consider whether your capital losses are considered ‘short-term’ (under 12 months) or ‘long-term’ investments (over 12 months). This will impact how your losses are treated – as we cover later in this Crypto Losses Tax guide.

How to Calculate Crypto Losses

This section will help you understand how to calculate crypto losses.

Note: The crypto prices provided are hypothetical. This will ensure you understand how crypto losses work.

Evaluate the Cost Basis

The first step is to calculate your ‘cost basis’ for the crypto loss. According to the IRS, the cost basis is the amount you paid for the asset in “cash, debt obligations, and other property or services“.

Importantly, each crypto purchase should be treated individually.

So, let’s suppose that you bought 1 Bitcoin in November 2021 at $60,000. The cost basis is $60,000.

You also bought one Bitcoin in January 2023 at $20,000. The cost basis is $20,000.

To summarize:

- Bitcoin 1: $60,000 cost basis

- Bitcoin 2: $20,000 cost basis

Evaluate the Sale Price

Next, you’ll need to assess the sale price of any crypto assets you sold. Only sales within the respective tax year should be included. As per the IRS, this is because crypto losses only include realized disposals.

Let’s suppose that in March 2023, you sell 1 Bitcoin at $20,000. In September 2023, you sell your other 1 Bitcoin at $30,000.

To summarize:

- Bitcoin 1: $20,000 sale price

- Bitcoin 2: $30,000 sale basis

Calculate Capital Gains and Losses

Now that we know the cost basis and the sale price, we can calculate our crypto losses.

- Bitcoin 1: $20,000 (sale price) – $60,000 (cost basis) = $40,000 capital loss

- Bitcoin 2: $30,000 (sale price) – $20,000 (cost basis) = $10,000 capital gain

In this example, you’ve got $40,000 in capital losses and $10,000 in capital gains. This means your total crypto losses for the year are $30,000.

What About FIFO and LIFO?

- In our example above, we used the FIFO (First in, First out) method.

- This means that the first Bitcoin we sold ($20,000) was based on the first purchase cost basis ($60,000). And the second sale ($30,000) was based on the second purchase cost basis ($20,000).

- However, there might come a time when it’s more beneficial to use the LIFO (Last in, First out) method. This means the cost basis is taken from the most recent purchase.

- This can help you maximize your crypto losses if you’re facing a large tax liability.

Separate Short and Long-Term Investments

The next step is to calculate whether your crypto disposals are considered short or long-term investments.

- If you held the crypto for under 12 months, it’s a short-term investment

- If you held the crypto for over 12 months, it’s a long-term investment

So, in our example, we have two trades to evaluate.

- Bitcoin 1 was purchased in November 2021 and sold in March 2023. This is a long-term investment.

- Bitcoin 2 was purchased in January 2023 and sold in September 2023. This is a short-term investment.

Starting with Bitcoin 1, this resulted in a long-term capital loss of $40,000. This can be offset against other capital gains for the year. For instance, suppose you sold real estate in the same year at a $35,000 capital gain. This means your total long-term capital losses are $5,000.

Now onto Bitcoin 2, in which you made a short-term capital gain of $10,000. No other short-term investments were realized for the year.

- Long-Term: $5,000 capital loss

- Short-Term: $10,000 capital gain

In terms of the tax implications, $3,000 of the long-term loss can be offset against your ordinary income for the year. The remaining $2,000 can be carried over to the next year.

The $10,000 short-term capital gain will be taxed at your ordinary income tax rate.

How to Report Crypto Losses on Your Taxes

Now that we’ve explained how to calculate crypto losses, let’s move on to the reporting process.

Step 1: Sort Transactions into Short-Term and Long-Term

Sorting your crypto transactions into short and long-term investments is crucial. This is because both are treated differently by the IRS.

This is relatively simple to calculate. All you need is:

- The date that the crypto asset was purchased.

- The date that the crypto asset was disposed

For example, suppose you bought 1 Ethereum in January 2022. You sell the 1 Ethereum in April 2023. The investment was held for more than 12 months, so it’s classed as long-term.

In addition, you bought 10 BNB in April 2023. You sell the 10 BNB in May 2023. The investment was held for under 12 months, so it’s classed as short-term.

