US Senators Fail to Find Stable Ground on Stablecoins

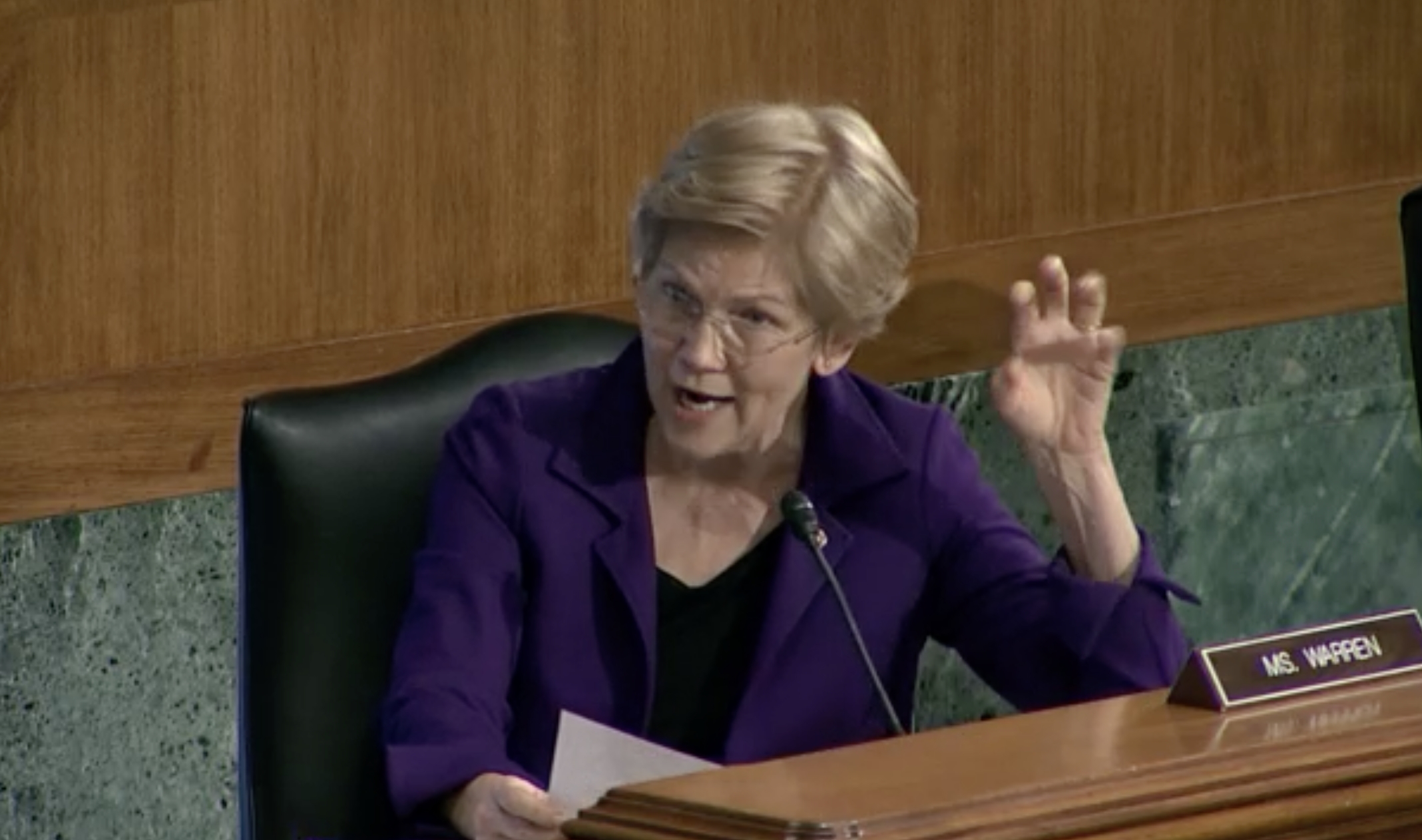

Stablecoins are not used to pay for real-world goods or services, but are instead a speculative tool for the “shadiest part of the crypto ecosystem,” Democratic Senator Elizabeth Warren said during a hearing on stablecoins in the US Senate Banking Committee yesterday. Others, meanwhile, stressed that stablecoins are likely safer than traditional banks, and that it would be “inappropriate” to regulate them as banks.

