How Much to Invest in Cryptocurrency in 2024

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Although cryptocurrencies remain the best-performing asset class since the creation of Bitcoin in 2009, this industry is still deemed high-risk.

As such, while there are plenty of opportunities to be had when investing in the cryptocurrency markets, investors should be mindful of the amount of capital being allocated.

The purpose of this guide is to ascertain the sweet spot when evaluating how much to invest in cryptocurrency.

How Much to Invest in Cryptocurrency – Key Factors to Help You Decide

Before diving into the fundamentals of how much to invest in cryptocurrency, consider the key takeaways highlighted below;

- Budget – The age-old saying of never invest more than you can afford to lose has never been more fitting in the cryptocurrency space. Crucially, investors should consider how much they can realistically afford to lose when assessing how much to invest in cryptocurrency.

- Risk Tolerance – Investors should evaluate how much risk they feel comfortable taking before investing in cryptocurrency. While gains can be significant, so can losses. After all, many cryptocurrencies are now trading more than 90% below their previous all-time high. For example, the best crypto ETFs allow traders to gain exposure to a wide range of cryptos within a single ETF.

- Disposable Income – Another smart way to assess how much to invest in cryptocurrency is to figure out the level of disposable income available at the end of each month. This will pave the way for a more risk-averse approach to cryptocurrency investing, through dollar-cost-averaging.

- Short-Term Needs – Although there is plenty of liquidity in the cryptocurrency markets, it remains to be seen if and when the next bull market will arrive. This means that investors should consider whether they have the capacity to wait many months or even years to see a return on their cryptocurrency investment.

- Focus on High-Quality, New Projects – Picking the best crypto to buy is also crucial when formulating an investment plan. In this regard, it could be worth focusing on new cryptocurrency projects that have sizable upside potential. New cryptos such as Smog ($SMOG) have soared since its exchange listing. Other presale tokens such as Sponge V2 and Bitcoin Minetrix have also raised millions.

Read on to evaluate our full and comprehensive discussion on the above points to ascertain how much to invest in cryptocurrency.

How to Decide How Much to Invest in Crypto

No two investors are the same – especially when it comes to long-term financial goals, risk tolerance, and budget.

Therefore, when assessing how much to invest in cryptocurrency, be sure to read through the following sections which detail how to get into crypto in 2024.

Look for Low-Risk, High-Upside Crypto Projects

Irrespective of budget, smart investors will often look to focus on investments that carry a low-risk, high-upside prospect. This simply means that the crypto project enables the investor to target an attractive upside without needing to risk significant amounts of capital. At the forefront of this are cryptocurrencies that possess a small market capitalization.