If you only sell a portion of your investment, the same rules apply. For example, suppose you buy 1 Bitcoin in February 2022. You sell 0.5 Bitcoin in April 2022. The 0.5 Bitcoin sale is a short-term investment. You sell the next 0.5 Bitcoin in March 2023. This segment of the sale is a long-term investment, as it was originally purchased in February 2022.

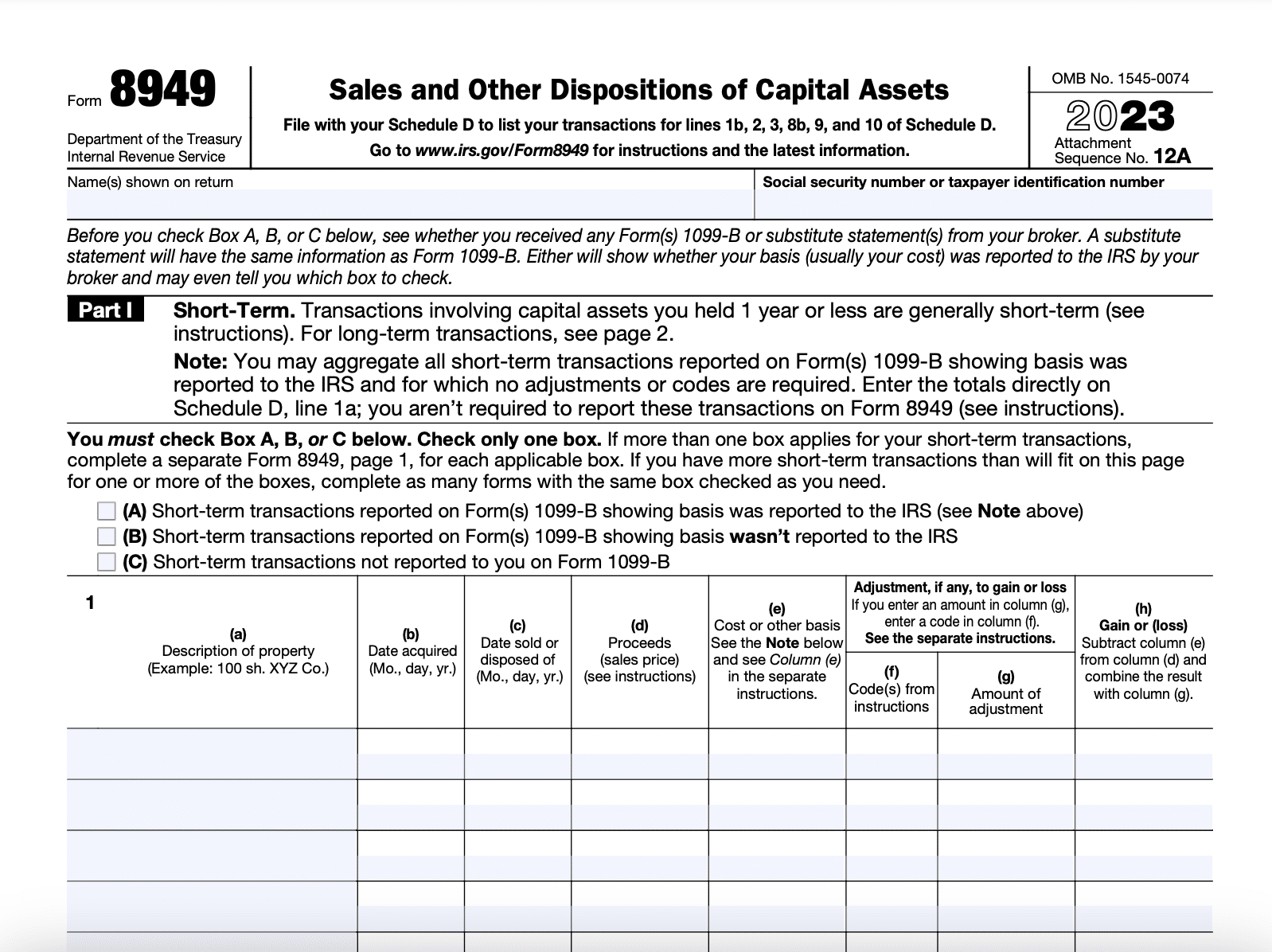

Step 2: Fill Out Form 8949

The next step is to fill out IRS Form 8949. This should detail all of your realizable crypto transactions for the year. It should also include any other capital gains or losses, such as stocks, bonds, or mutual funds.

