Traders Rotate From Bitcoin To Alts, While JPMorgan Sees Ether As Overvalued (UPDATED)

Ethereum (ETH) and altcoins might keep outperforming bitcoin (BTC) in the months ahead, while the most popular crypto is preparing for a lift off, according to major crypto exchange Kraken. Meanwhile, JPMorgan sees “froth” in the crypto market and claims that ETH is now heavily overvalued. (Updated at 17:04 UTC with the latest market data, a new section – Time to sell, time to buy, time to hodl – has been added.)

On average, April is its best performing month, but BTC posted its third-worst April performance (-2%) and its first negative monthly return since September 2020, Kraken said in its recent report.

BTC’s dominance falling to a 3-year low of 49% and ETH/BTC soaring to a 3-year high further indicate that “market participants are preferring altcoins over BTC at this point in the market cycle.”

This “underwhelming performance” may be the result of market participants using their BTC to rotate into altcoins to try to generate higher returns, given that “as BTC gets larger and larger, it cannot sustain the same growth. Therefore, market participants may see altcoins as having a greater upside and/or a better risk-reward profile.”

However, “staying true to the trend,” the percentage of BTC on exchanges decreased in April and hit a 3-year low of 12.8% before finishing the month at 12.9%. Also, there seems to be a slowdown in whale profit-taking, according to the number of wallet balances with more than BTC 1,000 unchanged. The on-chain data indicates that “BTC demand remains strong, market participants are opting to hold, and BTC’s immediately marketable supply continues to shrink.”

According to Kraken, the low of USD 47,000 could be the base for a march back up to BTC’s all-time high.

“Although BTC’s consolidation between USD 50K – USD 60K over the past few months hasn’t been as eventful as many hoped, said consolidation has allowed for the market to catch its breath and for BTC to build a new support to potentially lift off from in the not-so-distant future,” they added.

On the other hand, April “went down as ETH’s second-best month this year and marked a seventh consecutive month of gains.”

The researchers noted that, while “ETH’s outperformance can be attributed to new market participants, the case could also be made that existing market participants are opting to rotate into ETH over BTC.”

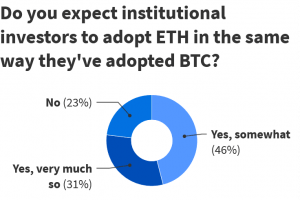

This “newfound wave of demand for ETH like never before” is a result of a surge in institutional interest and growing optimism surrounding ongoing developments on the network.

Its on-chain data suggests that, should ETH close and hold above USD 2,800 in May, “the case could be made that ETH is in the early innings of an ascent up to USD 5,200.”

Kraken opined that,

“As difficult as will be for ETH to sustain double-digit returns, the case could also be made that ETH still has plenty of upside. […] The fact that ETH continues to climb higher while retaining the same market share suggests that ETH has yet to take off.”

Meanwhile, analysts at JPMorgan noted that jumps in coins such as ETH are outshining BTC, while the drop in BTC’s dominance echoes of “froth” to the extent it’s being fuelled “by a rally in other cryptocurrencies driven more by retail demand,” per Bloomberg.

Also, JPMorgan analysts claim that ETH’s price has grown above fair value, and that measures of network activity suggest that ETH should be trading at around USD 1,000, per the Market Insider.

“Prices appear to have diverged somewhat from the measures of network activity since the start of the year,” the analysts wrote, with their note suggesting that ETH “investors may have gotten ahead of themselves by piling into the asset so quickly.”

At 17:03 PM UTC, ETH trades at USD 4,179 and is up by 6% in a day and 42% in a week. BTC is unchanged in a day and is up by 2% in a week, trading at USD 57,813.

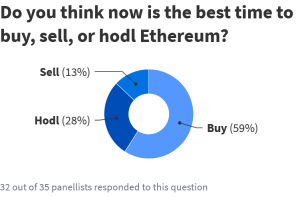

Time to sell, time to buy, time to hodl

Meanwhile, a recent report by personal finance comparison site Finder states that, according to a panel of experts comprising executives, investors, traders and researchers focused on the crypto market ETH could hit an average of USD 19,842 by 2025.

“Ethereum’s price will be supported by increased transaction use, the rise of DeFi and NFTs and higher adoption rates by institutional investors,” according to the company’s Cryptocurrency Predictions Report. Per the forecasts, BTC is set to peak at USD 107,484 in 2021 before capping off the year at USD 94,967 per BTC on average. Also, Finder’s panel expects BTC to jump to an average of USD 360,179 per BTC by 2025.

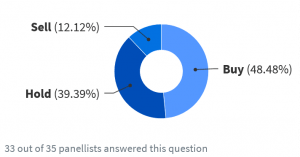

Is it time to sell BTC?

In addition to forecasting a major spike in the ETH’s value in the coming years, 51% of panelists said that ethereum will edge out BTC as the most widely transacted digital currency by the end of 2022. Some 70% of the panel’s participants claim that DeFi and NFTs have given ETH a greater use case than BTC.

However, according to John Hawkins, Senior Lecturer at the University of Canberra, having more use cases won’t necessarily increase the cryptoassets’s value.

“While ethereum has more uses than bitcoin, it will likely be dragged down with it,” Hawkins said.

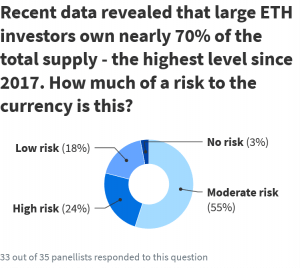

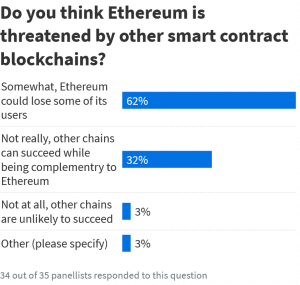

The report also states that 62% of panelists claim that ETH could be threatened by other smart contract blockchains, causing the network to lose some of its users.

Vishal Shah, CEO of crypto derivatives platform Alpha5, said he believed ETH’s value would not change drastically in the next few years, expecting the cryptoasset’s value to remain at the level of USD 4,000 by the end of 2025.

“ETH should continue to perform, but it simply does not have the same scarcity benefits as BTC. Further, ETH is in a race against other protocols to overhaul its usability profile. There are faster, cheaper chains that are gaining traction and will likely rival ETH in the long run,” according to Shah.

Some of the findings of the report:

__

__

__

____

Learn more:

– If History Rhymes, ETH Might Hit USD 19K; Downside Risk Stronger Than BTC’s

– ‘Fulfilment of Satoshi’s Dreams’ Ethereum Gets a Nod from JPMorgan

– ETH ‘Insanely Cheap,’ DeFi To Rally, BTC Dominance to Drop – Pantera Capital CIO

– Are Wall Street Giants Playing the ‘Make-Bitcoin-Cheaper’ Game Again?

– What’s in Store for Ethereum in 2021?

– Inflation Is Here & Bitcoin Will Hit USD 115K ‘Ahead of Target’ – Pantera