12 Best Real World Assets (RWA) Coins to Invest in 2024

Tokenized Real-World Assets (RWA) represent a huge growth market. They bridge the gap between blockchain technology and traditional assets, such as currencies, real estate, and fine art. Even JPMorgan Chase has expressed its vision for the RWA space, illustrating the market’s trillion-dollar potential.

This guide explores the best RWA crypto investments for 2024. Read on to discover undervalued RWA cryptocurrencies that could blow up in the coming months.

List of the Top RWA Coins

Let’s start with a brief overview of the 12 best RWA crypto tokens in the market today:

- 99Bitcoins Token – Learn-to-earn ecosystem for blockchain education, with tokenized rewards for course progression

- Chainlink – Key infrastructure for the RWA industry, providing real-world data to decentralized applications

- Maker – Decentralized finance network offering collateralized real estate loans in stablecoins

- Ondo Finance – Tokenization of high-grade investment products, including mortgage-backed securities

- Ribbon Finance – Structured investment products and fixed-income strategies, allowing users to become market makers

- Synthetix Network – Offers real-time exposure to tradable financial instruments via synthetic assets

- Algorand – Simplified blockchain tokenization for fine art, books, music, and other real-world assets

- Pendle – Future-value tokenization of yield-bearing assets in the decentralized finance space

- Polymesh – Institutional-grade blockchain platform for regulated securities, with a strong focus on compliance

- Goldfinch – Crypto-backed loans for real businesses in the developing world, 12-month growth of 800%

- TrueFi – Low-cap RWA project offering uncollateralized loans to businesses and individuals

- Creditcoin – Decentralized credit network for emerging countries, connecting borrowers and lenders

Best RWA Crypto Projects Reviewed

Learn more about the RWA crypto projects summarized above. I’ll explain how each project works, what problems it solves, and how it contributes to the broader RWA space.

In addition, we explore key metrics surrounding market capitalization, tokenomics, and future price potential.

1. 99Bitcoins Token – Learn-to-Earn Ecosystem for Blockchain Education, With Tokenized Rewards for Course Progression

99Bitcoins is the first RWA crypto project to consider. Put simply, 99Bitcoins is tokenizing the blockchain education industry. A comprehensive crypto and blockchain course has been developed, consisting of over 79 hours of material. This includes video explainers, guides, quizzes, exams, and other proven learning methods.

Students will begin with the basics of cryptocurrencies, before progressing to more complex topics. This includes smart contracts, decentralized finance, and trading strategies. The 99Bitcoins course offers tokenized rewards as students complete modules. Rewards are paid in the project’s native token, $99BTC.

Unlike the other RWA projects on this list, $99BTC is currently in presale. This enables investors to secure a discounted price. Not to mention a micro-cap valuation before the exchange listing. More than $1.2 million has been raised so far – the current token price is just $0.00104. Multiple presale payment types are accepted, including ETH, USDT, BNB, and credit cards.

Visit 99Bitcoins Token Presale

2. Chainlink – Key Infrastructure for the RWA Industry, Providing Real-World Data to Decentralized Applications

Chainlink is one of the top RWA crypto investments to consider. It’s considered an infrastructure play; Chainlink provides real-world data to smart contracts and decentralized applications. This is crucial, as it ensures RWA ecosystems have access to real-time data that’s reliable, unbiased, and accurate.

Put otherwise, Chainlink bridges the gap between the offline and blockchain spaces while protecting data security and integrity. Chainlink leverages a peer-to-peer style framework, where data providers are rewarded with LINK tokens. Similarly, decentralized applications that require data pay fees in LINK, ensuring Chainlink has long-term utility.

In terms of RWA industries, Chainlink covers all bases. For instance, it can provide real-world data for stablecoin projects, such as interest rates and currency exchange rates. It can also verify valuations for real estate, fine art, and other stores of value. The possibilities are endless. LINK has a market capitalization of $7.8 billion and trades 75% below all-time highs.

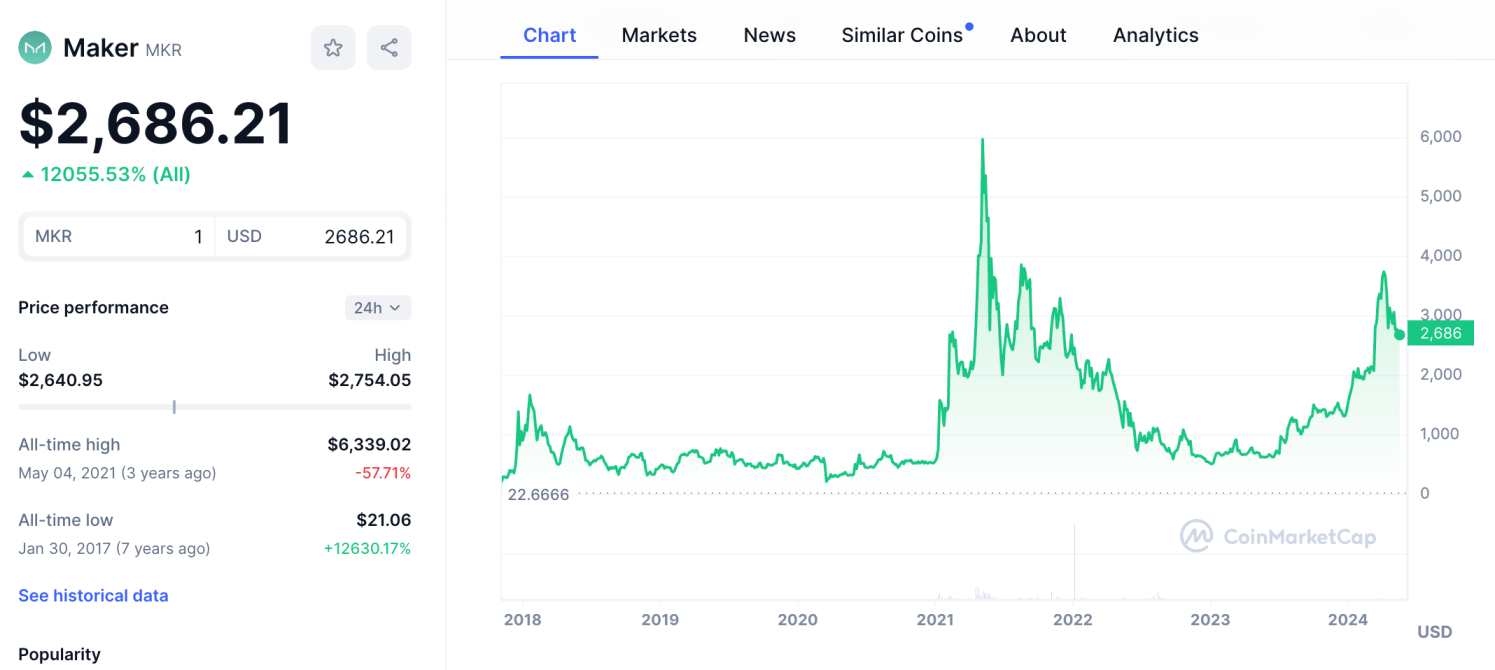

3. Maker – Decentralized Finance Network Offering Collateralized Real Estate Loans in Stablecoins

The next RWA project to consider is Maker. Launched in 2017, Maker is an established decentralized finance ecosystem that issues DAI, a leading stablecoin that’s pegged to the US dollar. Maker has since diversified into the RWA space by offering collateralized real estate loans. This means property owners can access real-time liquidity in DAI.

