Macro Backdrop ‘Never Been More Conducive’ for Bitcoin – Analyst

The current macroeconomic backdrop has never been more conducive for “a non-sovereign, censorship-resistant, provably scarce digital asset,” Kevin Kelly, Co-founder of crypto research boutique Delphi Digital, believes.

In an analysis piece in eToro’s latest quarterly The State of Digital Assets report, he admitted that the recent drawdown in bitcoin (BTC) prices has certainly caused some investors to “throw in the towel,” citing as their reason that bitcoin proved unable to be much of a hedge against financial market risks right when they needed it the most.

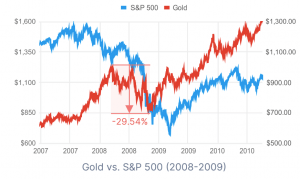

Countering this argument, however, Kelly explained that there are in fact “few asset classes […] that see their price appreciate in absolute terms during a liquidity crisis.” He noted that the same was also seen in the classic safe-haven gold during the stock market crash in 2008, when gold fell by 30% between March and October that year. This year, he explained, we saw the same thing happening again, as the yellow metal dropped by approximately 15% right when stocks were experiencing the worst sell-offs.

And although the fall in gold was rather small compared to bitcoin’s drop, that should be expected, Kelly wrote, while explaining that “bitcoin is far more volatile than gold, both on the upside and downside.”

Most importantly, however, it’s what happens after the initial sell-off that matters, whether it is for gold or bitcoin, Kelly summarized:

“Bitcoin’s performance following the aftermath is far more important than its sell-off going in, given the backdrop has never been more conducive for a non-sovereign, censorship-resistant, provably scarce digital asset.”

The analyst then went on to offer some details on this unprecedented backdrop, with the governments announcing both fiscal and monetary relief packages “totaling more than USD 10 trillion.”

“The backdrop for massive debt monetization is set and it appears all the usual suspects are making their way to the stage,” he wrote, citing quantitative easing (QE)-like programs launched by various central banks around the world.

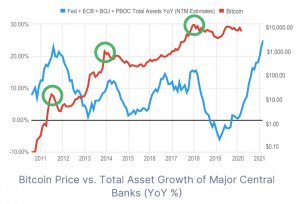

“Historical precedent is quite limited given bitcoin’s relatively short lifespan, but it is notable that prior BTC cycles have tended to peak with major central bank balance sheet growth,” Kelly wrote while pointing to a chart that showed what appears to be a relationship between bitcoin prices and the expansion of central bank balance sheets.

In conclusion, Kelly explained that with the current large-scale asset purchases by central banks, in addition to weak growth in the real economy, interest rates are likely to be kept at historically low levels, which in turn is “bolstering the investment case for non-income producing assets like bitcoin or gold even further.”

At pixel time, (14:22 UTC), BTC trades at c. USD 6,980 and is up by 3.5% in a day, trimming its weekly losses to less than 5%. The price is up 33% in a month and almost 34% in a year.

___

Learn more: Bitcoin to Face Stronger Global Recession Than In 2009, IMF Forecast Shows