For each transaction, you’ll need to fill in the following:

- Details of the crypto asset (e.g. Bought 1 Bitcoin)

- Date of the purchase (e.g. January 1st, 2023)

- Cost basis for the purchase (e.g. $30,000)

- Date of the sale (e.g. April 1st, 2023)

- Sale price for the disposal (e.g. $20,000)

- Your capital gain or loss (e.g. $10,000 capital loss)

Note that the Form 8949 has two sections. The first section is for short-term capital gains or losses. While the second section is for long-term investments.

Do I Need to Report Every Crypto Trade on Form 8949?

- Every realized crypto trade for the year needs to be added to Form 8949.

- If you haven’t closed a particular trade, it’s not realized. And hence, it’s not added to Form 8949.

- Naturally, this can be a nightmare for active crypto traders. After all, you might have executed hundreds of individual trades throughout the year.

- In this instance, you’re better off using a crypto tax software provider. They’ll be able to calculate your crypto gains and losses, and then automatically add each trade to Form 8949.

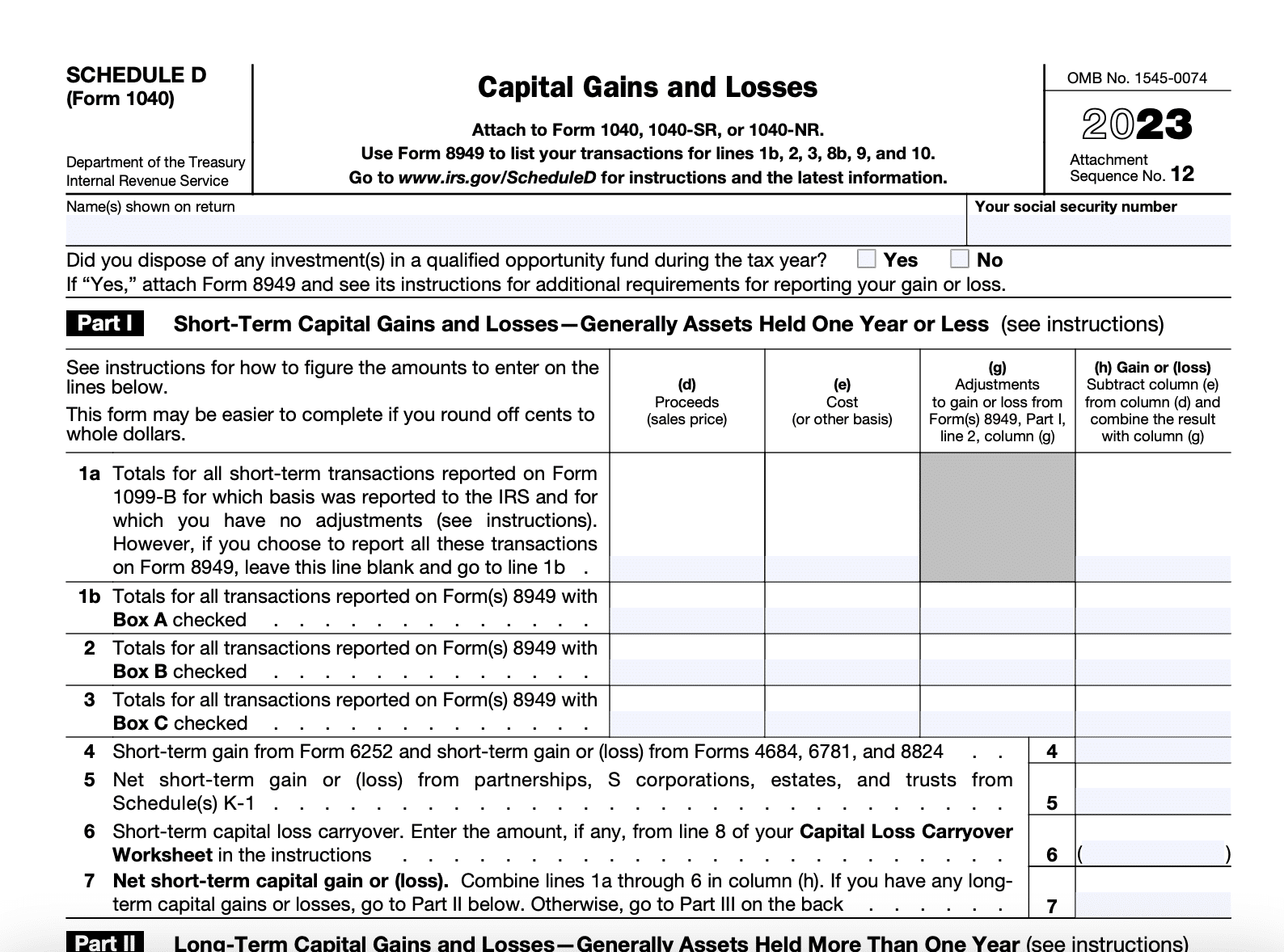

Step 3: Net Gains and Losses Against Each Other

Now that you’ve entered all of your transactions for the year, you’ll need to calculate your net gains and losses. This needs to be done separately for both sections, covering short and long-term transactions.

Once you’ve calculated everything, you’ll need to add the totals to IRS Schedule D. The final step is to transfer your short-term and long-term capital gains or losses to IRS Form 1040. This will determine your overall tax liability for the year.

How Much Taxes Do You Pay on Crypto Losses?

There are many factors to consider when assessing what taxes you owe on crypto losses, if at all. For example, if you made a crypto loss of $3,000 and no other investments were realized in the year, no crypto taxes will be due. On the contrary, you can use this $3,000 crypto loss against your overall tax liability for the year.

That said, another variable to consider is whether the crypto loss was a short-term or long-term investment. This will determine how the capital losses can be offset.

- For example, suppose you bought 1 Bitcoin in May 2023 for $30,000.

