Santiment Measures Social Media Text Volumes of Bitcoin – Here’s What They Find

The price of Bitcoin (BTC) generally moves in the opposite direction of what traders anticipate, crypto sentiment analysis firm Santiment has found.

Writing on Twitter earlier this week, Santiment said that the fact that Bitcoin’s price moves contrary to what “the crowd” expects is something that has been seen many times, and most recently this past weekend.

Last Sunday, Bitcoin briefly bounced to nearly $27,300, as traders expressed “disbelief” in social media, Santiment wrote.

Today, however, that situation has turned, and optimism has returned to the market.

This appears to be “resulting in a top,” Santiment pointed out in the tweet.

📈 As we have seen many times, #Bitcoin generally fluctuates in the direction that the crowd least expects. Traders were showing disbelief on social platforms Sunday, & it led to $BTC bounce. And now today, there appears to be optimism, resulting in a top. https://t.co/PLh6ep6Ial pic.twitter.com/wan9giEK9x

— Santiment (@santimentfeed) May 22, 2023

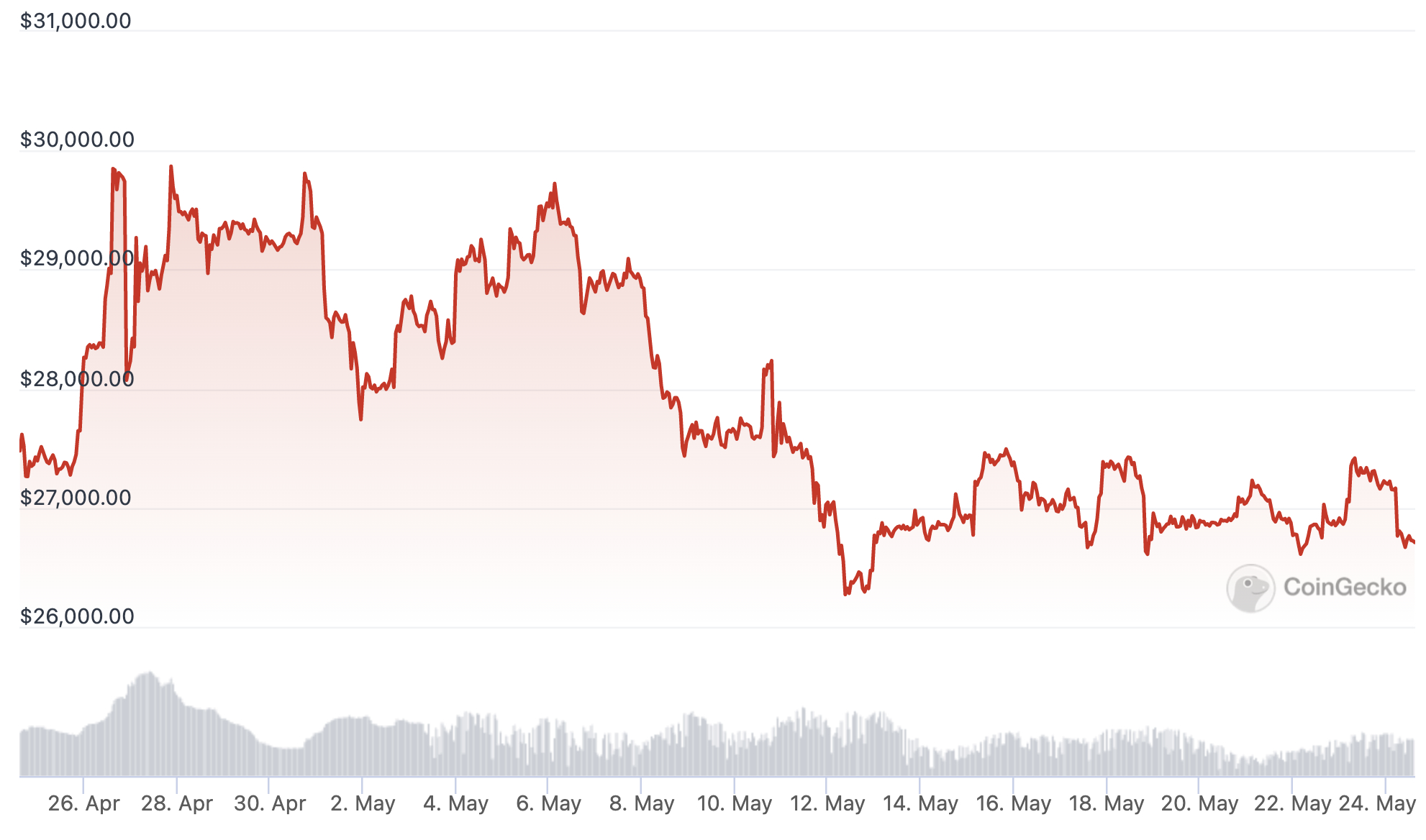

At the time of writing, Bitcoin was down some 2.2% over the past 24 hours, trading around the $26,700 level, data from CoinGecko showed.

