Nigeria Launches CBDC Amid Efforts To Tighten Grip Over Crypto Market

Nigeria’s President Muhammadu Buhari should launch a central bank digital currency (CBDC) today to enhance the operations of the country’s payments system.

“Following [a] series of engagements with relevant stakeholders including the banking community, fintech operators, merchants and indeed, a cross section of Nigerians, the CBN designed the digital currency,” the Central Bank of Nigeria (CBN) said.

According to the bank, the project will continue “with a series of further modifications, capabilities and enhancements to the platforms.”

The eNaira website went live on September 30, one day ahead of its official launch that was previously scheduled for October 1.

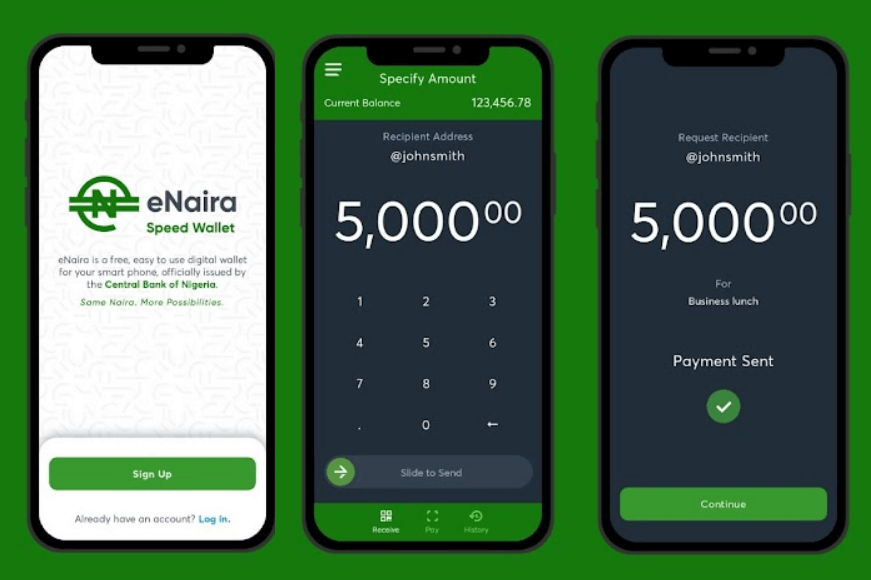

The CBN is promoting the new CBDC with the slogan: “Same Naira, more possibilities”.

Observers say the development could be part of efforts by the Nigerian authorities to use the eNaira project to counter the growing popularity of crypto among the country’s population.

Last August, digital asset research firm Arcane Research noted in an analysis that, as crypto adoption is on a growing trend in Nigeria, the country’s government is striving “to dampen the adoption of bitcoin (BTC), in part motivated by the desire to freeze out protesters from the EndSars movement from receiving funding to finance their operations.”

“However, unsurprisingly, stopping a globally traded censorship-resistant alternative to the Naira was harder than anticipated. Where there’s a will, there’s a way, and Nigerian citizens have been avid users of the Peer-to-Peer markets. This has now led Sub-Saharan Africa to become the largest region in terms of trading volume in the Peer-to-Peer markets globally,” according to the firm.

A recent report by blockchain analysis company Chainalysis ranked Nigeria as the sixth country in the Global Crypto Adoption Index, preceded by Vietnam, India, Pakistan, Ukraine, and Kenya, respectively.

_____

Learn more:

– Check Out FSB’s Roadmaps for Stablecoins and CBDCs

– The Financial System Is In ‘An Age of Disruption,’ BIS Official Admits

– IMF: Issue CBDCs, Improve Cross-border Payments to Counter Crypto’s ‘Phenomenal Growth’

– Visa Testing Regulatory Waters Before ‘Forcing Though’ its CBDC Solution