Vitalik Buterin Says High Ethereum Fees Might Be Gone Even Before ETH 2.0

Ethereum (ETH) Co-founder Vitalik Buterin brought his new proposal to the table that could make high fees on the network a thing of the past sooner than initially expected.

Summarising his ETHOnline Kickoff Summit presentation last Friday, Buterin wrote in a Twitter thread today that his proposal for Ethereum 2.0 is “not “rollups instead of sharding”, it’s “rollups on top of sharding.”

Rollup is a scaling technique that keeps transaction data on-chain, in a compressed form, but the computation is pushed off-chain. Meanwhile, sharding divides the blockchain’s nodes into smaller groups, known as ‘shards.’ Rather than validating the same transactions at the same time, different shards then validate different sets of transactions, thereby increasing the number of transactions that can be processed per second.

Buterin added that “rollups are already here or coming soon even before sharding, and rollups without sharding still offer that 100x increase in throughput. So get on a rollup today!”

With the network’s rising popularity, as well as the decentralized finance (DeFi) boom, things are getting increasingly crowded, and the way the network deals with this currently, said Buterin, is with higher fees – which recently hit a new all-time high.

“The [layer 1] is nearly unusable for many classes of applications,” wrote Buterin, “and there’s no non-[layer 2] path that can get us to scalability in the short-to-medium term.”

Layer 1 (L1) is the base protocol (the Ethereum blockchain), while Layer 2 (L2) is any protocol built on top of Ethereum.

It is Phase 1.5, which is an interim update, or ETH 1.0 to ETH 2.0 merger phase, when a scalable proof-of-stake (PoS) network could already be reached instead of waiting until Phase 2, by using shard chains as data availability layers and rollups as the execution environments instead of the shards. Or as Buterin wrote in a recent post: “phase 1.5 and done.”

He offered a scaling roadmap for which he said encompasses the next 1-2 years and includes “combining the scaling mechanism of sharding with the scaling mechanism of rollups.”

This follows the above-mentioned post in which Buterin proposed “a rollup-centric [E]thereum roadmap” wherein “the Ethereum ecosystem is likely to be all-in on rollups (plus some plasma and channels) as a scaling strategy for the near and mid-term future.”

Buterin argued that base-layer scalability for applications is not coming until Phase 2, “which is still years away,” while at the same time “[ETH 2.0’s] usability as a data availability layer for rollups comes in [P]hase 1, long before [ETH 2.0] becomes usable for “traditional” layer-1 applications.”

ETH 1.0 clients could be repurposed as optimistic rollup clients, he said, while the future needs to see all users’ primary accounts, balances, assets, etc., as well as Ethereum apps and Ethereum Name Service domains, entirely inside a layer 2, instead of their current home, layer 1.

“The main reasoning Vitalik gives for focusing our energy on this rollout plan instead of on getting to [P]hase 2 is he believes that by the time [P]hase 2 rolls around, we’ll already have a bustling layer 2 ecosystem which optimistic rollups will be a big part of,” wrote Anthony Sassano, SetProtocol product marketing manager and author of the Ethereum-focused newsletter The Daily Gwei. “Basically, the network effects will be too strong and we may have wasted research and development effort on [P]hase 2 instead of focusing on phase 1 and 1.5.”

Supporting Buterin’s proposal, Sassano added:

“Imagine that the base-layer of Ethereum becomes an ultra-decentralized and ultra-secure layer for these layer 2 constructions to settle on while end-users get to experience similar security guarantees but with ultra-low fees and near-instant transactions on layer 2.”

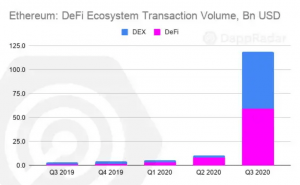

Meanwhile, per dapp data aggregator and analysis firm DappRadar, “Ethereum stands as the most significant blockchain even given the gas price jump” thanks to the recent DeFi and DEX dapp categories explosion, as well as the yield farming in combination with the interest in governance tokens. “While some anticipated Ethereum 2.0’s release, others joined the hype regardless of the high Ethereum gas prices,” it said.

There was also a 154% increase when looking at daily active wallets. DeFi and DEX categories together went up from 12,800 daily active wallets to 50,200 in Q3 2020. In Q3, DeFi became the largest ecosystem in Ethereum, holding 90% of total daily active wallets. 74% of the DeFi ecosystem’s daily active wallets belong to the Uniswap decentralized exchange which grew 560% quarter-on-quarter. Balancer (BAL) with 1,100 daily active wallets is in the second place, and SushiSwap with around 984 daily active wallets in the third.

Meanwhile, Ethereum 2.0 developers were hard at work launching testnets this year before the Phase 0 arrival. The most recent one is Medalla, followed by the parallel-running, short-term Spadina. Both have experienced issues, and with Medalla having stabilized, another short-term testnet will follow Spadina, called Zinken. The bugs are getting fixed and they’re getting smaller each time, Buterin said in his presentation:

At pixel time (11:15 UTC), ETH trades at USD 352 and is up by 1% in a day, trimming it’s weekly losses to 2%.

___

Learn more: Bitcoin And Ethereum Scale Slower Than Cryptoverse Grows