Now Bitcoin Price is as Stable as Apple Stock

The volatility of the bitcoin price is now nearly as low as shares of tech giant Apple, the world’s biggest company by market capitalization, according to new data released by the Chicago Board Options Exchange (CBOE).

As most traders are aware, the stock market has generally been considered far less volatile, and less risky, than the crypto market. However, this belief is now being put into question as a result of unusually stable prices for the number one cryptocurrency.

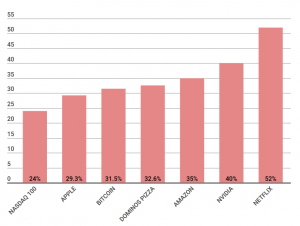

The CBOE data showed that bitcoin’s 20-day historical volatility has fallen to 31.5%, lower than that of well-established publicly traded companies like Amazon, an e-commerce giant, and Netflix.

20-day Historical Volatility

“A one standard deviation move for bitcoin is about USD 475. That works out to +/- 7.3% […],” Kevin Davitt, a senior instructor for the Options Institute at CBOE, was quoted as saying by Marketwatch. According to him, in mid-January, “the standard deviation measured $4,640 or +/- 42%.”

A standard deviation in a market is a measure of how often a certain move in prices can be expected to occur on average. Following a normal distribution, 68% of all moves are within +/- 1 standard deviation.

Although low volatility represents a challenge for active traders, long-term holders and bitcoin enthusiasts see it as a positive development for the digital asset, bringing it closer to the vision of it becoming “digital gold.”

“Perhaps we are witnessing the maturation of a market. It’s far too early to declare this the ‘new normal’ but the persistent range over the last few weeks may be hinting at a structural shift,” CBOE’s Davitt concluded.

Other experts have also suggested that the recently low volatility of the bitcoin market could be a sign that the market is maturing. Earlier this month, Gil Luria, research director at wealth management firm D.A. Davidson & Co., hinted that there is less speculation in the bitcoin economy today.

“When speculators are involved, they drive unusually high volumes as well as volatility by trading the asset with high frequency. As speculator involvement is diminished, volumes go down and volatility goes down as well,” Luria said at the time.