YFI Rallies 80% in a Week as Team Promises ‘Aggressive Buybacks’

YFI, the governance token issued by the decentralized finance (DeFi) protocol Yearn.Finance, has seen its price almost double in a week following the announcement of a completed token buyback worth some USD 7.5m.

The buyback, which Yearn.Finance said made up 0.77% of the total supply of YFI tokens, was announced via the protocol’s Twitter account on December 16, with the team behind it saying that “more YFI has been bought back in the past month than in the prior year.”

Further, the team also stated that the latest buyback would not be the last:

“Now that the Treasury has more than USD 45 million saved up and with earnings stronger than ever, expect much more aggressive buybacks,” the team wrote in a follow-up tweet.

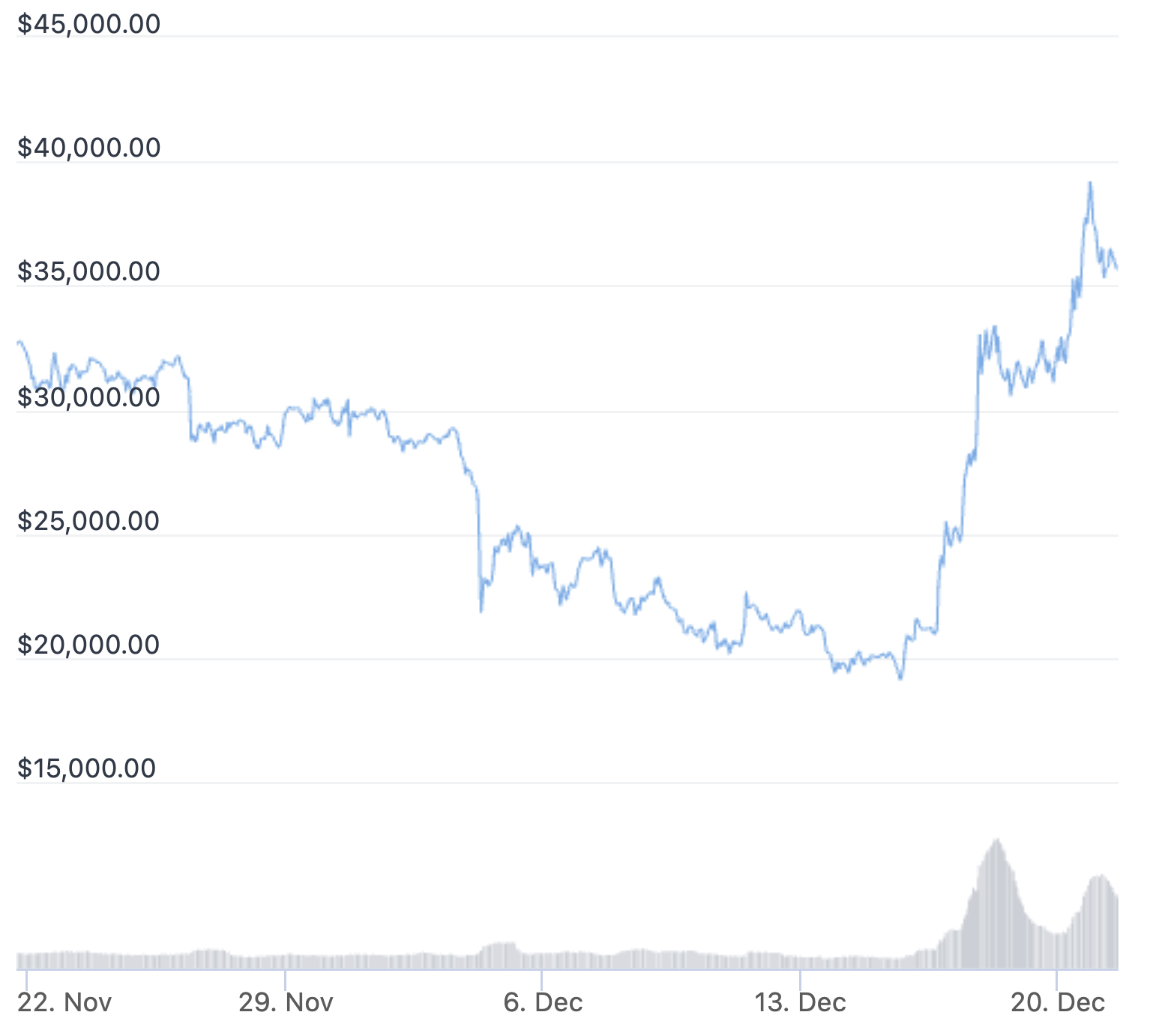

Since the news of the buyback, the YFI token has surged by more than 73%, and is currently trading at USD 35,559. The token is up 82% for the past 7 days, as well as 10.8% for the past month, data from CoinGecko showed.

90-day YFI price:

The announcement of the buyback was also followed by the publication of a governance proposal on Yearn.Finance’s governance forum on December 18, which laid out further details about the proposed ‘tokenomics’ behind YFI.

The proposal said it aims to “evolve the role YFI plays in Yearn,” with a number of changes that would be implemented in “four distinct phases.” These would include a new system for distributing YFI tokens that have been bought back, a new lock-up mechanism for YFI, new voting mechanisms, as well as a new system for rewarding YFI holders who contribute to governance of the protocol.

Judging from responses in the comments section, most users appeared to be in favor of the proposed changes, with some calling it “fantastic” and others saying they are “very excited for what’s coming.”

Meanwhile, the buyback of YFI tokens that have already been implemented has also received praise from community members, with a DeFi-focused blogger known as Ape Froman writing that it will “turn Yearn into a black hole for its own tokens, massively rewarding token holders and governance participators.”

Similar bullish sentiment was also shared by Adam Cochran, partner at Cinneamhain Ventures, who wrote on Twitter that “Yearn has started massively buying back YFI,” while also calling it “one of the only truly 100% decentralized defi projects.”

“Outside of holding ETH, YFI is actually my top pick for all of 2022,” the crypto-focused venture investor said.

Launched by the developer Andre Cronje in early 2020, Yearn.Finance is often considered one of the original yield farming protocols in the DeFi space. Its YFI token went live in July the same year, and has risen massively in price until reaching a peak of more than USD 82,000 in May of 2021.

____

Learn more:

– Yearn Finance Expects Treasury Yield-Farming to Boost Their Revenue

– Rise of YFI & Woofy May Be a Bellwether for Rotation From Ethereum To DeFi

– DeFi Darling YFI is More Expensive than Bitcoin Yet Again

– Senator Invests in Bitcoin, yearn.finance Goes Multichain, New Ad From FTX + More News

– Crypto Industry Insiders Share Top Ethereum, DeFi, Gaming, and TradFi Trends for 2022

– 2022 Crypto Regulation Trends: Focus on DeFi, Stablecoins, NFTs, and More