For the past 7 days as a whole, the price is nearly unchanged, after what has been a week with unusually stable Bitcoin prices.

Sentiment analysis like what Santiment does is a relatively popular method to use among crypto traders, with the general wisdom being to trade ‘against the crowd’ whenever sentiment appears extreme either on the bullish or bearish side.

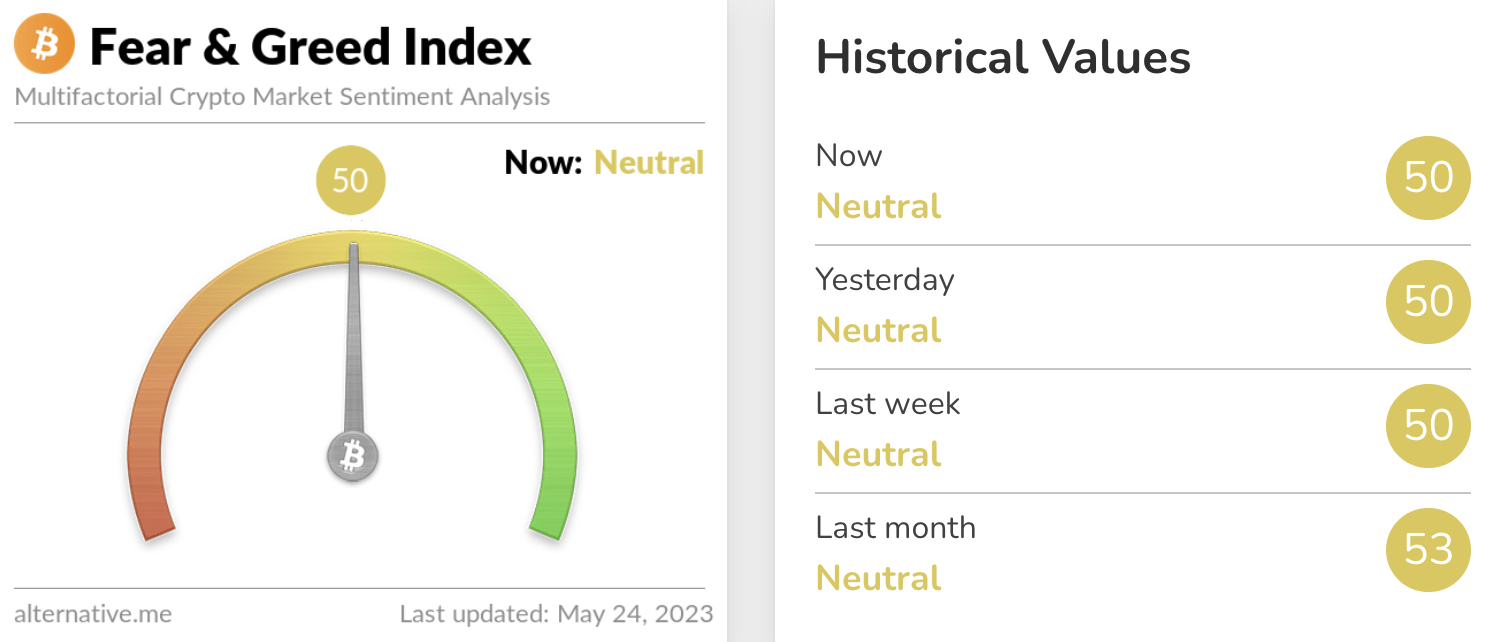

A commonly used tool in addition to Santiment is the Bitcoin Fear & Greed Index, which considers input from different sources, including social media, Google searches, price momentum and volatility.

At the time of writing, the Bitcoin Fear & Greed Index stood at exactly 50, indicating neutral sentiment among market participants.