What is Slippage in Crypto?

The meaning of slippage in crypto refers to when you get less (or more) than you expected in a trade, and it has a few causes, ranging from price volatility to low liquidity. Left unchecked, crypto slippage becomes a costly expense over time, one that sometimes goes unnoticed. The problem exists on both centralized and decentralized exchanges, making it doubly important to understand.

In this guide, we’ll answer the question, “What is slippage in crypto?” We’ll also examine how slippage happens and ways to prevent crypto slippage from eating your gains. Let’s dive in.

Slippage in crypto and other trading markets describes the price change compared to the expected price of the trade. In short, you expect to pay X, but the trade executes at a different price. A big contributor to slippage is supply and demand at a given price. A mismatch leads to slippage. Let’s look at an example using apples. You want to bake an apple pie for dessert, and the recipe calls for 11 apples. Apples at your favorite grocery store are $1 each, so you expect to buy 11 apples for $11. However, they only have eight apples when you get to the store. You’ll need three more apples. The store across town has more apples, but the price is $1.50. In the end, you pay $12.50 for the 11 apples you need rather than the expected $11. The first eight cost $8, and the remaining three cost $4.50. That’s slippage. In this case, the slippage was caused by low liquidity. There just weren’t enough apples available at the price you wanted. The same situation occurs in crypto trading, albeit with tokens instead of apples, and even in stock trading, as noted in SEC trading rules. However, crypto slippage can also be related to price changes rather than just liquidity. The trading price of the asset you’re buying or selling can change in an instant. In crypto trading, slippage can work both ways, meaning it’s possible to get more than you expected in a trade due to price volatility or changes in supply at a given price. When this happens, it’s called positive slippage.In Short: What is Slippage in Crypto?

Why Does Slippage Happen?

Slippage in crypto trades occurs for one of two primary reasons: price movements and liquidity, with the latter referring to the amount of an asset available at a given price point. The size of your order also plays a role, as larger orders can see slippage because there isn’t enough inventory available to meet your price. As a result, part of the order ‘slips’ into another price band. Let’s look at the two main types of slippage that can occur.

What is Price Slippage?

As its name suggests, price slippage happens when the price of a cryptocurrency changes before your order executes. For example, Bitcoin is trading at $60,000 at the time you place your order. But by the time your order executes, the price is $60,200. You won’t see a large difference in dollars and cents on a smaller order. However, the discrepancy is noticeable on a larger order, and you could pay hundreds more for your order than expected.

Another possibility is that you receive less than you expected. This can happen when using a fixed dollar amount to buy or if you’re trading two volatile assets, such as a BTC/PEPE pair. A price movement on either side of the pair can cause slippage.

What is Liquidity Slippage?

Liquidity slippage refers to when the expected quantity of a trade changes because of the amount of liquidity available at a given price point.

