What Bitcoin Price Models Flashing Green Reveal – Is Crypto Winter Turning to Spring

Bitcoin has been pumping since the start of 2023. The world’s first and largest cryptocurrency by market capitalization was last changing hands close to $21,000, up a stunning 27% so far on the month. That means Bitcoin is on course for its best monthly gain since October 2021, despite the month still having 15 days to go.

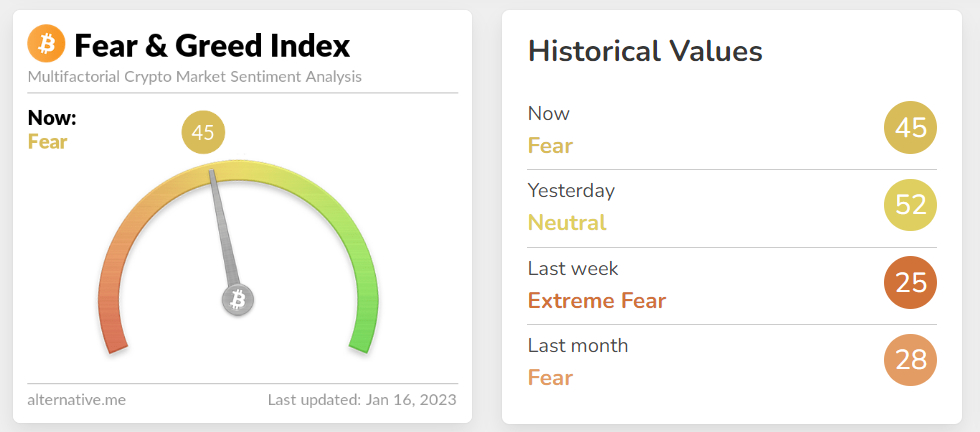

In light of the recent surge, Alternative.me’s popular Bitcoin fear and greed index moved out of “fear” for the first time since April 2022 over the weekend, hitting 52 before dropping back to 45 on Monday.

The latest rally has attracted the usual predictable scepticism from bears on social media, many of whom have been dismissing Bitcoin’s most recent recovery as a “bull trap”. In fairness, selling rallies was the playbook for 2022.

This Rally Could Be Different

But 2023 is going to be a vastly different year to 2022. 2022 was a year characterized by 1) big upside inflation surprises in key global markets like the US and Europe and 2) aggressive subsequent rate hikes from the likes of the US Federal Reserve and European Central Bank. The recent shift in economic data, particularly in the US, suggests that 2023 is much more likely to be a year of downside inflation surprises and easing expectations for Fed tightening.

As a result, this latest Bitcoin rally feels different. One closely followed options market indicator shows that investors have become the most optimistic on Bitcoin’s six-month performance outlook since the start of 2022.

Bitcoin’s 180-day call-put skew recovered into positive territory on Monday for the first time in a year, according to crypto derivatives data analytics firm Amberdata. That means bullish cash options expiring in six months now cost more than bearish put options of the same expiry.

“We see the current rally in digital assets as a market reversal and NOT a bear market rally,” said 3iQ’s head of research Mark Connors in a recent email to clients. Connors noted that recent less hawkish commentary from Fed policymakers suggests that the sharp reduction in money supply of 2022 may be ending.

These Indicators Suggest Crypto Winter Turning to Spring

Other widely followed technical indicators are also supportive of the idea that the crypto winter might finally be coming to an end. Firstly, Bitcoin has broken convincingly back to the north of its 200-Day Moving Average for the first time since December 2021.

Just as April 2021’s failed attempt to get back above the 200DMA ended up as a key market turning point (Bitcoin would go on to fall a further 67% in 2022), the Bitcoin bulls are hoping that January’s bullish 200DMA break could signal the start of a new bull market.

According to Glassnode, “since the 200-day SMA is so widely observed by market analysts, it tends to carry significant weight on investor psychology when it is broken convincingly… It is often considered a minimum macro bull/bear threshold level”.

Meanwhile, Bitcoin’s latest rally has also sent it back to the north of its Realized Price for the first time since early November, which according to Glassnode, was last at around $19,700. That means the average Bitcoin holder is now holding an unrealized profit and is “under a smaller degree of acute financial stress”.

According to Glassnode data, Bitcoin is back to the north of both its 200DMA and Realized Price for the first time since December 2021.