Funding amounts are based on the real estate’s value. DAI loans attract interest, just like in the traditional finance industry. However, the interest payments are injected back into the Maker system, allowing the project to grow organically over time. Maker is backed by MKR, the project’s native governance token.

Maker has a market capitalization of about $2.45 billion. MKR has been one of the top-performing cryptocurrencies in the past year, with growth of 325%. The project is up over 12,000% since inception. Even so, Maker currently trades 57% below all-time highs This could be the final opportunity to buy MKR tokens at these pricing levels.

4. Ondo Finance – Tokenization of High-Grade Investment Products, Including Mortgage-Backed Securities

Ondo Finance is also one of the top RWA crypto projects to explore. In a nutshell, Ondo Finance tokenized top-grade investment products from the traditional finance space. This means everyday investors can access financial instruments that would otherwise be reserved for large institutions.

One of the best examples of an Ondo Finance offering is mortgage-backed securities. Investors can gain exposure to a broad spectrum of real estate ventures without needing to directly buy property. Nonetheless, the mortgage-backed security is represented with an RWA token. This ensures ownership is secured on the blockchain and the real world.

The investor receives the respective interest payments that the mortgage-backed securities generate. This is just one example; Ondo Finance can tokenize virtually any asset class. Its native crypto coin, Ondo, has a market capitalization of just over $1 billion. Ondo has increased by 373% in the past year, making it a top-rated RWA investment.

5. Ribbon Finance – Structured Investment Products and Fixed-Income Strategies, Allowing Users to Become Market Makers

Ribbon Finance entered the blockchain space in late 2022. It’s an innovative RWA ecosystem that supports fixed-income strategies and structured investment products. Put otherwise, Ribbon Finance enables users to become market makers – a role historically reserved for those with vast resources. One example of Ribbon Finance’s potential is its call options strategy.

Consider an investor who deposits $5,000 worth of ETH. That ETH is used to write call (sell) options, which effectively creates a market for speculative traders. Due to market spreads, the call options generate passive income for the investor. For instance, if the strategy yields 8%, that $5,000 worth of ETH will generate an annualized income of $400.

Ribbon Finance’s native RWA coin, RBN, is another top-performing investment. It has increased by more than 585% in the past year. Interestingly, Ribbon Finance trades almost 80% below all-time highs. This offers a huge discount for new investors. Ribbon Finance has a market capitalization of just $542 million.

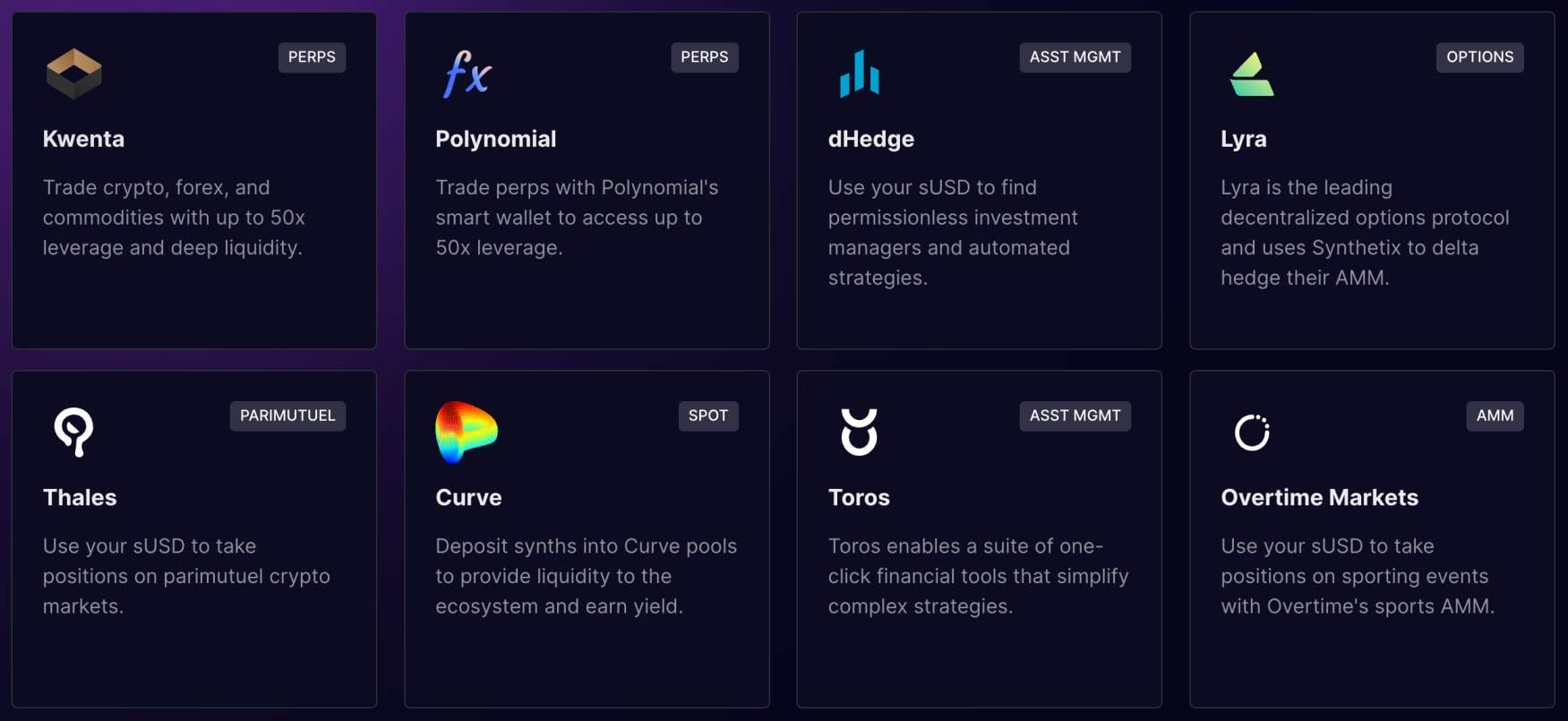

6. Synthetix Network – Offers Real-Time Exposure to Tradable Financial Instruments via Synthetic Assets

Synthetix Network operates in a trillion-dollar marketplace; it enables anyone to gain exposure to tradable financial instruments. This includes anything from cross-currency pairs like EUR/USD, not to mention commodities like gold, silver, and crude oil. Synthetix Network also covers traditional equities from virtually any stock exchange and global market.