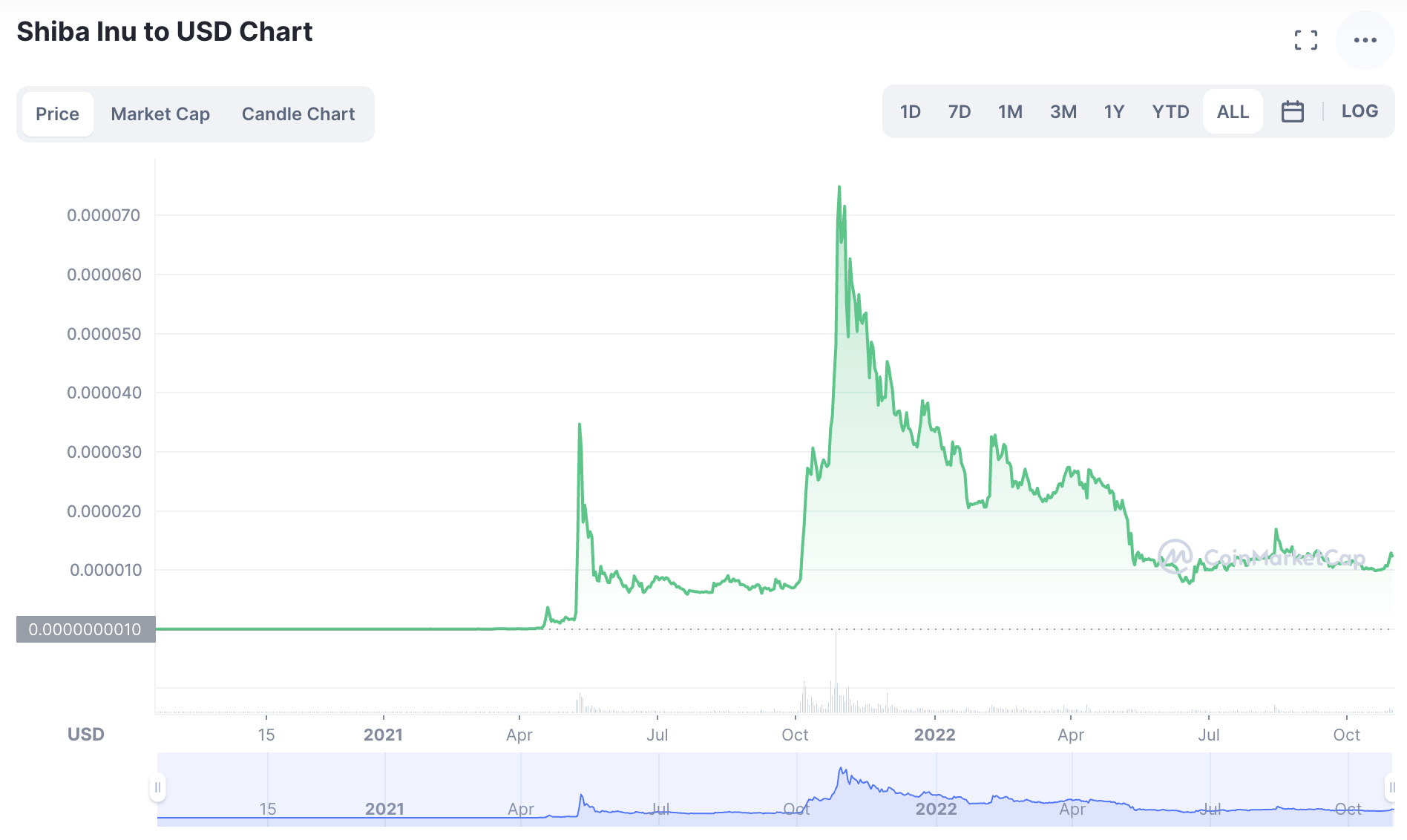

This is because when the valuation of a crypto project is low, it has a much greater chance of generating above-average gains. For instance, some of the top-performing projects during the bull run that began in 2020 were low-cap cryptocurrencies. The likes of Shiba Inu, Decentraland, Axie Infinity, and many others went on to generate unprecedented gains of 100x and more.

While the boat on the aforementioned projects has arguably been missed, finding the next cryptocurrency to explode doesn’t need to be overly challenging. The key factor is knowing where to look.

And in this regard, experienced investors will often target crypto presales and ICOs. The best upcoming ICOs enable investors to purchase a newly created token at the lowest price possible.

The idea is that early investors are rewarded for their belief in the project, not least because the token will eventually be listed on a crypto exchange at a higher price. And when this happens, investors are treated to an immediate upside. At this moment in time, there is one presals to keep an eye on – which could represent the best future cryptocurrency projects of 2024 and beyond.

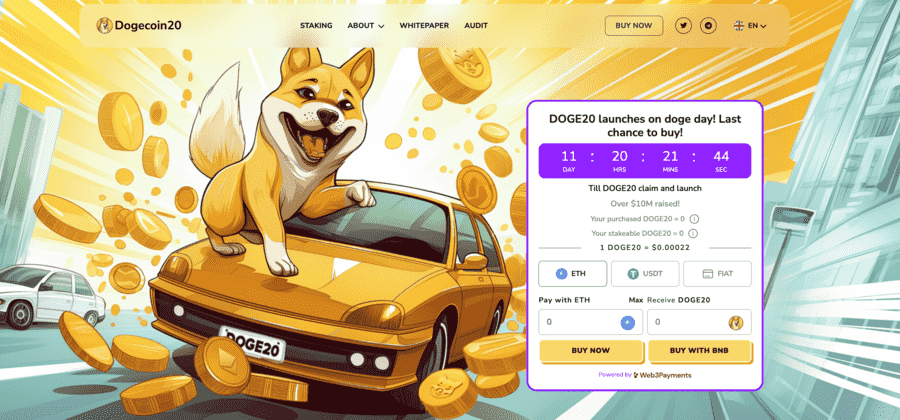

Dogecoin20 – Sustainable PoS alternative to Dogecoin, $10M raised, 50%+ APY Staking Rewards

Dogecoin20 ($DOGE20) is a trending new meme token on Ethereum that is gaining massive investor attention. It offers a sustainable alternative to traditional proof-of-work (PoW) tokens like Dogecoin. The token offers quick, secure, and environmentally friendly transactions due to its proof-of-stake model.

