Put-to-Call Ratio Rises as Ethereum Options Market Sets New Record

Despite a new record in the overall interest in ethereum (ETH) options trading seen yesterday, the market may be sending a signal that some ETH holders are hedging their bets on the second-most valuable cryptoasset.

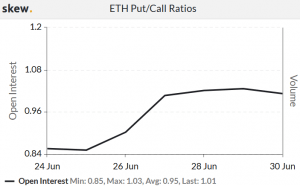

The increasing hedging, which may perhaps stem from a nervous sentiment among traders, is evident from the rising put-to-call ratio in the ethereum options market, where open interest (OI) now shows a put-to-call ratio above 1. This is the highest level since at least April, data from the crypto derivatives analytics provider Skew shows.

And although a level just above 1 still means that there is roughly an equal amount of trading in both bullish call options and bearish put options, the ratio has in the past few months been skewed more heavily to the bullish side than it is now.

ETH options contracts are useful for large holders of ETH because they give the option, but not the obligation, to either buy or sell ETH at an agreed upon price in the future. The contracts may thus be used as a form of financial insurance for large holders who want to protect their downside in the event of a sell-off in the spot market, in the same way as an insurance policy protects against large losses in the real world.

And although traders in the options market do not seem particularly bullish about the price of ETH, however, the overall interest in playing ETH with options is on the rise.

According to data from Skew, the open interest in ETH options is now at an all-time high, and has reached the same level as the bitcoin options market was at in December 2018 – about USD 200 million in total open interest – after a sharp spike in OI seen yesterday.

The new milestone for the ETH options market was also picked up on Twitter by Su Zhu, CEO of Three Arrows Capital, who said he “can confirm some of the largest ether holders in the world are now active in the ETH options market on Deribit Exchange.”

Three Arrows Capital is affiliated with the crypto derivatives exchange Deribit.