Synthetix Network leverages ‘Synthetic Assets’ when creating tradable markets. For instance, consider an investor who wants exposure to natural gas. The investor can mint a synthetic token that tracks the real-time value of natural gas – with data provided by Oracle systems like Chainlink. The value of the synthetic token will mirror the natural gas price.

Liquidity is provided by those staking SNX, Synthetix Network’s native ecosystem token. This generates passive rewards for stakers, while ensuring tradable markets have sufficient liquidity. ETH and LUSD can also be used to fund marketplace orders. Synthetix Network has a market capitalization of $796 million. SNX has increased by 21% in the past year.

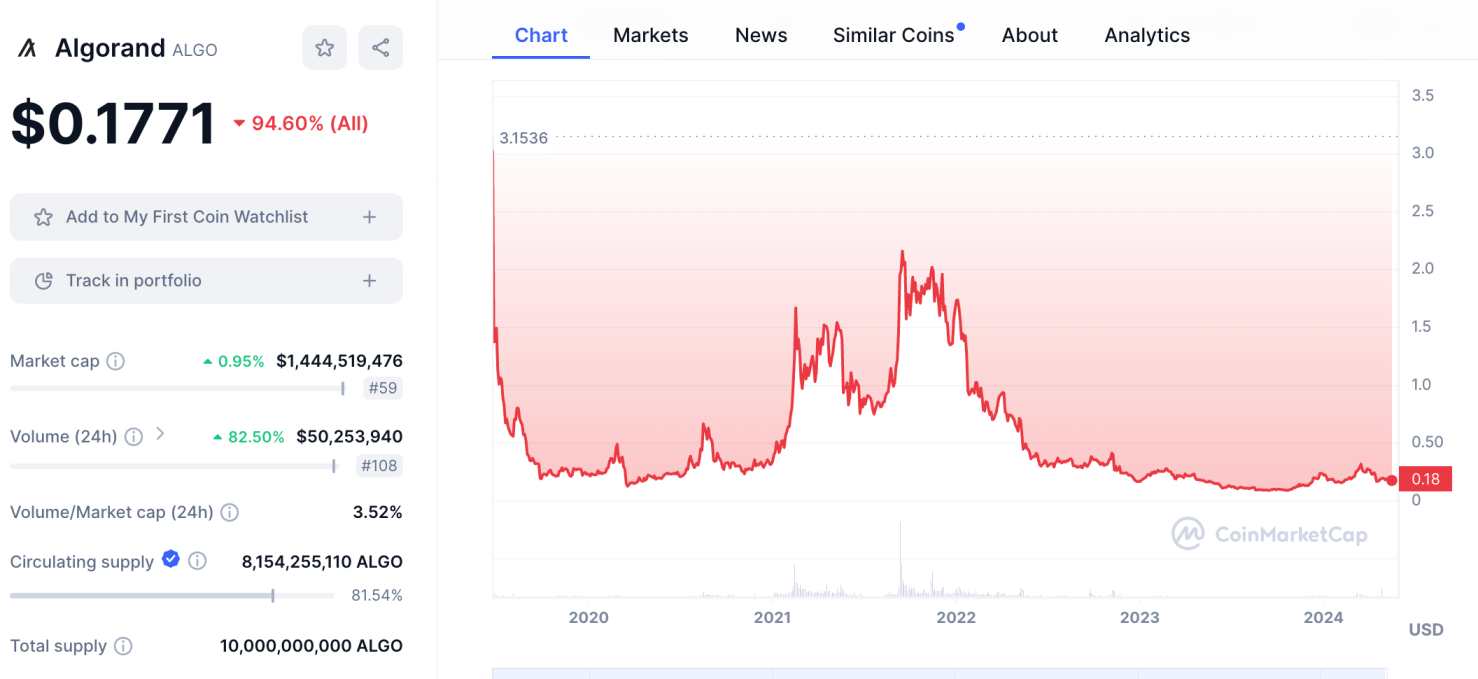

7. Algorand – Simplified Blockchain Tokenization for Fine Art, Books, Music, and Other Real-World Assets

Algorand is a blockchain platform that simplifies the tokenization process. It’s one of the best options for everyday users involved in the arts and entertainment industry. For example, consider an independent artist who specializes in fine art creations. Through Algorand, the artist can tokenize their physical artwork on-chain.

Not only does this secure ownership but it enables the artist to market and sell their creations. The same concept can be applied to musicians who want to protect their music. Not to mention ebook and audiobook authors who want to digitize their content. Algorand is also suitable for other tokenization industries, including tradable assets, stablecoins, digital tokens, and real estate.

Crucially, Algorand has partnered with multiple Web 3 platforms to ensure non-technical creators are catered for. Algorand’s native RWA coin is ALGO, which launched in mid-2019. While ALGO has a market capitalization of $1.4 billion, it trades almost 95% below its original launch price. Algorand has increased by almost 10% in the past year.