- In the same month, you sold that 1 Bitcoin for $27,000. This is a short-term capital loss of $3,000.

- In the same year, you made short-term capital gains of $1,000 from a stock trade.

- This means your short-term capital losses have been reduced to $2,000.

- You have no other short-term gains, so you can use this $2,000 to offset short-term capital gains in future years.

Now consider a long-term investment.

- You bought 1 Bitcoin in November 2020 at $20,000.

- You sell that 1 Bitcoin in October 2023 at $15,000.This results in a long-term capital loss of $5,000.

- In the same year of the crypto disposal, you made long-term capital gains of $8,000 from a real estate sale.

- You can use your $5,000 crypto loss against the $8,000 real estate gain. This leaves you with a net taxable long-term gain of $3,000.

- As such, you’ve just reduced your long-term tax liability.

Are Crypto Losses Tax Deductible or Taxable?

Whether crypto losses are tax deductible or taxable depends on your overall financial situation for the respective year.

Let’s look at a couple of examples to clear the mist.

- First, let’s suppose that in 2023, you executed two crypto trades.

- You made $5,000 on trade one, and a $7,000 loss on trade two. No other assets were disposed of for the year.

- In this instance, you have an overall $2,000 capital loss for 2023.

- You can’t offset the capital losses against other gains, as there weren’t any.

- As such, the $2,000 crypto loss can be used as a deduction from your income.

- For instance, suppose you earned $40,000 for the year – only $38,000 would be taxable.

Let’s consider another example.

- In 2023, you executed one crypto trade – making a $8,000 loss. In the same year, you made a $10,000 capital gain from a mutual fund investment.

- This means you’ve made a $2,000 capital gain in 2023.

- Taxes would be due on the $2,000 gain, even though you made a crypto loss. This is because all investment classes are considered, not just crypto.

Ultimately, while crypto losses can be tax deductible, it depends on the overall picture. This is why record-keeping is so important. What’s more, you can make strategic crypto sales to reduce your tax burden, as we cover in the next section.

How Does Tax Loss Harvesting Crypto Work?

