What is a Liquidity Pool? Explained for DeFi Beginners

Liquidity pools are crowdsourced cryptocurrency funds made available to traders and borrowers in crypto markets. A liquidity pool (LP) can serve as a lender for crypto borrowers or a way for buyers and sellers to swap one crypto token for another. These pools enable trading and borrowing that would otherwise be impossible for many investors, bringing easy-to-access financial services to everyone.

In this guide, we’ll explain liquidity pools, how they work, and the various uses for pooled funds in decentralized finance (DeFi). We’ll also discuss the risks and detail the best practices for using liquidity pools. Let’s get started with a simple explanation of an LP.

A liquidity pool refers to pooled cryptocurrency assets made available for lending or trading. For example, the Aave lending protocol lets people deposit cryptocurrency into a lending pool from which others can borrow, much like a money market fund. Another type of liquidity pool offers a way to trade one token for another. These transactions are called swaps, and liquidity pools make them possible without using a centralized crypto exchange like Coinbase or Binance. Investors deposit two (or more) cryptocurrencies into a liquidity pool. Other traders make swaps through the pool, earning swap fees for the depositor. DeFi centers on the ability to trade and transact freely, with total DeFi revenues now more than $26 billion. Liquidity pools make cryptocurrency much more useful than simply sending coins or tokens to each other on centralized exchanges.In Short: What is a Liquidity Pool?

How Do Liquidity Pools Work?

Liquidity pools play a crucial role in the crypto economy, but how does a liquidity pool work? Liquidity pool platforms use various algorithms behind the scenes, with lending pools being the easiest to understand. You can deposit a cryptocurrency, such as ETH or USDC into a lending protocol and earn a yield as borrowers borrow from the pool. The process runs on smart contracts, which are computer programs that run on blockchain networks.

Swap liquidity pools on decentralized exchanges are a bit more complex under the hood. Their basic function is to allow permissionless trading of digital assets without using a centralized exchange. For example, if you have ETH but want USDC tokens, you can swap these assets using a liquidity pool using a protocol like Uniswap.

This type of liquidity pool uses an automated market maker (AMM), which is an algorithm that keeps the pool’s assets balanced. The AMM determines the exchange rate for the cryptocurrencies in the pool and lets anyone make swaps using just a crypto wallet.

Let’s walk through the process step by step. In this example, we’ll assume that you already have two cryptocurrencies you want to use to provide liquidity. It’s also important to have the cryptocurrencies on the right network. We’ll use assets on the Base blockchain, a fast and cheap Layer-2 network that’s secured by the Ethereum Layer-1 blockchain.

1) Provide Liquidity

First, connect your wallet to the decentralized exchange (DEX) you want to use We’ll use a Uniswap liquidity pool in this example.

