S2F Bitcoin Price Model Gets ‘Red Dot,’ McAfee Bashes His USD 1M ‘Nonsense’

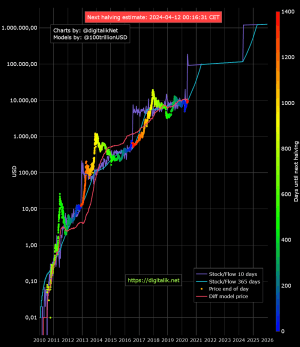

The disputed bitcoin (BTC) stock-to-flow model has once again been updated with a new data point, this time indicating that the new bull cycle has seemingly begun and BTC might reach USD 100,000 in a year.

Posting on Twitter Monday morning, the model’s pseudonymous creator, PlanB, said that a “red dot” has now been added to the chart, which historically has indicated the beginning of major bull runs for the digital asset.

Red dots on the stock-to-flow chart are printed in the first month after each halving, and although this has historically coincided with price rises, there is no guarantee that this will happen again.

The bitcoin stock-to-flow model predicts a price rise to USD 100,000 for bitcoin during the expected bull cycle after the latest halving, with further gains expected again after the next halving in 2024. The model works by looking at the reduction in supply of new coins to the market, using a similar logic as some analysts have applied to study price moves in commodities and precious metals markets.

However, the S2F model is being often criticized, while some claim that it is based on the flawed logic that “almost no one understands.”

Meanwhile, the infamous crypto evangelist John McAfee now calls his USD 1 million price target for bitcoin “nonsense.”

As everyone on the crypto community remembers, however, McAfee himself famously predicted that bitcoin would reach USD 1 million by the end of 2020. “If not,” McAfee said, “I will eat my own dick on national television.” In October of 2019, he was even talking of USD 2 million per BTC.

Tweeting over the weekend, the eccentric entrepreneur called bitcoin “the most crippled crypto-tech,” and said that “If bitcoin ever hit $1 mil, it’s market cap would be greater than the GDP of the entire North American Continent. What idiot could believe such nonsense?”

Although McAfee’s calculations about what a 1 million price tag would mean for the bitcoin market capitalization are not that far off, it still falls short of the total GDP of North America (US, Canada and Mexico). At its full supply of 21 million BTC, bitcoin’s market capitalization would be USD 21 trillion with a USD 1 million price, vs. a North American GDP of 23.47 trillion in 2018 according to data from the World Bank.

At pixel time (06:24 UTC), BTC trades at USD 9,549 and is unchanged in a day and up by 8.5% in a week.