Referring to lending and borrowing of crypto in the decentralized finance (DeFi) space, Senator Warren, who is well-known as one of Congress’s harshest crypto critics, said stablecoins are used to “lubricate speculation in the shadiest part of the crypto ecosystem.”

The Senator from Massachusetts then went on to bash bitcoin (BTC) and cryptoassets more broadly, saying bitcoin “is not backed by anything but hype.”

The comment about bitcoin came before Senator Warren turned to Under Secretary of the Treasury for Domestic Finance, Nellie Liang, who was the only witness to testify during the hearing, telling her: “I worry that you’re approaching the crypto market with blinders on.”

“You talk a lot about the benefits of stablecoins […],” but not about “the risks that are flashing bright red in our faces […]. Congress need to put guardrails around crypto,” the Senator said.

The hearing, which discussed a report on stablecoins from the President’s Working Group (PWG) on Financial Markets, was moderated by Democratic Senator Sherrod Brown, who chairs the Senate Banking Committee.

In his opening remarks, Senator Brown stressed that regulation of the emerging stablecoin market is necessary in order to protect American consumers.

“We need a strong, proactive approach from regulators and Congress to limit stablecoins’ risks for working Americans,” the Committee Chair said.

Meanwhile, Republican Senator Pat Toomey, the ranking member of the committee, said in his opening statement he does not see any more risk in stablecoins than in the traditional banking system.

“Stablecoin issuers using cash or cash equivalents to back its coin is likely safer than most existing financial institutions,” Senator Toomey said.

According to him, because of these differences, it would be inappropriate to subject stablecoin to the full range of bank regulations meant to address risks posed by the fractional reserve banking and lending system.

The hearing yesterday came one week after Under Secretary Liang discussed the same topic with members of the House of Representatives’ Financial Services Committee.

As in the last hearing, a partisan divide could be sensed during yesterday’s hearing: Democrats generally stressed the need for improved consumer protection, while Republicans favored a “light-touch” approach to regulation in order to foster innovation.

The President’s Working Group report has been criticized heavily by members of the crypto community for what some called “fear-mongering” over perceived risks in stablecoins.

Later in the hearing, Senator Toomey added that he does not see it as the task of regulators “make it impossible for an investor to lose money.” Instead, regulators should simply ensure that investors “are well-informed about the risks that they choose to take,” the senator said.

Meanwhile, asked by Republican Senator Mike Rounds if stablecoins have a chance to compete internationally with “a limited regulatory environment” in the US, Under Secretary Liang said that she believes a “stable stablecoin” would go far in preserving the dominant status of the US dollar as the global reserve currency.

“I think there is no conflict there,” the Under Secretary said. “It is part, in my view, of the future of the payment system.”

The hearing followed after the Democratic Congressman Josh Gottheimer released a discussion draft of a bill that he said would set up a new regulatory structure for stablecoins, classifying certain stablecoins as “approved.”

Notably, the structure would include an insurance scheme similar the government-backed guarantees that are already in place for traditional bank deposits. The regulator in charge of overseeing the stablecoin market would be the Office of the Comptroller of the Currency (OCC), the draft suggested.

“We shouldn’t stifle innovation in the cryptocurrency market,” Gottheimer said in a press statement, adding “we should ensure the proper safeguards are in place, and ensure our nation is a leading force in financial technology.”

____

Learn more:

– Russian Central Bank & Government Fail to Agree on Crypto Regulation; New Limits Proposed

– China Says it Has Closed all Crypto Exchanges – But Traders, Miners May Still Be Active

– 2022 Crypto Regulation Trends: Focus on DeFi, Stablecoins, NFTs, and More

– Canada Joins Lebanon and Turkey in ‘Bitcoin’s Marketing Team’

– Regulatory Clarity Would Bring More Crypto Trading to US – FTX’s Boss