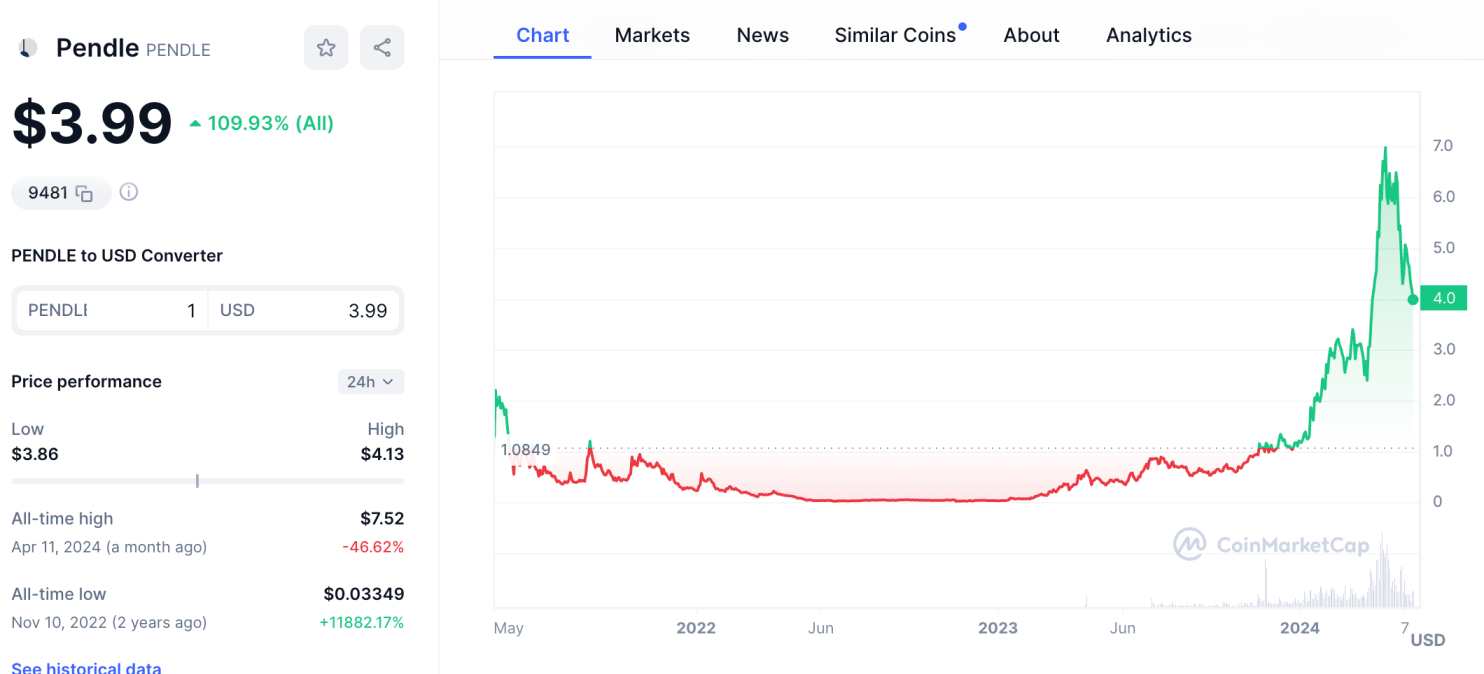

8. Pendle – Future-Value Tokenization of Yield-Bearing Assets in the Decentralized Finance Space

The next RWA project to offer huge price potential is Pendle. It enables users to tokenize future-value yields on decentralized finance products. For example, suppose an investor has previously staked 10 ETH at APYs of 6%. In this instance, the Pendle network will tokenize the original staking position (10 ETH) and the future yield (6%).

The original position is backed by Principal Tokens (PT). While the future yield is backed by Yield Tokens (YT). Now, the investors can list their YT tokens on Pendle’s decentralized marketplace. Anyone can purchase those tokens to secure the future yield available. This means the original investor has secured instant liquidity while retaining their original 10 ETH.

Not only can Pendle tokenize future staking yields but also lending agreements and liquidity pools. Pendle’s native token, PENDLE, has a market capitalization of just over $950 million. PENDLE has generated returns of almost 810% in the past year. All-time highs of $7.52 were hit in April 2024. A 46% market correction has since surfaced, offering a great time to invest.

9. Polymesh – Institutional-Grade Blockchain Platform for Regulated Securities, With a Strong Focus on Compliance

Polymesh is one of the best RWA crypto projects for the institutional space. Its native blockchain protocol has been designed for regulated assets, including traditional securities. This includes equities from multiple financial markets, not to mention bonds, ETFs, and other instruments. There is a strong focus on regulatory compliance.

This includes effective onboarding and KYC verification, ensuring that Polymesh products meet existing anti-money laundering guidelines. Polymesh is ideal for casual investors who want exposure to assets that historically attract high minimums. A great example is foreign government bonds, which can be fractionized on the Polymesh platform.

Polymesh doubles up as a secondary marketplace, meaning greater liquidity is available – even on illiquid markets like bonds. The Polymesh ecosystem is backed by POLYX tokens, which have increased by 165% in the past year. Current prices are 46% below all-time highs. Polymesh has a market capitalization of $335 million, so there’s plenty of upside potential.

10. Goldfinch – Crypto-Backed Loans for Real Businesses in the Developing World, 12-Month Growth of 800%

Goldfinch has created an innovative RWA ecosystem for crypto-backed loans. Anyone can lend money to real businesses in the developing world, ensuring competitive yields are based on actual revenues, rather than crypto speculation. Loans are funded and distributed in USDC. This ensures investors and borrowers avoid market volatility.

One of the best features is that investors can choose their preferred investment market. Each market comes with a USDC yield, duration, and risk-reward spectrum. For example, the Emerging Southeast Asia option offers APYs of 17% over a 25-month duration. There’s also an African Innovation fund offering similar terms.

A less risky option is the Goldfinch Senior Pool. This offers APYs of 7.6% with flexible terms. Goldfinch is a growing concept, with just under $100 million in active loans. This has generated just over $100,000 in 30-day revenues. Goldfinch has a market capitalization of $111 million. Its native token, GFI, has increased by over 800% in the past year.

