New ‘Red Dot’ and Criticism Hit Bitcoin S2F Model

As the widely followed pseudonymous bitcoin (BTC) analyst PlanB added another data point, the ‘red dot’ to his famous stock-to-flow (S2F) bitcoin price model, the community appears to be getting increasingly dismissive about the model’s predictions.

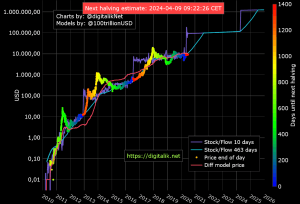

Writing on Twitter today, PlanB first shared the “cross asset” version of his model, dubbed S2FX, which does not enter into new phases immediately after halvings. Asked about this, however, the analyst then went on to share his traditional S2F model, which shows how the current price sits well below the model’s projected trajectory.

New dots on the S2F model appear monthly, with the red dots specifically appearing immediately after a halving has taken place. The first red dot in this cycle was thus added a month ago.

PlanB’s S2F model famously predicts a price rise to USD 100,000 for bitcoin in a year, with further gains expected again after the next halving in 2024. The model works by looking at the reduction in supply of new coins to the market, using a similar logic as some analysts have applied to study price moves in commodities and precious metals markets.

Unlike how the situation was a few months ago when the model enjoyed widespread popularity in the cryptoverse, the community now appears to be getting even more skeptical about the validity of the model.

Once again, among the critics is Vitalik Buterin, Co-founder of Ethereum (ETH), who shared an article by Nico Cordeiro, Chief Investment Officer (CIO) at investment firm Strix Leviathan LLC, that picked apart the model in an effort to uncover how it is “fatally flawed.”

“[…] we believe that the model’s accuracy will likely be about as successful at forecasting Bitcoin’s future price as the astrological models of the past were at predicting financial outcomes,” Cordeiro said, before going into detail about the alleged flaws with the model.

He urged investors to “be highly skeptical of this model even if they believe Bitcoin is digital gold.”

“The SF paper is not proper empirical analysis, but more akin to a marketing piece in which the author is trying to convince readers that Bitcoin is going to be worth a lot more tomorrow. This may or may not turn out true, but it has little to do with Bitcoin’s supply schedule,” the CIO concluded.

Recently, responding to the criticism, however, PlanB reminded his followers that models are nothing more than a “simplification of reality,” and added that “all models are wrong” although “some are useful.”

___

Other reactions and discussions

____

Learn more:

This New Bitcoin Model ‘Picks the Start of Exponential Bull Runs’

Bitcoin Price Models Go to War (Again) as Rainbow Champion Decries S2F

Hedge Fund Chief ‘Concerned’ by Growing Bitcoin Stock-to-Flow Hype

Four Reasons Why Bitcoin Might Not Rally Right After The Halving

Six Bitcoin Halving Scenarios and Likelihood of Each