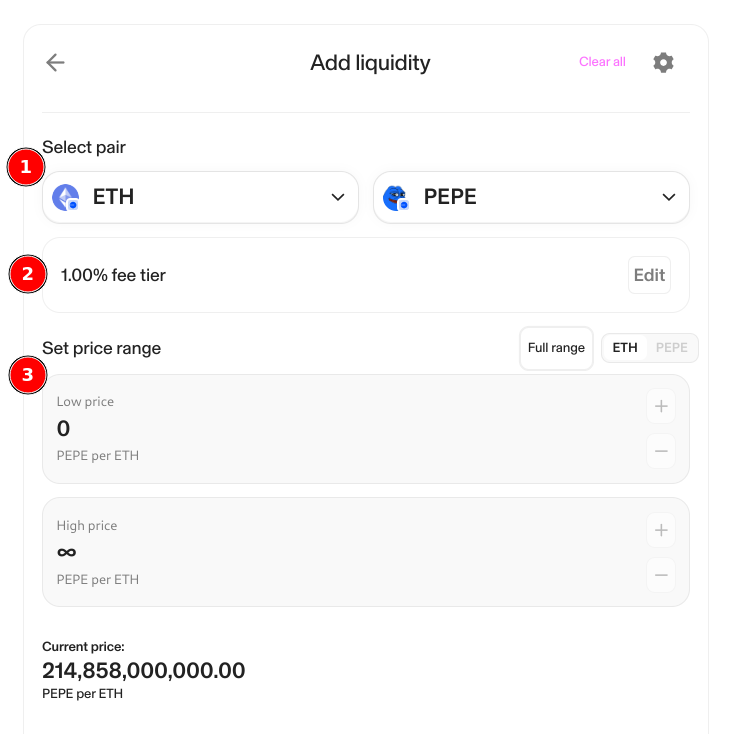

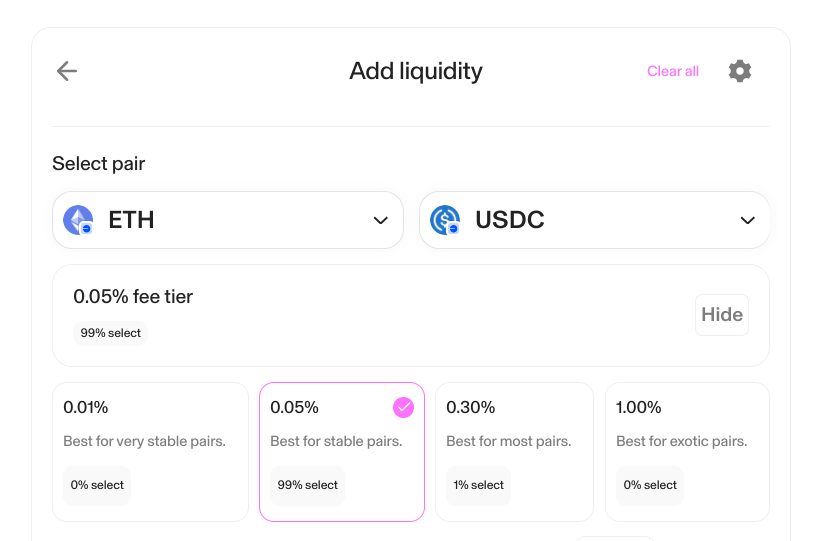

- Choose your pair. Most popular tokens come up in a search, but you may need to copy and paste the token contract address when providing liquidity for newer tokens. You can find the contract address on sites like CoinGecko or CoinMarketCap. We’ll use ETH and PEPE for this example.

- Choose your fee tier. You’ll earn swap fees as traders use the pool. Uniswap usually suggests a tier based on what others have chosen. Note: A higher fee tier doesn’t always mean more fees. Volume plays a larger role.

- Set your price range. In this example, we chose the full range, which is the simplest to set up. However, Uniswap V3 and some other DEXs, like Trader Joe’s, offer the ability to select a tighter range. This strategy is called concentrated liquidity and can earn more trading fees.

Since this is a full-range strategy, providing liquidity at any price, we’ll have to deposit an equal dollar value of tokens for the pair, half ETH and half PEPE.

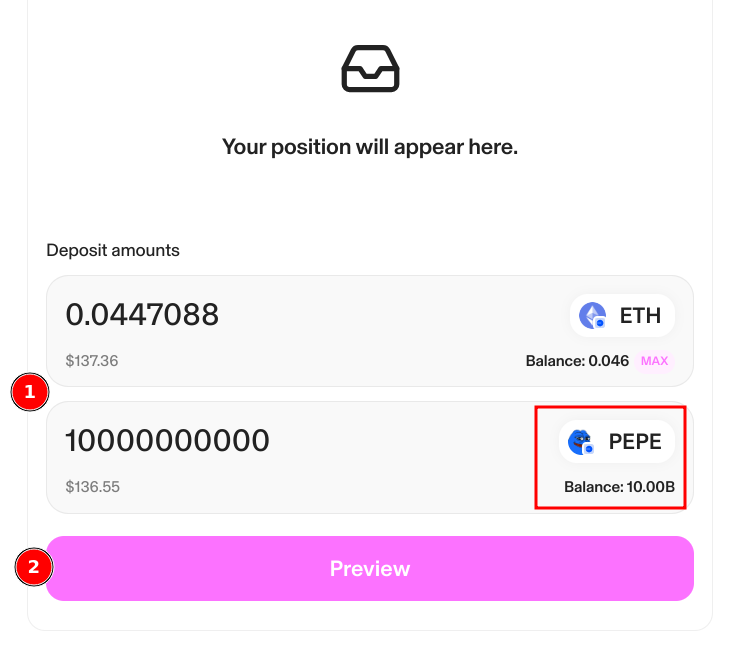

- Select your token quantities. We selected MAX for PEPE. Uniswap automatically calculates the amount of ETH needed for the LP position.

