The Big Comeback of 2020: Bitcoin Revisits USD 20,000 (UPDATED)

It finally happened on December 16th, 2020. The most popular cryptocurrency, bitcoin (BTC) just revisited the USD 20,000 level for the first time since December 17th, 2017, when it touched USD 20,089. (Updated at 15:44 UTC: updates throughout the entire text.)

At 13:49 UTC, BTC was already trading at more than USD 20,150 on Binance, HitBTC, Coinbase Pro, and Bitstamp.

Later, it even surpassed USD 20,680 and is now (15:42 UTC) trading at around USD 20,600. The price is up by 6% in a day and 12% in a week.

After crashing to almost USD 3,000 in December 2018, BTC started its series of hitting all-time highs (ATH) only in November this year, almost touching USD 20,000 on the first days of December and later correcting to almost USD 17,600.

BTC price chart:

___

The price is up by around 90% in the past 3 months and over 200% in a year.

“We have a new line in the sand and the focus shifts to the next round number of USD 30,000,” Antoni Trenchev, Co-founder and Managing Partner of crypto lender Nexo, told Bloomberg. According to him, this “is the start of a new chapter for Bitcoin. It’s a narrative the media and retail crowd can properly latch onto because they’ve been noticeably absent from this rally.”

“Whether the next big resistance will be at USD 50,000 or USD 500,000 is anyone’s guess but we firmly believe the risk/return is skewed to the upside,” Trenchev recently told Cryptonews.com.

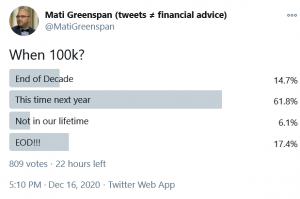

“It’s very likely bitcoin will reach USD 100,000 in 2021 just based on corporate and institutional demand alone. We’re seeing sustained demand for hosting of miners as well, which usually indicates bullish trends in mining from months ago,” Blockstream’s Chief Strategy Officer Samson Mow, recently told Cryptonews.com.

Mow isn’t the only one touting this benchmark. Also pointing towards institutional and corporate demand, Quantum Economics analyst Lou Kerner thinks bitcoin will increasingly eat into gold’s share of the store-of-value market next year.

Meanwhile, Tim Rainey, the Chief Financial Officer at powerplant-cryptomining hybrid Greenidge Generation, said he believes that “the price could easily reach the USD 25,000-USD 30,000 range” next year.

“Unlike the 2017 bubble, bitcoin’s latest price rally is driven by stronger fundamentals — institutions saving reserves in cryptocurrency or integrating cryptocurrencies into their services,” he told Cryptonews.com.

Also, according to Soravis Srinawakoon, CEO and Co-Founder of Sequoia-backed cross-chain data oracle Band Protocol (BAND), in 2017, there was a lack of products “for the new converts to experience.”

“Today there are endless uses, protocols, services across farming, lending, standard trading etc. Therefore we’d expect to see the new adopters hang around this time,” he said in an emailed comment, adding that the price of bitcoin can really drive talent to the cryptocurrency and blockchain industries.

Meanwhile, Dmitry Tokarev, Chief Executive of London-based crypto custodian Copper.co, claims that BTC isn’t showing any signs of the cataclysmic 30%-40% drops characteristic of previous major bull runs.

“Instead, there is an aggressive shift towards accepting the argument that bitcoin acts as a hedge against inflation. The outflows of gold into BTC supports this, and is evidenced by recent allocations from fund managers such as Ruffer here in the UK,” he said.

As reported today, UK-based Ruffer Investment Company allocated 2.7% of its assets under management to bitcoin.

“Ruffer’s exposure to bitcoin currently totals around GBP 550m [USD 744m],” a Ruffer spokesperson told Cryptonews.com.

“It’s also important to recognize the increasingly positive rhetoric from prominent institutional investors like JPMorgan, Blackrock and Bridgewater. They are responsible for bidding up the digital currency’s price and their respective executives have publicly endorsed bitcoin in recent months, in a way that would have been unheard of during the last comparative run of 2017,” Tokarev added.

___

Other reactions:

___

Learn more:

Exchanges Send More USD 1M Bitcoin Transfers as Investors Look For a Hedge

Bitcoin, Ethereum, XRP, Bitcoin Cash, Litecoin, Chainlink Price Predictions for 2021

Crypto in 2021: Bitcoin To Ride The Same Wave Of Macroeconomic Problems

Bitcoin Bulls and Bears List Reasons Why Price Will Rise or Drop by 2030

MassMutual’s Example Might Attract Fresh Billions To Bitcoin – JPMorgan

Morgan Stanley Exec Says Bitcoin is Coming for the US Dollar

This Bitcoin Cycle Is ‘Right On Track’ With ‘Striking Similarities’

Did Ray Dalio Just Say You Should Buy Bitcoin?

6 Most Common Misconceptions About Bitcoin Picked by Lyn Alden

___

{no_ads}