FTX to Reopen its Crypto Exchange Business? New CEO John Ray III Says He’s Open to the Idea

Speculation is mounting over whether FTX could reopen to users, after the company’s new CEO, bankruptcy expert John Ray III, said he is open to the idea.

“Everything is on the table. If there is a path forward on that, then we will not only explore that, we’ll do it,” Ray said with regards to a possible reopening of FTX.

The comments came in an interview with the Wall Street Journal published on Thursday. The interview is the first given by Ray since he took over as CEO of the exchange in November last year.

According to Ray, FTX has already set up a task force to explore if FTX.com should be restarted, and how it could happen. He explained to the Wall Street Journal that the issue has been brought up after some former FTX users have publicly praised the exchange and suggested a restart of it would be valuable.

Among those who from a user perspective have come out in support of FTX and its US arm, FTX US, is the popular crypto venture investor Nic Carter. Writing on Twitter, Carter made it clear that he would use FTX US again if it was restarted:

I would actually use FTX US again. It was a good product

— nic 🌠 carter (@nic__carter) January 19, 2023

FTX US is solvent, SBF claims

Earlier this week, FTX founder and former CEO Sam Bankman-Fried reiterated on Twitter that FTX US is solvent and should never have been part of FTX international’s bankruptcy filing.

“FTX US is solvent, as it always has been,” he wrote, while sharing a screenshot that showed details of the firm’s assets and liabilities.

TL;DR:

— SBF (@SBF_FTX) January 18, 2023

1) S&C files, claiming FTX US is insolvent

2) S&C forgot to include bank balances, ~$428m

3) Once you add those back in, you get in the neighborhood of my prior balance sheet (~+$350m)

4) Other slides in the same filing demonstrate (2)

Asked by the Wall Street Journal about this, Ray refuted the idea, saying Bankman-Fried’s proposal implies that losses at the US exchange would need to be covered by money that belongs to customers of the international exchange, FTX.com.

“This is the problem. He thinks everything is one big honey pot,” he said.

In response, Bankman-Fried was quoted in the article as saying that Ray “continues to make false statements based on nonexistent calculations.”

“If Mr. Ray had bothered to think carefully about FTX US, he would likely have realized both that his interpretation is wholly inconsistent with bankruptcy law, and also that even if one were to subtract $250m from my balance sheet, FTX US would still have been solvent,” Bankman-Fried said, before adding:

“Rather, Mr. Ray sees everything as one big honey pot—one he wants to keep.”

Commenting after the interview with Ray was published, Bankman-Fried gave the new CEO credit for “finally paying lip service to turning the exchange back on.”

“I’m still waiting for him to finally admit FTX US is solvent and give customers their money back…,” he added.

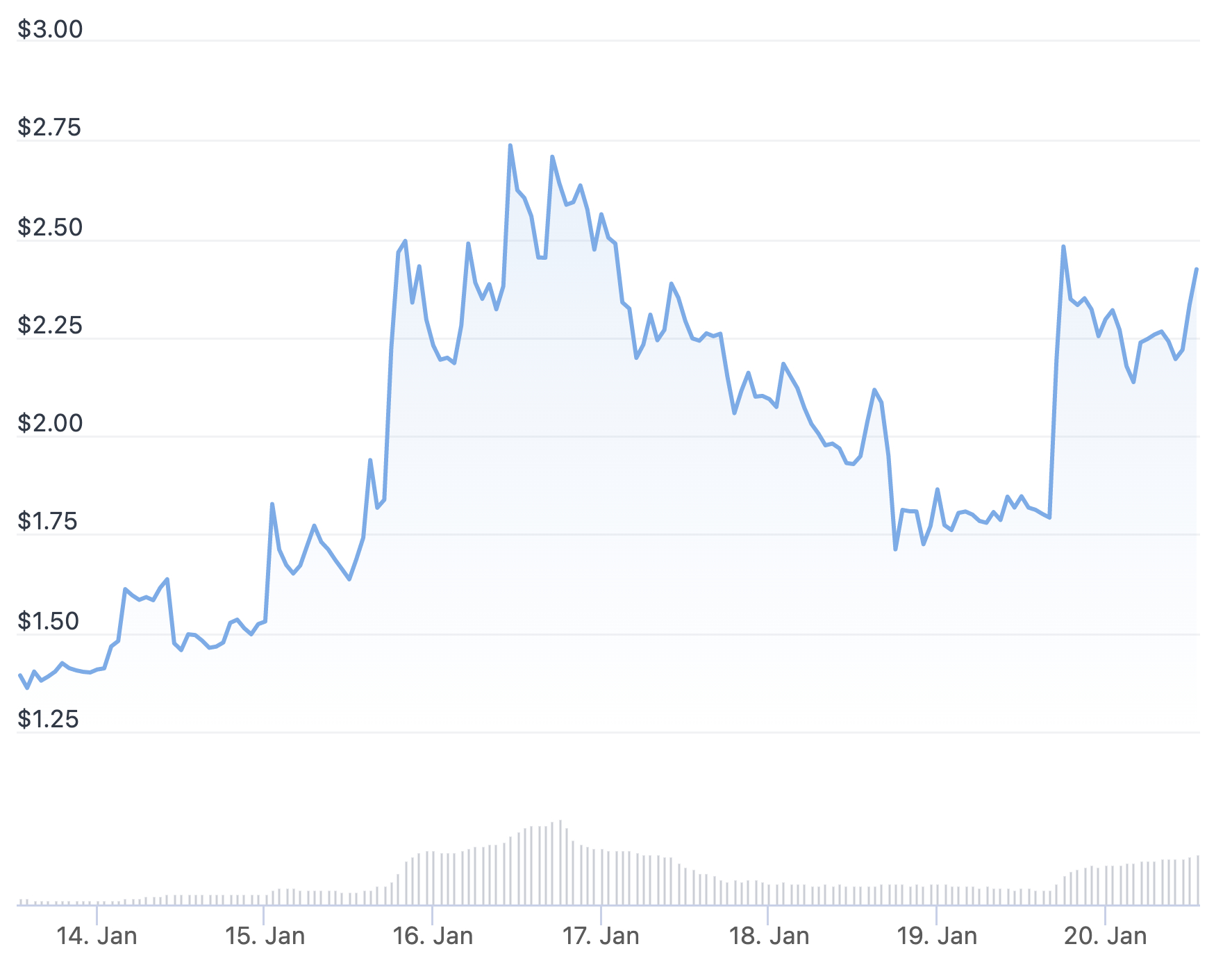

FTT token rising

The price of FTX’s exchange token FTT jumped on the news yesterday, and was up by more than 33% over the past 24 hours at the time of writing. For the past 7 days, FTT is now up by an impressive 76%, and is trading at $2.42.