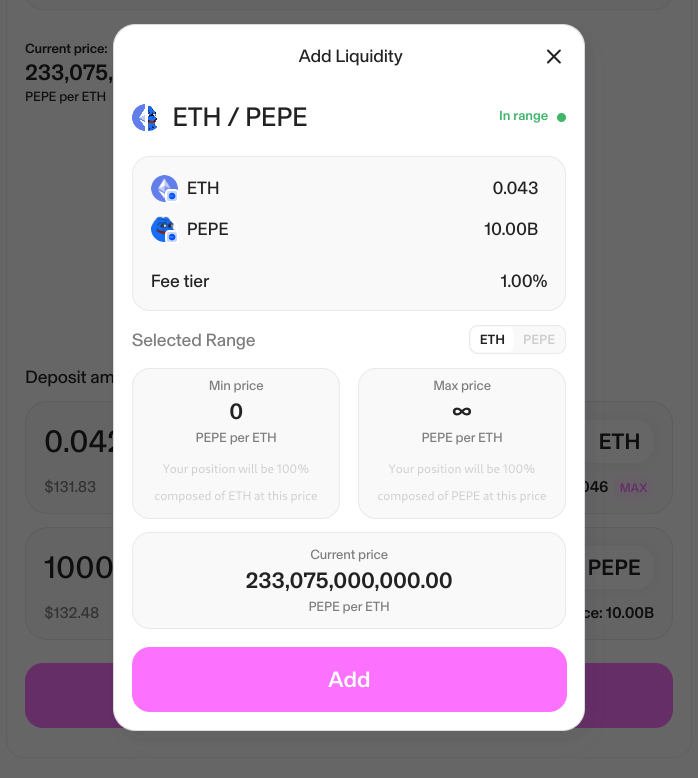

- Preview your LP position. Check your work to be sure you have the settings right. Once you sign the contract with your wallet, trading is available from your LP position.

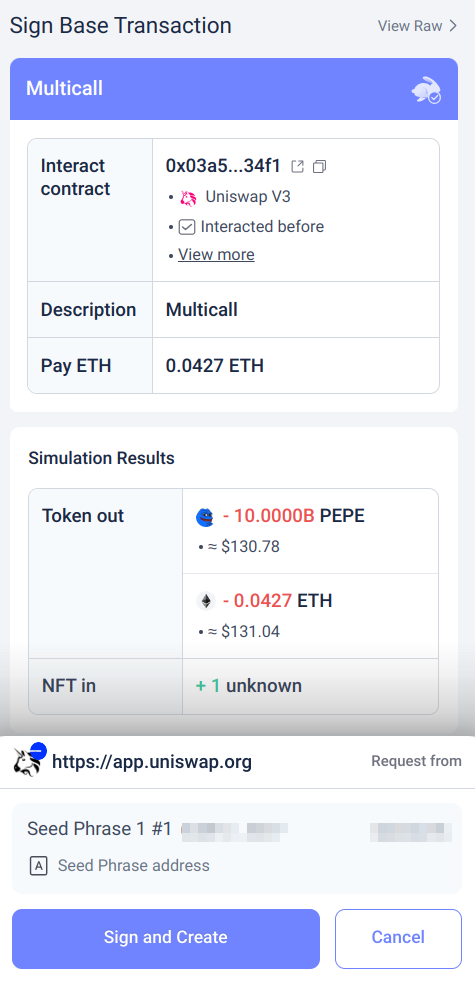

If everything looks good, click add and then sign the transaction with your crypto wallet.

2) Receive LP Tokens

Uniswap and other decentralized exchanges use a special token to represent your position. The token is usually an NFT (non-fungible token), meaning that it’s unique.