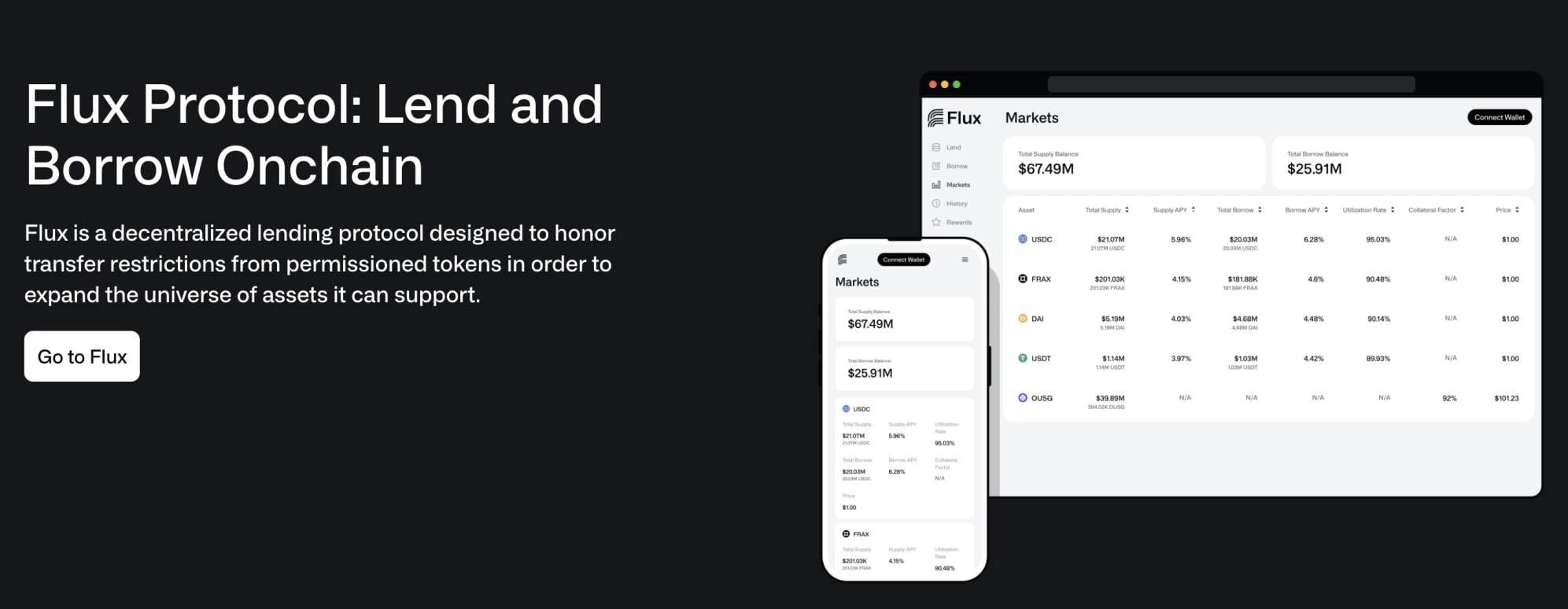

11. TrueFi – Low-Cap RWA Project Offering Uncollateralized Loans to Businesses and Individuals

With a market capitalization of just $118 million, TrueFi is one of the best low-cap crypto projects in the RWA space. It specializes in crypto loans for businesses and individuals alike. Crucially, unlike traditional DeFi lending agreements, TrueFi offers uncollateralized loans. This means that borrowers don’t need to deposit tokens for approval.

On the contrary, TrueFi has developed a credit scoring system that’s governed by its community. This considers a range of factors, such as creditworthiness, financial history, and existing assets to hand. These factors determine the loan terms, including APRs and repayment durations. Anyone can fund TruFi loans by providing the platform with crypto tokens.

Lenders earn a percentage of the interest payments generated. The balance is injected back into the TrueFi system, ensuring potential defaults are safeguarded. TrueFi’s native token, TRU, was launched in 2021. It’s one of the most volatile cryptos to trade. While TRU is currently 90% below all-time highs, it has returned almost 135% growth in the past year.

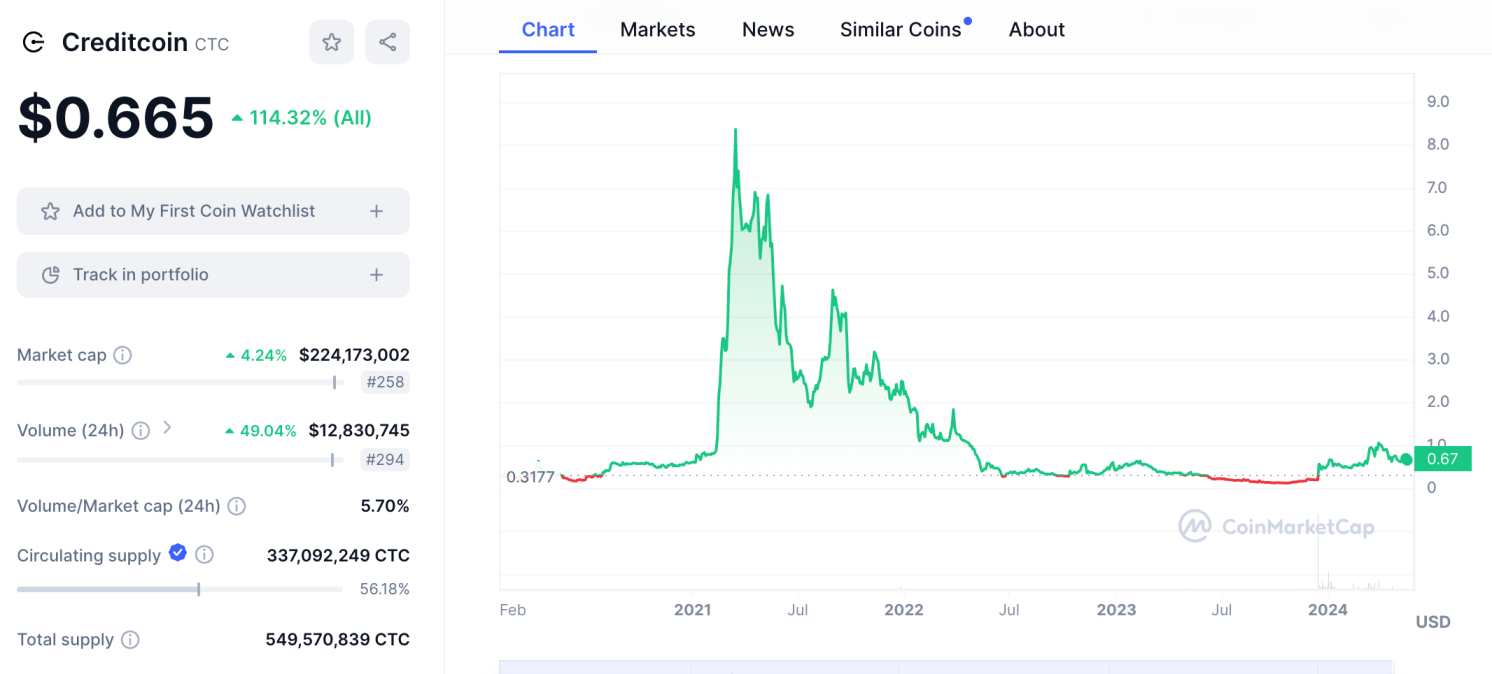

12. Creditcoin – Decentralized Credit Network for Emerging Countries, Connecting Borrowers and Lenders

Last on this RWA crypto list is Creditcoin. This undervalued project is building a credit network for emerging countries. It leverages the decentralized blockchain protocol to directly connect lenders and borrowers. All loan-related transactions, including applications, fund issuance, and repayments – are posted to the blockchain ledger.

This means individuals can build a credit score without relying on centralized bureaus – which often don’t exist in Creditcoin’s target market. In addition, Creditcoin is also developing cross-chain capabilities. This will enable users to lend and borrow assets across competing blockchains, ensuring Creditcoin’s use cases are flexible and broad.

For instance, suppose a borrower wants access to Bitcoin. Someone holding Ethereum would like to fund the loan without swapping their coins. Creditcoin facilitates these needs seamlessly. Creditcoin has a market capitalization of under $225 million. Its native token, CTC, has increased by over 90% in the past year.

What are Real World Assets (RWA) in Crypto?

Still asking the question; what is RWA in crypto? Real-World Assets, or RWA, is one of the fastest-growing trends in the crypto market. In simple terms, RWA tokenizes assets from the physical world onto the blockchain protocol. This bridges the gap between real-world ownership and the Web 3 industry, providing many benefits that weren’t previously possible.