Tax loss harvesting can be an effective strategy to avoid crypto taxes. In simple terms, tax loss harvesting will see you make strategic crypto sales to purposefully make a capital loss. The loss can then be used to offset other capital gains, allowing you to reduce your taxes for the respective year.

Let’s look at an example of how harvestable tax losses crypto works.

- Let’s say you buy 1 Bitcoin in February 2023 at $40,000.

- In April 2023, you cash out a long-term stock position, resulting in capital gains of $20,000.

- It’s now December 2023. As it stands, you’ve still got $20,000 in capital gains for the year.

- Bitcoin is currently trading at $25,000. You dispose of the 1 Bitcoin, resulting in a $15,000 capital loss.

- This means your overall capital gains for the year have been reduced to $5,000 ($20,000 stock gain – $15,000 crypto loss).

The above example shows that the investor purposefully sold their 1 Bitcoin at a $15,000 loss. This was to avoid paying capital gains on the $20,000 stock disposal.

Now, sticking with the same example, suppose the investor decides to immediately repurchase the 1 Bitcoin that they sold. This offers the best of both worlds; the investor keeps their exposure to Bitcoin, while reducing their capital gains for the year. This was achieved with minimal effort and cost.

How does the Wash-and-Sale Rule Apply to Crypto?

When exploring crypto losses tax, you might come across the Wash Sale Rule. According to the IRS, the Wash Sale Rule prohibits investors from repurchasing assets that were sold for tax loss harvesting reasons, within 30 days of the disposal.

For example, suppose an investor makes a $10,000 capital loss on Apple stock on November 1st. If the investor repurchased Apple stock before December 1st, they wouldn’t be able to use the $10,000 loss to offset other capital gains.

Fortunately, the Wash Sale Rule does not apply to crypto assets. The reason is simple; the IRS treats crypto assets as property, which isn’t impacted by the rule. Therefore, you can legally repurchase a crypto asset that you sold for tax loss harvesting reasons. You do this without needing to wait 30 days.

Is Crypto A Long-Term or Short-Term Gain?

Crypto can be a long-term or short-term gain; it all depends on how long the investment was held.

- Long-term gains are investments held for at least 12 months. So, suppose you bought 2 Bitcoins in April 2022. You paid $20,000 for each Bitcoin, meaning your total investment is $40,000. In May 2023, you sell one of your Bitcoins for $30,000. This results in a long-term capital gain of $10,000. The other 1 Bitcoin remains unsold, meaning there aren’t any tax implications.

- Short-term gains are investments held for under 12 months. For example, suppose you buy 10 Ethereum in January 2023. You paid $1,500 per Ethereum, taking your total investment to $15,000. In April 2023, you sell 5 Ethereum at $2,000 each. This results in a short-term capital gain of $2,500 ($2,000 – $1,500 x 5). The remaining 5 Ethereum are unsold.

Things can get complicated if you have both short-term and long-term gains or losses for the year. This is because short-term losses must initially be offset against short-term gains. And the same for long-term gains and losses. If the losses exceed the gains in either category, you can offset them from the other category.

For example:

- You have $6,000 worth of short-term gains from a stock investment.

- You also have $10,000 worth of short-term losses from a crypto investment

- This wipes out the $6,000 stock gain, leaving you with $4,000 worth of short-term capital losses

- In the same year, you have $1,000 worth of long-term capital gains. This is wiped out from the $4,000 short-term capital loss.

- This leaves you with $3,000 worth of capital losses for the year. You can then use this $3,000 to reduce your taxable income.

What Does the IRS Need from Crypto Holders?

In a nutshell, any crypto-related transaction that is realized must be reported to the IRS when filing your taxes. To recap, a realized transaction is an investment that has been sold. Therefore, you don’t need to report crypto trades that haven’t been disposed of.

As we mentioned earlier, you’ll initially need to fill out IRS Form 8949. This details every realized crypto trade that you’ve made for the year. This should also include other asset classes, such as stocks and bonds. You’ll then need to transfer the totals to IRS Schedule D. And finally, the totals are carried over to IRS Form 1040.

Now, it’s important to note that the IRS needs information related to all digital assets. This means standard cryptocurrencies, stablecoins, and NFTs.

