Lawyers Unsure of Fate of Do Kwon’s ‘Missing $37B’ – Will Investors Ever Get Their Money Back?

South Korean legal experts are unsure if “victims” of fraud allegedly committed by Do Kwon and Terraform Labs executives will ever be able to recoup their funds – with an estimated $37 billion now “missing.”

Segye Ilbo reported that South Korean prosecutors are hopeful of freezing at least $5.5 million worth of this amount.

They think that Kwon, Terraform’s CEO, has been holding these funds on overseas crypto exchanges and in Swiss bank accounts.

And they have this week asked exchanges and banks to help them cut off Kwon’s access to the funds.

Prosecutors also think that they will be able to recoup some funds from the seizure of Kwon’s South Korean assets.

Assets, including land, crypto, vehicles, and buildings, have also been seized from Terraform executives.

Similar assets have also been seized from the firm’s co-founder Daniel Shin.

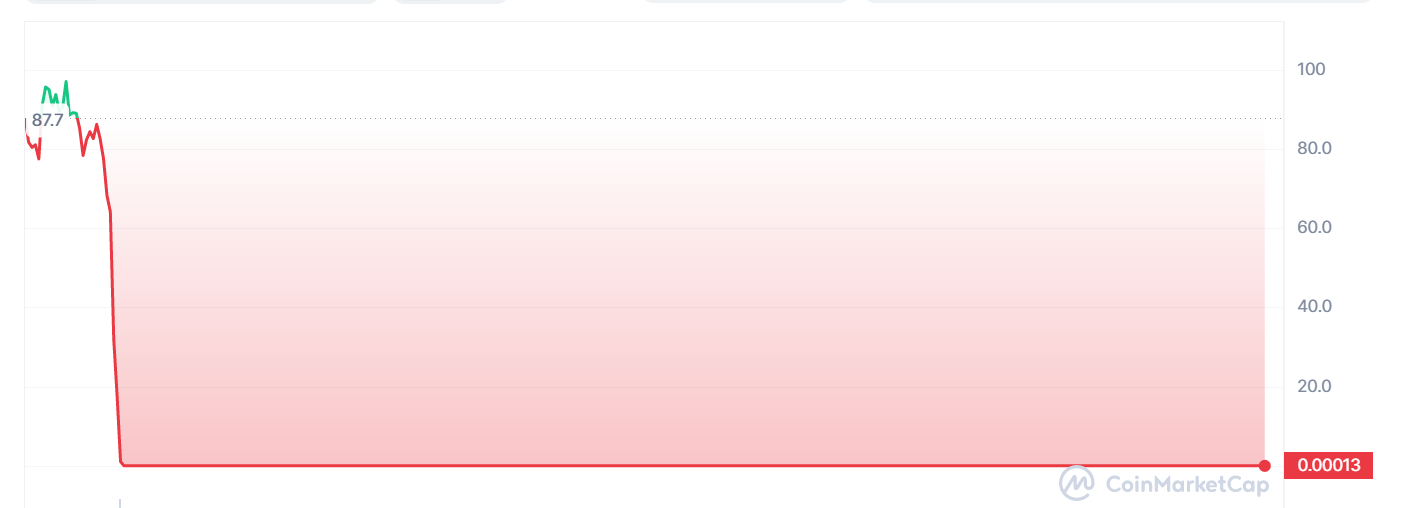

The $37 billion figure, quoted widely in the South Korean media, consists of the total amount of money investors in Terra projects paid to the firm to buy Terra ecosystem coins.

South Korean media outlets have reported that South Korea’s President, Yoon Suk-yeol, is making an “all-out” effort to repatriate Kwon.

Yoon reportedly wants Kwon brought back to South Korea to face charges.

Kwon has claimed that his rights are being “violated.”

Kwon was arrested in Montenegro last month along with another Terra executive.

The duo were reportedly found with a cache of forged travel documents.

Legal authorities in the United States and Singapore have also pushed Montenegro to extradite Kwon to face charges in their jurisdictions.

Some are hopeful that bringing Kwon back to South Korea will help investigators locate the rest of the “$37 billion” that has “evaporated” since Kwon’s flight last year.

Kwon shuttered his South Korean companies just ahead of the May crash of Terra ecosystem coins.

But legal experts appear to be skeptical.

What Will Happen to ‘Evaporated’ $37 Billion?

In an interview with KBS’ Klab, the attorney Ye Ja-seon of the Gwangya law firm opined that it would be “difficult” to prosecute Kwon in South Korea.

She stated that it would fall on prosecutors to prove that “the Capital Markets Act has been violated.”

And doing this would require prosecutors to prove that crypto can be considered “to be a financial product” according to the terms of national law.

The case would also rest on prosecutors proving that cryptoassets can be considered as “securities.”

Again, South Korean law does not provide a legal footing for this claim.

Ye also told Hankook Ilbo that it was “unclear whether Kwon will be repatriated to South Korea, despite [the government’s] efforts.”

Would Prosecuting Kwon in South Korea Help Investors Get Their Money Back?

Ye had bad news for the many groups of South Korean investors who are hoping to sue Kwon for fraud and receive damages payments.

She explained:

“[According to South Korean law,] the confiscated proceeds of crime belong to the national treasury, and are not distributed to the victims.”

Ye added that while in the USA, the regulatory Securities and Exchange Commission (SEC) is able to recover funds for scam victims via civil suits in some cases, no such system exists in South Korea.

She stated:

“The [South Korean] authorities should honestly admit that it will be very difficult to recover the lost money. They should instead admit that the best thing to do in this case is to prevent more victims from getting hurt. Only by trying to protect the market can real victims gain protection.”

The legal expert additionally remarked that the punishments for financial crimes tend to be much more lenient in South Korea than in the United States.

Ye concluded:

“It is up to us whether South Korea becomes a haven for financial crime or a clean country.”