It also provides actual utility to investors by allowing them to earn passive income (via staking). DOGE20 has a fixed supply of 140 billion tokens. Currently, 25% of the total supply is available via the ongoing presale phase.

Early buyers can get the tokens for only $0.00021 at the time of writing. However, this price will rise in the next stage and during exchange listings.

At press time, the Dogecoin20 presale raised nearly $10 million in just a few days after its launch after witnessing huge investor interest.

With staking at the heart of the platform, buyers can currently get an APY of over 50%. Once the presale ends, Dogecoin20 plans to list on the Uniswap decentralized exchange. This can provide more liquidity and accessibility in the coming weeks.

Dogecoin20 builds on the popularity of dog-themed meme coins and aims to offer a more sustainable and rewarding experience. Users can follow Dogecoin20 on X (Twitter) and enter its Telegram channel to get the latest updates on its listings and other developments.

| Presale Started | Q1 2024 |

| Purchase Methods | ETH, USDT, Credit Card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

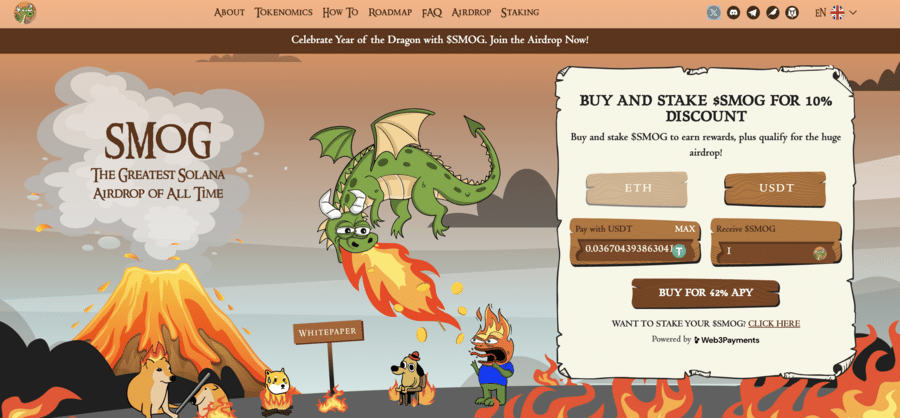

Smog – New Meme Coin Soared to a $100 Million Market Cap, Get 42% Staking Yields

One of the top future cryptos to purchase is Smog ($SMOG). Named after the Dragon character from the ‘Lord of the Rings’ trilogy, Smog is a new meme coin displaying huge earning potential.

After conducting its decentralized exchange listing in February 2024, $SMOG jumped by nearly 6,000%. The token price soared from $0.001419 to an all-time high of $0.08611, in a matter of days. With a market cap of nearly $100 million, Smog could offer even higher returns in the long-term.

While meme tokens tend to attract high volatility, Smog looks to offset some of the uncertainty through its staking mechanism. Token holders can lock-in $SMOG on the smart contract and earn up to 42% in APYs. Over 10 million tokens have already been staked.

Rewards can also be earned in the form of airdrops. From a 1.4 billion token supply, 490 million tokens are being distributed as airdrop rewards. Participants can earn airdrop points by holding $SMOG, staking the token, and completing various challenges.

In the future, $SMOG will be listed on more centralized and decentralized exchanges. This can help attract higher trading volume. Stay updated with this cryptocurrency by going through the Smog whitepaper and joining the Telegram channel.