What’s more, you don’t necessarily need to sell crypto for US dollars for it to be viewed as a disposal. For example, swapping Bitcoin for Ethereum would still be classed as a disposal, meaning it must be reported on your IRS Form 8949. This is also the case when using crypto to make purchases.

For instance, suppose you use 0.5 ETH to pay for a flight. This 0.5 ETH has been disposed of. Therefore, you’d need to report the cost basis and sale price to the IRS. The sale price would be the price of ETH on the day of the purchase.

Do I Need to Pay Tax on Crypto Income?

- Crypto income should also be considered when assessing your tax liability. This can include income from staking and yield farming. Using the best crypto interest accounts is also viewed as income.

- Unlike crypto disposals, income is treated the same as other income forms, such as employment. It’s simply added to your total income for the year.

- The income is based on the value of the crypto asset received on the respective day.

- For example, suppose you receive 0.01 Bitcoin from a crypto interest account. 1 Bitcoin is worth $20,000 when you receive the income. Therefore, you’d need to add $200 to your income for the year.

- Our guide on crypto tax statistics provides more information on how income can impact your tax liability.

How Does the IRS Know if You Own Crypto?

The IRS requires US-based exchanges to file 1099 Forms. This includes Coinbase, Kraken, and Gemini, among others. The 1099 Form details all crypto transactions made by US clients on the respective exchange. Therefore, the IRS does know that you own crypto.

That said, some crypto exchanges might only submit a 1099 Form if the total volume of trades exceeds a certain amount. For example, Coinbase only submits reports to the IRS if clients have “earned more than $600 in crypto”. If you’re using an exchange that doesn’t report transactions to the IRS, it’s your responsibility to do so.

After all, if you fail to report your crypto gains, this will likely be viewed as tax evasion. Moreover, the IRS has previously worked with blockchain analytics firm Chainalysis. Although the partnership was aimed at finding Russians using crypto to avoid sanctions, Chainalysis can also help the IRS track wallets owned by US citizens.

Can you Avoid Paying Crypto Tax?

There are several ways that you can avoid paying crypto tax.

This includes:

- Tax Loss Harvesting: We’ve established that tax loss harvesting is a great way to avoid crypto taxes. The 30-day Wash Sale Rule doesn’t apply to crypto assets, so you can immediately repurchase the coins – and still benefit from a capital loss.

- Crypto IRA: Another strategy is to buy Bitcoins via a crypto IRA. In 2024, you can invest up to $7,000 in an IRA without paying tax. Those aged over 50 get an additional $1,000.

- Avoid Selling: The IRS is only interested in realizable gains. This means you won’t pay any taxes if you’re yet to sell your crypto investments.

- Long-Term Gains: If you’re currently in profit but the crypto investment has been held for under 12 months, it’s best to hold for a bit longer. This is because long-term capital gains come with more favorable tax treatment than short-term gains. Simply hold the investment for at least 12 months to qualify for long-term rates.

- Gift Crypto: Some investors will gift their crypto assets to family or friends. Gifts are not liable for tax, so this is another strategy to consider.

- Donate Crypto: Similar to gifts, crypto donations are another way to avoid paying taxes. Make sure the chosen charity is registered with the IRS.

Another option is to use a crypto tax software provider such as ZenLedger. They’ll be able to analyze all of your wallet and exchange transactions over several years. The process usually takes minutes. The provider might find some crypto tax losses that you can then offset against other gains.

ZenLedger is a leading crypto tax software in 2024 with over 100k customers using this service to streamline their crypto taxes. The way it works is it automates the cost calculations, and monitors the gains and losses for users’ transactions. Calculating capital gains and losses is done with the click of a button and users can review their tax liability for all crypto transactions. Once all the reports have been reviewed, users can then create their tax reports and file them for approval.

For those interested in automating their crypto taxes ZenLedger offers affordable pricing including a free plan, easy tax filing, highly-rated customer support, top-level security and much more. Check out ZenLedger today by following the link below.

Can You Write Off Crypto That Has a Value of 0?

Many investors will ask the question: Can you write off crypto losses?

