Michael Saylor Says Ethereum ETF Approvals Are Good For Bitcoin – Here’s Why

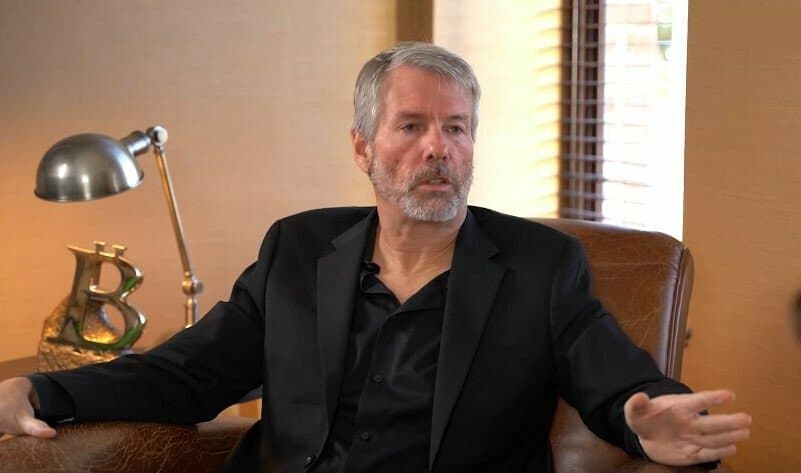

The recent approval of Ethereum spot ETFs is a net positive for Bitcoin adoption, according to MicroStrategy executive chairman Michael Saylor, who appeared on the What Bitcoin Did podcast last week.

The billionaire Bitcoin investor has long championed Bitcoin as the best crypto asset for value storage and assumed that no other assets would gain regulatory legitimacy in the United States. Recent developments have proven that the country’s leadership is pivoting in a more industry-friendly direction, however.

Michael Saylor Wrong On Ethereum ETFs

“I think right now, the best expectation is the crypto asset class will be legitimized, supported by both parties,” said Saylor during the interview. “There’s a lot of things that will be considered in a more open light, and Bitcoin will be the leader of the crypto asset class.”

.@saylor on the Ethereum ETF approval and what the recent crypto regulatory changes mean for Bitcoin pic.twitter.com/jOmM4rRJud

— Beagle (@BeagleBitcoin) May 25, 2024

Saylor’s new forecast wildly differs from his comments during MicroStrategy World earlier this month, during which he said Ether, the second largest cryptocurrency, “will not be approved” by regulators and would soon be classified as an unregistered security.

“It will never be wrapped in a spot ETF. It will never be accepted by Wall Street nor institutional investors,” he said at the time. “Bitcoin is the one universally accepted institutional grade crypto asset. There won’t be another one.”

Bloomberg ETF experts also assigned a low likelihood of Ether ETF approvals until early last week, when regulators suddenly began engaging with issuers on their applications after months of radio silence. On Thursday, the agency approved exchanges to list the funds, which legal experts say also certifies Ether as a non-security.

Changing Political Winds On Crypto

Saylor believes a combination of political developments in May led to the Securities and Exchange Commission (SEC)’s change of stance, along with that of the Biden administration.

First, the House and Senate passed legislation with bipartisan support to enable banks in the United States to offer crypto custody services.

After that, the House of Representatives passed FIT21, a comprehensive bill providing a legal framework for crypto issuers and companies to operate legally.

Additionally, ex-President Donald Trump came out in full support of protecting citizens’ rights to hold crypto if re-elected, promising to override the Democratic party’s more hostile stance.

“I think it is good for Bitcoin – in fact it may be even better for Bitcoin because I think that we are much more powerful supported by the entire crypto industry,” said Saylor. “I actually think it could accelerate institutional adoption.”