This Ratio Shows that Bitcoin is Better than Stocks

Cryptocurrencies may generate higher risk-adjusted returns than stocks and other assets traditionally thought of as “safer,” according to a new study from Yale University.

The study, named “Risks and Returns of Cryptocurrencies” was carried out on three major cryptocurrencies – Bitcoin, Ripple and Ethereum – by calculating the Sharpe ratio, a measure for the performance of an asset adjusted for risk and volatility.

The ratio provides a mathematical method to compare how different assets compensate the investor for the risk taken, making different assets more comparable.

The price data examined for Bitcoin was the most comprehensive, spanning from 2011 to 2018. For Ripple and Ethereum, the price data began in 2012 and 2015, respectively.

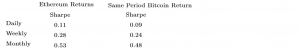

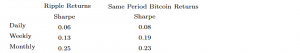

At the monthly frequency, the Sharpe ratios of bitcoin are similar to those of stocks for the comparable time period, although higher than the historical Sharpe ratios for stocks, the study found. Meanwhile, at the daily and weekly frequencies, the ratios are about 50% and 75% higher than those of stocks for the comparable time period.

The higher the Sharpe ratio, the better an asset is compensating an investor for the associated risk.

The comparison of the Sharpe ratios

Stock* shows results for the whole sample between 1953/07 and 2018/04.

Below are the Sharpe ratios for Ethereum and Ripple, as presented in the study:

_______

_______

The two scholars behind the study, economist Aleh Tsyvinski and Ph.D. candidate Yukun Liu, further found that cryptocurrencies do not behave in a fashion similar to stocks, fiat currencies, or precious metals, and that it is therefore necessary to use other methods than those traditionally used to predict performance.

Two trading strategies

Two phenomena the researchers found to be useful in terms of predicting the performance of cryptocurrencies include the “momentum effect” and an effect they referred to as “investor attention.”

Investor attention could essentially be thought of as the level of hype among people. For example, an abnormally high number of Google searches or tweets about positive things related to cryptocurrencies such as “buy bitcoin,” tends to generate higher returns in bitcoin. Likewise, high numbers of searches on things like “bitcoin hack” tends to lower returns for holders of that asset.

Tsyvinski told CNBC in an interview that “for weekly returns, the Google search proxy statistically significantly predicts 1-week and 2-week ahead returns.”

The momentum effect is another phenomenon well-known in finance, which basically says that an asset that has gone up in price, tends to continue up, simply as a result of more and more investors jumping on the bandwagon.

To take advantage of the momentum effect in bitcoin, the two researchers developed a simple trading strategy that says a trader should buy bitcoin if its price increases more than 20% in the previous week, and sell seven days later. “This strategy generates outstanding returns and a very high Sharpe ratio,” the two were quoted by Yale University’s news portal as saying.

Lastly, the pair claims to have debunked the myth that the cost of mining can predict cryptocurrency prices, as experts such as Tom Lee argues for. “We were surprised to see that it does not predict cryptocurrency returns,” the scholars said.