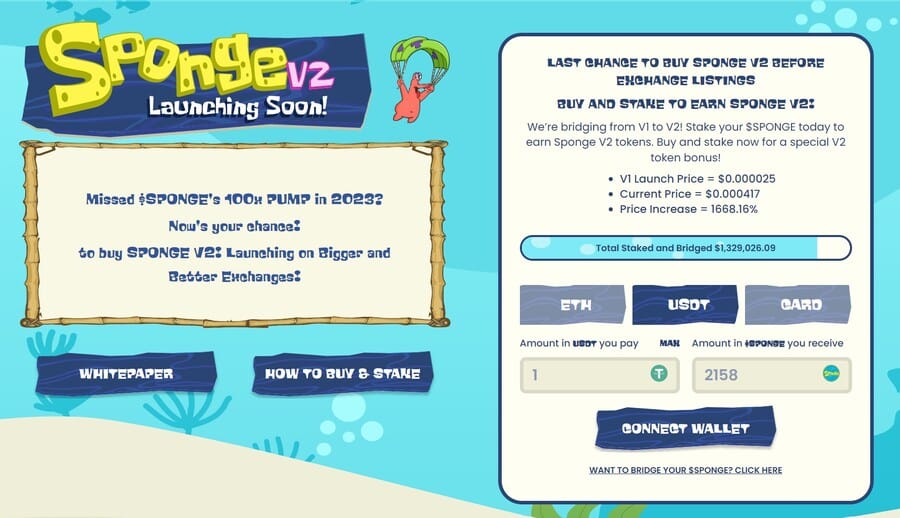

Sponge V2 – Popular Crypto With Over 191% Staking APY And Utility Within an Upcoming Play-to-Earn Game

Sponge V2 is a meme coin that follows the success of Sponge V1, a popular token that peaked at $100 million market cap in 2023, returning over 100x to early investors. Sponge V2 plans to outperform this by adding utility to the token in an upcoming play-to-earn game.

Those who already hold Sponge V1 tokens can stake them on the Sponge V2 website and earn passive yield. Those that don’t have the token can buy it on the Sponge V2 website by using an Ethereum wallet. You need ETH or USDT coins to complete the purchase.

Stake your $SPONGE tokens as early as possible to take advantage of the 191% APY as the number won’t stay that high for long. According to the Sponge V2 whitepaper, there will be at least 40% APY for four years for those who stake $SPONGE tokens.

The project roadmap is straightforward. There are three stages:

- The token staking is enabled.

- The token is listed on major exchanges and you can claim your tokens.

- The play-to-earn game is released.

Follow Sponge V2 on X and join Sponge V2 on Telegram to get project updates. Join Sponge V2 Discord if you want to engage with the community and the developers.

| Presale Started | Dec 2023 |

| Purchase Methods | ETH, USDT and Card |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

Bitcoin Minetrix – Revolutionary Stake-to-Mine Crypto Offering Tokenized Cloud Mining Credits

One of the top cryptocurrency presales in 2024 is Bitcoin Minetrix (BTCMTX). This revolutionary cryptocurrency project is the first to introduce the stake-to-mine mechanism.

The Bitcoin Minetrix ecosystem will tokenize the cloud mining space. Since Bitcoin mining requires high fixed costs to get started, many individuals opt to use rented mining times from cloud mining companies. However, third-party cloud mining corporations are known to engage in dubious activities and scam investors.

Therefore, Bitcoin Minetrix will leverage the $BTCMTX token to offer cloud mining credits. These credits can be earned by staking the $BTCMTX token. By staking the cryptocurrency, you will earn the ERC-20 cloud mining credits. These are non-transferable but can be burned on the ecosystem to earn Bitcoin cloud mining power.

With the mining power one acquires, you can get allocated mining times and earn mining revenues. With a minimum investment of just $10, investors can buy $BTCMTX through the ongoing presale. The presale consists of twenty rounds – each allocating 140 million tokens. In total 2.8 billion tokens from the total 4 billion token supply will be allocated to the presale.

Bitcoin Minetrix has raised more than $11 million in only a few months. The aim is to raise a $33.46 million hard cap by the end of the presale. Currently, $BTCMTX is priced at $0.0135 per token.

Read the Bitcoin Minetrix whitepaper and join the Telegram channel to learn more about this cryptocurrency.

| Presale Started | 26 Sept 2023 |

| Purchase Methods | ETH, USDT, BNB |

| Chain | Ethereum |

| Min Investment | $10 |

| Max Investment | None |

Evaluate the Investment Budget

It goes without saying that when deciding how much to invest in crypto, an assessment of the investor’s budget is a priority.

