New Institutionals Poured Hundreds of Millions in Crypto Last Year

New institutional investors flocking into Bitcoin helped major digital asset manager Grayscale Investments to raise over USD 600 million in 2019, or more than in 2013-2018 combined.

Cumulative investment across the Grayscale family of products surpassed USD 1 billion for the first time, the company said in their 2019 Digital Asset Investment Report.

The report reveals that Grayscale’s Bitcoin Investment Trust brought in Q4 investments of USD 193.8 million—the single largest capital raise since the firm’s inception in 2013. In the same quarter, investments in non-Bitcoin related products dropped to USD 31.7 million. In total, the company raised USD 225.5 million in Q4, or 12% less than in Q3.

However, the firm claims it saw substantial growth in new clientele, with a 24% increase in client base. Further, diversification within the platform also led to growth, with 36% of all clients now using more than one product.

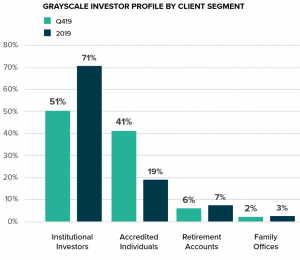

The new client totals were largely due to institutional investments, with 71% of all new assets in 2019 flowing from this source, hedge funds mostly. Also, the firm saw a substantial bump in high net worth investors in the fourth quarter, representing 41% of all investments during the time.

__

Last year, Grayscale has intentionally made investing in cryptocurrencies more simple for legacy-style investors: “We have removed the barrier to entry so that institutions and individual investors can benefit from exposure to digital currencies.”

Notably, investors in the Grayscale products do not actually hold the coins. Instead, Grayscale remains in possession of the coins, but offers shares in the investment, providing both exposure and risk protection. This feature has apparently proven highly valuable for risk-averse investors.

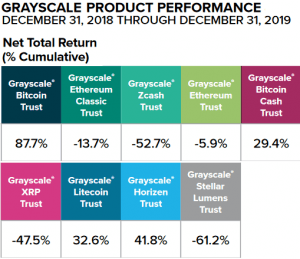

Nevertheless, returns for the year reflected the overall market movement. The Bitcoin Investment Trust returned investors 87.7%, largely due to value increases in the asset. However, investors lost over 60% on the Stellar Lumens fund, and nearly 50% in the XRP fund.