- Receive your LP token. This token may show in your crypto wallet. If you connect to the app you used to provide liquidity the app can read this token to show the activity for the LP position.

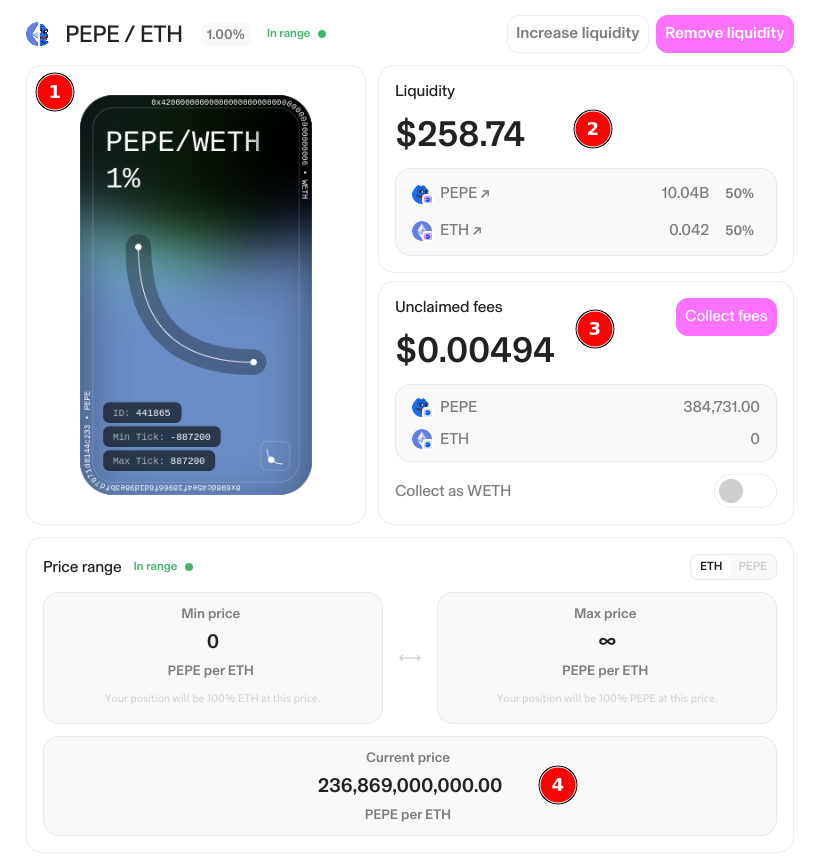

- Check LP balance. You can see the pool balance change in real time as swaps occur and the market prices move. This example uses a full-range pool, so the mix maintains a 50/50 ratio.

- Monitor your earnings. This LP started earning fees immediately because the PEPE token is traded often.

- Monitor the current price. Uniswap treats this value as an exchange rate, i.e., how many PEPE per ETH.

3) Earn Trading Fees

You’ll earn trading fees as swaps occur that use the market liquidity you provide. For example, if someone sells PEPE, you’ll earn some PEPE tokens. If they buy PEPE, you’ll earn ETH.