This should be the case irrespective of the respective investor’s net worth. A good starting point in this regard is to assess how much the investor can realistically afford to lose.

This is because cryptocurrencies are high-risk assets and thus – the investor could lose some or even all of their money.

Consider the case of Terra Luna, which recently went from a multi-billion dollar project to a worthless cryptocurrency in the space of a few days.

Crucially, investors should look at how much money they need as a safety net, in terms of day-to-day living expenses and the possibility of an emergency that requires access to fast cash.

Disposable Income for a DCA Strategy

Rather than attempting to time the market, a more suitable strategy could be to dollar-cost average each investment. This means investing a predefined amount of money each month into the cryptocurrency markets – religiously.

To assess how much to invest in crypto via a dollar-cost averaging strategy, the investor should figure out what they can realistically put to one side each month.

This means that instead of dipping into savings, the investor will only allocate funds that they have left over after each month passes. Moreover, the investor will average out the cost price of each cryptocurrency purchase – which is a more risk-averse strategy in the long run.

Create a Diversified Portfolio

Another important factor to take into account when evaluating how much to invest in cryptocurrency is the diversification of an investment portfolio.

- This will give the investor the best chance possible of avoiding a repeat of the previously mentioned Terra Luna capitulation.

- Put otherwise, investors that were holding Terra Luna in addition to dozens of other cryptocurrencies likely wouldn’t have felt the impact as much as those that were over-exposed.

- Moreover, there is every chance that one of the other cryptocurrencies held by the diversified investor performed well, which could have countered some or even all of the losses.

The good news is that even those on a budget can diversify their cryptocurrency portfolio. After all, cryptocurrencies can be split into much smaller units, so investors only need to allocate a few dollars to each purchase.

Time in the Market

The next factor to bear in mind when evaluating how much to invest in cryptocurrency is the length of time to spend in the market. After all, 2022 was an extremely disappointing year for cryptocurrencies in general, with most project trading at huge lows when compared to previous highs.

In other words, it remains to be seen how long it will take for the next bull run to arrive. This means that investors will need to consider how much time they are willing to HODL when assessing how much to invest in cryptocurrency.

Those happy to wait for many months or years should only invest money that they likely won’t need anytime soon. Crucially, the most successful investors in the cryptocurrency market are those that buy and hold in the long run.

Panic sellers always lose out in the end, so investors should avoid allocating capital that they might need access to.

Liquidity

Another metric to consider when deciding how much money to invest in cryptocurrency is the availability of liquidity. On the one hand, the overall market capitalization of the entire cryptocurrency market stands at $1 trillion.

Moreover, in the prior 24 hours of writing, more than $72 billion worth of cryptocurrencies have been traded online.

However, liquidity can become an issue when investing in smaller-cap projects. In fact, many projects in this space carry daily trading volumes of just a few thousand dollars. This means that it can be difficult to find a seller when it comes to cashing out.

This is why it is wise to only allocate a small percentage of the portfolio to smaller-cap projects, and the balance to those that attract vast daily trading volumes.

Becoming More Active During the Bear Market

Many investors have elected to stay away from the crypto markets while the industry is stuck in a bearish cycle. This is evident in the major reduction in trading volumes.

On the flip side, experienced traders will argue that the overall best time to invest in cryptocurrency is in the midst of a bear market. After all, many cryptocurrencies are trading 70-90% below their bull market highs. This enables investors to enter positions while prices are cheap – in anticipation of the next bull run.

In fact, those on a budget that are asking themselves ‘how much should I invest in crypto’ should consider the value proposition of buying the dip.

- For example, let’s suppose that after careful consideration of the risks, the investor determines that they wish to allocate $2,000 to cryptocurrency.

- If the investor allocated $2,000 to MANA tokens at peak pricing in late 2021, they would have paid $5.90. This means that the investor would have purchased 338 MANA tokens for their $2,000 investment.

- As of writing, however, the same $2,000 investment would get 2,985 MANA tokens.

As per the example above, by investing in the midst of a bear market, the investor acquired an additional 783% worth of MANA tokens for their $2,000.

