Pantera Capital Believes Bitcoin Will Hit $150,000 Soon, Here’s How and When

Crypto asset manager Pantera Capital believes Bitcoin (BTC) will hit close to $150,000 sometime in the first half of 2025 while also hinting that this cycle’s bottom could be right around the corner.

The predictions about the BTC price and what will happen after the next Bitcoin halving came in the latest Blockchain Letter by Pantera’s Dan Morehead, Joey Krug, and Jesus Robles.

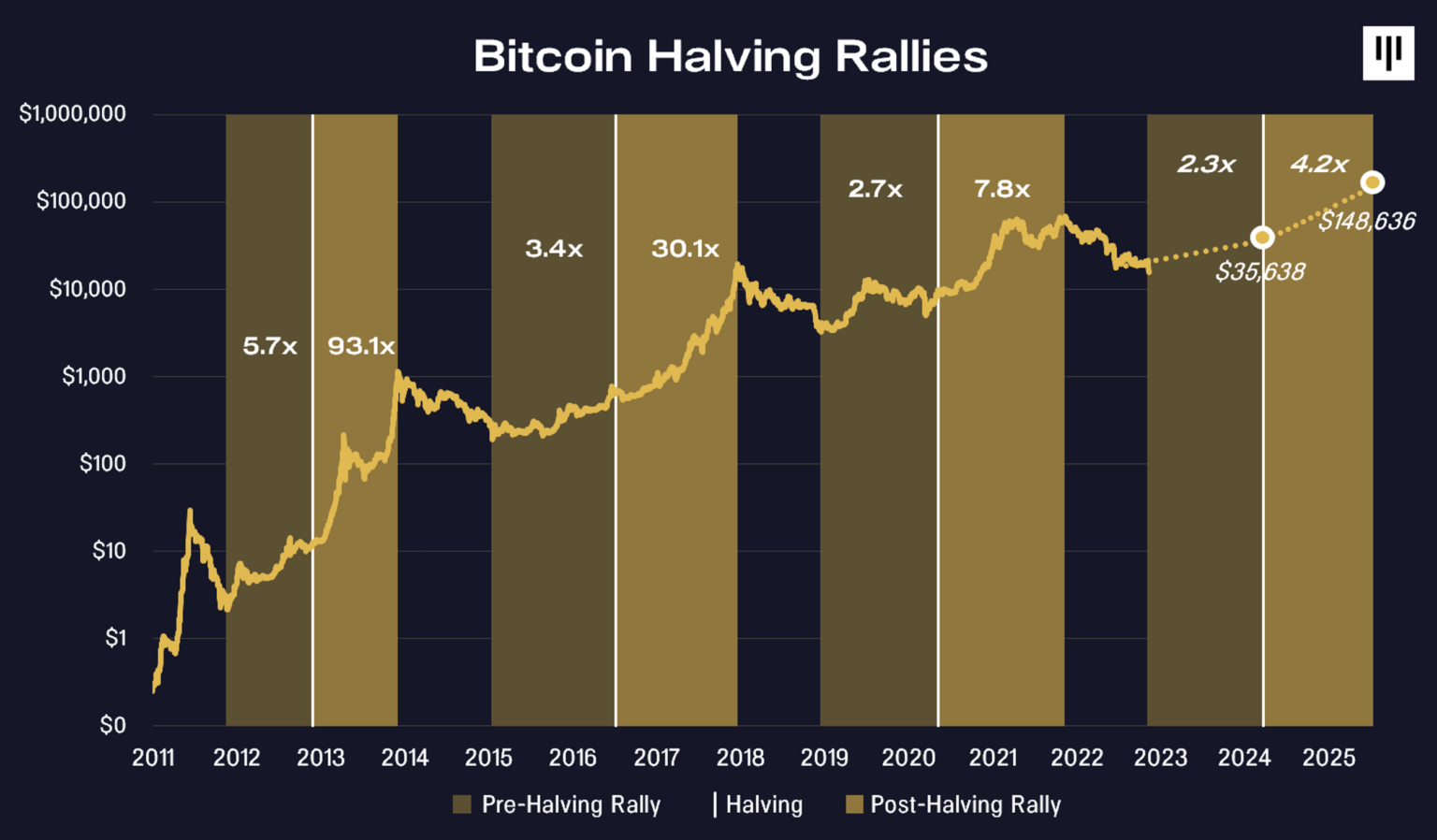

“Bitcoin has historically bottomed 477 days prior to the halving, climbed leading into it, and then exploded to the upside afterward. The post-halving rallies have averaged 480 days – from the halving to the peak of that next bull cycle,” the three crypto investment managers wrote in the letter.

“IF history were to repeat itself, the price of bitcoin would trough November 30th, 2022. We would then see a rally into early 2024 and then a strong rally after the actual halving,” they added.

Specifically, Pantera’s predicted that Bitcoin would rise to around $36,000 before the halving and reach a high of almost $150,000 after.

The next Bitcoin halving is expected to occur on March 22, 2024.

Historically, Bitcoin has bottomed 1.3 years before each halving and peaked 1.3 years after the halving.

If history is to repeat itself, the peak of the next bull market should therefore be seen sometime in the first half of 2025.

Not the first time Pantera predicts higher prices

Worth noting, however, is that this is not the first time Pantera predicts massively higher Bitcoin prices.

Back in February this year, Pantera’s chief investment officer Joey Krug said he believes the crypto market is ready to “decouple” from traditional macro assets, even in the face of higher interest rates.

“It doesn’t guarantee that it won’t go down a lot more next month, or whenever, but it just means the odds are really high that the markets are at an extreme and will bounce back relatively quickly,” Krug said at the time.

The firm still remained cautiously bullish in June of this year, when Pantera’s Morehead predicted that the worst was already behind us for this year’s crypto market downturn.

There could still be “a few more [meltdowns] to come in the next month or two,” Morehead said before adding that “with a 70-90% downdraft, we probably have worked through most of the problems.”

At the time, Morehead also admitted that his fund – which is normally heavily focused on altcoins – had taken on “a larger bitcoin allocation to reduce downside risk.”