Fed Fails to Calm Markets; Bitcoin, Gold Slide Alongside Stocks

The number one digital asset, bitcoin (BTC), once again saw heavy selling on Monday, after news came out on Sunday that the U.S. Federal Reserve (Fed) is taking emergency measures to mitigate the financial devastation that is currently going on around the world.

Source: iStock/technotr

As announced by the Fed on Sunday, the U.S. central bank is cutting interest rates to the band between 0 and 0.25% – the lowest possible without going into negative territory. In addition, the controversial Quantitative Easing (QE) program is also being re-introduced to pump more liquidity into the financial system, while reserve requirements for commercial banks are slashed to 0%.

and so it begins…

— Meltem Demirors (@Melt_Dem) March 15, 2020

– fed cuts rates to 0 – 25 bps

– 0 reserve requirement

– will buy $500B in treasuries, $200B in mortgage-backed securities

people – you are WATCHING the Fed sell YOUR FUTURE to bail out the BANKS, again!

get good and mad 😡https://t.co/f032lNcz4s

I'm calling it right now.

— Pomp 🌪 (@APompliano) March 15, 2020

This emergency rate cut to zero and $700 billion in QE is the biggest monetary stimulus bomb that the Fed can drop right now.

If this doesn't work, they will have almost nothing left in the gun to fire.

In theory, extreme measures like the ones announced yesterday by the Fed should all be insanely bullish for a “hard” asset with limited supply such as bitcoin. In reality, however, the opposite has happened, and bitcoin – as well as the broader crypto market – is currently selling off along with the stock market.

As of press time on Monday (14:43 PM UTC), BTC was down 12% over the past 24 hours, trading at USD 4,722. Ethereum (ETH), meanwhile, was down 15% to a price of USD 107.

BTC price chart:

Source: coinpaprika.com

__

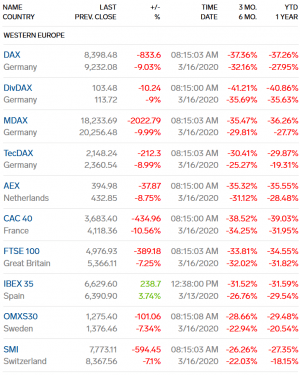

Stock market indices on Monday:

Source: markets.businessinsider.com

However, crypto and stocks were not the only assets headed lower today, with even the traditional safe-haven gold being sold. So far, all central bank actions to try to limit the selling globally has been ineffective.

HOLY FREAKING SHIT!!! Markets open DOWN after biggest monetary bazooka shot in world history.

— Erik Townsend 🛢️ (@ErikSTownsend) March 15, 2020

Even I couldn't be bearish enough to see this coming!

“The central banks threw the kitchen sink at it yesterday evening yet here we are (with deep falls in stock markets),” Societe Generale strategist Kit Juckes, told Reuters. “There is a great sense that central banks are going to get to grips with the issues of getting money flowing … But the human problem, the macro problem, there is nothing they can do about that.”

The current market action is being discussed among members of the community, with some once again questioning the narrative of whether bitcoin can be considered an uncorrelated asset.

This question was also raised by the economist and trader Alex Krüger, who noted that “Having to pay attention to what traditional assets and central banks do makes crypto an entirely different ballgame.”

Having to pay attention to what traditional assets and central banks do makes crypto an entirely different ballgame.

— Alex Krüger (@krugermacro) March 15, 2020

See that, that was $BTC *front running* the response to the Fed before the CME open, and the subsequent fade after the open. pic.twitter.com/KowT3voPD5

Further setting the tone for the discussions was Roy Sebag, founder of GoldMoney and a well-known crypto-skeptic, who proclaimed that “With U.S. dollar interest rates now officially at zero, today marks the end of the fiat dollar experiment which began in 1971. The path from this point to a gold standard is much shorter than most realize.”

Meanwhile, the discussion on what can be expected next from governments and central banks circled mainly around what can be done to avoid a complete economic meltdown, and what the consequences of those actions might be.

Among them, chief investment officer at crypto investment firm Arca, argued in a Twitter thread that “fiscal stimulus” – increased government spending – will most likely be announced in the near future.

1) First step is to save the banks, calm the markets, stop the panic selling — The Fed just issued what is basically an all in circuit breaker.

— Jeff Dorman, CFA (@jdorman81) March 15, 2020

Fiscal stimulus is next (probably tonight/tomorrow) which will help save small businesses and consumers

And hopefully that production and normal real economic activity is something we see as soon as a couple of months from now. /End

— Joe Weisenthal (@TheStalwart) March 15, 2020

Despite the recent bitcoin crash, however, leading members of the community remained optimistic about bitcoin’s potential during these uncertain economic times, with co-founder of Morgan Creek Digital, Anthony Pompliano, even going as far as calling The Fed’s measures “a USD 700 billion marketing campaign for Bitcoin.”

THEY ARE LITERALLY CUTTING RATES AND PRINTING MONEY RIGHT INTO THE BITCOIN HALVING.

— Pomp 🌪 (@APompliano) March 15, 2020

Unbelievable.

Taking it one step further, Ryan Selkis, founder of Messari Crypto, urged his followers to “sell cash, buy bitcoin,” following yesterday’s unprecedented announcement from the Fed, while Tyler Winklevoss, Co-founder of crypto exchange Gemini, called bitcoin “a hedge” to Fed’s rate cuts and money printing.

Following down the same path was also Jesse Powell, CEO of crypto exchange Kraken, who jokingly asked his followers if they knew where he could get some of those 0% interest loans. “Seems like a good time to leverage all hard assets to go long BTC. Obviously, not financial advice,” he wrote.

However, not everyone is convinced that massive government stimuli will directly benefit bitcoin. Among them was Tushar Jain, managing partner at crypto investment fund Multicoin Capital, who wrote:

“A lot of Bitcoiners are very excited about the Fed’s recent rate cuts and QE program. I see lots of claims about how this is good for Bitcoin’s price. Can anyone explain how the money from QE actually makes it to Bitcoin?”

“Obviously some BTC traders got excited about [quantitive easing] but the market could not sustain the price,” he went on to add.

The same sentiment was also shared by Josh Rager, co-founder of trading platform Blockroots, saying that the current stock market meltdown “is not bullish for crypto markets whatsoever,” while revealing that he has “moved more crypto holdings to cash” after it became evident that central bank efforts were not going to save the stock market.

“We believe this time is different and potentially is much worse than the 2008 Global Financial Crisis. It could begin as a global economic crisis whereby the global economy experiences a sudden downturn due to a financial crisis, impacting every single aspect of our daily life,” according to TokenInsight, a token data and rating agency.

“We believe cryptocurrency like any other asset class, is in an irrational stage. In light of market-wide panic, the financial model and structured diversified strategies might not be effective. We believe the market requires a period to shake off the irrationality and return to a more rational state,” they added.

___

Learn more: 10 Crypto Minds Weigh in On Post-Crash Bitcoin and Its Future