Record Crypto Investment Outflows, PayPal Coin, Binance CEO’s Net Worth + More News

Get your daily, bite-sized digest of cryptoasset and blockchain-related news – investigating the stories flying under the radar of today’s crypto news.

__________

Investments news

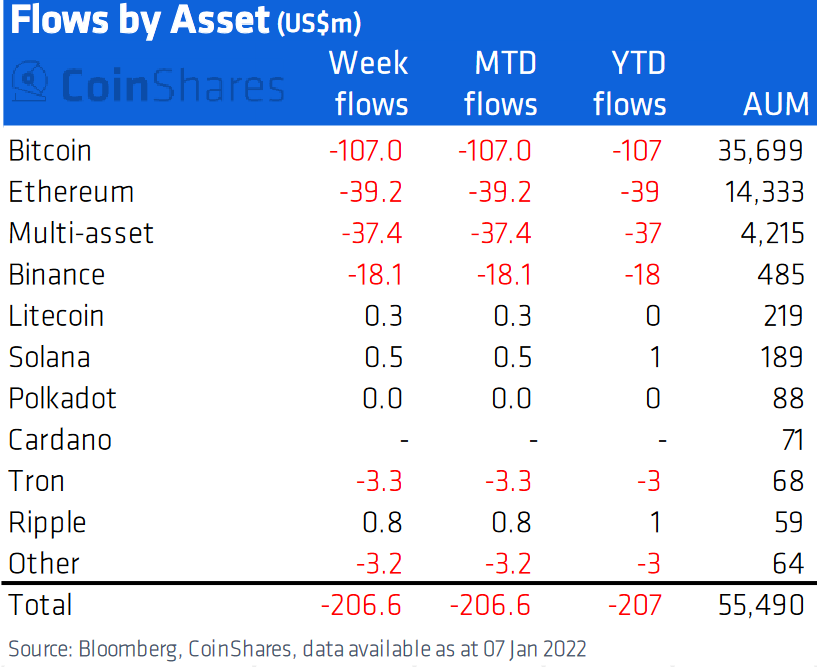

- Digital asset investment products saw outflows totaling a weekly record of USD 207m (compared with USD 32m a week earlier), per CoinShares data. “Bitcoin [BTC] saw outflows totaling USD 107m [compared with USD 7.5m of inflows a week earlier] last week in what we believe was a direct response to the FOMC minutes which revealed the US Federal Reserve’s concerns for rising inflation, and the fear amongst investors of an interest rate hike,” the firm said. Ethereum (ETH) saw outflows totaling USD 39m last week (it was USD 61m a week earlier), bringing the 5-week run of outflows to USD 200m. “On a proportional basis to this is far greater than Bitcoin’s outflows representing 1.4% of [assets under management],” they added.

- N26 is planning to launch a crypto trading business this year and an equities brokerage after that, co-founder Max Tayenthal told the Financial Times. He admitted that this German online bank rushed to be global too quickly and missed out on the crypto boom.

- Market infrastructure provider TP ICAP announced it had completed the first trades on cryptoasset equity instruments with Goldman Sachs. The company expects to see continued interest across cryptoasset-based futures and options products, and an interbank NDF (non-deliverable forward) market develop on Bitcoin (BTC), and potentially Ethereum (ETH), throughout the course of 2022.

- Katie Haun, the departing partner of Andreessen Horowitz, is looking to raise at least USD 900m for two separate crypto investment funds, according to the Financial Times. Haun announced in December that she was starting her own fund.

- Asset manager Pantera’s Bitcoin Feeder Fund now has USD 63.7m in funding from 153 investors, up from USD 18m and 56 backers a year ago, according to a new regulatory filing. The Bitcoin Feeder Fund lets investors make indirect investments in the firm’s main Bitcoin Fund.

- General purpose dead man’s switch Sarcophagus DAO raised USD 5.4m in a recent funding round. The builders plan to expand the dapp (decentralized application) to support lower cost networks, as well as build tooling to make it easier for 3rd party developers to integrate the dead man’s switch functionality into their dapps.

Payments news

- Payments processor PayPal is exploring the launch of its own stablecoin as part of its cryptocurrency push, Bloomberg reported. A PayPal spokeswoman told the outlet that the images and code previously hinting at a stablecoin inside of the PayPal app stemmed from a recent internal hackathon within the company’s blockchain, crypto, and digital currencies division.

Exchanges news

- Binance generated at least USD 20bn of revenue last year, according to a Bloomberg analysis of its trading volume and fees, while the Bloomberg Billionaires Index estimated CEO Changpeng Zhao’s personal net worth at USD 96bn. Zhao declined to comment for this story, and Binance disputed the accuracy of Bloomberg’s estimates of the firm’s market value.

- The Frankfurt Certificates Exchange saw certificates on cryptocurrencies remain the most popular products in 2021 with a trading volume of more than EUR 1bn (USD 1.13bn). The total number of trading orders in structured products decreased from 3.9m to 3.4m compared to the previous year, but the exchange noted a trading volume high of EUR 18.4bn (USD 20.8bn).

Economics news

- The US Federal Reserve will likely raise interest rates four times this year and will start its balance sheet runoff process in July, if not earlier, according to Goldman Sachs Group, Bloomberg reported. Rapid progress in the US labor market and hawkish signals in minutes from the Dec. 14 to 15 US Federal Open Market Committee suggest faster normalization, according to the bank.

Regulation news

- A cross party group of Members of Parliament (MPs) and Lords in the UK Parliament launched a new All Party Parliamentary Group (APPG) for Crypto and Digital Asses Group. They aim to act as a forum to discuss crypto policy and regulation, and explore issues like customer protection and financial education and inclusion.

- US-based venture capital powerhouse Andreessen Horowitz published a policy agenda aimed at global governments with 10 guiding principles on how to “build a better internet.” They encourage world leaders to think proactively about Web3 policy, starting by establishing a clear vision, providing clear and fair tax rules as they apply to digital assets, embracing multi-stakeholder governance, and more.

Blockchain news

- The Ethereum layer-two network Arbitrum suffered its second outage in less than five months following a hardware failure. They released a postmortem, explaining that the core issue was a hardware failure in their main Sequencer node.

Mining news

- China’s National Development and Reform Commission, the executive State Council’s economic policy arm, has dealt the coup de grace to the crypto mining industry. Mining has de facto been banned since September last year’s crackdown, but the commission has followed through with its intentions – announced in October last year – to place the industry on a list of “banned” industries that must be “stamped out” in the country. The decision was made in late December, and made public in an official document on January 10.

- Bitcoin self-mining company Bitfarms purchased BTC 1,000 for USD 43.2m, increasing the BTC holdings 30% to over 4,300. They added that they “seized the dip,” and that their goal is delivering 8 exahash/second by the end of 2022.

___

(Updated at 16:42 UTC with the “Economics news” section.)