Ethereum Tests All-Time High as On-Chain Activity Grows, SHIB Burns ETH

The price of ethereum (ETH) briefly touched a new all-time high on Friday, with key on-chain metrics growing faster than competitors over the past month. Meanwhile, the current meme coin craze is also contributing to ETH’s value proposition, with shiba inu (SHIB) now consuming more gas than even major stablecoins.

At 11:13 UTC, ETH was still up almost 5% over the past 24 hours to trade at USD 4,335, after earlier today briefly reaching north of the 4,400 mark for the first time ever.

The new all-time high (USD 4,416, per Coingecko) came as on-chain data compiled by Kraken Intelligence showed that the number of active Ethereum addresses has grown 5.8% since last month. The growth for Ethereum came as the other smart contract platforms Cardano (ADA) and Polkadot (DOT) saw a decline in the number of active addresses on their platforms of 8.9% and 3.3%, respectively. Meanwhile, Bitcoin (BTC) outperformed them all with a 9.7% growth.

Similarly, the number of transactions made over the Ethereum network also grew since last month, with an increase of 2.3% (the monthly average number of transactions – 1.2m). That compares to a growth in the number of transactions of just 1.5% for Polkadot, and a decline of 9.5% for Cardano. BTC saw an increase of almost 9% (to 272,000 transactions).

Not surprisingly, new highs for ETH also excited investors. Right around the same time as ETH hit its all-time high, the founder & CEO of Real Vision, Raoul Pal, said that he is “more than irresponsibly long ETH right now.”

“I now have leverage but via calls. This is by far and away the biggest personal position of my entire life by a factor of 10 (or more),” Pal said, adding in his timeframe for when he expects the major moves in ETH to be seen:

“My view horizon for this part of the trade is 6 to 9 months.”

However, as reported, per CoinShares data, last week, ETH saw investment outflows for a 3rd consecutive week. The firm said they believe it “is minor profit-taking as the price closes-in on all-time highs.” At the same time, BTC saw 99% of all inflows totaling USD 1.45bn last week after BTC futures ETFs debuted last week in the US.

Meanwhile, it’s also worth noting that the rising price for ETH has coincided with the recent craze surrounding shiba inu, dogecoin (DOGE), and other meme coins, with the former being an Ethereum-based ERC-20 token.

As a result of this, all transactions made with Ethereum-powered SHIB also contributes to the burning of ETH tokens, which in theory should help push up its price. At press time on Friday, the SHIB token ranked as the 7th largest ETH destroyer, even ahead of the major stablecoin USDC and just below the popular wallet MetaMask’s Swap Router, blockchain data showed.

