Ethereum Whales Almost Double Their Holdings in A Month – Report

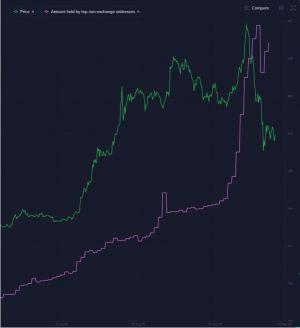

The largest holders of ethereum (ETH) tokens have become even larger, with a near-doubling of their bags over the course of August, new data from on-chain analysis firm Santiment showed.

Looking at the holdings of the largest non-exchange ETH wallets, the firm found that holdings increased by 84% in August, from ETH 3.16m ETH at the start of the month, to ETH 5.80m at the end. In Santiment’s own words, the finding serves to “clear any doubt that top ETH whale holders are confident in crypto’s #2 market cap coin.”

Ethereum top non-exchange holdings (purple line) vs. price (green line):

Commenting on the findings, Alex Svanvik, founder and data scientist at blockchain analytics firm Nansen, said that the increased whale holdings “makes total sense” given that what he called “pro yield farmers” are taking profits in ETH.

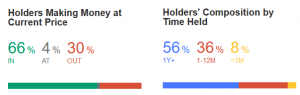

Also in support of Santiment’s finding is data from analytics firm IntoTheBlock, which also said that “large holders,” defined as those holding more than 0.1% of the circulating supply, are accumulating ETH, with a positive signal value of 0.49%.

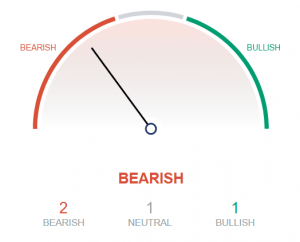

Despite the accumulation of ETH by whales, however, a decline in the number of large transactions, and more holders sitting on losses, contributed to an overall bearish outlook on the token price, based on IntoTheBlock’s on-chain sentiment indicator.

According to the same data, the concentration of large ETH holders now stands at 41%, well above that of for instance bitcoin (BTC), which currently stands at 10%.

At the time of writing (16:42 UTC), ETH trades at USD 350 and is up by 2% in a day, trimming its weekly losses to less than 18%. The price is down by almost 11% in a month but is still up by 96% in a year.