Proof-of-Hypocrisy: Securities Regulator Calls for Bitcoin Mining Ban in EU, Promotes PoS

A leading EU financial regulator wants the union to “ban” proof-of-work (PoW) crypto mining and force tokens into proof-of-stake (PoS) paradigms, while the EU itself and the traditional finance sector are reportedly less environment-friendly than Bitcoin (BTC) when it comes to electricity consumption.

The comments came from Erik Thedéen, the Vice-Chair of the European Securities and Markets Authority, the chair of sustainable finance for the International Organization of Securities Commissions, and the Director-General of Sweden’s Financial Services Authority (FSA), who was speaking to the Financial Times. Thedéen redoubled previous claims that Bitcoin mining has now become a “national issue” in Sweden.

Thedéen’s remarks echoed those made in a joint statement from the FSA and the nation’s Environmental Protection Agency last year, when the bodies claimed that only a total ban on PoW mining could help the country meet its Paris Agreement goals – despite a rebuttal of this claim from the nation’s state-owned power provider.

Thedéen was quoted as stating:

“The solution is to ban proof-of-work. Proof-of-stake has a significantly lower energy profile. We need to have a discussion about shifting the industry to a more efficient technology.”

(Learn more: ‘Fiat-Like’ Proof-of-Stake Chains Favor Centralization & Rich Players)

He also stated that BTC mining should not be allowed to eat up large portions of the nation’s renewable power supply.

Last year, Eric Wall, Chief Investment Officer at crypto hedge fund Arcane Assets, took aim at the “armchair googling” activities of Thedéen’s “poorly researched” claims.

Not only did you recommend Sweden to frontrun EU legislation based on yours and Erik Thedéen’s armchair googling, you even had the cheek to *issue guidance to the EU* based on it?

— Eric Wall (@ercwl) November 6, 2021

Thedéen claimed that he was not in favor of a “wholesale ban” on crypto, however, as “the financial industry and a lot of large institutions are now active in cryptocurrency markets.”

Last year, however, the Swedish regulators claimed that “the social benefit of cryptoassets” was “questionable.”

“These comments show a lack of understanding of Bitcoin, combined with a lack of understanding of Bitcoin mining and a lack of understanding of the European electricity mix,” Jad Comair, Founder and CEO at investment management company Melanion Capital, said in an emailed comment.

According to him, “it is sad to see once again policymakers and officials call for such uninformed decisions, which penalize an industry that could be key to enabling the energy transition in the European Union.”

Comair stressed that the economical model of Bitcoin mining implies that the used electricity is not being distributed elsewhere, it doesn’t go back into the grid.

“Otherwise it would be trading at Electricity price levels which are not competitive for Bitcoin mining,” the CEO added.

“The European Bitcoin mining market share is negligible compared to the rest of the world PRECISELY because of its INABILITY to source cheap energy from renewables, showcasing the incapacity of governments, officials and energy organizations to organize themselves to address this issue. Bitcoin mining cannot be held responsible for their incompetence,” Comair said.

Also, earlier today, Cryptonews.com reported that the MicroStrategy CEO Michael Saylor, speaking ahead of the mining industry’s hearing in Congress this week, claimed that the total use of energy in the BTC mining sector is “inconsequential,” and that the industry is “rapidly becoming more efficient.”

And per data compiled by the Bitcoin Mining Council last month, global BTC mining consumes 3.2% of the electrical system energy wasted or lost in the USA in the space of a year. They also claim that Bitcoin mining energy use is 0.142% when compared to the world’s total energy.

Furthermore, per this data, almost 59% of global BTC miners now use sustainable power – compared to nations like Brazil, which uses just over 2% renewable electricity. The USA uses less than 32%, while the EU figure is almost 44%.

Additionally, the council added, BTC mining technology has come on in leaps and bounds, meaning that miners working today are now 5,814% more efficient than those working just eight years ago.

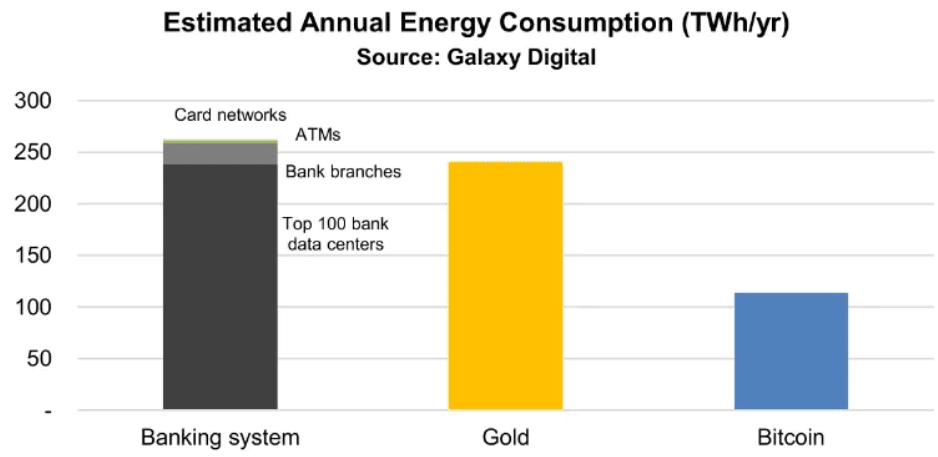

Data compiled by Galaxy Digital last year, also indicated that the banking sector and gold production’s own energy use dwarfs that of Bitcoin – with the lion’s share of power being used to keep the world’s biggest banks’ data centers running.

Nordic miners downscaling

Meanwhile, in other news related to Bitcoin mining this week, reports out of Europe suggest some miners there are now faced with the decision of whether they should switch off their mining operation in the face of record-high energy prices on the continent.

According to a report from the Norwegian financial news outlet E24, some Bitcoin miners located in the Scandinavian country have recently shut off more than half of their capacity, with high energy costs making their operations unprofitable during certain periods.

“We switched off a major part of our production, more than 60% in total, when the high energy prices rose even further last year. This has helped us reduce our overall energy costs,” Kjetil Hove Pettersen, CEO of the local Bitcoin miner Kryptovault, told E24.

Also admitting that they have at times switched off mining machines in order to save costs, Arcane Crypto CEO Torbjørn Bull Jenssen pointed to the ability miners have to switch machines off during period of high energy prices as an advantage that miners have over other industrial users of energy.

“This illustrates the flexibility in mining,” Jenssen said, noting that machines can be turned off and on at any time without adding extra costs to their operation.

____

Learn more:

– Misleading Memo for US House Hearing on Bitcoin & Ethereum Mining Includes ‘Basic Errors’

– Bitcoin & Crypto Mining in 2022: New Locations, Technologies, and Bigger Players

– How Bitcoin Mining Might Help Nations With Domestic Energy Production

– A Closer Look at the Environmental Impact of Bitcoin Mining

– Bitcoin Miners Adapt Fast As EU Mulls ‘Climate-Friendly Cryptoassets’

___

(Updated at 08:53 UTC with the last section. Updated at 10:23 UTC with comments from Jad Comair.)