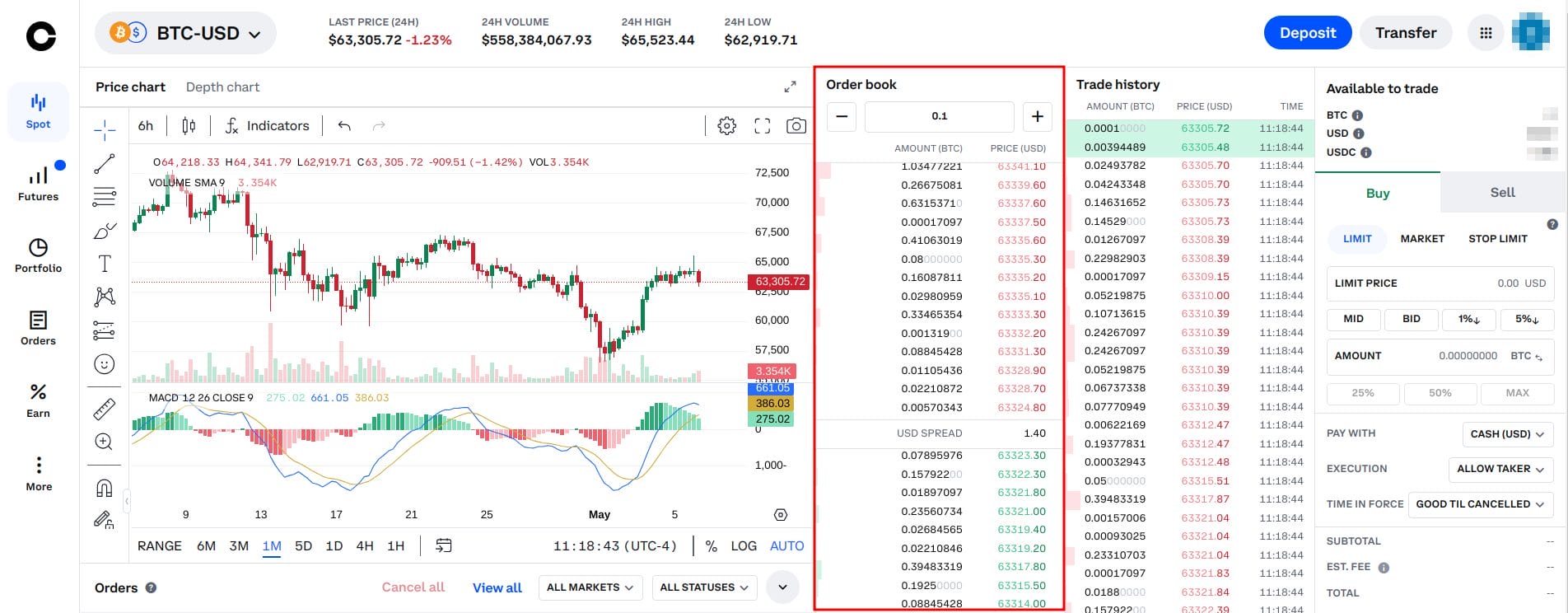

For example, let’s say you’re buying BTC, and the price of BTC is $63,305, as shown below. You place an order for $6,330.50, expecting to get 0.1 BTC. However, the next open orders are priced higher than the latest trading price.

- 0.00570343 BTC at $63,324.80

- 0.02210872 BTC at $63,238.70

- 0.0105436 BTC at $63,328.90

- 0.08845428 BTC at $63,331.30

A market order for 0.1 BTC will need to take liquidity from all these open sell orders to fill the 0.1 BTC order. As you take liquidity from each open order, the price slips into the next order, giving you some BTC at each level, with the largest amount filling at $63,331.05 rather than $63,305.

In this example, there wasn’t enough liquidity to fill the order at your expected price of $63,305. You’ll also get less than 0.1 BTC in the trade because the price was higher than expected. Slippage can also be much higher, depending on how much liquidity is available at a target price.

6 Best Ways to Avoid Slippage in Crypto

The good news is that several methods for managing slippage can help you keep more of your trading profits. On centralized exchanges, limit orders solve much of the problem, but there are other methods for both centralized and decentralized exchanges to help keep crypto slippage costs under control.

For instance, you can focus on trading pairs with high liquidity. You can also stagger your orders so you don’t take too much liquidity off the market at once.

1) Place Limit Orders

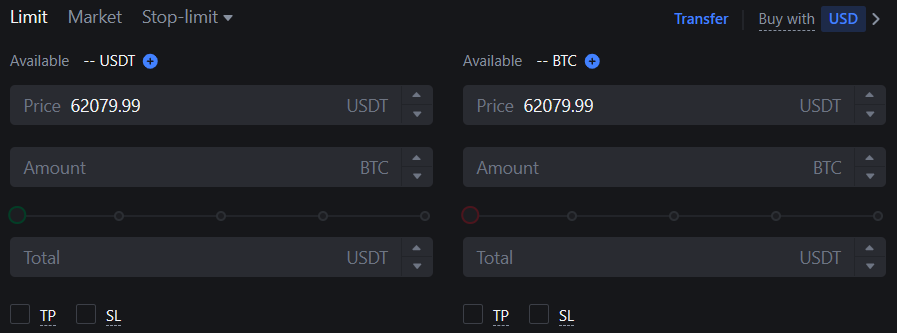

An earlier example showed how using a market order can lead to slippage. A market order fills at market prices rather than a fixed price. By contrast, a limit order lets you set the price for your order and wait for the market to come to you.

There is a risk, however, because the market might move away from the price you choose. Your order might not execute at all, but if you study the trading range, you can often find a price that’s likely to execute without slippage. With a limit buy order, market sellers take the liquidity from your limit order. With a limit sell order, buyers take the liquidity.

Limit orders are typically only available with centralized crypto exchanges like Coinbase or Binance, and you’ll need to use the advanced trading platform on each. Simple buy platforms usually don’t support the feature and have other hidden costs, such as spreads (markups) and higher fees.