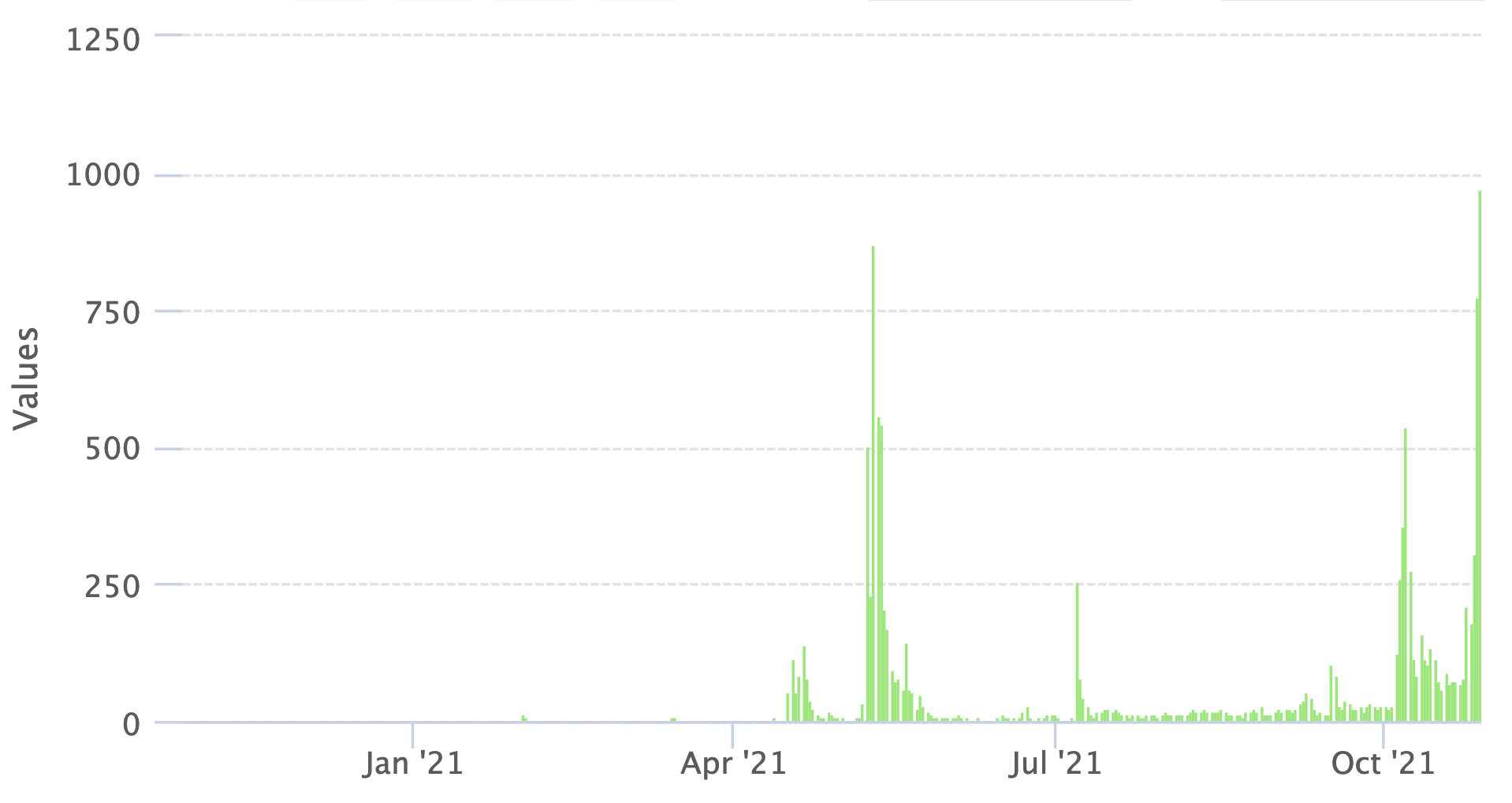

ETH transaction fees used by shiba inu token:

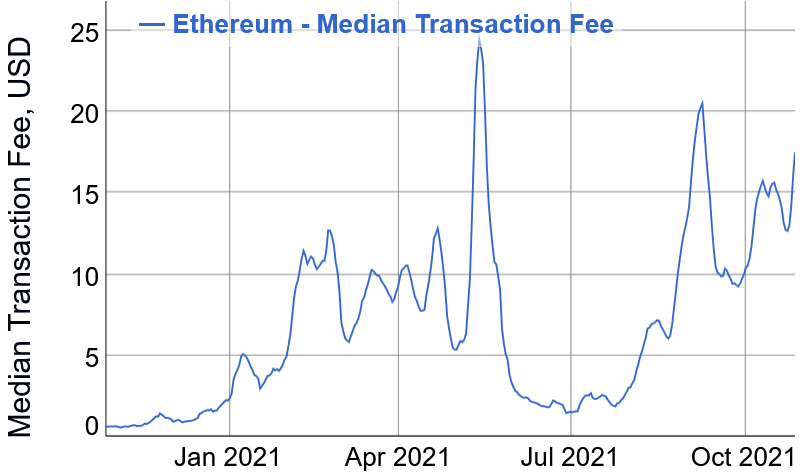

Token burning on Ethereum was introduced with the EIP-1559 upgrade on August 5 this year, with an aim to make ETH less inflationary than it was before. Since activation, ETH 671,259 (USD 2.9bn) have been burned, making up more than half of the new tokens issued over the same period, according to data from WatchtheBurn.com.

Meanwhile, as reported, the Altair hard fork, the first mainnet upgrade to Ethereum’s beacon chain, went live this past Wednesday. The update is considered a “low stakes warm-up” to the upcoming Merge, when the current Ethereum mainnet, which is secured by a proof-of-work (PoW) consensus mechanism, “merges” with the beacon chain proof-of-stake (PoS) system.

____

Learn more:

– Ethereum Merge Estimated in May-June 2022 – Developers

– Following the First Bitcoin ETF, Ethereum Might be Next

– Multi-Chain Future Brings Multiple Competitors to Bitcoin & Ethereum – Analysts

– Ethereum Needs to Try Harder To Keep Its Dominance in a Multichain Future

– The Ethereum Economy is a House of Cards

– Why Ethereum is Far From ‘Ultrasound Money’