Store Or Not Store Of Value? Three Reports Weigh In On Bitcoin

Three recent reports once again showed that the popular narrative surrounding bitcoin (BTC) as ‘digital gold’, a safe haven asset, is not so simple and the jury is still out on this question.

Analysts at Goldman Sachs, Arca, and Bloomberg Intelligence discussed BTC as a store of value, safe haven, or defensive asset from different perspectives. Some argued that bitcoin and gold are not necessarily comparable and that BTC is by no means a defensive asset, while one analyst sees a bull on the horizon for this “upcoming digital reserve asset.”

Volatility again

Even if BTC is a competitor to other cryptoassets, it’s not a direct competitor to gold, and the reason is its often-cited volatility, analysts at US investment banking giant Goldman Sachs argued in a note, as reported by the Market Insider.

They added that,

“Gold is competing with crypto to the same extent it is competing with other risky assets such as equities and cyclical commodities. We view gold as a defensive inflation hedge and crypto as a risk-on inflation hedge.”

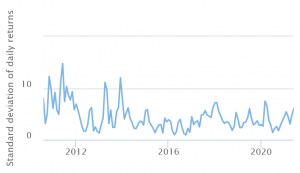

Bitcoin volatility chart:

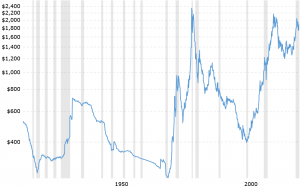

Meanwhile, historically, gold is also not the most stable asset.

Gold price chart:

Furthermore, the competition between bitcoin and ethereum (ETH), as well as with other assets, is what is preventing any of them from becoming an asset that investors would see as safe, according to the analysts.

Given that Ethereum is the most popular smart contract platform, ETH “currently looks like the cryptocurrency with the highest real use potential,” and one that “could eventually overtake bitcoin as the top cryptocurrency,” they added. What Bitcoin lacks, despite its “stronger brand,” is certain real use cases. However, speaking of real use cases, today, payments giant Visa said that their consumers globally spent more than USD 1bn worth of cryptocurrency on goods and services through Visa’s crypto-linked cards in the first six months of the year.

Bitcoin is one of the year’s worst performers

“Bitcoin is not a “defensive asset”, even within digital assets,” wrote Jeff Dorman, the Chief Investment Officer (CIO) of US-based investment management firm Arca. Defensive assets consist of more stable investments with steadier returns – they tend to carry lower risk and are more likely to generate a lower return over the long term in the form of income, Dorman said, adding: “That sure doesn’t describe Bitcoin…at all.”

While it is expected that defensive assets like utility stocks, healthcare stocks, and US Treasuries will perform well regardless of the business cycle, and there are companies and projects within the digital asset industry that have these characteristics, Bitcoin, per Dorman, is not one of them.

“This narrative that Bitcoin is the defensive asset within digital assets is even more shocking considering Bitcoin is one of the worst performing digital assets YTD [year-to-date] by a long shot, and it continues to underperform every bounce (like last week), while declining in line with the asset class during periods of stress,” he said. “The only thing Bitcoin seems to be defending against is profits.”

At 10:49 UTC, BTC was trading at USD 34,701. It was up 2% in a day, down 3.5% in a week, and up 20% YTD. In comparison, ETH was trading at USD 2,380, or 5% higher than yesterday and nearly 10% higher than a week ago. It rallied by 222% YTD.

To drive his point home, Dorman compared bitcoin that is “being pressured negatively by China, ESG, celebrity CEOs, FED regime shifts and regulatory pressures” to decentralized finance (DeFi) tokens like SUSHI with a 14% dividend yield that books revenue and free cash flow every day regardless of market cycle, and gaming tokens like Axie Infinity (AXS) that is “growing revenues exponentially, has equity support behind it, and the token is explicitly backed by the balance sheet assets of the company.”

‘Decentralized reserve and store of value asset’

While the two previous analysts expressed certain similarities in their opinions, Bloomberg Intelligence seems to be on the opposite side of this debate.

Bitcoin appears on track to becoming a globally accepted decentralized reserve and store of value asset, Mike McGlone, Bloomberg Intelligence Senior Commodity Strategist, said, adding:

“Seemingly unstoppable and competing, advancing measures of money supply and debt-to-GDP in most countries are a race to which gold and its upstart digital version, Bitcoin, help provide a hedge. <…> Diminishing quantity juxtaposed with the propensity of currencies to debase over time and the substantial amount of money being pumped into the system is a solid foundation for Bitcoin’s price appreciation.”

Furthermore, he argued, bitcoin may be more than a digital version of gold. BTC’s potential path is to stabilize around 100x an ounce of gold and for its volatility to continue its downward trajectory.

Speaking of which, the declining volatility, as well as a rising price trajectory, are set to follow bitcoin’s continued migration into the mainstream. “Bitcoin volatility is well poised at the start of 2H to resume its generally downward trajectory since infant days,” McGlone said, adding that partial allocations to BTC may be a prudent addition to low-yielding bond portfolio.

The crypto market is likely entering a more adult stage in the second half of the year. Per the analyst, “Bitcoin has backed into layers of support at the start of 2H,” with probabilities for it resuming the upward trajectory, potentially with some macroeconomic fuel from lower bond yields.

“If the US Treasury long bond sustains below the 2% threshold, Bitcoin and gold are well poised to be leading 2H performers — 2Q dips may prove to be pauses within enduring bull markets. <…> Declining yields mean less competition for stores of value like gold and should enhance the price-discovery stage of the upcoming digital reserve asset, Bitcoin.”

He added that primary factors that pressured BTC in the second quarter, such as energy-consumption issues, China’s crackdown, and delayed US exchange-traded funds (ETFs), are all “transitory, and their resolution would be quite bullish for the longer term.”

____

Learn more:

– Some Central Bankers Show Interest in Bitcoin; Inflation Fears Mount

– Imagine Bitcoin as a Reserve Asset. What Then?

– Bitcoin Is More ‘Public’ Money than Central Bank-Issued Fiat Currencies

– Bitcoin Faces Hedge Test Amid Rising Inflation Concerns

– A Debt-Fuelled Economic Crisis & Bitcoin: What to Expect?

– El Salvador Will Be a Serious Test for Bitcoin’s Layer-2 Networks

{no_ads}