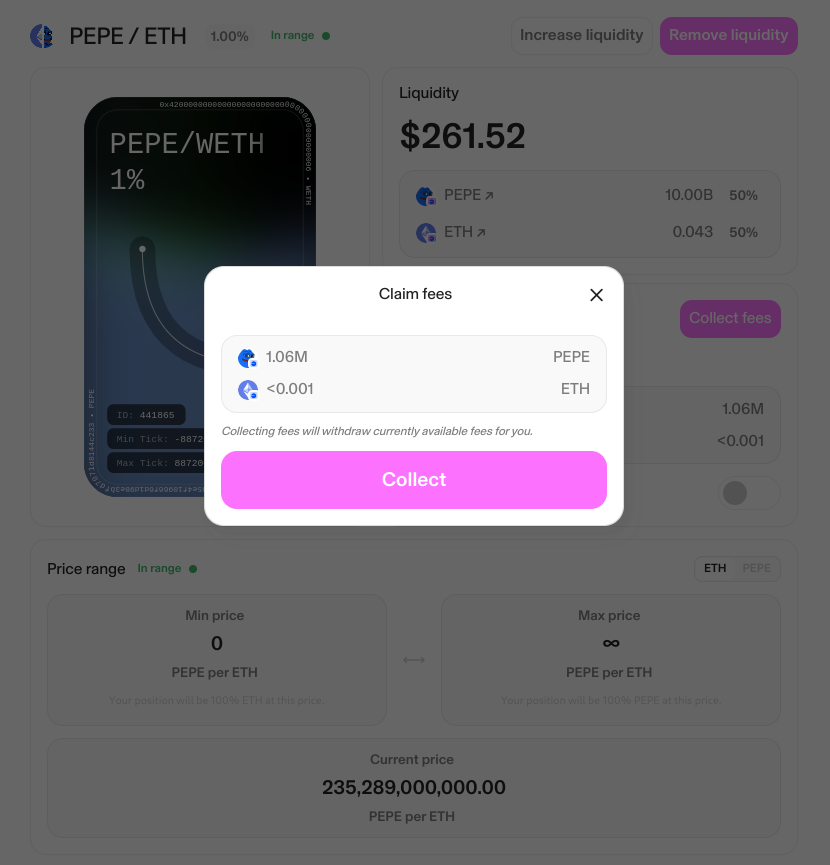

Collect your trading fees when you’re ready. Each smart contract interaction costs gas fees, so waiting until you have significant earnings is often best.

Some platforms also offer additional platform tokens as an incentive to use the DEX. These tokens can boost your earnings, but most of the volume occurs on Uniswap. You may see higher earnings on a high-volume DEX.

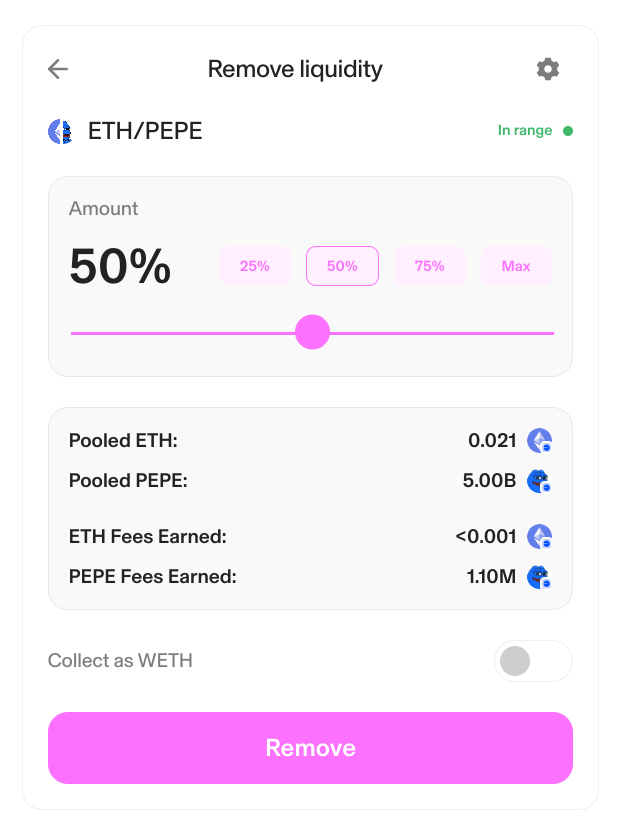

4) Monitor and Rebalance

Prices change over time, and you may want to rebalance your LP or even choose a concentrated liquidity strategy that trades within a limited range. To make changes, you can remove some or all of the liquidity and launch a new pool according to your needs.

Different Types of Liquidity Pools

Liquidity pools aren’t just for swaps. Even within those that provide swap liquidity, there are several types of pools. All DeFi liquidity pools serve a different purpose or provide distinct methods for the behind-the-scenes math that happens.

For example, Uniswap V2 uses a constant product formula to keep the pool balanced. However, this strategy can lead to impermanent loss (IL). With impermanent loss, you can end up with less value than if you had just held the tokens. However, transaction fees alone might offset this. More on IL in a bit.