You also won’t find limit orders on most decentralized exchanges, like Uniswap. A workaround could be to create a liquidity pool above or below the price you want, depending on whether you’re selling or buying. If the price reaches the range you want, other traders will utilize the pool for swaps. However, this is a more advanced technique and comes with some risks, such as impermanent loss.

2) Set a Suitable Slippage Tolerance

Trading on a DEX like Uniswap often means higher slippage compared to a centralized exchange. A DEX uses an automated market maker algorithm to adjust prices and balance the liquidity pool. In most cases, this means the more you buy or sell in one swap, the more slippage you’ll experience.

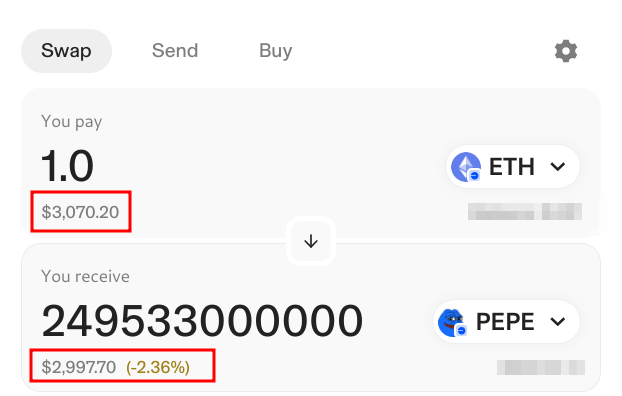

For example, in an ETH/PEPE swap on the Base network, the slippage looks like this.

- 0.1 ETH: Slippage = 1.47%

- 0.5 ETH: Slippage = 2.38%

However, if you watch the trade amount, you might find a lower slippage rate or even negative slippage if others are selling at the same time as you’re buying. Waiting a minute or two can help.

Volatile markets and trading activity also affect DEX slippage. For example, a popular meme coin can jump in price quickly if trading activity is high. Fortunately, DEXs like Uniswap allow you to set the slippage for your swaps.

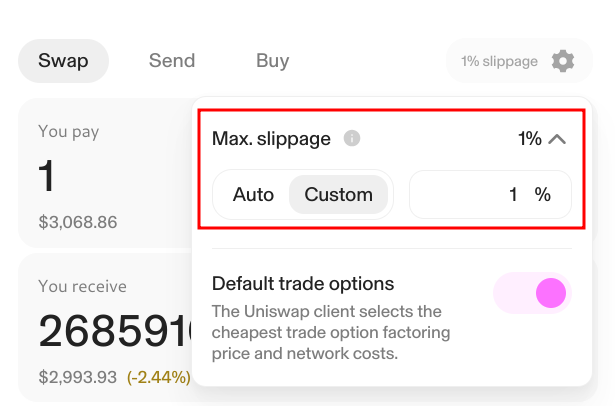

In this example, slippage costs 2.36% on the swap, more than $70. You can change a setting to prevent swap mishaps with unacceptable slippage.

Click on the settings gear icon to access the slippage settings. Note: In this example, the slippage is positive due to selling activity. More on that in a bit. Slippage works both ways, but you’ll probably want to prevent accidental slippage that works against you.

Next, select custom slippage and choose a percentage that works for your trade. In this example, we chose 1%. If you choose a slippage setting that’s too low, you may experience failed trades (but still pay network fees).

3) Use Trading Pairs with High Liquidity

Trading pairs with higher liquidity for buying and selling offer lower slippage. This is true for both centralized and decentralized exchanges. Newer or exotic tokens may not have enough liquidity to trade efficiently, whereas pairs like BTC/USDT or ETH/USDT offer plenty of liquidity for both buyers and sellers. Popular trading pairs allow trading with lower price impact.

4) Trade During Periods of Low Volume

The time of day you trade can also play a role. If possible, trade when fewer people are trading, particularly for DEX trades, where prices can move quickly during busy times. Although crypto trades 24/7, peak trading tends to correlate with the times US stock markets are open. Trading volume is often lower right after the market closes, with a spike later in the evening. Activity falls again after 9 PM EST, staying lower until morning.

Choosing the best time to trade can reduce price slippage and can also save on network fees if you’re trading on a DEX.

5) Use Trading Tools

Using crypto tools can also help you optimize your trades to minimize slippage and plan your entry or exit points.

- View liquidity: Ample liquidity is key. Trading tools like Messari allow you to gauge the price impact of trades before making your move. DEX tools like Dexscreener, Dextools.io, and GeckoTerminal provide stats on liquidity for DEX-traded tokens.