How Much Should I Invest in Cryptocurrency? What the Experts Say

Considering that Bitcoin is now the largest crypto on the market, how much BTC should I buy? It is often beneficial to hear what so-called experts in the space believe is the right amount to invest in cryptocurrency.

For example, Erik Finman – a young Bitcoin millionaire who by the age of 19 had already acquired over 400 BTC tokens, has previously explained that young investors should attempt to allocate 10% of their salary to leading cryptocurrencies.

This figure may, however, not be suitable for many – which is why assessing disposal income is perhaps a more risk-averse metric to take.

- Additionally, more traditional models argue that the 50-30-20 rule is likely to pay off over the course of time.

- This suggests utilizing 30% and 50% on day-to-day necessities and discretionary spending, respectively.

- While the 20% balance should be utilized for investment purposes.

- Of course, investing the entire 20% in cryptocurrency alone would mean being significantly over-exposed to market cycles.

- Instead, it is wise to also consider other asset classes, such as property, stocks, index funds, and bonds.

In other circles, even strong proponents of cryptocurrencies argue that investors should only invest money into the space that they are prepared to lose.

The good news, however, is that even by allocating a tiny percentage of an investment portfolio to cryptocurrency, this can still yield unprecedented results in the long run.

After all, even in the midst of the current crypto winter, projects like Tamadoge and Lucky Block have witnessed post-presale gains of 20x and 60x, respectively.

How Much Crypto Should be in Your Portfolio?

Wondering what the best crypto portfolio allocation is? Investment portfolios should be as well-diversified as possible. Not only in terms of cryptocurrencies but other asset classes. The key point is that no two investors are the same. This means that a blanket rule on how much to invest in cryptocurrency does not make sense.

On the contrary, investors should consider a range of factors, such as their tolerance for risk, long-term belief in cryptocurrency, financial goals, and how much time they wish to spend in the market.

Another metric to consider is the age of the investor.

- Generally, seasoned investors will advise investing in higher-risk markets when time is on the side of the investor.

- This means that in addition to crypto, growth stocks and perhaps emerging bonds will appeal to young investors.

- On the other hand, those inching towards the age of retirement will generally avoid high-risk assets and instead focus on the stability offered by blue-chip stocks and US treasuries.

Crucially, a slow and steady approach is always the best strategy to take when entering cryptocurrency for the first time. Consider limiting cryptocurrency to just 5% of the overall portfolio, with the balance spread out between other, more established assets and markets.

In doing so, should the cryptocurrency investments not go to plan, this will only represent a tiny segment of the portfolio. Furthermore, as noted earlier, even allocating just 5% of the portfolio to cryptocurrency can yield impressive returns if and when the next bull market arrives.

Conclusion

In summary, assessing how much to invest in cryptocurrency will vary from one investor to the next. Factors such as the investor’s budget and disposal income, risk tolerance, and financial goals will need to be taken into account.

Another metric to consider when evaluating an investment strategy is the risk-return ratio of the cryptocurrency. Cryptocurrencies such as Smog are potentially attractive in this regard. The token offers 42% staking APYs and airdrop rewards.

FAQs

Is investing in crypto worth it?

Cryptocurrencies, since the launch of Bitcoin in 2009, are by far the best-performing asset class. While the industry is overly volatile and speculative, broader trends remain positive. Many cryptocurrencies, even in 2022, generated gains of 10x or more. Investors should, however, avoid investing more than they can avoid losing.

How much should I invest in cryptocurrency?

Deciding how much to invest in cryptocurrency is dependent on the financial profile of the individual investor. While some cryptocurrencies are too high-risk, for many they have a place in a well-diversified portfolio. Investors can see how much disposable income they have to spare each month and subsequently deploy a dollar-cost averaging strategy.

Can you get rich investing in crypto?

Making considerable gains from cryptocurrency is often achieved by investing in a project early. While new investors have no doubt missed the kind of returns previously seen by Bitcoin and Ethereum, there a numerous presale campaigns to explore in 2024.

Is it worth investing $100 in crypto?

There is no set minimum amount to invest in cryptocurrency. On the contrary, investors should only consider risking an amount that they can afford to lose. Just remember that investing $100 in a project like BNB in late 2017 would have been worth over $600,000 at its peak in 2021.