For example, consider an RWA project that tokenizes a holiday resort in Thailand. The resort is valued at $10 million and it’s been tokenized into 10 million units, each valued at $1. This means anyone – no matter their budget, can own a slice of the resort. And in doing so, are entitled to their share of revenues and operating profits.

This is just one example – the RWA concept can be applied to virtually any real-world asset. This includes commodities like gold, silver, and crude oil. Not to mention luxury goods, supercars, and fine art. In fact, RWA is also suitable for intangible assets, such as intellectual property, music royalties, and digital audiobooks.

RWA has also expanded into traditional financial markets. For instance, RWA projects can tokenize uncollateralized loans, stablecoins, equities, and metaverse land. The possibilities are endless.

RWA Crypto Market Snapshot

According to CoinRanking data, the total value of all RWA crypto tokens is just over $17 billion. This is just a small fraction of the industry’s true potential. After all, the assets that RWA tokenizes operate in trillion-dollar markets.

This means that RWA tokens will appeal to growth investors searching for the next crypto to explode. And, with the RWA space recently witnessing a temporary market correction, now could be the best time to start building a position.

Methodology: How We Ranked The Top RWA Tokens

We discussed the 12 best RWA crypto tokens for investors in 2024. But how did we rank the top projects? After all, there are more than 100 options in the market, ranging from up-and-coming micro-caps to large-scale behemoths. We developed a methodology to ensure projects with the greatest upside potential were prioritized.

One of the core factors we analyzed was the respective RWA niche, such as uncollateralized loans, real estate, traditional financial securities, and decentralized credit networks. We also considered the market capitalization and price performance, relevant to the wider RWA market. Let’s take a closer look at our own research methods when ranking the best real-world asset tokens.

RWA Niche – 30%

Our methodology initially short-listed RWA projects based on their niche. This ensures that investors have access to a wide range of projects from various marketplaces. For example, 99Bitcoins is revolutionizing blockchain education via a learn-to-earn mechanism. We selected Ondo Finance for its collateralized real estate loans, and Ribbon Finance for its fixed-income strategies.

We choose Algorand for exposure to the arts and entertainment spaces. It enables artists, musicians, and authors to tokenize their creations. Other popular niches covered include decentralized credit networks, uncollateralized loans, regulated financial securities (e.g. foreign government bonds), commodities, and mortgage-backed financing.

Ultimately, creating a diversified portfolio of each RWA niche is the best strategy. Not only can investors cover all bases but also de-risk. After all, the RWA industry is nascent, so nobody quite knows which projects will succeed, and which will fail.

Market Capitalization – 30%

Our research methods also considered the market capitalization when ranking RWA projects. This ensures that all risk profiles are catered for. Large-cap projects included Chainlink and Maker, which are valued at $7.8 billion and $2.45 billion, respectively. These projects are less volatile than smaller-cap alternatives. However, the growth potential is also more conservative.

To counter this, we also included RWA projects with much smaller valuations and hence – a higher upside potential. For example, 99Bitcoins is considered one of the best crypto presales. Having already raised $1.2 million, $99BTC tokens have huge growth potential. The presale enables investors to buy $99BTC before the tokens are listed on exchanges.

However, crypto presales are extremely risky, so we also included RWA projects in the small-to-mid-cap range. For example, Creditcoin and Polymesh are valued at $225 million and $335 million, respectively. These projects have a realistic chance of hitting billion-dollar valuations when the next RWA wave begins.

Price Performance vs RWA Benchmark – 20%

Price performance was another important metric when choosing RWA crypto investments. First, our methodology created a benchmark index, allowing us to assess the average RWA growth trajectory. We used the data provided by Coinranking, which shows that the broader RWA space has increased by over 89% in the prior 12 months.

Therefore, RWA projects exceeding the benchmark average were prioritized. For example, Maker and Ondo have increased by 325% and 373% in the prior year. Ribbon Finance, Pendle, and Goldfinch have produced even larger gains. These projects have returned 585%, 810%, and 800% respectively.

However, some RWA projects discussed today have underperformed the benchmark average. For example, Algorand and Synthetix Network have returned just 10% and 21% over the same period. Even so, these are still top-rated RWA projects that offer solid long-term potential.

Valuation From All-Time High – 20%

We also considered the current price of RWA tokens when compared to their prior all-time high. After all, the wider RWA space – like other crypto niches, has recently entered a market correction. This is why many all-time high valuations were achieved as recently as April 2024.

The good news is that this offers many investment opportunities and a great chance to enter the market. Therefore, our methodology awarded extra points to projects offering a sizable discount. For example, although Ribbon Finance has returned 585% in the past 12 months, it currently trades 80% below all-time highs.

This means Ribbon Finance offers the best of both worlds; it has outperformed the broader RWA benchmark while still trading at an affordable entry price. Similarly, while Polymesh has increased by 165% in the past year, it currently trades at a 46% discount. Investors can assess the all-time discount on CoinMarketCap via the left-hand panel.

Types of RWAs

The best thing about the RWA space is it covers a broad spectrum of industries, markets, and use cases. This includes everything from stablecoins and fine art to real estate and intellectual property. Considering the specific niche is a core investment criterion, let’s take a closer look at some RWA examples.