Balancer, another popular DEX, allows users to change the ratio of assets to mitigate IL. For example, you might have a pool with 80/20 instead of 50/50.

| Type of Liquidity Pool | What it Does | Example |

| Stablecoin Pools | Allow swaps of $1-pegged coins like USDC and USDT. This solves the problem of IL for liquidity providers. | Curve Finance |

| Constant Product Pools | Use a constant product formula to balance the value of assets in the pool. | Uniswap |

| Smart Pools | Allow customized weighting of assets in the pool to mitigate IL. | Balancer |

| Leveraged Pools | Use leverage to borrow against pool assets and increase yields by providing more liquidity. | Extra Finance |

| Lending Pools | Allows lenders to earn a yield by supplying liquidity to a pool. Borrowers use collateral to borrow from the pool. | Aave, Compound |

What are the Risks of Liquidity Pools?

While liquidity pools allow easy swaps (or borrowing) and provide crypto passive income opportunities for liquidity providers, they aren’t without risks. The protocols that enable crypto liquidity pools use smart contracts that may be vulnerable to exploits. There’s also a risk of impermanent loss (IL). Let’s dive into that topic first.

Impermanent Loss

refers to when the value of your LP position is less than the value of the tokens if you have held them in your crypto wallet. The problem stems from uneven volatility in the two pooled assets, which creates a price divergence. The result is that the quantity of tokens on each side of the pool changes.

For example, if you’re providing liquidity for an ETH/USDC pool, ETH’s value will change over time. However, USDC’s value will remain at $1. As a result, the ratio of tokens in the pool will shift over time.

Let’s say the price of ETH is $3,000, and you start a pool with 3,000 USDC and 1 ETH. If the expected price of ETH goes up to $4,000, the amount of ETH in the pool will be reduced to about 0.87, and the USDC tokens balance will grow to $3464.10.

The total value of the pool is $6928.20, a profit of $928.20. However, if you held the tokens, they would be worth $7,000. The $71.80 loss in value compared to holding is the impermanent loss. Closing the position locks in the loss.

On the other hand, you earn trading fees along the way, which typically outweigh the impermanent loss. You can reduce IL risk by choosing pools that are closely correlated in price, such as stablecoin pools (100% correlation) or ETH/WBTC (~90% correlation). This strategy helps keep pool ratios closer.

Smart Contract Vulnerabilities

Behind the mobile app and web app interfaces, decentralized applications (dApps) run smart contracts on the blockchain. These computer programs may be vulnerable to exploits that can put your crypto assets at risk. Major DEX platforms and lending protocols have undergone several audits by third-party security firms. However, if there’s an undiscovered way to exploit the contract, you can be sure someone will find it eventually.

Best Practices for Providing Liquidity

You can also take some additional steps to help ensure safer trading when using liquidity pools. Where you choose to deploy your capital can make a difference. You can also consider diversifying your risk by using multiple liquidity pools in DeFi.

Use Established DeFi Platforms

Most well-known DeFi protocols are open-source, making the code available for viewing. This also means that, in addition to third-party audits, talented security experts from around the world have crawled through the protocol’s functions. A smaller or newly launched protocol likely won’t get the same level of scrutiny.

Well-established swap liquidity providers for pools include Uniswap, Balancer, SushiSwap, Pancakeswap (BSC), and Jupiter (Solana). For lending pools, you can consider platforms like Aave or Compound.

Diversify Across Liquidity Pools

Similar to other types of investing, it’s often safer to diversify your crypto portfolio and liquidity pools. You can consider using multiple platforms or using multiple liquidity pools with different crypto assets. The first limits risk from smart contract vulnerabilities because your funds aren’t all on one protocol. The latter creates multiple income streams. Of course, you can also do both.

Many crypto investors use lending pools in addition to swap pools to drive income from multiple sources.

Understand Impermanent Loss

Trading fees and forming rewards often offset any impermanent loss. However, if you choose a volatile pair, the IL for the pool can be much higher. For example, pairing ETH with a meme coin that can move by 50% or more in a day can lead to higher IL compared to pairing established cryptocurrencies like ETH/WBTC.

How to Choose a Liquidity Pool

Choosing a liquidity pool is largely dependent on your risk tolerance regarding which assets you want to pair. However, several factors to consider include daily trading volume, fee tier options, and platform security.

