Lottery Giant 500.com Buys Bitcoin Miner BTC.com From Jihan Wu

Listed Chinese online sports lottery service provider 500.com said it agreed to acquire the BTC.com Bitcoin (BTC) mining bussiness from Bitmain co-founder Jihan Wu.

500.com is buying the business in exchange for its newly issued class A shares, or around a 10% stake in this lottery provider with a market capitalization of USD 860m. However, if BTC.com Pool Businesses records a net operating profit of no less than USD 20m this year, the current shareholders should get an additional, up to a 5% stake in 500.com. In case the mining business records a net operating loss this year, 500.com “shall be entitled to repurchase certain Class A Ordinary Shares held by Blockchain Alliance at par value.”

“Most recently, 500.com is actively developing its blockchain-related business, including Bitcoin mining, mining pool business as well as mine construction and operation,” the company said.

BTC.com, operated by Bitdeer Technologies Holding Company, a computing power-sharing platform, is a multi-currency integrated mining pool established in 2016 that has a hash rate of around 17 EH/s and supports various cryptocurrencies, including BTC, BCH, ETH, and LTC, the company said.

BitDeer’s biggest beneficially owner is Jihan Wu, BitDeer’s chairman, per the announcement. As reported, Jihan Wu resigned as the CEO and Chairman of Bitmain, a major BTC mining hardware manufacturer, in January. Moreover, BitDeer claims that besides BTC.com, “in strategic partnership with Bitmain,” it also aggregates mining pools from such as Antpool, F2Pool, ViaBTC, and BTC.top.

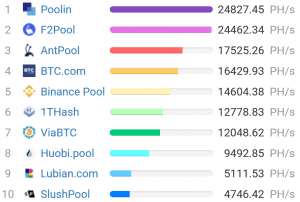

BTC.com claims it has over 10% of Bitcoin’s hashrate, or computing power, and is the fourth largest mining pool.

Despite its USD 860m market capitalization, 500.com said its net revenues were USD 3.3m and it suffered an operating loss of USD 29.2m in 2020.

However, its shares rallied in February as the company announced its moves into the crypto industry and investments of over USD 20m into the BTC mining business.

“Assuming full delivery of the 15,900 bitcoin mining machines, the Company’s total hash rate will be increased by approximately 1,000 petahashes per second (PH/S),” they said.

Moreover, the company said it will issue new shares and 50% of them, worth around USD 11.5m, to be settled in BTC.

Top mining pools:

___

Learn more:

– Bitcoin Miners Buy Oversupplied Energy, Turn To Renewables – Nic Carter

– Bitcoin Mining in 2021: Growth, Consolidation, Renewables, and Regulation