Terra Classic Price Could Put on Another 1,000% if Crypto Complex Stabilises

Terra Classic has been on a massive rebound in recent weeks. LUNC, the native token for the original Terra Luna blockchain, recorded a massive plunge in May after the depegging of the TerraUSD (UST) stablecoin and the resulting collapse of the Terra blockchain. Now, LUNC looks prime to make a comeback.

Terra Classic eyes 1000% gains

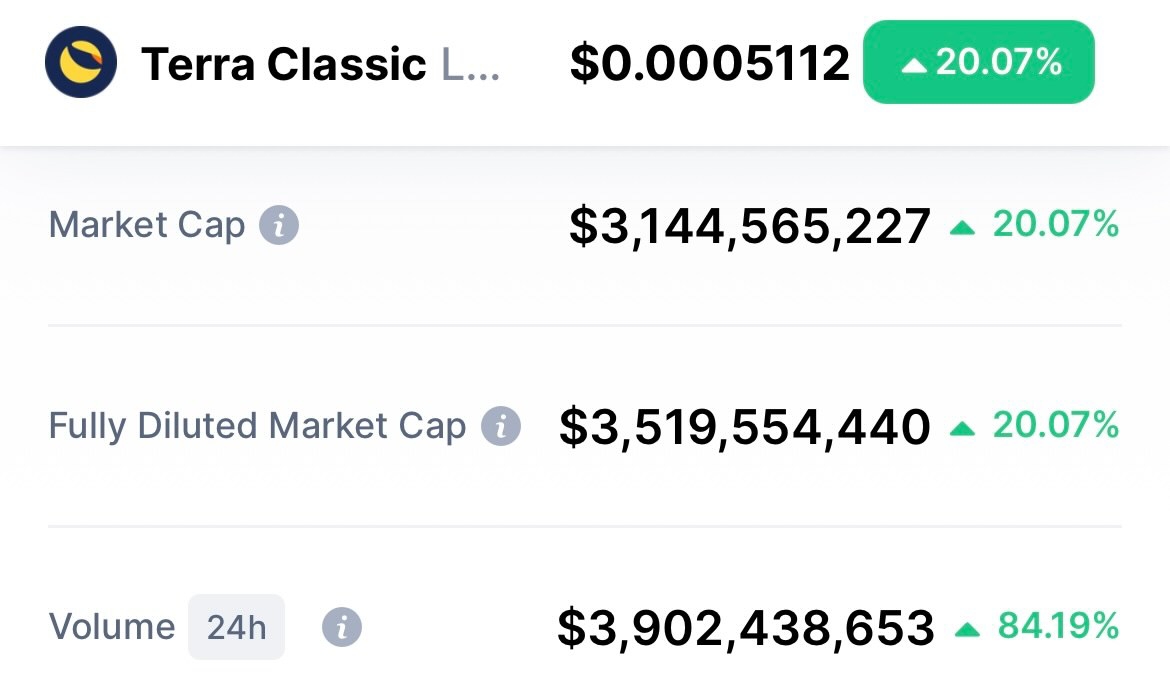

Over the past month, LUNC has gained more than 300%. At the time of writing, the token was trading at $0.000432, according to data from CoinGecko. The uptrend reported during the past month has been one of the highest since May’s volatility.

Despite this uptrend, there is the possibility that a pullback could be on the way, as seen in the cooling down of the uptrend. The recent uptrend comes amid intense buying pressure, but the buyer momentum could soon be exhausted because of the recession in the broader market.

Earlier this month, LUNC’s prices consolidated as the bears and bulls fought to have control of the market. Bulls seem to be winning, but the demand could be exhausted, and the prices could soon consolidate.

During the past 24 hours, LUNC has consolidated between the $0.000339 and $0.000441 range. Its trading volumes during the past 24 hours also stand at over $2 billion, making it the seventh-most traded cryptocurrency.

The uptrend reported during the past month has also aided LUNC in climbing up the leaderboard to become the 28th largest cryptocurrency with a market cap of $2.9 billion. The current uptrend is optimistic for the LUNC traders that bought post the May crash. However, the early LUNC investors are still in losses following the token’s 100% drop from the all-time high of $110.

Before the collapse, LUNC was one of the top ten largest cryptocurrencies by market cap and one of the leading projects in the web 3.0 & crypto sector. However, its price correlation with the UST stablecoin was a major weakness that saw it crumble after UST lost its peg. The UST stablecoin has also been on a bold uptrend during the past month, gaining by around 30%.

The gains made by LUNC are spectacular, given that the rest of the cryptocurrency market is bleeding. The global cryptocurrency market has plunged by 4.5% during the past 24 hours and dropped below $1 trillion. Bitcoin is also back to trading at the June 2022 lows, but none of these happenings are harming LUNC’s momentum.

LUNC’s price chart

LUNC has a Relative Strength Index of 55%, showing that the bears are in control. Buyers seem to be losing control of the market, which could signal a downturn soon. The sellers could be behind LUNC’s consolidation and the token cooling off after the significant gains made during the past few weeks.

At the current prices, the next resistance level LUNC needs to overcome is $0.00045. The token has failed to break this resistance during the past 24 hours amid the declining buying support caused by the broader market volatility.

On the other hand, LUNC could also dip if the bears take control. If this happens, the support levels of $0.0003 and $0.00025 will be tested. If the token drops to these support levels, further dips could be seen as holders relinquish their tokens.