- Avoid frontrunning bots: The DEX you choose can also help mitigate frontrunning, also known as MEV (maximum extractable value) mining. This is another area where slippage settings come into play. Many DEX platforms offer a warning if your slippage settings could make your swap vulnerable to bots that ‘cut in line’ ahead of you, taking a slice of the trade.

6) Stagger Your Orders

Larger trades can cause slippage. Often, a better strategy is to break down the trade into multiple trades. Centralized exchange fees usually use percentage-based trading fees for advanced orders, so this technique doesn’t bring a penalty due to increased trading fees. However, regardless of the swap size, DEX swaps each have gas fees. Network fees can add up, so weigh your options compared to the potential slippage for the swap.

Is Slippage Lower on Centralized or Decentralized Exchanges?

Slippage on decentralized exchanges is typically higher than on centralized exchanges. Additionally, advanced trading platforms on centralized exchanges offer the option of limit orders, which eliminates the risk of slippage.

| Centralized Exchanges | Decentralized Exchanges | |

| Liquidity | Expect high liquidity on popular pairs, like BTC/USDT, and acceptable liquidity on other pairs. | Liquidity varies dramatically based on the trading pair. |

| Market Structure | Centralized exchanges use an order book; traders buy or sell against the liquidity provided by maker (limit) orders. | A DEX uses an automated market maker and is designed to keep the pool values balanced. |

| Order Types | Limit orders or market orders are supported. | Most DEX platforms only offer simple swaps, which resemble market orders.

|

| Transaction Speed | Fast execution times reduce the risk of slippage. | Network delays and wallet approvals take precious time and can increase slippage. |

Slippage on Centralized Exchanges (CEXs)

Slippage can be an issue on both centralized and decentralized exchanges; a CEX typically offers more protection against slippage risks.

- Higher liquidity: Centralized exchanges are still the most popular way to trade, which translates to increased liquidity, particularly on popular exchanges like Binance or Coinbase.

- Order book model: The order book model used by exchanges offers more transparency, allowing you to craft your trades to reduce slippage.

- Limit orders: The availability of limit orders allows you to eliminate slippage entirely by setting your own price.

- Faster transaction speeds: Centralized exchanges optimize for fast trade execution, minimizing the risk of price slippage.

While slippage risks remain lower for centralized exchanges, the issue has led to consumer complaints regarding CEX platforms.

Slippage on Decentralized Exchanges (DEXs)

Due to their automated market maker algorithm and lower liquidity, DEX trading can bring a higher risk of slippage. According to Uniswap Info, the DEX’s market data page, ETH has a 24-hour trading volume of $772 million. Trading volume on Binance alone dwarfs this figure, with nearly $1.1 billion in 24-hour trading volume.

- DEXs often have lower liquidity: Less liquidity can lead to higher slippage.

- DEX platforms use an AMM: An automated market maker (AMM) mechanism used by a DEX works to keep the pool balanced but can lead to higher slippage and disconnects with centralized exchange prices.

- Slower transactions: Transactions often take longer to confirm, especially during periods of high trading activity, which causes gas fees to rise and can allow more price slippage.

What is Positive Slippage?

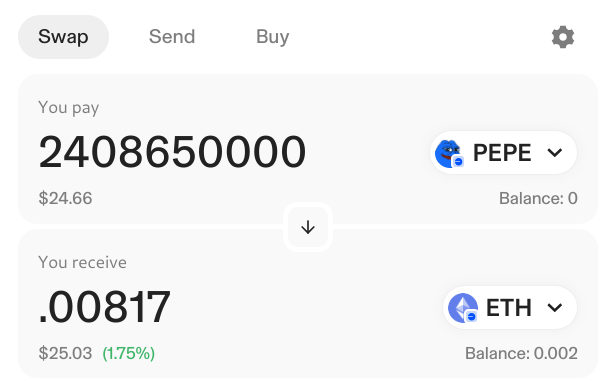

Slippage isn’t always a bad thing. If the stars align just right, you can see ‘positive slippage,’ meaning you get more from your trade than expected.