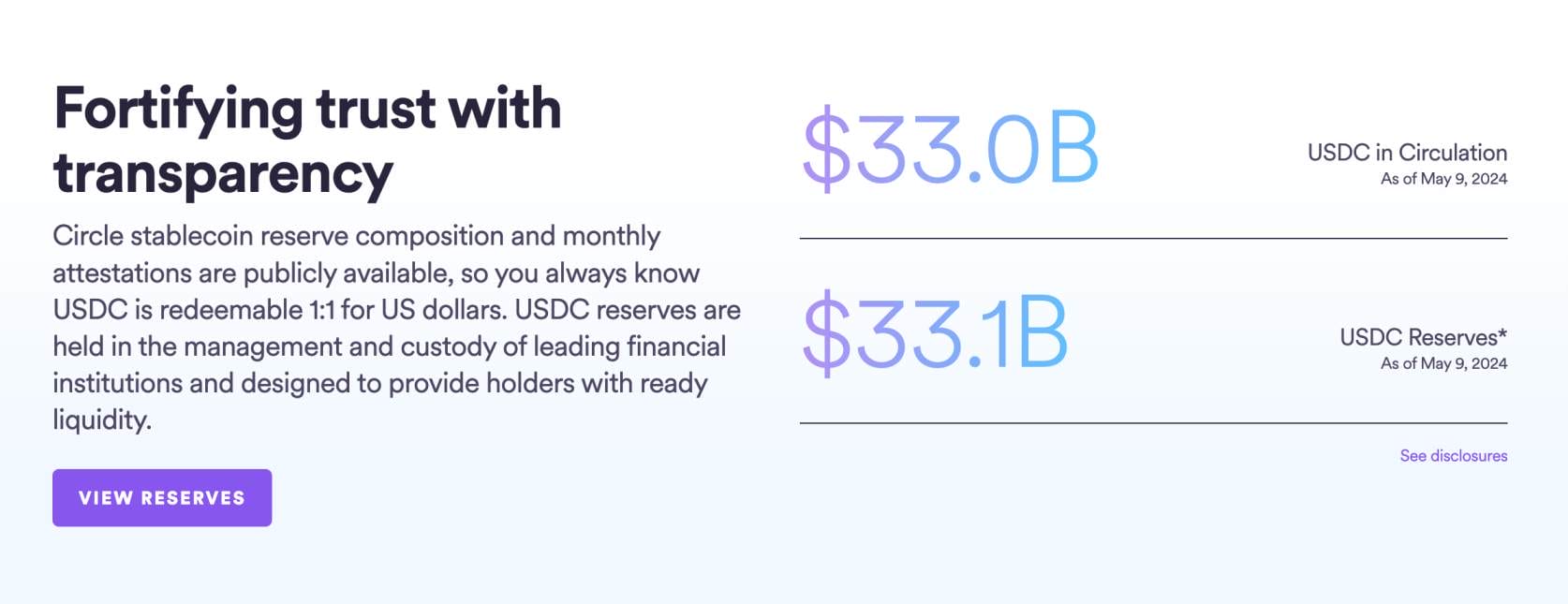

Stablecoins

Stablecoins play an integral role in the RWA industry. Some of the most commonly used stablecoins are Tether (USDT) and USD Coin (USDC). Both are backed by proven reserves, ensuring they maintain their peg to the US dollar. Crucially, stablecoins support various markets within the RWA arena.

For example, consider Goldfinch – which offers loans to small businesses and individuals in the developing world. Loans are issued in USDC. This is purposeful, as USDC isn’t volatile like other cryptocurrencies. As such, loan amounts remain fixed, plus the respective interest.

Similarly, Maker’s stablecoin, DAI, also has wide use cases in the RWA niche. It enables homeowners to access financing, using their property as collateral. APRs and LTVs are based on the real estate’s value and location. Although unpopular in some segments of the crypto industry, we should also mention central bank digital currencies (CBDCs).

According to a JPMorgan Chase report, CBDCs will revolutionize the cross-border payment sector. The report states that in 2020, financial institutions paid $120 billion in fees to move $23.5 trillion across borders. What’s more, the average settlement time was 2-3 days. In contrast, RWA stablecoins can move funds near-instantly at almost no cost.

What’s the Difference Between RWA Tokens and Tokenized Securities

‘RWA tokens’ and ‘tokenized securities’ are terms loosely connected, but they refer to two different markets. For instance, tokenized securities are exclusively linked to financial securities like equities, bonds, and mutual funds.

The RWA movement can tokenize any real-world asset. While this can include financial assets and securities, it also extends to commodities, credit, real estate, intellectual property, fine art, and everything in between.

Real Estate

Real estate is another huge market within the wider RWA industry – here’s why:

- Historically, real estate investments are only available to those meeting one of two conditions. The buyer must have sufficient capital to purchase a property outright. Or, have access to financing, such as a mortgage with a minimum downpayment.

- Those unable to meet these requirements are unable to directly own real estate. Sure, investors can buy Real Estate Investment Trusts (REITs), but the underlying real estate is owned by the respective fund manager.

- In contrast, RWA projects enable anyone to own real estate. Not only residential properties but commercial ventures, such as hotels, warehouses, and shopping malls.

Crucially, RWA projects fractionize the ownership structure.

- For instance, consider a new condominium development in New York. The real estate project is valued at $3 million.

- An RWA project could purchase the condominium on behalf of investors. It can then tokenize the property into small units, ensuring they remain affordable to all budgets.

- This could be 3 million tokens, meaning each is valued at $1.

- Now consider an investor who purchases $10,000 worth of tokens. Based on a $3 million valuation, that investor owns 0.333% of the overall condominium.

Now for the important part; not only do RWA projects make real estate affordable; but they create a secondary market. This means token holders can trade their RWA real estate investments at any time. Considering real estate is an illiquid asset, RWA solves a huge problem for investors.

Art and Collectibles

RWA will also revolutionize the art and collectible spaces. This is a win-win outcome for creators and investors. For example, consider an independent artist who specializes in abstract paintings. Traditionally, the artist would need to rely on third parties to sell their creations, such as galleries and auction houses. These third parties invariably take a large cut of the artist’s revenues.

RWA solves this issue overnight. First, the artist can tokenize their abstract paintings on the blockchain. After that, the artist can sell their painting via an RWA marketplace. Depending on the value, the painting could be fractionized into small units, ensuring affordability and inclusiveness. In turn, anyone can build exposure to fine art and collectibles – no matter their budget.

Precious Metals and Other Commodities

Another area where RWA will excel is precious metals. In its current form, the precious metals industry is controlled by centralized entities. For instance, those seeking a liquid investment in gold will likely use an ETF provider. This means the investor never directly owns the gold. Rather, they own shares that trade on stock markets.

Alternatively, an investor could purchase physical gold coins or bars. However, this increases the security risks. It also makes it challenging to trade, considering the logistical issues of storage and fractionalizing a physical item. In comparison, RWA projects can tokenize gold on the blockchain – ensuring that token holders own the underlying asset.

RWA projects can also tokenize precious metals that are more difficult to obtain. For instance, platinum and palladium. It can also extend to other commodity classes, such as crude oil, wheat, natural gas, and corn.

Intellectual Property

Although many RWA crypto projects focus on physical items, other tangible assets and digital assets also benefit from tokenization. This includes intellectual property ownership, such as trademarks, patents, and copyright.

For example, consider an independent singer who creates a unique pop hit. Rather than give away intellectual property rights to centralized record labels, the singer could tokenize ownership via an RWA platform.

That one pop hit could be fractionized into 1 million tokens, allowing anyone to invest. Depending on the song’s success, the value of the tokens will rise and fall on secondary RWA markets.