- Fee structure: Uniswap V3 offers four fee tiers, ranging from 0.01% to 1%. By contrast, many other DEXs offer a one-tier fee structure, often 0.25% or 0.3%. More options allow you to fine-tune the fees for the assets in your LP.

- Asset price correlation: Safer assets include stablecoins like USDC and USDT. These usually trade within a fraction of a penny relative to each other, which eliminates IL risk, assuming they both maintain their peg to $1.

- Daily trading volume: High trading volume can help you earn more with your assets. Consider trading volume for both the assets and the platform. According to stats from CoinGecko, Uniswap offers the highest trading volume on Ethereum and Arbitrum, whereas Jupiter tops the list for Solana.

- Tools to optimize yields: Platforms like Uniswap and Trader Joe’s support concentrated liquidity, which allows you to set a tight trading range and increase your fee earnings.

- Platform security: Established platforms like Uniswap have been audited multiple times by third-party crypto audit firms, including ChainSecurity, ABDK, and others. Similarly, Balancer has undergone several audits by leading security firms.

- Existing liquidity pools: Initializing a new pool on Uniswap can be a daunting task. If someone has already created pools at the fee tier you want, that may sway your decision. You can also consider how much liquidity is available. If the space is crowded, you may earn less than if you can find a profitable niche.

- Supported blockchains: The type of asset you want to use for your pool might determine the best DEX or lending pool for your needs. For example, Solana tokens won’t work on Ethereum Virtual Machine (EVM) chains. If you want to LP Solana tokens, you can consider Jupiter. Uniswap only supports select EVM chains.

Conclusion

Liquidity pools allow permissionless swaps, allowing anyone to transact using just a crypto wallet. Lending pools, another type of liquidity, allow lenders to pool their assets and earn a yield on their proportional share of the pool as borrowers access the liquidity.

Getting started with liquidity pools isn’t necessarily difficult, but it comes with a learning curve and some potential risks. Invest some time in choosing the right pools for your income goals, balancing risks like impermanent loss compared to the income opportunities. When choosing a pool, an established platform like Uniswap may make a safer first choice because the protocol is battle-tested and has undergone several audits.

FAQs

What are liquidity pools?

Liquidity pools are crowdsourced crypto assets that allow investors to swap crypto tokens without using a centralized crypto exchange. A second type of decentralized liquidity pool offers crypto lending, allowing investors to pool their assets and earn interest on funds borrowed from the pool.

How do I become a liquidity provider?

To provide liquidity to swap pools, such as those on the Uniswap protocol, first connect your crypto wallet to the decentralized exchange app. Then, choose your liquidity pool tokens and fee tier. Next, set a trading range (if available), then select a token quantity. Preview your liquidity pool and sign the transaction with your crypto wallet.

What is the difference between liquidity pools and staking?

Liquidity pools vs staking take different approaches to passive income. Staking most often refers to locking your tokens in a smart contract to help secure a proof-of-stake network like Ethereum. By comparison, liquidity pools also lock a set amount of cryptos into a pool to provide greater liquidity for those trading assets on a particular exchange. Liquidity pools are susceptible to impermanent loss which means that if a token price dives or jumps users can end up with fewer tokens than if they’d just HODLed the tokens in the first place.

Are liquidity pools risky?

Swap liquidity pools bring two types of risk: risk related to smart contracts and impermanent loss. Lending liquidity pools also have smart contracts, in addition to the risk of defaults if the platform can’t liquidate collateral assets fast enough during market volatility.

Does yield farming work with liquidity pools?

Some decentralized exchanges and lending liquidity platforms offer additional yields in the form of platform tokens. These liquidity tokens can be sold or, in some cases, staked to boost overall yields earned by providing liquidity.

References

- DeFi Worldwide (statista.com)

- How Uniswap works (uniswap.org)

- Top Decentralized Exchanges Ranked by 24H Trading Volume (coingecko.com)

- Code Assessment of the Permit2 Smart Contracts (chainsecurity.com)

- ABDK Smart Contract Audit (github.com)

- Balancer Audits (balancer.com)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Sergio Zammit

Sergio Zammit

Kane Pepi

Kane Pepi