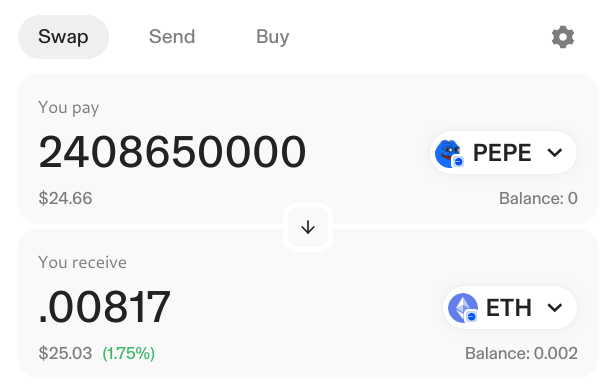

You might see positive slippage when selling into buying pressure on a DEX, as shown below. However, expect positive slippage to be lower with larger orders in most cases.

How to Calculate Slippage in Your Trades

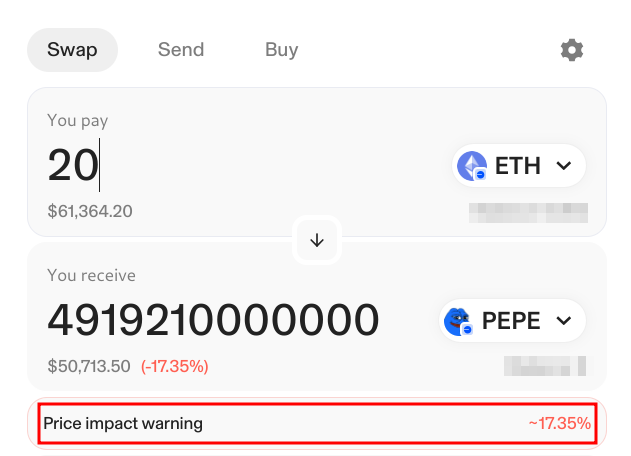

If you’re using a DEX for swaps, you can usually see the slippage percentage displayed for the swap. For example, we created a large swap, shown below, to demonstrate how much slippage can impact bigger trades. The same problem can arise for smaller swaps without sufficient liquidity.

Many crypto wallets also offer a trade summary that lets you compare swapped asset values rather than calculating slippage yourself. However, if you want to calculate slippage on your own, you can use the following formula to find the slippage percentage.

((Executed Price−Expected Price) / Expected Price) ×100 = Slippage (as a percentage)

The executed trade price is what the actual trade amount is, whereas the expected price is what you hoped to get.

Let’s use the swap above as an example. If you expected to buy PEPE with ETH at a current market price of $61364.20 but only received $50,713.50 worth of PEPE, here’s how the math works. Unfortunately, you won’t get the PEPE tokens for $50,713.50.

(($61,364.20-$50,713.50) / $61,364.20) x 100 = 17.35%

The formula is the same for a sale because it compares the actual execution price to the expected price.

Conclusion

Crypto slippage is a challenge for both centralized and decentralized exchange trading, but the issue can be more common with DEX swaps due to lower liquidity. Centralized exchanges also offer the opportunity to use limit orders, eliminating the risk of slippage altogether. To minimize slippage in crypto trading, look for high liquidity trading pairs and consider trading after the US stock markets close to avoid volatility during peak trading times. You can also consider staggering your orders to use less market liquidity at a time and optimize your trades.

FAQs

What does slippage mean in crypto?

Slippage in crypto refers to the difference between a trade’s expected output and the amount you receive from it. Crypto slippage can be either negative or positive, with negative trades working against your profit and positive trades providing higher output than expected.

What is a normal amount of slippage when trading?

Slippage on centralized exchanges is typically under 0.5% for common trading pairs, although volatility can lead to higher slippage. Slippage on decentralized exchanges often ranges from 0.5% to 3% or higher.

How do I calculate slippage on my trade?

To calculate the slippage on your trade, subtract the expected price from the execution price. Then, divide by the expected price. Multiply the total by 100 to find the slippage expressed as a percentage.

Is slippage always a bad thing?

No. Slippage can work both ways. It’s possible to have positive slippage in which you receive more from a trade than expected.

What is the best way to avoid slippage?

When using a centralized exchange, use limit orders to avoid slippage. This type of order is available on advanced trading platforms and lets you choose a fixed price for your trade, eliminating slippage.

References

- REGULATION NMS (sec.gov)

- What Is the Best Time To Trade Crypto? (yahoo.com)

- Complaint Bulletin – An analysis of consumer complaints related to crypto-assets (consumerfinance.gov)

- Uniswap Info (uniswap.org)

Sergio Zammit

Sergio Zammit

Kane Pepi

Kane Pepi