The Top RWA Coins by Market Cap

According to Coinranking, here are the 10 top RWA coins by market capitalization:

| RWA Project | Ticker | Market Cap | 3-Month Price Performance |

| Chainlink | LINK | $ 7.93 billion | -32.03% |

| Maker | MKR | $ 2.50 billion | +31.15% |

| Ondo | ONDO | $ 1.52 billion | +205.31% |

| Pendle | PENDLE | $ 882.78 million | +21.69% |

| Synthetix Network | SNX | $ 792.87 million | -33.29% |

| Ribbon Finance | RBN | $ 695.25 million | +106.9% |

| Wrapped Centrifuge | CFG | $ 331.92 million | +6.67% |

| Polymesh | POLYX | $ 329.34 million | +134.26% |

| Goldfinch | GFI | $ 281.39 million | +215.54% |

| Chromia | CHR | $ 238.67 million | -21.51% |

Benefits of RWA Tokens

The RWA narrative offers many benefits – not just for investors but for multiple industries and sectors. For a start, RWA makes traditional financial services more inclusive. High-value assets, such as fine art, real estate, and luxury goods can be tokenized into small units – making them affordable to the masses.

RWA also streamlines markets that retail investors might find challenging to access. Examples include mortgage-backed securities and energies like crude oil and natural gas. RWA also increases transparency in these markets, considering tokenization happens on the blockchain ledger. Let’s look at the benefits of RWA in more detail.

Fractionization of High-Value Assets

One of the biggest advantages of RWA is that high-value assets can be fractionized into small units. This makes assets affordable for all budgets. For example, consider a rare bottle of whiskey that’s valued at $1 million. Its value has historically increased by 15% annually. However, due to its price, only wealthy individuals have the opportunity to purchase the bottle.

- Now consider an RWA project that purchases the $1 million whiskey and tokenizes it into 1 million units.

- This values each unit at $1.

- Let’s say a retail investor purchases 1,000 tokens, valued at $1,000.

- The whiskey’s value increased by 15% the following year, meaning those 1,000 tokens are now worth $1,150.

Without RWA, these attractive yields would only be available to those with at least $1 million in liquid capital.

Difficult-to-Access Investments

Another core benefit of RWA is that difficult-to-access assets can be tokenized. This creates a more inclusive investment space, where retail and institutional clients have an equal playing field. One example is foreign-issued government bonds – many of which yield double-digit APYs.

However, foreign-issued government bonds come with minimum lot sizes. This is often at least $100,000 but can be considerably more. Additionally, foreign-issued government bonds are often only available to accredited investors, considering the increased risks involved.

Now consider an RWA ecosystem that tokenized bonds. They could meet the minimum lot size on behalf of investors. The bonds can then be tokenized into small units. The same concept can be applied to other exotic markets, such as crude oil, fine art, rare wine, and even sports memorabilia.

Secondary Markets

The RWA industry also creates secondary markets, turning traditionally illiquid assets into highly liquid investments. Real estate is a great example. Consider the traditional process of selling a property. It can take several months, if not years to find a suitable buyer. This means the real estate capital is locked until the sale is made.

Now consider the same process but via RWA tokenization. The real estate tokens can be listed on secondary markets, allowing people from all over the world to invest. This streamlines the process of turning property into liquid cash. What’s more, there are also RWA projects that support real estate financing.

Maker, for example, allows real estate owners to refinance their property. The property is used as collateral and the loan terms are executed via smart contracts. Funds are distributed in stablecoins, ensuring speed, cost-effectiveness, and transparency. As always, the RWA possibilities are limitless.

Challenges Facing RWA Tokens

We’ve covered the benefits of RWA tokens. Now let’s explore the industry’s challenges and risks.

Compliance and Regulation

One of the biggest barriers for RWA is regulatory compliance. After all, many of the assets that RWA tokenizes operate in heavily regulated markets. For example, the commodity investment markets are governed by the Commodity Exchange Act & Regulations. Enforcement of these regulations is undertaken by the Commodity Futures Trading Commission (CFTC).

This means RWA projects involved in commodities must comply with CFTC guidelines. Otherwise, products and services can’t be offered to US clients. Similarly, RWA projects tokenizing financial securities – such as equities or bonds, must comply with the Securities and Exchange Commission (SEC). Failure to do so can lead to substantial fines. Ultimately, at a minimum, compliance typically means an adequate KYC process. This might not appeal to all investors.

Lack of Liquidity

We mentioned earlier that RWA tokens create new opportunities for secondary markets. However, without sufficient liquidity levels, these secondary markets cannot function effectively.

For instance, consider a secondary market for mortgage-backed securities, with agreements based on a 10-year term. Without any buyers in the market, the investor will be stuck with those mortgage-backed securities until the 10-year term passes.

Overpriced Valuations

Another key risk that RWA investors could be overpaying for their tokenized assets. RWA projects must cover their own operating costs to remain sustainable. For example, consider investing in a RWA that specializes in global real estate investments. They’d need a full-time team of analysts who research potential purchase opportunities.

Not to mention a team dedicated to regulatory compliance. These fees will invariably be priced into the RWA token’s valuation. Moreover, while RWA projects operate on the blockchain, there could be a lack of transparency when valuing investments. After all, negotiations typically happen behind the scenes.

Conclusion

In summary, the RWA crypto space could soon become a multi-trillion-dollar marketplace. Every industry imageable will benefit from tokenization, from real estate and traditional currencies to lending and fine art. Blockchain education will also benefit from RWA’s expansion, with 99Bitcoins leading this revolution.

99Bitcoins has developed a learn-to-earn ecosystem, rewarding students for completing blockchain courses. Check out the 99Bitcoins Token presale for early access to this new RWA token; over $1.2 million has already been raised.

Visit 99Bitcoins Token Presale

FAQs

What is real-world asset tokenization?

Real-world asset (RWA) tokenization bridges the gap between real-world assets and the blockchain protocol. Any physical assets can be digitally tokenized into small units, such as real estate, fine art, and intellectual property.

Which RWA crypto is best?

99Bitcoins is one of the best RWA crypto tokens to buy. This presale project is tokenizing blockchain education via a learn-to-earn mechanism.

Is Chainlink an RWA token?

Yes, Chainlink sits at the heart of the RWA crypto space, considering it provides real-time data to smart contracts and decentralized applications. Without accurate and unbiased data, RWA projects are unable to function effectively.

Which RWA tokens are on Coinbase?

Some of the leading RWA coins on Coinbase include Chainlink, Maker, Ondo, Synthetix, and Ribbon Finance.

What is the RWA meaning in crypto?

RWA standards for real-world assets (RWA), which tokenize traditional assets like real estate, commodities, and rare wine. RWA can also tokenize intangible assets, such as patents and music royalties.

References

- Deposit Tokens: A foundation for stable digital money (JPMorgan Chase)

- Real-World Assets (RWAs) Explained (Chainlink)

- Demystifying web3: What does web3 mean for your business? (PwC)

- Why ‘Tokenizing’ Assets Is Turning Banks On to Crypto (Bloomberg)

- Commodity Exchange Act & Regulations (CFTC)

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Sergio Zammit

Sergio Zammit

Eric Huffman

Eric Huffman