If you’ve invested in a crypto project that has since become worthless, you might be able to write off the entire amount. This would be known as an abandonment loss, as stated within IRS Section 165.

However, for the crypto to be defined as worthless, you’d need to prove that there is no reasonable expectation that the investment will recover in the future. For instance, if you invested in a project that turned out to be a scam, this could be treated as an abandonment loss.

Unlike conventional capital losses, abandonment losses come without limits. So, suppose you invested $10,000 into a crypto asset that was rug-pulled. The value of the crypto is now $0. This $10,000 could be filed as a loss on your tax return. The IRS will then determine whether the investment qualifies as an abandonment loss.

Why You Should Claim Your Crypto Losses Tax

In summary, you should always claim your crypto losses tax. After all, you can offset the losses against other capital gains. And thus, reduce your tax burden.

Even if you don’t have any capital gains, you can use up to $3,000 of your crypto losses each year as deductible income. You can get the ball rolling by reviewing your historical crypto trades. Any losses you find could help you reduce or completely avoid taxes in future years.

References

- https://www.irs.gov/taxtopics/tc409

- https://www.irs.gov/businesses/small-businesses-self-employed/digital-assets

- https://www.irs.gov/taxtopics/tc703

- https://www.irs.gov/individuals/international-taxpayers/frequently-asked-questions-on-virtual-currency-transactions

- https://www.irs.gov/pub/irs-pdf/f8949.pdf

- https://www.irs.gov/pub/irs-pdf/f1040.pdf

- https://www.experian.com/blogs/ask-experian/can-you-write-off-crypto-losses-on-taxes/

- https://www.schwab.com/learn/story/how-to-cut-your-tax-bill-with-tax-loss-harvesting

- https://www.irs.gov/pub/irs-drop/n-13-48.pdf

- https://www.cnbc.com/2023/02/01/crypto-tax-loss-harvesting-expert-tips.html

- https://www.cnbc.com/select/how-is-crypto-taxed/

- https://www.cnbc.com/2023/03/25/what-cryptocurrency-investors-should-know-about-filing-taxes.html

- https://www.coinbase.com/learn/your-crypto/tax-documents-explained

- https://www.bloomberg.com/news/articles/2023-05-11/irs-chainalysis-working-with-ukraine-to-track-russian-crypto-sanctions-evaders

- https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000

- https://www.irs.gov/newsroom/charitable-contributions

- https://www.irs.gov/pub/irs-drop/rr-04-58.pdf

FAQs

Why should I report my crypto losses?

Reporting your crypto losses can help you reduce your tax burden. This is because losses can be offset against other capital gains. If you don’t have other capital gains, crypto losses can be used as a deduction against your income.

Is my crypto subject to IRS taxes?

Yes, the IRS views crypto assets as ‘property’, meaning it’s subject to tax. You only need to report crypto trades that are realized, meaning the position has been sold or exchanged.

Do I have to report crypto on taxes if I lose money?

Yes, the IRS requires you to report all capital transactions – including gains and losses. Doing so can be beneficial, as you might be able to offset the crypto losses against gains in future years.

What’s the maximum amount that crypto losses can be offset?

There is no maximum crypto loss that can be offset against other capital gains. However, you can only offset $3,000 as deductible income each year. Anything left over can be offset in future years.

Can I report NFT losses on my taxes?

Yes, the IRS views all digital assets as property for tax reasons. This means you can report NFT, crypto, and stablecoin losses when filing.

Is it legal to write off your crypto losses?

Yes, it’s legal to write off your crypto losses if the digital assets are deemed worthless. However, you’d need to prove that there’s no reasonable chance of the crypto asset recovering. If not, then you’d need to report the losses as a ‘capital loss’, rather than an ‘abandonment loss’.

What happens if I don’t report crypto losses?

You can face fines, penalties, and even criminal charges if you don’t file all of your crypto losses and gains. If you’ve failed to report losses, you can file a Form 1040-X. This enables you to amend a previous tax return.

Can you claim crypto losses on taxes?

Yes, up to $3,000 worth of crypto losses can be claimed on taxes. However, this is only possible if you don’t have other capital gains for the respective year.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Viraj Randev

Viraj Randev

Dassos Troullides

Dassos Troullides